The Role of Artificial Intelligence in Payment Fraud Prevention

With digital payments on the rise, so is fraud. Traditional methods can’t keep up—but AI is stepping in to detect and prevent threats in real time.

Recent Posts

An Integrated Payment Gateway Can Cut Your Costs and Increase Profits

An integrated payment gateway streamlines payment processing by connecting your systems, reducing fees, improving security, and creating a smoother checkout experience that can increase conversions and profits.

Loan Management Software: Benefits and Features

Learn the benefits of loan management software, including automation, scalability, AI-driven credit decisions, and improved borrower experiences for lenders and retailers. Modern loan servicing platforms streamline the entire lending lifecycle, reduce manual tasks, and help businesses originate, manage, and grow loan portfolios more efficiently.

What is a Loan Management Software?

Loan management software is a centralized platform that automates the entire loan process from application and onboarding to servicing, payments, and compliance while delivering a fully digital customer experience. By streamlining workflows and integrating essential tools, it helps lenders reduce costs, improve risk management, and increase profitability across multiple loan types.

Dynamic Loan Management Software

Loan management software automates the entire lending lifecycle, from AI-powered credit screening to automated collections. For microlenders and payday lenders, it’s the difference between a sustainable business and an unmanageable default rate.

Soft Declines vs. Hard Declines: What Every Merchant Needs to Know

Many lost sales come from failed payment transactions. Understanding the difference between soft and hard declines helps merchants recover revenue and reduce cart abandonment.

Omnichannel Payments With ECS: Connecting Your Online Store, Terminals, and Invoices in One System

72% of businesses say payment processing impacts their ability to grow. ECS omnichannel payments unify every channel, including online, in-store, mobile, and invoicing, into one system so you can scale without the complexity.

Why Choose ECS for ACH and eCheck Processing: Lower Costs, Faster Cash Flow

Most business owners don’t realize how much profit they’re quietly losing to payment processing fees, until they run the numbers. This guide breaks down how ECS ACH processing can reduce transaction costs, stabilize cash flow, and give your business a smarter way to get paid.

Choosing the Right Payment Terminal or Virtual Terminal Setup for Your Business

What if a single second delay at your checkout was enough to cost you a lifelong customer? It sounds like an exaggeration until you look at the modern consumer who expects every transaction to be instantaneous. Many business owners do not realize that their payment setup is often the final hurdle that determines whether a […]

What Is an FFL Transfer? A Complete Guide for Firearm Dealers and Buyers

FFL transfers are a critical part of legal firearm sales, ensuring every transaction meets ATF requirements, includes a proper NICS background check, and stays fully compliant with federal and state regulations. Whether you’re a buyer, seller, or licensed dealer, understanding the FFL transfer process helps protect your business, build customer trust, and avoid costly compliance mistakes.

A/B Testing Your Checkout: A Practical Guide to Increasing Conversion Without Lowering Prices

Every day, potential profit drains away because of small, unnoticed hurdles in your payment flow. Checkout A/B testing lets you stop guessing what your customers want and start using real data to build a frictionless buying experience.

What to Expect When You Switch to ECS Payments: Onboarding, Cost Review, and Ongoing Support

Switching payment processors doesn’t have to be complicated or disruptive. With ECS Payments, you gain clarity before committing, full support during onboarding, and real human support that helps you better understand and manage your costs.

Payments Analytics 101: The Metrics That Actually Move Revenue for Merchants

Most merchants only look at their payments when something breaks, and by then the damage is already done. Payments analytics helps catch problems early and turn payment data into better business decisions.

Payment Facilitator vs. Payment Gateway: What’s the Difference and Which Do You Need?

Payment facilitators and payment gateways may sound similar, but they offer very different levels of control, cost, and scalability. Understanding how each works can help you avoid frozen funds, reduce fees, and choose a solution that grows with your business.

Daily Discount Funding: A Smarter Way to Manage Merchant Cash Flow

End-of-month processing fees can drain a business’s bank account at the worst possible time. Daily discount funding eliminates that stress by spreading fees across daily deposits for more predictable cash flow.

Smarter Payment Strategies for B2B Subscription Services

B2B subscription services rely on secure, automated, and compliant payment systems to deliver predictable revenue and scalable growth. Smarter payment strategies help reduce churn, improve cash flow visibility, and support seamless subscription management.

The Hidden Revenue Inside Your Checkout: How Embedded Payment Platforms Drive Growth

Today’s payment platforms do more than process transactions; they shape revenue, efficiency, and customer trust. When designed strategically, payments become a competitive advantage rather than a back-office expense.

How Dual Pricing Is Changing the Game for Small Businesses

Dual pricing is a simple, compliant strategy that helps merchants recover processing costs by offering clear cash and card pricing. It restores control over profit margins while keeping customers informed and empowered to choose how they want to pay.

Emerging Payment Rails & What They Mean for Small and Mid-Sized Merchants

Learn how new real-time and open-banking payment rails accelerate settlements, enhance security, and unlock better customer experiences. Merchants that upgrade now gain faster cash flow and a decisive competitive advantage.

How The Rich Scale Their Businesses

The rich scale their businesses by identifying their most profitable customers and focusing their marketing efforts on reaching new ones

Mobile and Contactless Payments

Everything you need to know about why your business should offer convenient and secure contactless payment options to your customers.

The Rise of Embedded Payments: What It Means for Software Platforms and ISVs

Embedded Payments let SaaS companies and ISVs create seamless, all-in-one platforms where transactions happen inside the software. With ECS Payments, ISVs get true Embedded Payments backed by direct bank relationships, full compliance, and flexible white-label options.

WooCommerce Fraud Prevention: How to Protect Your Online Store and Customers

WooCommerce Fraud Prevention is essential for protecting your business from costly chargebacks and lost trust. One incident of fraud can damage your reputation and customer confidence. Staying proactive is the only way to keep your store secure and your sales genuine.

Why ECS Payments Is Superior to Other Processors: The Power of Dedicated Customer Service

When payment processing fails at your busiest time, ECS Payments delivers fast, expert support to protect your revenue and keep your business running smoothly.

Unlocking Growth Together: Partner and Reseller Opportunities with ECS Payments

ECS Payments helps businesses turn everyday transactions into ongoing revenue through partner and reseller opportunities.

How Tariffs Are Impacting Businesses

Many U.S. businesses are turning tariffs into opportunities, strengthening supply chains and unlocking new growth.

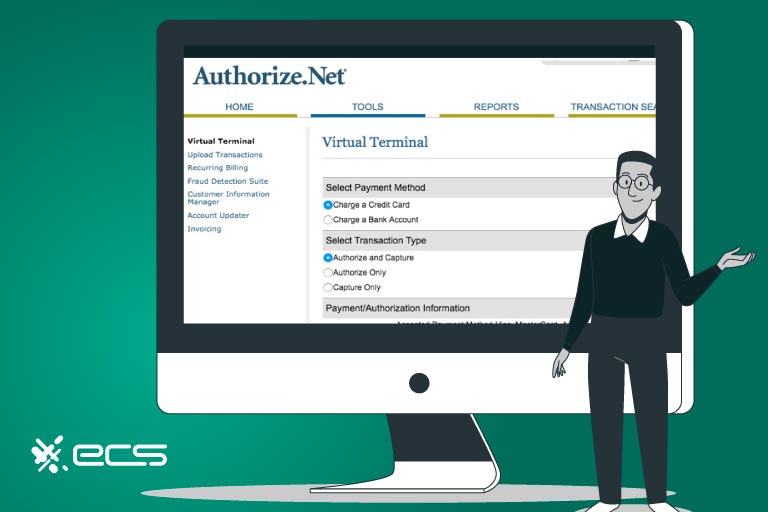

Authorize.net vs Shopify Payments: A Comparison

Is your payment gateway quietly cutting into your profits? Discover how Authorize.net and Shopify Payments compare and which one better supports your business’s growth.

ECS Payments Makes 2025 Inc. 5000 List, Celebrating 11-Time Recognition Across Brand History

ECS Payments celebrates its continued growth and resilience with a spot on the 2025 Inc. 5000 list, proving that with innovation and unwavering dedication, even the toughest challenges become stepping stones to success.

Payment Strategies for Modern Businesses

The way you collect payments could be quietly costing you sales, loyalty and time as a smart payment strategy is essential to thrive in today’s competitive market.

The Best Dejavoo POS Systems for Retail Stores

Choosing the right POS system can make or break your retail experience. Dejavoo POS helps you streamline checkout, boost efficiency, and keep customers coming back.

Why Dejavoo POS Systems for Restaurants Are a Smart Move for Busy Kitchens

Think Toast or Square are your only POS options? Discover why Dejavoo could be the smarter, more flexible choice for restaurants that want control without the costly extras.

Which Dejavoo Credit Card Terminal Is Best For Your Business?

Choosing the right credit card terminal can transform your checkout process, and with secure and easy to use options for every setup, this guide to Dejavoo terminals helps you find the perfect fit for your business.

How Long Does an ACH Transfer Take? ACH Payment Timeline Explained

Confused about ACH transfer timing? Learn how understanding the ACH payment timeline can help you avoid delays, protect your cash flow, and keep your business running smoothly with help from ECS Payments.

ACH for Recurring Payments: Why Credit Cards May Be Costing Your Business More Than You Think

Is your payment method quietly draining your profits? Discover how switching from credit cards to ACH for recurring payments can reduce fees, minimize failures, and boost your bottom line.

How to Accept ACH Payments Online: A Practical Guide for Growing Businesses

Imagine waking up to a fresh deposit in your business bank account,no chasing payments, no card fees. Just reliable, low cost revenue thanks to ACH, the smarter way to get paid online.

High Risk Payment Merchant Accounts Made Easy: Why Businesses Choose ECS Payments

ECS Payments supports high-risk businesses with tailored payment solutions that protect your cash flow and keep your operations running smoothly.

USAG Inc. Secures A Spot In OCBJ’s Best Place to Work in 2025

Recognized as a 2025 Best Place to Work in Orange County, US Alliance Group—parent company of Electronic Cash Systems—is leading the charge in revolutionizing the payment processing industry.

Voice Payments: How This Hands Free Payment Method Is Reshaping Checkout

What if your customers could pay just by speaking? Voice payments are changing checkout—and it’s time to see what that means for your business.

Are Instant Payments For Businesses Worth the Hype?

In today’s fast-paced payment landscape, instant payments move money in seconds—not days—giving business owners the speed, certainty, and cash flow they need to stay competitive.

Payment Orchestration: How to Future Proof Your Payments Stack

Turn your payment stack into a revenue driver—not a roadblock—with payment orchestration that simplifies transactions, reduces failures, and future-proofs your business.

TeacherZone + ECS Payments: All in One for Lessons and Billing

Tired of chasing payments and juggling apps? TeacherZone, powered by ECS Payments, streamlines scheduling and payments so teachers and coaches can focus less on admin—and more on what they love.

PCI DSS 4.0: What Merchants Need to Know in 2025

Is your business ready for PCI DSS 4.0? Discover what’s at stake—and what steps you must take to protect your customers and stay compliant in today’s evolving data security landscape.

Cyber Threats in a Cashless Society: Prevention Strategies for Stronger Digital Payment Security

Ever had a transaction that just didn’t feel right? Learn how understanding digital payment risks and using the right security tools can protect your business, your customers, and your peace of mind.

The True Cost of Credit Card Fees for Small Merchants

Credit card fees are eating into your profits—understanding how they work could be the key to smarter pricing and thousands in savings for your business.

Accepting Cash & Credit Card Surcharge Laws: Best Practices

What if adding a small credit card surcharge could actually protect your profits? Learn how to implement surcharge and cash discount programs legally, clearly, and smartly.

What is vPOS, and Is it the Right Solution For Your Business?

The most efficient businesses aren’t using outdated registers, they’re thriving with VPOS systems that make payments seamless across in-store, phone, and online checkouts.

Smart SaaS Upselling Strategies That Actually Boost Revenue Without Burning Out Customers

Wonder how top SaaS brands scale so fast? Their secret isn’t just the product—it’s smart upselling that drives revenue and retention.

SaaS Payment Tokenization: A Complete Guide

You’ve scaled your SaaS—now it’s time to secure it with tokenization, the key to safe, seamless, and compliant payments.

How Tariffs Are Driving Up Your Credit Card Processing Costs

Tariffs may seem like they only affect product prices, but they can also influence credit card processing fees—learn how trade policy could impact your business costs.

How Smart SaaS Billing Becomes Your Secret Growth Weapon

In the world of SaaS, your billing system isn’t just how you get paid—it’s how you build trust, reduce churn, and fuel long-term growth.

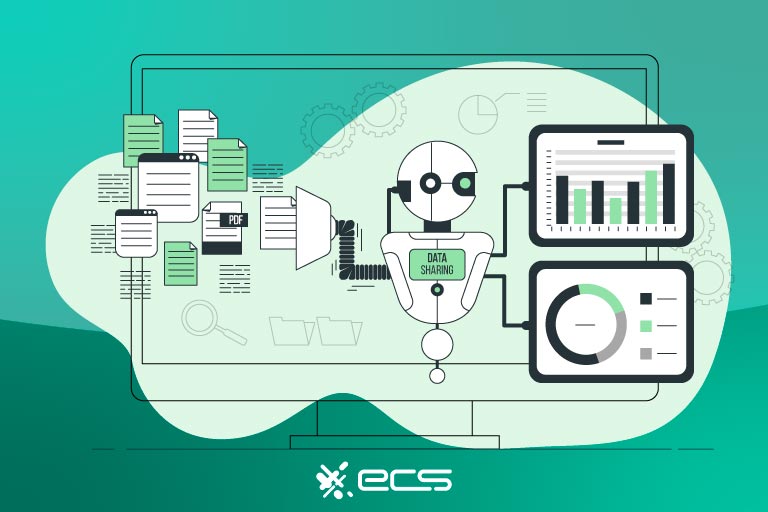

The Shift from Manual to Automated Bookkeeping: Why AI in Accounting Is No Longer Optional

Finance teams are replacing manual bookkeeping with AI to save time, reduce errors, and gain strategic insights faster than ever.

Choosing the Right ISV Payments Partner: What to Look For

Integrating payments is no longer optional—it’s a strategic move that can drive growth, reduce churn, and reshape your roadmap.

Why Direct Debit Might Be the Smartest Billing Move Your Business Hasn’t Made Yet

Still printing invoices or chasing payments? Discover how direct debit can simplify billing, boost cash flow, and save your business time, money, and stress.

Why Most Online Stores Fail and What the Smart Ones Are Doing Differently in 2025

Launching an online store is easy—but growing one takes smart systems, seamless payments, and a strategy built to scale from day one.

Navigating the New “Click to Cancel” Law: What Merchants Need to Know in 2025

Running a subscription-based business? The FTC’s new Click to Cancel Rule could impact how you retain trust, stay compliant, and avoid costly penalties

How Long Can You Stay Afloat? The Truth About Cash Burn Rate Most Owners Ignore

Know your burn rate—because guessing your cash runway isn’t a strategy. ECS Payments helps you stay in control.

What Are Virtual Terminals? A Simple Guide for Small Businesses

Easily accept payments from anywhere—learn how a virtual terminal turns your device into a secure, no-hardware-needed solution for your business.

Payment Solutions for Firearm Training Academies: Streamline Billing, Reduce Risk, and Stay Compliant

Launching a firearms business without the right payment processor is risky. From chargebacks to compliance issues, the wrong fit can cost you big.

How to Handle Refunds and Cancellations in Payment Systems

Refunds and cancellations can make or break customer trust. Learn how to streamline your processes, prevent chargebacks, and protect your brand—whether you’re in retail, eCommerce, or services

Understanding Payment Processor Fees and How to Optimize Them

Credit card fees eating into your profits? Learn how to cut costs, avoid hidden charges, and keep great service—all without the confusion.

Reducing Billing Errors: Tips for Maintaining Invoice Accuracy

Small billing errors can lead to big issues—lost payments, disputes, and delays. Discover how invoice accuracy protects your bottom line.

Exploring the Differences Between ACH Payments Vs. Credit Card Payments

ACH or credit cards—which is better for your business? While both offer digital payment perks like eCommerce and recurring billing, the differences could impact your cash flow and costs. Dive into our quick comparison to find out which fits your needs best.

A Guide to Integrating Payment Systems with Accounting Software

Manual payment entry wastes time and invites errors. Our quick guide shows you how integrating your payment system with your accounting software can simplify your workflow, improve accuracy, and help your business grow.

How to Create Custom Invoices with Branding and Personalization

Custom invoices boost professionalism, brand recognition, and workflow efficiency. Discover how to easily create personalized invoices that reflect your brand with the right tools and design elements.

Recession vs Depression: How To Protect Your Business

knowing the key differences and outcomes of a depression and a recession can better help prepare your business to succeed no matter the economic climate.

How to Implement a Secure Payment System for Your Online Store

Protecting payment data is key to maintaining trust and security. Learn how ECS Payments can help secure your online store with advanced e-payment solutions.

Understanding Payment Gateway Integration: How to Choose the Right One for Your Business

Selecting the right payment gateway is essential for running a successful online or eCommerce business. Without a reliable payment solution, transactions can fail, revenue can suffer, and customer trust can be lost.

How to Optimize Your Invoicing Process for Faster Payments

Timely payments are crucial for maintaining healthy cash flow, yet many businesses face delays that impact growth and add financial strain. By optimizing your invoicing process, you can improve payment speed, reduce client late fees, and enhance cash flow management.

The Impact of Payment Fraud on Small Businesses and How to Protect Yourself

Small businesses face growing risks of payment fraud due to advancing technology and increased online transactions. This threat can cause significant financial and reputational damage, but implementing best practices can help protect against it.

Understanding Pass Through Fees: What They Are, How They Work, and How to Minimize Them

Many business owners focus on cutting labor or retail costs, but a smarter way to save is by reducing credit card processing fees. Pass-through fees are often overlooked, yet they can quietly eat into profits. Understanding and managing these fees can help businesses keep more of what they earn.

Understanding Temporary Holds on Credit Cards: A Guide for Merchants and Financial Managers

Explore how holds work behind the scenes, how customers perceive them, and strategies to make them more acceptable. While not all businesses use holds, they are particularly relevant for those managing reservations, travel, or shipping transactions.

The Ultimate Guide to Electronic Invoicing: How It Works, Benefits, and Best Practices

The Ultimate Guide to Electronic Invoicing explains how digital transformation in accounts payable enhances efficiency, reduces bad debt risk, and simplifies payment collection for small businesses.

How Credit Card Settlements: Impact on Business Finances and Payment Processing Best Practices

When a customer pays with a debit or credit card, the funds don’t instantly appear in the business’s bank account. Instead, a series of steps transfer the money from the customer’s account to the business. A key component of this process is credit card settlement.

Mastering Business Financial Decisions: Strategies, Tools, and Techniques for Success

Whether it’s choosing between a pricey lunch or a full gas tank or deciding how to invest $5,000 in a business, all financial decisions have consequences. Even small choices can impact overall financial stability. For SMB owners, the challenge is making smart financial decisions that balance short-term desires with long-term success.

Everything You Need to Know About Merchant Accounts for Your Small Business

A merchant account temporarily holds funds from purchases. Once the customer’s bank verifies sufficient funds and the transaction is complete, the funds are transferred to the merchant’s business checking account.

Integrated Accounting Systems: Streamlining Financial Operations for Your Business

Accounting software has advanced from basic tools to integrated systems, unifying financial data across departments. Now, you can instantly reconcile books and access accurate company financials in one place.

Implementing Dual Pricing to Reduce Credit Card Processing Fees: A Guide for Business Owners and Accountants

Merchant pricing models always involve costs for accepting credit cards. When reducing processing fees isn’t feasible, implementing dual pricing can help. Here’s an overview of dual pricing and its legal considerations.

Mastering the 3 Core Principles of Accounting: A Guide for Business Leaders

Accounting principles help businesses track finances. The cash principle records settled transactions, while the accrual principle includes earned revenues and expenses.

12 Essential Questions to Choose the Right Merchant Service Provider for Your Business

Searching for a new merchant service provider? Think of it like dating—you want to ask the right questions and get to know the payment processor before committing. To help, we’ve compiled a list of key features and questions to guide your decision.

Top Expense Policy Strategies for Modern Businesses

From fraud to compliance, learn how a well-crafted expense policy can protect your business, prevent disputes, and keep spending under control!

Comprehensive Guide to Optimizing Payment Links

Learn how payment links and mobile wallets simplify transactions—offering your customers a seamless, one-tap payment experience that boosts convenience and satisfaction!

Can I Legally Charge a Credit Card Fee to My Customers?

Is charging credit card fees to your customers legal and could it actually help your business stay afloat? Discover the answers and key insights that every business owner needs to know!

Federal Firearms License (FFL): A Step by Step Guide for Aspiring Gun Dealers

Unlock the step by step guide to securing your Federal Firearms License (FFL) and navigate the legal process with confidence and ease.

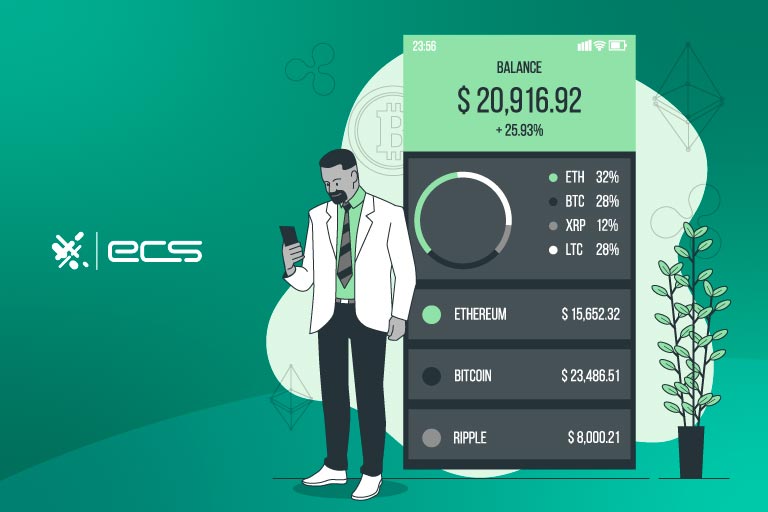

How is XRP and Ripple Designed for Payments?

Ripple XRP could be the future of payments as it bridges two different currencies in a way that is easier to manage and send than current methods.

Processing Recurring Payments: Challenges and Solutions

Overcome subscription payment challenges by implementing automation, PCI DSS compliance, dunning management, multiple payment solutions & customer service.

How to Optimize Payment Processing for Seasonal Businesses

Optimize payment processing for seasonal businesses by managing cash flow, reducing fees, and utilizing scalable solutions for peak and off-peak periods.

Omnichannel Payment Processing: Integrating In Store, Online, and Mobile Payments

The more opportunities you have to collect payments through different channels with omnichannel payment processing, the more sales you will have.

Avoiding Common Pitfalls When Using Merchant Cash Advances

Choosing a Merchant Cash Advance? Ensure you assess cash flow, research thoroughly, and understand the terms to avoid costly mistakes.

ECS Payments Partners with Trident1 to Deliver an All in One POS Solution for the Firearms Industry

ECS Payments, a leading provider of payment processing solutions and merchant services, is excited to announce a strategic partnership with Trident1 POS, the top software provider serving the firearms industry.

Is a Merchant Cash Advance Right for Your Business? 5 Questions to Ask Yourself

A Merchant Cash Advance offers businesses funding repaid through future credit card sales, but it’s important to evaluate if it aligns with your business needs and cash flow.

Navigating Regulatory Challenges in Payment Systems for Healthcare

Build trust and avoid penalties. Payment systems for healthcare must comply with industry regulations such as HIPAA and PCI DSS.

Analyzing the Role of Payment Gateways in Enhancing Customer Experience

Implementing customer-centric payment gateway solutions can ensure a seamless and satisfying payment process for customers.

Charge Cards vs. Credit Cards: Which is Right for Your Business?

Is there a difference between charge cards and credit cards? The answer might surprise you. And yes, it can affect your business.

Charging Credit Card Fees: Understanding the Legality and Best Practices

Charging credit card fees to customers is a great way to avoid extra costs for your business. However, surcharges have regulations you must follow.

US Alliance Group Secures A Top Spot In The Orange County Business Journal’s Fastest Growing Private Companies List

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

Advancements in Biometric Authentication for Payment Systems

Payment solutions that use biometric authentication can provide a more secure transaction process, reducing fraud and potential chargebacks.

Exploring Non Profit Payment Solutions: Challenges and Opportunities

Efficient payment solutions for non-profits include increased donor satisfaction, retention, and fundraising potential, and reduced administrative costs and risk of fraud.

10 Efficient Ways to Collect Payments from Customers

No matter what type of business you own, there are many ways to efficiently collect payment from your customers. Here’s how ECS can help get you started.

Case Studies: Success and Challenges with Contactless Payments in Small Businesses

The trends and adoption rates of contactless payments help us to understand how contactless payments impact businesses and consumers.

For the 10th Time, US Alliance Group Inc. Appears on the Inc. 5000 list, Ranking No. 4095 with Three Year Sales Growth of 109%.

Inc. magazine today ranked US Alliance Group Inc. NO. 4095 on its annual Inc. 5000, the most prestigious ranking of the nation’s fastest-growing private companies.

Fadi Cheikha of US Alliance Group, Inc. Honored with 2024 Midwest Acquiring Association Industry Achievement Award

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

US Alliance Group Inc. Secures A Spot In Orange County Business Journal’s Best Place to Work in 2024

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

30 Business AI Tools To Streamline Your Business

Business AI tools are designed to simplify tasks for a more efficient business. AI can revolutionize your processes, enhance profitability, and unlock new opportunities.

US Alliance Group Reviews and What Merchants Have to Say About The Payment Processor

USAG Reviews depict real examples of how the payment processing company excels in customer satisfaction, dedication to excellence, and industry leadership.

US Alliance Group Has Been Named To Inc.’s 2024 Best Workplaces List

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

The Future of Blockchain in Payment Processing

Blockchain technology in payment processing has benefits including enhanced security transparency, traceability, cost-efficiency & global reach.

Payment Processing for the Gig Economy And Freelancers

Payment processing options for freelance and the gig economy aren’t all equal. If you are a freelancer or gig worker you have choices with how you accept payments.

Digital Identity Verification and Payments

Digital identity verification enhances transaction security and streamlines KYC compliance by using advanced digital ID methods.

US Alliance Group Inc. Is Recognized By Orange County Business Journal At The 2024 Family Owned Business Awards

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

Innovations in Payment Hardware

Examining the latest in POS technology, from smart terminals to portable devices for small businesses. Your payment hardware could make or break your business.

The Future of Retail: Unattended and Automated Payments

Improvements in automated payment technology has really improved customer checkout experiences, except at small businesses.

The Role of Social Media in E commerce Payments

Businesses can use social media to create social proof and leverage influencer marketing along with paid ads to increase their eCommerce payments.

Digital Banking: Financial Inclusion Through Technology

Fintech advancements and digital banking can bridge the gap between the banked and unbanked, creating more financial inclusion.

Emerging Markets and Digital Payment Adoption

Consumer demand for digital payment adoption continues to increase, leading to the emergence of new markets and driving global economic growth.

The Impact of Quantum Computing on Payment Security

With AI advancements and quantum computing on the horizon, payment security may be threatened. Here’s what you need to know as a business.

How to Qualify for a Merchant Cash Advance: A Step by Step Guide

Merchant cash advances are easy to apply for. Providers care more about your processing than your credit and you will simply need a few things to qualify.

Strategic Use of Merchant Cash Advances in Business Growth

Strategically using merchant cash advances can help a business grow. But, when misused, they can be detrimental. Be sure you understand how to properly…

AI and Machine Learning in Fraud Detection

Machine learning and AI technologies have revolutionized payment security, enabling more efficient fraud detection systems for businesses.

Merchant Cash Advance Costs: What You Need to Know

Understanding merchant cash advance costs will help your business better determine if this type of financing is the best option for increased cash flow.

Understanding Merchant Cash Advance

Understanding merchant cash advances can open new doors for financial freedom for your business.

How to Improve Business Cash Flow

Understanding your business’s cash flow is essential for conducting a healthy financial analysis and making informed decisions

Mobile Wallets Vs. Traditional Banking

Mobile wallets use contactless technology to allow customers to easily make payments from their phones online or in person without plastic cards.

ECS Merchant 101: Credit Card Authorization Explained

A credit card authorization protects both the merchant and the cardholder. The merchant can ensure funds are available before delivering goods or services and

How to Implement Sustainable Payments to Benefit Your Business

Sustainable payments benefit businesses and the planet—from biodegradable cards, digital wallet solutions and paperless receipts.

Efficient Invoicing Practices: Strategies For Prompt Payments

Efficient invoicing practices help businesses to receive prompt payments and avoid any future disputes between their clients.

Friendly Fraud: What Is It And How To Avoid It?

Friendly fraud does not involve third-party criminal activity. Rather, it occurs when a cardholder purposely or accidentally issues a chargeback.

The Rise of Biometric Payment Systems

biometric payment systems are the way of the future. Business owners must prepare themselves with what accepting payments will look like in just a few years.

Adapting to Consumer Demand for Payment Flexibility

Consumers want payment flexibility at the point of sale. Is your business equipped to handle this demand? If not, you could be missing out on business.

The Impact of 5G on Mobile Payments

The Impact of 5G on Mobile Payments is revolutionizing the speed, security, efficiency, and accessibility of transactions.

Integrating Payment Systems with IoT Devices

Integrating payment systems with IoT devices has helped to automate transactions and enhance user convenience.

Navigating Global Payment Regulations To Ensure Compliance

Accepting global payments can be challenging due to varying regulations. But, the potential rewards can be advantageous.

The Role Payment Gateways Play in Enhancing Customer Experience

Up to date payment gateways and check-out processes keep customer experience intact. Make sure you’re not making these mistakes with your business.

The Impact of Digital Transformation on Lending Institutions

Digital innovation is transforming how lending institutions operate. However, financiers can harness technology to enhance efficiency.

Manufacturing Businesses Can Effectively Bill Customers with ECS Payments

Manufacturing businesses can effectively bill customers with ECS Payments, offering flexible invoicing options while ensuring security, analytics, and mobile payment gateway options.

How To Accept Payments Over The Phone

Learn why businesses need to accept payments over the phone, their benefits, risks, costs, and seamless integration tips.

How Mobile Apps are Changing the Borrower Experience in Personal Loans

Mobile applications are streamlining personal loan applications and helping lenders in efficient credit assessment and faster borrower approvals.

Is Merchant Cash Advance Right for Your Business?

A merchant cash advance is a type of financing that benefits businesses during start up or slow periods. Repayment is tied to credit and debit card transactions.

Businesses Virtual Credit Cards Explained

Virtual credit cards are a secure alternative for businesses to fill the gaps left by traditional credit cards, checks, or other payment methods.

Payment Reconciliation 101: A Guide For Businesses

Businesses can ensure their accounting is accurate through payment reconciliation.

Expanding Horizons: Treu Merchant Cash Advance for E-commerce Stores

Merchant Cash Advances are a quick and easy way for eCommerce businesses to get the funds they need when in a pinch without the need of good credit.

Fraud Management Solutions: Does Your Business Need One?

Layered fraud management solutions use various advanced methods to prevent fraud losses that can significantly affect businesses.

eCommerce Checkout Best Practices

Efficient eCommerce checkout optimizes your customer experience and generates higher conversion and revenue growth.

Payment Link: Accept payments online without a website

Payment links are an easy and convenient way to accept digital payments. But is it required to have a business website to use payment links? Let’s find out.

Five In-Person Payment Methods: Which One is Right for You?

In-person payments for mobile or brick-and-mortar businesses is essential. But, which type should you accept? Cash, debit or credit card, check, or ACH?

How To Accept iPhone Payments

Accepting as many forms of payment as possible, including iPhone payments, will always benefit businesses by catering to a broader market share.

Payment APIs: A Guide for Merchants

Payment APIs enable communication between different digital systems, which facilitates secure and seamless payment processing for businesses.

How To Scale Your Saas Business

Claim your market share of the growing SaaS industry? Scale your SaaS business through social media, content marketing, trade shows & sales teams.

Merchant Accounts 101

Merchant accounts are essential for businesses to accept digital payments such as debit and credit cards both in-person and online.

Inflation Indicators: 4 Metrics to Guide Business Planning

Inflation indicators have become a crucial tool for businesses and consumers, providing valuable insights into what to expect in the economic landscape.

How To Accept Digital Wallet Payments

Digital wallets provide secure mobile payments, boost sales, expedite checkout, enhance security, and attract customers. Businesses can accept them with an NFC card reader.

Google Pay: An In-depth Guide

Merchants boost customer base and revenue by seamlessly integrating Google Pay at their point of sale, enhancing payment options.

Integrated Payments with ECS Payments

Integrated payments create a cohesive business by seamlessly combining payment processing hardware and software with various business operations.

How To Accept Apple Pay From Customers

Elevate customer experience and optimize revenue by embracing Apple Pay – the top choice for secure, hassle-free payments in-person and online.

Incorporate in Delaware vs. California: Pros and Cons

Deciding whether to incorporate in Delaware or California is a pivotal choice for businesses, with each state offering distinct advantages and drawbacks.

ACH Reversals vs. ACH Returns

ACH reversals correct transactions that may have errors, while ACH returns occur when a transaction fails or is rejected before funds are transferred.

Online Payment Systems: How Does It Work?

Online payment systems secure businesses and broaden their reach, yet active data security measures are essential beyond relying solely on payment.

The Future of Retail Stores

The future of retail stores involves coexisting with e-commerce, embracing tech trends, enhancing customer experience, optimizing payments options and more.

Tap To Pay: Transforming Mobile Devices Into Payment Terminals

Turn your smartphone into a contactless tap to pay POS to revolutionize your business, enhance customer experience & streamline operations.

10 Questions You Should Ask Before Buying POS Software

POS software is the control system of your entire business operation. Don’t make the wrong decision in your business tools.

Accept Payments For Your Cleaning Service Business

Why your cleaning service business must accept credit and debit card payments, how to easily do it, and why cash and p2p payments aren’t worth it.

How To Sell My eCommerce Business: A Step-by-step Guide

Learn if there is a simple trick you’re missing to save your eCommerce business from selling. If not, these steps can get you the most out of your sale.

Understanding High-Risk Payment Processing Gateways: A Comprehensive Guide

High-risk payment processing gateways cater to high-risk businesses. They specialize in handling larger transaction volumes & international transactions.

A Comprehensive Guide on Personalized eCommerce Marketing Strategies

Personalized eCommerce marketing strategies can take your shop from bleh to booming. Implement these easy steps today to see growth.

How To Open A Bar Successfully

Navigate the essential steps on how to open a bar successfully. From licenses to design, master the art of bar ownership and turn your passion into profit.

Mastering High-Risk Payment Processing: Strategies, Challenges, and Solutions for Businesses

To navigate the challenges that come along with high-risk payment processing such as chargebacks, fraud, and fees, you need to understand how payment processing works.

The Best Online Marketplaces That Are Reshaping Business to Business Sales

Successfully navigating business to business marketplaces can impact your relationships. Here’s the best platforms to consider and what you need to do.

Best Practices To Grow E-commerce Businesses

Online sales competition is fierce, to increase your market share, you have to know how to properly grow your e-commerce business with scalability.

Corporate Transparency Act Of 2024: What Businesses Need to Know

The Corporate Transparency Act went into full effect on January 1, 2024 & It will impact millions of businesses.

E-commerce: How to Build a Direct-to-Customer Online Sales Channel

Optimize your business by incorporating various online sales channels into your strategy to thrive in today’s digital marketplace.

3 Ways to Strengthen Your Supply Chain in 2024

Strengthen your supply chain to secure a competitive advantage, boost operational efficiency, and achieve cost savings with these 3 steps.

When to Say Goodbye to Your Legacy eCommerce Platform

Outdated systems are holding your business back. Here are the key signs to look for to know when it’s time to upgrade your eCommerce platform.

Benefits of a Pop-Up Shop to Perfect Your Brand

A pop-up shop offers a temporary retail space for businesses to increase brand awareness, gain new customers, boost sales & engage with clients.

12 Fears of Starting a Business and How To Overcome Them

Identifying which fears of starting a business are holding you back is essential. Here, we help you understand and overcome these common fears.

How to Keep Costs For Processing Wholesale Payments Down

Processing wholesale payments requires strategic considerations. With lower profit margins, minimizing credit card fees is essential.

Merchant Services for Wholesalers Beyond Just Payment Processing

Wholesale merchant services offer unique solutions due to the industry’s place in the supply chain. See what wholesalers should consider beyond payment processing.

Green Landscape Billing: Online Invoicing

Online invoicing streamlines the process of getting paid. Paper invoices, cash, and checks all have their drawbacks. Discover why online invoicing wins.

7 Strategies For Business Growth in 2025

Businesses that adapt quickly and leverage these 7 strategies for business growth will thrive, while those that lag behind will struggle.

E-Commerce Isn’t Killing Retail, It’s Inspiring Experiential Shops

Is the ease of eCommerce killing retail? Or has it created an opportunity for in-person merchants to create a more immersive space for consumers?

Discounting Smarter, Not Deeper! Discount Strategies That Work

Offering discounts is a great way to drum up more business, but it could eat away at your profits. Here are discounting strategies that work.

What Your Business Needs to Know About Collecting Payments Online

Collecting payments online is a beneficial way to increase your business whether you sell eCommerce, in-person goods, or even services.

Navigating Regulatory Waters: How Gun Store POS Software Simplifies Compliance

The right POS system can provide the perfect solution to maintaining gun store regulatory compliance.

Pricing Strategies For Service-Based Businesses

Strategies for service-based businesses, unlike retail-based ones, involve a more complex evaluation of factors.

The Three Pillars of Gun Store POS: Hardware, Software, and Payment Processing

Gun store POS systems help firearms merchants with regulatory compliance, lowering costs and increasing efficiency, and exploring new revenue streams.

7 Reasons Your Business Needs a Satellite Location

A satellite location can provide benefits such as new sales opportunities, reduced overhead costs, enhancing customer experience, and more.

Is a Brick and Mortar Worth it Anymore?

Questioning the significance of traditional brick and mortar businesses in the era of digital dominance? We examine strategies for sustained relevance.

Remote Work Security: Challenges and Solutions

Remote work security is essential for businesses that have employees working outside of the workplace.

Upselling Techniques and Other Creative Ideas to Boost Your Average Ticket Price

Discover effective upselling techniques to enhance your business revenue. Explore insightful strategies for sustainable growth and reduced marketing costs.

Digital Payment Methods in Healthcare Billing: Empowering Patients for Smooth Adoption

Learn how modern healthcare is embracing unique digital payment methods to make billing hassle-free for both patients and providers.

E-Commerce Security: Protecting Transactions in the Digital Marketplace

Online payments make e-commerce possible. But they are a perfect target for hackers and other criminals.

The Future of Payment Processing: Innovations and Challenges in 2024

Merchants must stay informed on the fast-evolving future of payments for a seamless blend of convenience, security, and limitless possibilities.

Sustainable Goods and Payments: Navigating Risks and Opportunities

Consumers are looking for more sustainable goods and businesses they can trust. Show your customers you care with sustainable practices and payment options.

EdTech Payment Processing: Overcoming Risks and Enhancing Accessibility

How can EdTech companies seamlessly integrate and efficiently manage edTech payments? ECS Payment shows you the best payment solutions.

High Risk Payment Processors for Payment Gateways

A high-risk payment gateways makes it possible for your business to accept all digital payments. Discover the best high-risk gateways 2024 has to offer.

Telemedicine: Bridging Gaps in Healthcare and Simplifying Payments

Telemedicine makes health care visits convenient. Your patient payment options should be just as easy.

How To Save Receipts For My Business Taxes

Saving business tax receipts is essential for the most streamline accounting practices and best tax break.

Why NACHA API Standardization Matters For Your Business

NACHA API Standardization in the ACH network facilitates the translation process between systems of the payment ecosystem.

Custom Patient Payment Options Can Improve Your Healthcare Practice’s Revenue

Leveraging the help of a practice management bridge can help you provide flexible, customized patient payment options to increase your revenue.

Business Tax Deadlines 2024: Corporations and LLCs

Business tax deadlines can be tricky to navigate. This in-depth review will help you to stay on top of all your tax to dos for 2024.

11 Ways to Prevent Data Breaches in Healthcare

Over the past 15 years, 360 million medical records were compromised. To prevent data breaches in healthcare, implement security measures & educate staff.

How to Sell Merchant Services

Learning how to sell merchant services successfully means understanding your market, and addressing customer needs through active listening & authenticity.

Streamlining Healthcare: The Power of Practice Management Software

The impact of practice management software on healthcare practices and payment processing efficiency. Do you have the best program?

How to Invoice: 9 Essentials You Should Include

This guide teaches businesses like you how to write an invoice like a pro to ensure timely payments and streamline your financials.

Cut Costs and Boost Sales: Why It’s Time to Consider a New Payment Processor for the Holidays

Switching to a new payment processors for the holidays can be a cost-effective strategy for your business.

Unleash Your Website Potential: How a New Payment Processor Can Transform Your Holiday Season

A new payment processor for your eCommerce business may be the key to unlock your holiday sales potential. Find out the signs you need to switch.

Upgrade Your Retail Store Payment Processor for a Record-Breaking Holiday Season!

Upgrading your payment processor will better prepare you for a successful holiday season.

How to Upgrade Your Payment Processing Equipment

Upgrade Your Payment Processing Equipment to Stay Ahead of the Tech Curve With Modern POS Solutions. Boost Security, Efficiency, and Customer Experience.

Pre-Authorization Charges: What are they?

Preauthorization charges can be a great tool for merchants to protect their high-dollar transactions.

9 Signs You Have a High-risk Business

9 signs that say your business is high-risk and will need high-risk payment processing solutions including the products you sell.

Failproof Tip to Get Approved For a Merchant Account

To process credit or debit card payments with your business, you must be approved for a merchant account.

The Benefits Of ACH Payments For Business Owners

Business owners can take advantage of the benefits of ACH transactions, such as cost-efficiency & convenience.

Enterprise Payment Processing

Enterprise payment processing for large businesses making millions of dollars per year needs a variety of payment methods & a positive payment experience.

Magnetic Stripe Card vs. EMV Chip Card

EMV Chip Card technology makes the transfer of credit card data safer than magnetic stripe cards. Mag stripes will be eliminated completely by 2024.

Gun Store POS Software and eCommerce Solutions You Need

Discover Gun Store POS Software: Explore features and benefits for firearm retailers, including range management and ATF compliance.

Payment Processing Gateways 101

You need the right payment processing gateway to run your business. Learn everything you need to know about what to look for when selecting the right gateway.

POS Debit, Descriptors, Disputes, and Point of Sale Charges 101

Learn how to properly navigate POS debit, optimize bank descriptors, and minimize chargebacks with our point-of-sale guide.

An Integrated Payment Gateway Can Cut Your Costs and Increase Profits

Integrated payment gateways benefit businesses by reducing costs, increasing efficiency, providing security features, and offering control.

Wireless Credit Card Processing Benefits

Wireless credit card processing has advantages for both brick and mortar retail, restaurants, pop-up shops, foods trucks, and vendors in any industry.

The Importance of Disclosing Your Return Policy to Customers

Crafting clear and effective return policies can elevate customer trust and satisfaction, leading to increased sales and business success.

How to Pick the Best Healthcare Payment Processor for Your Practice

The right healthcare payment processor is essential. Practice Management Bridge and ECS explain exactly what to look for, for a secure and streamlined practice.

Improve Your Patients Experience And Lower Your Cost With ECS Payment Processing Solutions For Healthcare

The right payment processing solutions for healthcare can eliminate time-consuming and revenue-draining manual practices.

Unlock Business Bliss with Spa Credit Card Processing Solutions

Enhance client and business experience through seamless spa credit card processing with contactless payments, online reservations & subscriptions.

2024 Sales Strategy: Markups and Margins

We explain the key differences and strategies for boosting your sales in 2024 with markups and profit margins.

Secure and Compliant Payment Processing for Healthcare Practices

HIPAA-compliant payment processing for healthcare facilities is crucial, ensuring secure, private, and legal transactions, safeguarding patient data and trust.

Protect Your Business Against Email Scams

Learn how to protect your business against phishing scams. compromised business emails and phishing attacks threaten, exploit, and can be financially disastrous to any business.

Understanding B2B Payments

Explore efficient B2B payment processing solutions, including tailored integration for streamlined operations and enhanced customer experiences.

How to Lower Food Costs For Your Restaurant

Discover how to lower food costs through proven restaurant strategies. These simple solutions will make you kick yourself for not thinking of them sooner.

How To Choose the Right Provider for Your Medical Credit Card Processing

Learn how to choose the ideal partner for your medical credit card processing needs, ensuring seamless HIPAA-compliant payments.

Top Trends in Healthcare Payments You Need to Know

Stay Ahead in Healthcare Payments: 2023’s Game-Changing Trends to watch.

Improve the Healthcare Experience With Automatic Patient Payments

Discover how automated patient payment solutions are transforming the overall patient healthcare experience and streamlining processes.

How to Hold Employees Accountable

Learn these top tips for how to hold employees accountable while encouraging a positive workplace.

6 Strategies To Win Back Customers

Seeking out new customers is expensive. Learn how to win back customers with the following strategies.

How to Launch and Operate A Successful Restaurant

Launching a successful restaurant takes time, research, a great concept, and funding. We are here to break this down for you to give you a head start.

Introducing ECS and Practice Management Bridge Payment Processing Solutions For Your Healthcare Facility

ECS and Practice Management Bridge payment processing solutions and management systems reduce healthcare facility costs by 33%.

Why and How To Collect Customer Data

Collecting customer data is important for facilitating recurring payments and guiding marketing strategies—both on a personal and market-wide level.

Trendy Restaurant Social Media Ideas To Boost Your Business

Use these viral restaurant social media ideas to engage customers and boost the popularity of your brand online and in person for higher sales.

9 Tools to Protect Your Business from Credit Card Fraud

Strategies to prevent credit card fraud

Must-Have Restaurant Payment Solutions For Your Small Business

Successful restaurants need to leverage their restaurant payment solutions, among other systems, to overcome challenges and emerge more robust.

How To Protect Yourself From Restaurant Liabilities

There are plenty of ways to address risks and restaurant liabilities in the industry.

How to Streamline Your Payments With the Right Healthcare Merchant Account

Optimize healthcare payments with the right healthcare merchant account: Explore HIPAA compliance and the best payment processing for your practice.

The Best Dental Payment Processing for Offices

The best dental payment processing solutions to date. Enhance efficiency and financial management in your dental practices with Practice Management Bridge and ECS Payments.

SMS Payment: How Your Business Can Leverage Text to Pay

Businesses can use text to pay by texting customers a payment link. With a click, the customer is brought to a payment gateway to complete their payment.

How to Get a Federal Firearms License (FFL)

See which Federal Firearms License or FFL you need to work in the firearms industry. There are different types of FFLs based on your business.

Collecting Online Rent Payments Made Easy

Collecting online rent payments can be easy…if you use a payment processor for online rent payments.

Online Payment Processing For Dropshipping

A dedicated payment processor and merchant account can help protect your dropship business and its online payments.

Why a Vending Machine Card Reader Will Attract More Customers

Vending Machine Card Readers attract more customers because most don’t carry cash anymore. It also is a safer way to collect payment.

Accurate Customer Data For Recurring Payments is Crucial

Subscription services are a popular money-making business today. But, if you are not getting accurate data in subscription services, you could be missing out.

3 Mistakes To Avoid in Recurring Billing

Subscription services business models are a great way for merchants to profit more with loyal customers. But be careful to avoid these fatal mistakes.

Equip Your Business with Trident1: The All-in-One Gun Store POS System and Range Management Solution

Gun store POS systems need extra functionalities. Trident1’s FFL POS system puts sales, CRM, compliance, and asset management all in one dashboard.

SaaS Payment Processing

SaaS payment processing involves recurring payments. The recurring billing cycle is handled by the payment gateway or the subscription management software.

US Alliance Group Inc. Wins Orange County Register’s Top Work Places of 2023

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry.

Authorize.net and ECS Payments Processing For Your Business

Explore Authorize.net and ECS Payments Gateway Features for your business. You’ll learn about integration options, eCommerce solutions, secure transactions.

How To Implement Recurring Billing Integration

Efficiently process your customers’ credit cards, debit cards, and ACH payments, with recurring billing integrations for your merchant account.

Payment Processing for Freelancers

Take control of your business with cost-effective payment processing for freelancers. Say goodbye to hefty platform fees and save thousands of dollars each year for your financial freedom.

US Alliance Group Secures A Top Spot In The Orange County Business Journal’s Fastest-Growing Private Companies List

US Alliance Group Inc.

Parent Company to Electronic Cash Systems

Revolutionizing the Payments Industry

Payment Terminal vs. POS Systems

Payment Terminal vs. POS System: Both provide merchants with card acceptance capabilities. We explore the benefits of each depending on your needs.

Do I Need To Be PCI Compliant?

Do I Need to be PCI Compliant? See what the Payment Card Industry has to say about merchants who are PCI compliant.

ECS Payments: Credit Card Processing Solutions

The best merchant service provider is ECS Payments credit card processing solutions. Offering 1. credit and debit card processing 2. In-house support 3.Integrated gateways.

Best Credit Card Processing for Franchises

The best credit card processing for franchises should offer unique customizations that help businesses succeed. 1. Online 2. Mobile 3. High-risk 4. gateways.

Online Payment Processing 101

ECS specializes in online payment processing and high-risk payment solutions for every type of eCommerce business.

SaaS Billing Process and Best Practices

Discover the best SaaS billing processes to keep your business ahead of the competition and attract more clients to your service with these best practices.

Online Payment Processing For Nonprofits

The best online payment processing for nonprofits should offer 1. Credit, debit, and ACH payments 2. Integrated payment links.

What To Put On Your Business Card

Whether you are an owner of a business, a freelancer, networking, or searching for a job, here are the top things you must put on your business card.

How the NMI and ECS Payments Partnership Can Benefit Your Business

Access diverse features like multi-currency acceptance, virtual terminals, subscription management, and more with the NMI and ECS Payments partnership.

What Is A Hosted Payment Page?

A hosted payment page is hosted by another server, generally run by your payment gateway. It is the fastest way to start accepting payments for an eCommerce website.

How to Price Your Services: A Formula

How to price your services (1) know your marketplace (2) factor in your indirect and direct expenses (3) factor in how much you need to make (4) charge.

The Most Comprehensive Firearms Payment Processing Point of Sale Solutions You Need For Your Business

The ECS Trident1 partnership facilitates high-risk firearm payment processing, compliance, inventory, and other business processes for gun stores, gunsmiths, and shooting ranges.

Your Sales Are Down? Do This to Fix it in 15 Days

Transform your business with expert insights, data-driven tactics, and actionable steps that guarantee rapid revenue growth in only 15 days!

US Alliance Group Secures A Spot In The Inc 5000 List of 2023

US Alliance Group, Inc (USAG), parent company to Electronic Cash Systems (ECS), announced it has once again secured a spot on the prestigious Inc. 5000.

How to Leverage eCheck Payments

Save time and money by learning to leverage echeck payments for your business. The ACH network makes it easy to process digital payments.

POS Best Practices For Transaction Security

POS Best Practices For Transaction Security 1. Use The Most Up To Date POS Hardware 2. Do Not Leave Your POS Unattended 3. Monitor Activity.

What Does PCI Stand For and What Is PCI Compliance?

PCI compliance is when a merchant follows standardized regulations for credit card security put forth by the PCI Security Standards Council.

9 Ultimate Business Growth Strategies

Business Growth Strategies For Your Small Business 1. Sales Strategies 2. Free Content Delivery 3. Influencer Marketing 4. Expand Your Product or Service Range.

What To Do When WooCommerce Drops Your Merchant Account

WooCommerce merchant accounts can be tricky for high-risk merchants. Follow these steps when you need a payment gateway if yours is dropped.

Retail Payment Processing 101

Without the right retail payment processing systems, services, and pricing structures, your business is missing out on savings that could multiply your revenue.

The Best Restaurant Credit Card Processing Solutions

The best restaurant credit card processing solutions will grow your business, provide exceptional customer service, and run a streamlined operation.

What Is Straight Through Processing And How Can It Benefit Your Business?

Merchants using straight through processing can enjoy the benefits of seamless automated electronic data transfers.

Insurance Agencies Payment Solutions: What You Need To Know

What insurance agencies’ payment solutions you need to look for to build better automated collections and payout systems without paying ridiculous fees.

How Instant Bank Verification Can Help High-Risk Merchant Accounts

Instant Bank Verification helps high-risk merchants not only receive merchant account approval faster but if implemented in their ACH transaction flow.

Payment Processors For Your Online Gambling Merchant Account

Payment Processors For Your Online Gambling Merchant Account

5 Effective Ways Digital Goods Merchants Can Prevent Chargebacks

Because the products are not tangible, digital goods merchants experience a high volume of chargeback disputes. But there are ways to solve this issue.

Signing Credit Card Receipts: Is it still Required?

Signing credit card receipts is now optional if you have an EMV-compliant credit card reader. EMV-compliant checkout carries many benefits.

Biometrics in Payments: How Will They Affect Your Business?

biometric payments technology may be the ultimate level of security, in addition to facilitating easy, quick payments. The future of payments will affect your business in the following ways.

Online Payment Problems (And How To Fix Them)

online payments are a great way to increase sales and offer more to your customers. However, there are a few problems you need to be aware of such as 1) security 2) chargebacks.

The Risks Of Buy Now Pay Later Services

Buy Now Pay Later (BNPL) offers payment plans to customers for immediate purchases, even though they may not have the full funds available.

What is Authorize.net? A Payment Gateway Explained

Authorize.net is a gateway solution for traditional and high-risk merchant transaction processing. It offers many different tools for merchants to use.

Sales Invoices For Payment Processing: a Godsend to My Growing Business

A sales invoice includes key information from an order such as how much, the cost per unit, and the total cost. It includes information about the buyer.

Why You Should Avoid Signing Up For Merchant Bank Credit Card Processing

Merchant Bank Credit Card Processing may not be the best solution for your business…and here’s why!

5 Signs It’s Time to Switch Payment Processors Before the Holidays

5 signs it’s time to switch payment processors before the busy holiday season. 1. high fees or wrong payment structure 2. poor customer service.

How to Switch Merchant Accounts

Don’t make the mistake of sticking with or choosing the wrong payment provider. Learn how to best switch merchant accounts for your business.

6 Red Flags Indicating That It’s Time To Switch Payment Processors

Red flags that you need to switch payment processors for your business include 1) expensive pricing structures 2) Hard-to-reach customer support.

Temporary Merchant Accounts For Seasonal Businesses

Temporary Merchant Accounts could be an option for seasonal businesses, however, companies like ECS offer permanent merchant accounts for a better cost.

Food Truck POS: Get the Most out of Your Mobile Payments

These guidelines help to maximize your revenue with the perfect food truck POS system and processing for mobile payments catered to your small business.

Get a Clover Kitchen Display System (KDS) For an Efficient Restaurant

Clover kitchen display systems show customer orders to the chef and line cooks in the restaurant kitchens. Replace paper tickets for efficient an business.

What is a Merchant Services Provider?

A merchant service provider provides services to businesses that eneable digital payment collection for their products and services from their customers.

What Are Integrated Payments And How Do They Work?

Integrated payments leverage analytics to help merchants boost their sales with insights into their business

Stop Packages From Being Stolen by Porch Pirates

Use these steps to protect packages and your business from porch pirates and stolen deliveries

Merchant Account Limits: A Guide

Merchant account limits are set in place to protect businesses, cardholders, and the financial institutions involved in the process.

Get Paid Faster With Payment Links!

payment links help your business accept payments online without the need of an eCommerce website. They offer easy solutions for quick payments.

Everything Your Small Business Should Know About PCI Compliance

What is PCI Compliance? All things your small business needs to know about PCI compliance and how it affects you are answered here.

7 Easy Contactless Ways to Collect Payments

Merchants can collect contactless payment in 7 easy ways 1) NFC-payment 2) QR codes 3) mobile wallets 4) online payments 4) Subscriptions 5) ACH