As a business owner, it is important that you understand the difference between a recession versus an economic depression. Because as we head into quarter 1 of 2023, we’ve all been warned of the coming economic collapse. It’s important to know the difference and how you can prepare for it.

As we all know, 2022 brought many trials and times of uncertainty with the rising inflation. It was a season that forced many small businesses to become creative to prosper regardless of the troubling economic times.

If you were able to make it through the skyrocketing expenses and new commerce trends with consumer responses, the next goal is to make it past the recession hurdle too. My hope is this article will provide you with encouraging insight on how to prepare for the next season of the economic cycle.

What is a Recession?

The United States National Bureau of Economic Research (NBER’s) technical recession definition is a significant decline in economic activity where there is a fall in the GDP for more than two successive quarters.

Who Determines a Recession?

Since 1978, The National Bureau of Economic Research (NBER) has had the task, in the United States, to analyze and declare the country’s economic season. Including dating the start and end of recessions. The NBER uses the country’s GDP to make its determination.

When Is an Economy Considered to Be in a Recession?

The fall in GDP is not marked by a set number, however, certain elements pinpoint the effect of a recession including:

- A decrease in the gross domestic product (GDP)

- An increase in the rate of unemployment

- A decrease in household income

- A decrease in consumer demand

- A decrease in production and sales

- A decrease in sales

What Causes a Recession in the Economy?

Throughout US history, there have been triggers that have led to the commencement of an economic downturn. Though these triggers are common, it is not always an indication that a recession will occur as a result. Regardless, some of the common causes of recessions include the following.

Rising Inflation

The first trigger is Inflation. Experts characterize inflation as a rise in the cost of goods and services. Inflation prices generally increase over time. Rising prices can have both positive and negative effects on businesses and the economy.

Inflationary times generally allow businesses to charge higher prices on essential goods. Creating a higher profit margin.

While inflation’s beginning can trigger consumers to make big purchases before prices become too steep along with their essential purchases, it can also erode consumer purchasing power over time– leading to a decline in living standards. And when this happens, spending slows. When spending slows, a recession may be on the horizon.

Stock Market Crash

The Standard and Poor’s 500 (The S&P 500) is an index that tracks the stock market performance of 500 of the United State’s largest public companies. When the economy begins to shift, the S&P 500 will reflect this change.

Stock market panic generally occurs when investors anticipate a crash. A stock market crash is categorized by a sudden steep drop in company stock prices. A decrease in stock prices could happen due to political turmoil, natural disasters, or the more obvious, economic shift in its natural cycle.

Financial market crashes create lowered stock prices because investors lose confidence in the economy. With lowered stock prices, companies can suffer in investments and cash flow needed for profit, growth, and simply making ends meet.

Rising Interest Rates

The economic yo-yo fluctuates based on supply and demand. Regulated and balanced by the central bank’s Fed rat credit availability is either tightened or loosened. So to combat peaked inflation, the central bank will increase interest rates.

As a result, financing becomes more expensive. Tightened credit availability from the Federal Reserve can lead to a decrease in consumer demand. Thus a decrease in sales and profits.

Resulting in employees losing their jobs. The increase in interest rates can then lead to an overcorrection of economic inflation, resulting in the onset of a recession.

Asset Bubble Bursts

As a result of inflation, asset prices increase. When investors purchase assets at higher prices than they are worth, an asset bubble is created. Over time, the asset bubble will “burst.” Resulting in plummeting asset prices. Far below their true worth. When undervalued buying and selling occurs, a recession is soon to hit.

Black Swan Events

A “black swan” event is in other words, an unforeseen incident that is outside the norm, causing significant economic consequences. This could include new political initiatives, war, health crises, such as Covid-19, and more. Black swan events can also trigger inflation, stock market crashes, and interest rate fluctuations.

Supply and Demand Pulls

Because supply and demand drive the economy, recessions occur when there is an overage of supply combined with a lack of demand. Recessions are natural in the business cycles. And supply and demand are in constant fluctuation.

Any of the above factors can lead to a decrease in consumer demand. And with overstock on supply, manufacturers and merchants are desperate to make a sale. Even if the sale is undervalued.

Regardless of why recessions occur, it is important to understand they will happen. The economy is a cycle.

What Are the Effects of a Recession?

So, in contrast to what causes a recession, it’s important to know What a recession means for the economy. Recessions can affect consumers, businesses, and the economy as a whole.

Recessions can happen from time to time. However, it doesn’t mean consumers or merchants welcome it with open arms. Though Federal Reserve policies put in place to combat inflation are aimed at providing relief to consumer pockets, they can lead to undesirable recession side effects.

The effects of economic recession include the following:

Threatened Wages

The number one thing recessions disrupt is the labor market. When face to face with a slow economy, businesses may need to consider abandoning their expansion plans and conversely find ways to cut spending.

This may mean delaying new projects or investments. Ceasing growth oftentimes goes hand in hand with reduced profit margins. As an employer, it will fall on your shoulders as livelihoods are at stake, and it’s up to you to manage to keep your business afloat while also trying not to negatively impact as many employees as possible.

Because of this, the solution that offers the best compromise between drowning in the recession or laying off employees is cutting wages, and hours, or halting raises. With a decrease in demand, there is less growth and thus, fewer job opportunities.

With fewer available job opportunities, current staff will do what they can to remain employed. And that may be to accept a cut in wages or hours until the company can gain traction again after surviving the recession.

Increased Unemployment

If wage cuts aren’t sufficient enough for your business to make ends meet, you may have to go into survival mode. The last straw before closing up shop is department closures or layoffs.

Increased job losses have accompanied every US recession. Because of this, unemployment caused by a recession is called cyclical unemployment. As the economy cycles through the years unemployment ebbs and flows the same way interest rates rise and fall, inflation and deflation arise and the cycle continues.

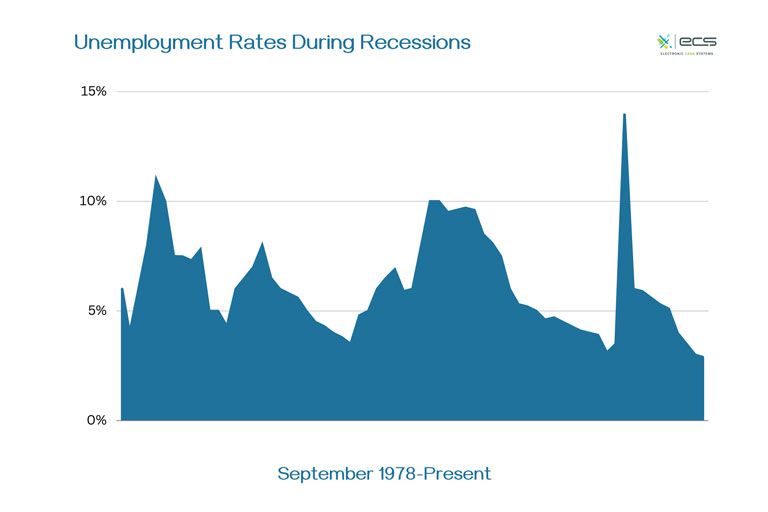

The unemployment rate, however, depends on the severity of the economic downturn. For example, the unemployment rate surged to 14.7% during the COVID-19 pandemic. This is the highest the United States has seen since the Great Depression.

Recessions diminish job security and significantly reduce alternative job prospects. The amount of time a person remains unemployed also depends on how long the economy can kick start again.

During the Great Recession, 45 % of the unemployed remained so for over six months. Luckily, the COVID unemployment result did not suffer this much and businesses began hiring again soon after layoffs and temporary furloughs ensued.

Overextended Employees

Recessions even impact employees lucky enough to remain employed. Because many businesses have to employ layoffs, many employees have to pick up the slack. Leaving them feeling overworked and underpaid during recessionary times.

And even as the stress of the job adds up every day, the question of their value or the company’s stability looms overhead every day. Wondering what their financial future looks like.

Tightened Credit Availability and Banking Crises

With the risk of unemployment on the horizon during a recession, financial institutions become more stringent with financing and loan approvals. The goal is to avoid the risk of consumer defaults and bankruptcies during times of financial hardship.

Moreover, bank panics may initiate as the stock market plummets. Additionally, once unemployment rises and loans begin defaulting, banks experience a shortage of funds. Which could ultimately lead to a banking crisis.

Some examples include Wells Fargo Bank, Chase Bank, and Citi Bank. During the COVID-19 pandemic, these financial institutions denied most, if not all applications for new home equity lines of credit.

Meanwhile, credit card companies also reduced credit limits on existing cardholders. These financial pullbacks make it difficult for consumers and businesses to access necessary funds for purchases, growth, and making ends meet.

Prices Drop

One of the most common consumer trends during a recession is a decrease in product demand. Decreased demand results in decreased sales. As the Federal Reserve tightens credit availability and raises interest rates, spending slows and consumers tighten their budgets.

Forced to lower product and service prices, as a result, businesses hope to attract customers to make a purchase. Over time, lowered sales numbers equal losses for businesses. Though price drops sound like an advantage for consumers, they can hurt businesses, which then reflects on their employees and cause further consumer hesitation.

Federal Assistance Creates Higher Budget Deficit

With cyclical unemployment, sales depletion, and decreases in household income, tax collections suffer. Because the federal budget relies on the collection of taxes, the federal government budget also suffers.

The government has created programs to assist its citizens, during recessionary times. Even though there is a reduction in tax collections. These programs aim at providing relief to Americans to boost spending power and thus the economy. These automatic stabilizer programs include:

- Unemployment assistance

- Stimulus checks

- Food stamps

- Business Bailouts

However, federal interference in the economy can be politically controversial. This is because these assistance programs create a higher federal deficit. Which years later, can bite the public in the behind. Resulting in higher taxes and new invasive legislation once the economy is healthy again.

Falling Living Standards

During a recession, household income per capita falls from deficient economic output. Causing high unemployment rates. Which results in the inability to keep up with previous living standards.

Job losses include the loss of health insurance and all other benefits. Adding to the financial stress of a household that has medical bills to cover. And leads to neglected health because insurance will no longer cover routine services, checkups, chronic disease treatment, or emergency services.

Moreover, with a lack of financial resources, nonessentials are no longer an option. Which means no more date nights, family vacations, self-care days, or home upgrades. Even the essentials can become burdensome and may be lacking in the household for periods of time. Including food staples, electricity, and gas.

The lack of access to resources can lead to terminal illness, malnutrition, poverty, and homelessness.

Interest Rates Fall

One of the final effects a recession has on the economy is the decrease in interest rates. The central bank maintains the balance of the American market. The goal is stable costs of living and low unemployment rates.

To attempt to balance the economy, the central bank leverages interest rates through the Federal Reserve, which affects the way both Americans and financial institutions can borrow money.

To combat inflation, borrowing becomes more expensive as the Fed Reserve raises interest rates. Conversely, to combat recessions, borrowing becomes more affordable, because the Fed Reserve lowers the interest rate.

When money becomes more available, spending will pick back up, creating an increase in demand. Thus, stimulating the economy once again.

How Does the Recession Affect Me?

If you are a business owner, it’s important to know what happens in a recession. When there is a significant decrease in demand, businesses’ revenue drops. So merchants must adapt by making adjustments to remain afloat. These changes are a direct result of the economic recession.

Decrease in Profit and Employee Layoffs

However, economic recessions can have varying levels of consequences based on a company’s size. For example, a small business may experience a significant decline in business, which results in the need for wage slashing and layoffs to remain afloat.

Meanwhile, a public corporation may be able to weather financial hardships by issuing temporary employment furloughs or cutting hours and finding alternative partnerships and suppliers.

Though both size businesses will ultimately face a decline in demand and sales, small businesses have less financial cushion and thus, a more difficult time avoiding failure.

Restricted Access to Funds

Because small businesses have fewer assets, they have less collateral. So lenders are more likely to deny loans and financing to these businesses as credit becomes more restricted during a recession.

Additionally, because small businesses are private companies, they do not play a role in the stock market. This means they cannot sell company stock to investors to gain more cash flow. Moreover, government bailouts usually skip right over the little guy when it comes to saving businesses.

What is a Depression?

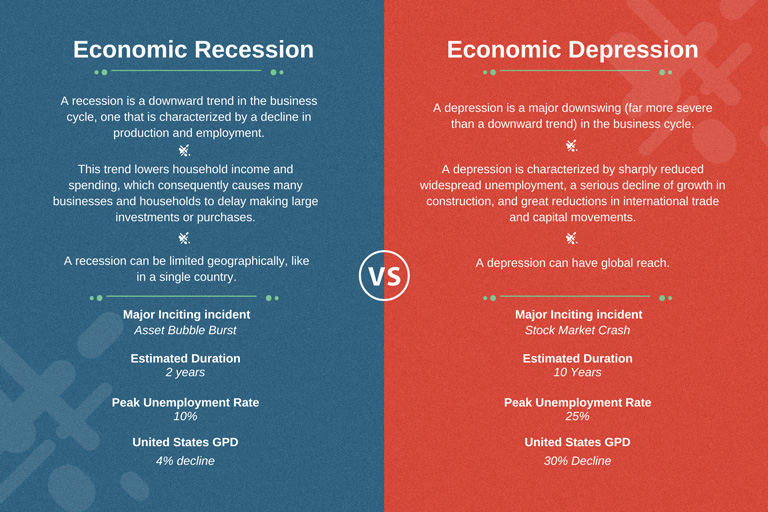

Depression is characterized by an economic decline that leads to a decline in real gross domestic product (GDP) of at least 10%. Experts have said this sharp decline is characterized as a depression if the contraction lasts anywhere between one to three years or greater.

What Causes an Economic Depression?

As it relates, the above-listed triggers of a recession are also depression triggers. It’s imperative to note that recessions and depressions do not stem from one singular event or trigger. In most cases, it’s the combination of multiple conditions that triggers the onset of economic decline.

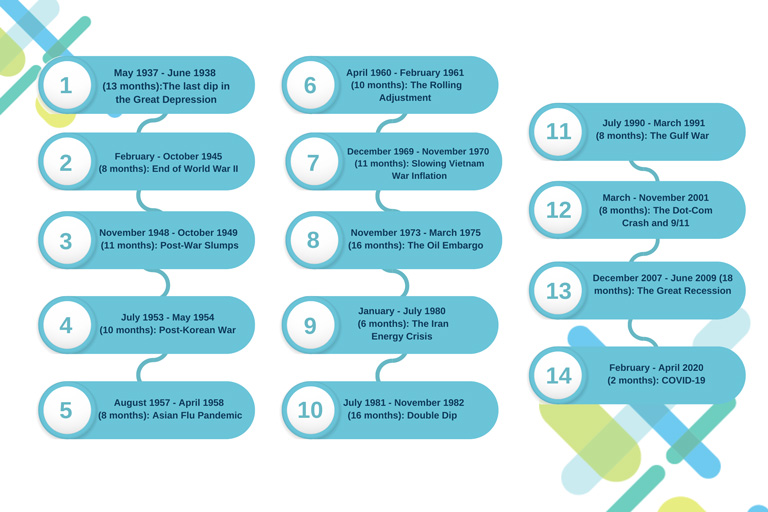

How Many Recessions in US History?

There have been small recessions here and there since the founding of the United States in 1776. However, economists focus mainly on the economic cycle since the Great Depression. According to the National Bureau of Economic Research, since 1929, there have been about 14 recessions in the United States. All last for varying lengths of time.

However, all economists do not agree with this number. Some argue that the recession from 1937-38 is more of a second dip of the Great Depression. Some add that the recessions from 1980 and 1981-82 are more of a combined recession with ups and downs.

Furthermore, as far as 1945-46 is concerned, some experts do not even consider this a recession because the unemployment rise was insignificant.

The good news is that the average recession is only about 10 months. Some a little more, some a little less. However, expansion periods can persist for an average of 57 months. This means, there is always a light at the end of the tunnel when a financial crisis looms ahead.

How Many Depressions Has the United States Had?

Though there are about 14 different recessionary periods in US history over the last 89 years, the Market Crash of 1929 was the United States’ only depression. Otherwise known as “The Great Depression.”

How Long Did the Depression Last?

So, how long did The Great Depression last? By definition, an economic depression lasts over a year. However, in the US case, the one and only Great Depression lasted over 10 years.

It commenced on October 29, 1929. And experts argue about the conclusion. Some will say 1939 and others will protest The Great Depression did not end until 1041.

What’s the Difference Between a Recession and a Depression?

Depressions typically stem from extended recessions. So if the economy declines steeply enough for far too long, the economy will soon be in a depression. Basically, a depression is a recession on a higher scale.

It’s far more severe, and not always naturally included in the economic cycle. This severe decline in economic activity leads to a substantial incline of unemployment, poverty, and even homelessness as a result.

Furthermore, recessions are typically country-specific. Whereas drastic economic erosion in one country can infect the world economy as a whole. A depression can become a global crisis.

The Great Recession vs The Great Depression

Let’s take a quick look and compare the outcomes of the Great Recession of 2007-2009 to the Great Depression of 1929 – 1939.

Is the United States Heading for a Depression?

We all know by now that the economy is a natural cycle. So where are we in the cycle? Did we experience a US Depression in 2022? Will there be a Recession in 2023? Are we headed to another great depression?

All great questions.

We all know 2022 had its challenges with explosive inflation rates. In the Summer of 2022, inflation spiked to 9.1%. The highest we have seen in decades. Gas prices rose 90% and groceries have become nearly unaffordable for the average household.

In the last few months, economists have argued about the current state of the American economy. Even with high inflation rates, the GDP still declined by 1.6 percent in quarter 1 of 2022 and 0.6 percent in quarter 2 of 2022. In contrast, quarter 3 saw an increase of 3.2 percent, and quarter 4 is estimated to have had a 4.1 increase in GDP.

A recession is defined as a significant decline in economic activity where there is a fall in the GDP for more than two successive quarters. So as fast as 2022 is concerned, Q1 and Q2 experienced a slight recession, even though prices were highly inflated. In Q3 and Q4 of 2022, the US came out of recession as the GDP increased.

Looking ahead to 2023, economists have forecasted a recession. Claiming it to be inevitable. This is because, with the still high prices and cost of living out of control, the central bank is sure to step in, doing all it can to quell the out-of-control inflation.

But with the small amount of cool-off time we did receive in 2022, we may actually be headed for a more balanced future. The hard part is, we can never know for sure until we are in it.

Preparing Your Business Against a Recession or Depression

Once we are in it, it may just be too late. So if you’re reading this today, you’re doing the smart thing by educating yourself and preparing your business for the future. But know this, it is not easy to prepare for troubling times.

However, below are a few steps you can take to prepare your business financially to withstand a recession storm:

Budget Accordingly

Recession or not, it’s always important to budget wisely. In fact, financial advisors urge to have a large enough budget to cover an emergency fund that covers 6 months of expenses.

So how much would that mean? To create an efficient and manageable budget, you will need to list your non-negotiable business expenses. From there you can calculate how much your business expects to spend every month. Multiply that times 6 and you have your emergency fund goal.

But calculating a goal and meeting it are two different things. Be sure to hire an expert in accounting to properly manage your business finances. Your accountant may have innovative ways to save and may even catch additional spending you were unaware of.

Build Good Credit

As mentioned previously, during recessions, lenders tend to shy away from approving financing or credit for unpredictable small businesses. Because of this, it is important to work on building a good credit score. This will prove you as a worthy candidate to investors if the time ever comes for you to apply for a loan or line of credit.

To build good credit you will need to:

- Utilize revolving credit

- Avoid late payments

- Maintain a proper debt-to-income ratio

One way to get around traditional lending’s strict stipulations is to look into online financers like ECS. These types of institutions typically have a less steep protocol for approving merchant financing.

And if all else fails- you are denied financing or you cannot build your credit in time- you could always look into merchant cash advances in times of financial hardship. With ECS’s merchant cash advance program, a healthy credit score is not required.

The Bottom Line: Depression vs Recession

As it stands, there are two types of economic downturns. Recessions and depressions. However, a depression is born from a recession. Lasting much longer, impacting more greatly, and reaching far wider.

Even though the economy is a cycle, it can still seem unpredictable at times. As a result, it is possible for business owners, even the most responsible ones, to be caught off-guard by an economic recession.

I hope that this article has given some insight into what happens in an economic collapse and some helpful tools to better prepare yourself when the next recession inevitably hits.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.