Payment Solutions

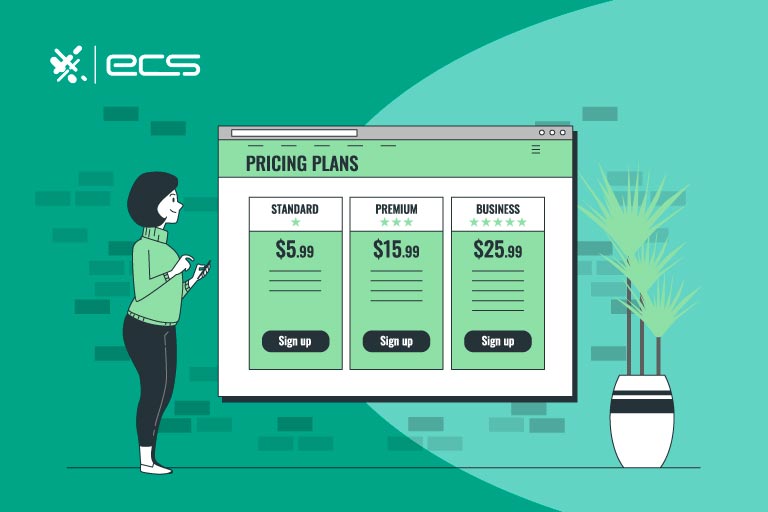

Smart SaaS Upselling Strategies That Actually Boost Revenue Without Burning Out Customers

Wonder how top SaaS brands scale so fast? Their secret isn’t just the product—it’s smart upselling that drives revenue and retention.

Choosing the Right ISV Payments Partner: What to Look For

Integrating payments is no longer optional—it’s a strategic move that can drive growth, reduce churn, and reshape your roadmap.

Why Direct Debit Might Be the Smartest Billing Move Your Business Hasn’t Made Yet

Still printing invoices or chasing payments? Discover how direct debit can simplify billing, boost cash flow, and save your business time, money, and stress.

Payment Solutions for Firearm Training Academies: Streamline Billing, Reduce Risk, and Stay Compliant

Launching a firearms business without the right payment processor is risky. From chargebacks to compliance issues, the wrong fit can cost you big.

How to Implement a Secure Payment System for Your Online Store

Protecting payment data is key to maintaining trust and security. Learn how ECS Payments can help secure your online store with advanced e-payment solutions.

How Credit Card Settlements: Impact on Business Finances and Payment Processing Best Practices

When a customer pays with a debit or credit card, the funds don’t instantly appear in the business’s bank account. Instead, a series of steps transfer the money from the customer’s account to the business. A key component of this process is credit card settlement.

Integrated Accounting Systems: Streamlining Financial Operations for Your Business

Accounting software has advanced from basic tools to integrated systems, unifying financial data across departments. Now, you can instantly reconcile books and access accurate company financials in one place.

Mastering the 3 Core Principles of Accounting: A Guide for Business Leaders

Accounting principles help businesses track finances. The cash principle records settled transactions, while the accrual principle includes earned revenues and expenses.

Top Expense Policy Strategies for Modern Businesses

From fraud to compliance, learn how a well-crafted expense policy can protect your business, prevent disputes, and keep spending under control!

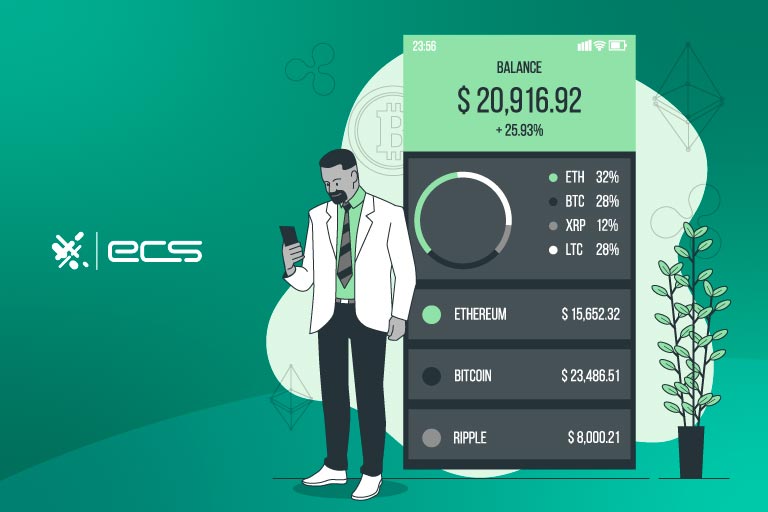

How is XRP and Ripple Designed for Payments?

Ripple XRP could be the future of payments as it bridges two different currencies in a way that is easier to manage and send than current methods.

Processing Recurring Payments: Challenges and Solutions

Overcome subscription payment challenges by implementing automation, PCI DSS compliance, dunning management, multiple payment solutions & customer service.

Omnichannel Payment Processing: Integrating In-Store, Online, and Mobile Payments

The more opportunities you have to collect payments through different channels with omnichannel payment processing, the more sales you will have.

Is a Merchant Cash Advance Right for Your Business? 5 Questions to Ask Yourself

A Merchant Cash Advance offers businesses funding repaid through future credit card sales, but it’s important to evaluate if it aligns with your business needs and cash flow.

Navigating Regulatory Challenges in Payment Systems for Healthcare

Build trust and avoid penalties. Payment systems for healthcare must comply with industry regulations such as HIPAA and PCI DSS.

Analyzing the Role of Payment Gateways in Enhancing Customer Experience

Implementing customer-centric payment gateway solutions can ensure a seamless and satisfying payment process for customers.

Charge Cards vs. Credit Cards: Which is Right for Your Business?

Is there a difference between charge cards and credit cards? The answer might surprise you. And yes, it can affect your business.

Advancements in Biometric Authentication for Payment Systems

Payment solutions that use biometric authentication can provide a more secure transaction process, reducing fraud and potential chargebacks.

Exploring Non-Profit Payment Solutions: Challenges and Opportunities

Efficient payment solutions for non-profits include increased donor satisfaction, retention, and fundraising potential, and reduced administrative costs and risk of fraud.

10 Efficient Ways to Collect Payments from Customers

No matter what type of business you own, there are many ways to efficiently collect payment from your customers. Here’s how ECS can help get you started.

Case Studies: Success and Challenges with Contactless Payments in Small Businesses

The trends and adoption rates of contactless payments help us to understand how contactless payments impact businesses and consumers.

30 Business AI Tools To Streamline Your Business

Business AI tools are designed to simplify tasks for a more efficient business. AI can revolutionize your processes, enhance profitability, and unlock new opportunities.

The Future of Blockchain in Payment Processing

Blockchain technology in payment processing has benefits including enhanced security transparency, traceability, cost-efficiency & global reach.

Payment Processing for the Gig Economy And Freelancers

Payment processing options for freelance and the gig economy aren’t all equal. If you are a freelancer or gig worker you have choices with how you accept payments.

Digital Identity Verification and Payments

Digital identity verification enhances transaction security and streamlines KYC compliance by using advanced digital ID methods.

Innovations in Payment Hardware

Examining the latest in POS technology, from smart terminals to portable devices for small businesses. Your payment hardware could make or break your business.

The Future of Retail: Unattended and Automated Payments

Improvements in automated payment technology has really improved customer checkout experiences, except at small businesses.

The Role of Social Media in E-commerce Payments

Businesses can use social media to create social proof and leverage influencer marketing along with paid ads to increase their eCommerce payments.

Digital Banking: Financial Inclusion Through Technology

Fintech advancements and digital banking can bridge the gap between the banked and unbanked, creating more financial inclusion.

Emerging Markets and Digital Payment Adoption

Consumer demand for digital payment adoption continues to increase, leading to the emergence of new markets and driving global economic growth.

The Impact of Quantum Computing on Payment Security

With AI advancements and quantum computing on the horizon, payment security may be threatened. Here’s what you need to know as a business.

How to Qualify for a Merchant Cash Advance: A Step-by-Step Guide

Merchant cash advances are easy to apply for. Providers care more about your processing than your credit and you will simply need a few things to qualify.

Strategic Use of Merchant Cash Advances in Business Growth

Strategically using merchant cash advances can help a business grow. But, when misused, they can be detrimental. Be sure you understand how to properly…

AI and Machine Learning in Fraud Detection

Machine learning and AI technologies have revolutionized payment security, enabling more efficient fraud detection systems for businesses.

Merchant Cash Advance Costs: What You Need to Know

Understanding merchant cash advance costs will help your business better determine if this type of financing is the best option for increased cash flow.

Understanding Merchant Cash Advance

Understanding merchant cash advances can open new doors for financial freedom for your business.

Mobile Wallets Vs. Traditional Banking

Mobile wallets use contactless technology to allow customers to easily make payments from their phones online or in person without plastic cards.

How to Implement Sustainable Payments to Benefit Your Business

Sustainable payments benefit businesses and the planet—from biodegradable cards, digital wallet solutions and paperless receipts.

Efficient Invoicing Practices: Strategies For Prompt Payments

Efficient invoicing practices help businesses to receive prompt payments and avoid any future disputes between their clients.

The Rise of Biometric Payment Systems

biometric payment systems are the way of the future. Business owners must prepare themselves with what accepting payments will look like in just a few years.

Adapting to Consumer Demand for Payment Flexibility

Consumers want payment flexibility at the point of sale. Is your business equipped to handle this demand? If not, you could be missing out on business.

The Impact of 5G on Mobile Payments

The Impact of 5G on Mobile Payments is revolutionizing the speed, security, efficiency, and accessibility of transactions.

Integrating Payment Systems with IoT Devices

Integrating payment systems with IoT devices has helped to automate transactions and enhance user convenience.

Navigating Global Payment Regulations To Ensure Compliance

Accepting global payments can be challenging due to varying regulations. But, the potential rewards can be advantageous.

The Role Payment Gateways Play in Enhancing Customer Experience

Up to date payment gateways and check-out processes keep customer experience intact. Make sure you’re not making these mistakes with your business.

The Impact of Digital Transformation on Lending Institutions

Digital innovation is transforming how lending institutions operate. However, financiers can harness technology to enhance efficiency.

Manufacturing Businesses Can Effectively Bill Customers with ECS Payments

Manufacturing businesses can effectively bill customers with ECS Payments, offering flexible invoicing options while ensuring security, analytics, and mobile payment gateway options.

How To Accept Payments Over The Phone

Learn why businesses need to accept payments over the phone, their benefits, risks, costs, and seamless integration tips.

How Mobile Apps are Changing the Borrower Experience in Personal Loans

Mobile applications are streamlining personal loan applications and helping lenders in efficient credit assessment and faster borrower approvals.

Is Merchant Cash Advance Right for Your Business?

A merchant cash advance is a type of financing that benefits businesses during start up or slow periods. Repayment is tied to credit and debit card transactions.

Businesses Virtual Credit Cards Explained

Virtual credit cards are a secure alternative for businesses to fill the gaps left by traditional credit cards, checks, or other payment methods.

Payment Reconciliation 101: A Guide For Businesses

Businesses can ensure their accounting is accurate through payment reconciliation.

Expanding Horizons: Treu Merchant Cash Advance for E-commerce Stores

Merchant Cash Advances are a quick and easy way for eCommerce businesses to get the funds they need when in a pinch without the need of good credit.

eCommerce Checkout Best Practices

Efficient eCommerce checkout optimizes your customer experience and generates higher conversion and revenue growth.

Payment Link: Accept payments online without a website

Payment links are an easy and convenient way to accept digital payments. But is it required to have a business website to use payment links? Let’s find out.

Five In-Person Payment Methods: Which One is Right for You?

In-person payments for mobile or brick-and-mortar businesses is essential. But, which type should you accept? Cash, debit or credit card, check, or ACH?

How To Accept iPhone Payments

Accepting as many forms of payment as possible, including iPhone payments, will always benefit businesses by catering to a broader market share.

Payment APIs: A Guide for Merchants

Payment APIs enable communication between different digital systems, which facilitates secure and seamless payment processing for businesses.

How To Scale Your Saas Business

Claim your market share of the growing SaaS industry? Scale your SaaS business through social media, content marketing, trade shows & sales teams.

Merchant Accounts 101

Merchant accounts are essential for businesses to accept digital payments such as debit and credit cards both in-person and online.

Google Pay: An In-depth Guide

Merchants boost customer base and revenue by seamlessly integrating Google Pay at their point of sale, enhancing payment options.

Integrated Payments with ECS Payments

Integrated payments create a cohesive business by seamlessly combining payment processing hardware and software with various business operations.

Online Payment Systems: How Does It Work?

Online payment systems secure businesses and broaden their reach, yet active data security measures are essential beyond relying solely on payment.

The Future of Retail Stores

The future of retail stores involves coexisting with e-commerce, embracing tech trends, enhancing customer experience, optimizing payments options and more.

Tap To Pay: Transforming Mobile Devices Into Payment Terminals

Turn your smartphone into a contactless tap to pay POS to revolutionize your business, enhance customer experience & streamline operations.

10 Questions You Should Ask Before Buying POS Software

POS software is the control system of your entire business operation. Don’t make the wrong decision in your business tools.

Accept Payments For Your Cleaning Service Business

Why your cleaning service business must accept credit and debit card payments, how to easily do it, and why cash and p2p payments aren’t worth it.

A Comprehensive Guide on Personalized eCommerce Marketing Strategies

Personalized eCommerce marketing strategies can take your shop from bleh to booming. Implement these easy steps today to see growth.

The Best Online Marketplaces That Are Reshaping Business to Business Sales

Successfully navigating business to business marketplaces can impact your relationships. Here’s the best platforms to consider and what you need to do.

Best Practices To Grow E-commerce Businesses

Online sales competition is fierce, to increase your market share, you have to know how to properly grow your e-commerce business with scalability.

E-commerce: How to Build a Direct-to-Customer Online Sales Channel

Optimize your business by incorporating various online sales channels into your strategy to thrive in today’s digital marketplace.

When to Say Goodbye to Your Legacy eCommerce Platform

Outdated systems are holding your business back. Here are the key signs to look for to know when it’s time to upgrade your eCommerce platform.

Benefits of a Pop-Up Shop to Perfect Your Brand

A pop-up shop offers a temporary retail space for businesses to increase brand awareness, gain new customers, boost sales & engage with clients.

How to Keep Costs For Processing Wholesale Payments Down

Processing wholesale payments requires strategic considerations. With lower profit margins, minimizing credit card fees is essential.

Merchant Services for Wholesalers Beyond Just Payment Processing

Wholesale merchant services offer unique solutions due to the industry’s place in the supply chain. See what wholesalers should consider beyond payment processing.

Green Landscape Billing: Online Invoicing

Online invoicing streamlines the process of getting paid. Paper invoices, cash, and checks all have their drawbacks. Discover why online invoicing wins.

E-Commerce Isn’t Killing Retail, It’s Inspiring Experiential Shops

Is the ease of eCommerce killing retail? Or has it created an opportunity for in-person merchants to create a more immersive space for consumers?

What Your Business Needs to Know About Collecting Payments Online

Collecting payments online is a beneficial way to increase your business whether you sell eCommerce, in-person goods, or even services.

Navigating Regulatory Waters: How Gun Store POS Software Simplifies Compliance

The right POS system can provide the perfect solution to maintaining gun store regulatory compliance.

Pricing Strategies For Service-Based Businesses

Strategies for service-based businesses, unlike retail-based ones, involve a more complex evaluation of factors.

The Three Pillars of Gun Store POS: Hardware, Software, and Payment Processing

Gun store POS systems help firearms merchants with regulatory compliance, lowering costs and increasing efficiency, and exploring new revenue streams.

7 Reasons Your Business Needs a Satellite Location

A satellite location can provide benefits such as new sales opportunities, reduced overhead costs, enhancing customer experience, and more.

Digital Payment Methods in Healthcare Billing: Empowering Patients for Smooth Adoption

Learn how modern healthcare is embracing unique digital payment methods to make billing hassle-free for both patients and providers.

E-Commerce Security: Protecting Transactions in the Digital Marketplace

Online payments make e-commerce possible. But they are a perfect target for hackers and other criminals.

The Future of Payment Processing: Innovations and Challenges in 2024

Merchants must stay informed on the fast-evolving future of payments for a seamless blend of convenience, security, and limitless possibilities.

Sustainable Goods and Payments: Navigating Risks and Opportunities

Consumers are looking for more sustainable goods and businesses they can trust. Show your customers you care with sustainable practices and payment options.

High Risk Payment Processors for Payment Gateways

A high-risk payment gateways makes it possible for your business to accept all digital payments. Discover the best high-risk gateways 2024 has to offer.

Telemedicine: Bridging Gaps in Healthcare and Simplifying Payments

Telemedicine makes health care visits convenient. Your patient payment options should be just as easy.

Custom Patient Payment Options Can Improve Your Healthcare Practice’s Revenue

Leveraging the help of a practice management bridge can help you provide flexible, customized patient payment options to increase your revenue.

How to Sell Merchant Services

Learning how to sell merchant services successfully means understanding your market, and addressing customer needs through active listening & authenticity.

Streamlining Healthcare: The Power of Practice Management Software

The impact of practice management software on healthcare practices and payment processing efficiency. Do you have the best program?

Cut Costs and Boost Sales: Why It’s Time to Consider a New Payment Processor for the Holidays

Switching to a new payment processors for the holidays can be a cost-effective strategy for your business.

Unleash Your Website Potential: How a New Payment Processor Can Transform Your Holiday Season

A new payment processor for your eCommerce business may be the key to unlock your holiday sales potential. Find out the signs you need to switch.

Upgrade Your Retail Store Payment Processor for a Record-Breaking Holiday Season!

Upgrading your payment processor will better prepare you for a successful holiday season.

The Benefits Of ACH Payments For Business Owners

Business owners can take advantage of the benefits of ACH transactions, such as cost-efficiency & convenience.

Enterprise Payment Processing

Enterprise payment processing for large businesses making millions of dollars per year needs a variety of payment methods & a positive payment experience.

Gun Store POS Software and eCommerce Solutions You Need

Discover Gun Store POS Software: Explore features and benefits for firearm retailers, including range management and ATF compliance.

An Integrated Payment Gateway Can Cut Your Costs and Increase Profits

Integrated payment gateways benefit businesses by reducing costs, increasing efficiency, providing security features, and offering control.

Wireless Credit Card Processing Benefits

Wireless credit card processing has advantages for both brick and mortar retail, restaurants, pop-up shops, foods trucks, and vendors in any industry.

How to Pick the Best Healthcare Payment Processor for Your Practice

The right healthcare payment processor is essential. Practice Management Bridge and ECS explain exactly what to look for, for a secure and streamlined practice.

Improve Your Patients Experience And Lower Your Cost With ECS Payment Processing Solutions For Healthcare

The right payment processing solutions for healthcare can eliminate time-consuming and revenue-draining manual practices.

Unlock Business Bliss with Spa Credit Card Processing Solutions

Enhance client and business experience through seamless spa credit card processing with contactless payments, online reservations & subscriptions.

Secure and Compliant Payment Processing for Healthcare Practices

HIPAA-compliant payment processing for healthcare facilities is crucial, ensuring secure, private, and legal transactions, safeguarding patient data and trust.

How To Choose the Right Provider for Your Medical Credit Card Processing

Learn how to choose the ideal partner for your medical credit card processing needs, ensuring seamless HIPAA-compliant payments.

Top Trends in Healthcare Payments You Need to Know

Stay Ahead in Healthcare Payments: 2023’s Game-Changing Trends to watch.

Improve the Healthcare Experience With Automatic Patient Payments

Discover how automated patient payment solutions are transforming the overall patient healthcare experience and streamlining processes.

Introducing ECS and Practice Management Bridge Payment Processing Solutions For Your Healthcare Facility

ECS and Practice Management Bridge payment processing solutions and management systems reduce healthcare facility costs by 33%.

Must-Have Restaurant Payment Solutions For Your Small Business

Successful restaurants need to leverage their restaurant payment solutions, among other systems, to overcome challenges and emerge more robust.

How to Streamline Your Payments With the Right Healthcare Merchant Account

Optimize healthcare payments with the right healthcare merchant account: Explore HIPAA compliance and the best payment processing for your practice.

The Best Dental Payment Processing for Offices

The best dental payment processing solutions to date. Enhance efficiency and financial management in your dental practices with Practice Management Bridge and ECS Payments.

SMS Payment: How Your Business Can Leverage Text to Pay

Businesses can use text to pay by texting customers a payment link. With a click, the customer is brought to a payment gateway to complete their payment.

Collecting Online Rent Payments Made Easy

Collecting online rent payments can be easy…if you use a payment processor for online rent payments.

Online Payment Processing For Dropshipping

A dedicated payment processor and merchant account can help protect your dropship business and its online payments.

Why a Vending Machine Card Reader Will Attract More Customers

Vending Machine Card Readers attract more customers because most don’t carry cash anymore. It also is a safer way to collect payment.

Accurate Customer Data For Recurring Payments is Crucial

Subscription services are a popular money-making business today. But, if you are not getting accurate data in subscription services, you could be missing out.

3 Mistakes To Avoid in Recurring Billing

Subscription services business models are a great way for merchants to profit more with loyal customers. But be careful to avoid these fatal mistakes.

Equip Your Business with Trident1: The All-in-One Gun Store POS System and Range Management Solution

Gun store POS systems need extra functionalities. Trident1’s FFL POS system puts sales, CRM, compliance, and asset management all in one dashboard.

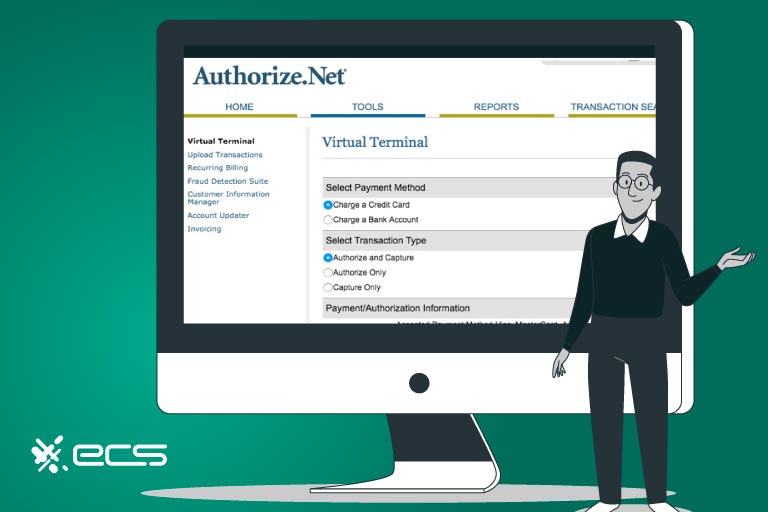

Authorize.net and ECS Payments Processing For Your Business

Explore Authorize.net and ECS Payments Gateway Features for your business. You’ll learn about integration options, eCommerce solutions, secure transactions.

How To Implement Recurring Billing Integration

Efficiently process your customers’ credit cards, debit cards, and ACH payments, with recurring billing integrations for your merchant account.

Payment Processing for Freelancers

Take control of your business with cost-effective payment processing for freelancers. Say goodbye to hefty platform fees and save thousands of dollars each year for your financial freedom.

Payment Terminal vs. POS Systems

Payment Terminal vs. POS System: Both provide merchants with card acceptance capabilities. We explore the benefits of each depending on your needs.

Best Credit Card Processing for Franchises

The best credit card processing for franchises should offer unique customizations that help businesses succeed. 1. Online 2. Mobile 3. High-risk 4. gateways.

SaaS Billing Process and Best Practices

Discover the best SaaS billing processes to keep your business ahead of the competition and attract more clients to your service with these best practices.

Online Payment Processing For Nonprofits

The best online payment processing for nonprofits should offer 1. Credit, debit, and ACH payments 2. Integrated payment links.

What Is A Hosted Payment Page?

A hosted payment page is hosted by another server, generally run by your payment gateway. It is the fastest way to start accepting payments for an eCommerce website.

The Most Comprehensive Firearms Payment Processing Point of Sale Solutions You Need For Your Business

The ECS Trident1 partnership facilitates high-risk firearm payment processing, compliance, inventory, and other business processes for gun stores, gunsmiths, and shooting ranges.

How to Leverage eCheck Payments

Save time and money by learning to leverage echeck payments for your business. The ACH network makes it easy to process digital payments.

What To Do When WooCommerce Drops Your Merchant Account

WooCommerce merchant accounts can be tricky for high-risk merchants. Follow these steps when you need a payment gateway if yours is dropped.

The Best Restaurant Credit Card Processing Solutions

The best restaurant credit card processing solutions will grow your business, provide exceptional customer service, and run a streamlined operation.

Insurance Agencies Payment Solutions: What You Need To Know

What insurance agencies’ payment solutions you need to look for to build better automated collections and payout systems without paying ridiculous fees.

Payment Processors For Your Online Gambling Merchant Account

Payment Processors For Your Online Gambling Merchant Account

Biometrics in Payments: How Will They Affect Your Business?

biometric payments technology may be the ultimate level of security, in addition to facilitating easy, quick payments. The future of payments will affect your business in the following ways.

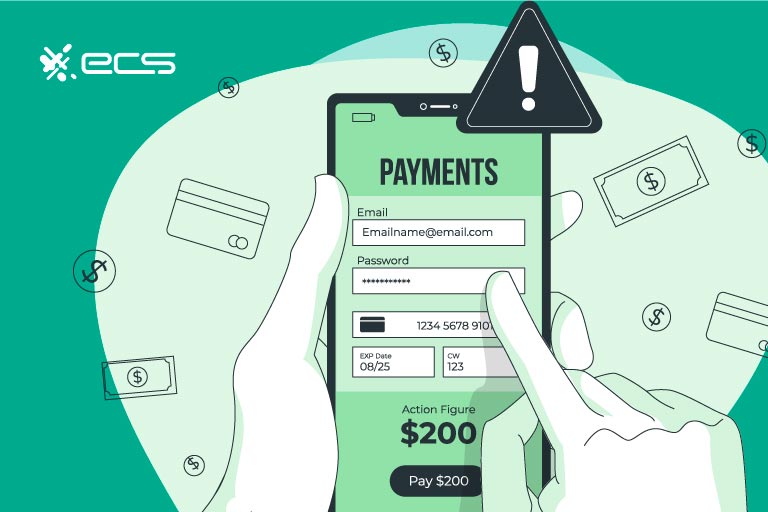

Online Payment Problems (And How To Fix Them)

online payments are a great way to increase sales and offer more to your customers. However, there are a few problems you need to be aware of such as 1) security 2) chargebacks.

The Risks Of Buy Now Pay Later Services

Buy Now Pay Later (BNPL) offers payment plans to customers for immediate purchases, even though they may not have the full funds available.

Food Truck POS: Get the Most out of Your Mobile Payments

These guidelines help to maximize your revenue with the perfect food truck POS system and processing for mobile payments catered to your small business.

Get a Clover Kitchen Display System (KDS) For an Efficient Restaurant

Clover kitchen display systems show customer orders to the chef and line cooks in the restaurant kitchens. Replace paper tickets for efficient an business.

What Are Integrated Payments And How Do They Work?

Integrated payments leverage analytics to help merchants boost their sales with insights into their business

Get Paid Faster With Payment Links!

payment links help your business accept payments online without the need of an eCommerce website. They offer easy solutions for quick payments.

7 Easy Contactless Ways to Collect Payments

Merchants can collect contactless payment in 7 easy ways 1) NFC-payment 2) QR codes 3) mobile wallets 4) online payments 4) Subscriptions 5) ACH

Can Your Business Benefit From Using A Password Manager?

A password manager helps keep your business secure. But with LastPass Data breach in 2022, you may need a new one, Consider these factors when securing your business

Merchant Payment Solutions to Benefit Your Business

Merchant service providers provide merchant payment solutions that businesses can leverage for seamless POS including 1) debit and credit card processing.

How To Price Your Products: A Guide

Knowing how to price your products can be tough. That’s why we’ve created his guide to give you the scoop on where your prices should come from and how to set them.

What’s The Difference Between Debit Cards and Credit Cards? Which is Better?

The difference between debit cards and credit cards may play a factor into processing fees, rewards points, where a customer will shop.

Accepting Secure E-wallet Payments Gives Your Business a Competitive Edge

Accepting secure e-wallet payments through apps like Apple Pay and Google Pay can give your business a competitive edge by offering more ways to pay for your customers

Credit Repair Merchant Accounts

To process credit card payments, you may need a high risk credit repair merchant account. ECS can better help you to understand

Implement Cashless Payments For Business Growth

A cashless payment system includes those that accept debit cards, credit cards, ACH deposits, cryptocurrency, and checks.

Are Credit Cards on File Payments Safe?

Keeping credit card information on file helps facilitate your cash flow. Avoid major data breaches and detrimental damage by utilizing a payment processor that protects your data.

Debit Card Solutions: An Overview

With the right debit card processing solutions, you have a convenient way to collect payments from multiple sources, attract more clients to your business

Automate Invoice Processes to Up Level Your Business

With a simple integration, automated invoice processes will benefit your business with more time for better task management resulting in increased profits.

Push and Pull Payments Explained

To push money means to give it or send it and to pull money means to take it. We explain more on how this type of payment is used

What Systems You Need to Consider For Your Small Business Payments

With the landscape of the market and technology constantly changing, small business payments need to keep up. Consider implementing these payment systems

Refinancing a Business Loan Could Save You Thousands

We will show you how refinancing your business loan will save your business money and generate more working capital with a lower interest rate

Key Benefits to Implementing Digital Receipts with Dejavoo GoGreen and Other Paperless Receipt Platforms

Learn how you can benefit from implementing digital receipts with Dejavoo’s GoGreen and other digital receipt platforms.

Friendly Firearm Payment Processing For Gun Shop Merchants

ECS Payment Solutions is specifically designed to help gun shop merchants with friendly firearm payment processing.

Security Rules For Merchants At POS Terminals: PCI Compliance Requirements Explained

PCI Compliance Requirements Explained so you can feel confident in your payment processing security generating client trust and confidence in your brand.

Get The Most Out of Your Debt Collection Agency Merchant Account

To get the most out of your debt collection agency, work with a high-risk payment processor that offers online debt collection payments, chargeback assistance & more

How to Easily Build Business Credit with an EIN

Build your business credit with your EIN. Separating your personal and business finances is the best way to make sure you are set up for success.

Payment Gateway Comparison: Authorize.net vs NMI

The most popular payment gateways are Authorize.net and NMI, in this article we dive into a detailed Payment Gateway Comparison

11 Guaranteed Strategies You Can Use to Gain Followers and Increase Sales on Instagram

Strategies to increase Sales on Instagram 1. Optimize Your Profile 2. Design an Eye Capturing Feed 3. Leverage Instagram Reels 4. Always Respond to Comments

Step-by-Step Guide: Setting Up A Merchant Account For eCommerce

A merchant account for eCommerce lets businesses accept credit and debit card payments via their online shop. Learn the steps needed to open a merchant account

Efficient Credit Card Processing For Veterinarians to Run a Successful Clinic

Solve friction and inefficiency with the right credit card processing tools for your veterinary clinic.

A Guide On How To Start Your Own Subscription Business Model

A Subscription business model’s key advantage is that its revenue is based off of recurring billing. This helps small businesses with customer retention

8 Simple Tricks To Increase Customer Retention

Customer retention is the practice of gaining maximum lifetime value from an existing customer through various techniques that encourage them to spend

What is Easy Finance For Merchants?

Easy financing for merchants can play a pivotal role in the growth and success of a business.

Why ECS Merchant Services Support Blows the Competition Out of the Water

There is no comparison ECS merchant services support and solutions are the best you will find. ECS offers a wide variety of innovative payment solutions.

How To Easily Drive More Sales to Your Website

If you’re wondering how to drive sales to your website, you can implements the following tactics for your small business

The Benefits of a True Merchant Cash Advances

A merchant cash advance is a temporary type of financing tool that can benefit businesses that accept credit and debit payments.

ACH Vs Wire Transfer: Understanding The Key Differences

The key difference between ACH vs wire transfer is that wire transfers are quicker but more expensive and potentially more exposed to fraud, while ACH payments are slower, much more cost-effective, and very secure.

What to do When Authorize.net Drops Your High-Risk Merchant Account

Authorize.net merchant accounts and payment gateways are necessary for merchants to process credit card payments.

Payment Processing for Small Businesses

The best payment processing for small businesses offers flexible pricing structures, card acceptance and transaction variety to accept all credit cards from anywhere.

How to Build a Profitable Pool Service Company

Pool service companies can have profit margins of 28% for installation, maintenance, and repairs. But to be successful you will need payment processing

Credit Card Processing for Cosmetic Surgery

Credit card processing for cosmetic surgery provides surgeons and patients with flexible, affordable, and secure payment solutions when insurance won’t cover necessary or desired procedures.

Discover Plastic Surgery Financing Solutions that Top Surgeons Offer

Plastic surgery financing is key if you’re looking to accept more patients and turn over more profits this year

How to Use Retail Analytics to Grow Your Sales

We provide you with the key concepts you need to learn how to use retail analytics to grow your sales in 2023.

What are NFC Payments and How Do They Work?

There are advancements in payment technology all the time. One of which is NFC payments. Learn all there is to know about how NFC payments work

9 Best Liquor Store POS Systems to Streamline Your Business

There are plenty of liquor store POS systems to choose from. However, not all options carry the same benefits. Learn which have the most beneficial features

Shopify Dropped Your High-Risk Merchant Account? Here’s What You Do

Shopify high risk merchants may face some dilemmas when it comes to processing payments online. Learn how to combat such complications with your Shopify merchant account

Key Benefits Laundromat Payment Systems Offer

Laundromat Payment Systems can generate long-term growth for your business. Here are the key benefits that taking digital payments can offer

Everything You Need to Know About Opening a Bail Bonds Merchant Account

Opening a bail bonds merchant account — made easy with our tips and tricks to help you grow and get ahead of your competition.

8 Benefits of a High Risk Merchant Account

Establishing a high-risk merchant account for your business offers 8 key benefits that are a must know if you want to grow your profits.

High-Risk Merchant Accounts and Payment Processing With Instant Approval

Finding a credit card processor for your high risk merchant account doesn’t have to be a challenge. Learn everything you need to know about high risk transactions

High-Risk Payment Processing: Multi-level Marketing 101

find out why multi-level marketing transactions are considered high-risk payment processing and how to successfully navigate payment within an MLM industry

Everything Your Small Business Should Know About Liquidity

Learn how your business liquidity defines the financial health of your business and your pivoting potential during uncertain economic circumstances.

High-Risk Merchants: Payment Processing Checklist

Conquer the battle of finding the best high-risk payment processor for your business with these easy steps to nail that application process.

High-risk Business Payment Processing: Are You At Risk?

High-risk business payment processing solutions are available to these businesses to easily collect credit card payments from customers.

Is Your Nonprofit Getting the Most Out of its Payment Processing?

Streamline your fundraising donations and payments for your nonprofit organization with our secure and reliable payment processing solutions.

6 Tips To Make Your Plumbing Business More Profitable in 2024

Maximize your plumbing business’s profitability and streamline operations to increase customer satisfaction

Need a Merchant Account But Have Bad Credit? Do This!

A merchant with a low credit score, whether it’s because of a sales downtrend, a prior bankruptcy, or any other reason, ECS can help you!

How The Rich Scale Their Businesses

The rich scale their businesses by identifying their most profitable customers and focusing their marketing efforts on reaching new ones

Preparing Your Business For a Recession: 6 Foolproof Strategies

To survive a recession, business owners need to think on their feet, get creative, and learning to pivot. These 6 tips will prepare your business for a recession

5 Key Benefits Pay-at-the-Table Technology Can Offer Your Business

Either by SMS or QR code, pay-at-table benefits offer you convenience, speed, and efficiency

9 Ways Your HVAC Business Can Be More Profitable in 2024

License to print money: HVAC businesses have the highest profit margins at 26% on average.

14 Sales Trends Every Merchant Should Try in 2025

It’s impossible to look into the future, however, uncovering 2023 sales trends can help you better forecast sales for 2024

Integrating Gateway Services Directly With Your Processor – Collect Payment Like a Pro

ECS integrated gateway allows you to collect payments with no third parties involved during a secure checkout.

The Ultimate Point-of-Sale Security Guide All Businesses Need

Take the measures necessary to protect yourself and your customers with an all encompassing point-of-sale security checklist. A must read for all merchants.

The Future of Electronic Payments is Changing Commerce As We Know It

Electronic payments are changing as we know it. With abundance in technological innovation, merchants should understand how currency will flow in the future

Best Retail Point of Sale Systems

A POS system, or point-of-sale system, facilitates cash or credit card transactions in retail sales and contactless payments

Conquer Customer Hesitation With Convenient Point-of-Sale Consumer Financing

Boost sales and crush consumer hesitation when you offer easy point-of-sale consumer financing at check out.

14 Benefits of Virtual Terminals For Businesses

Virtual terminal solutions offer many enhanced features that merchants can significantly benefit from. whether you’re a small business or a large.

How To Boost Revenue with Self-Serve Card Payment Solutions

Discover how self-serve card payment solutions can easily generate business growth and the ultimate customer experience at your merchant location.

10 Key Features Your Payment Processing Company Should Offer

Choosing the best payment processing for your needs is important. Follow along for the top 10 key features you need from your payment provider.

Payment Processing Technology: Mobile Payments Made Easy

New tap-to-mobile technology empowers merchants to seamlessly accept contactless payments right on their mobile phones.

9 Reasons Why Healthcare Must Adopt Contactless Payments

Contactless payments are the number one desired method of transaction for today’s healthcare patients. Adopt contactless payment technology

Discover How Consumer Financing Can Drastically Boost Your Small Business Sales

The solution for inflated prices is as easy as offering consumer financing. Discover how consumer financing can profit your small business.

Medical Financing: A Simple Solution to Boost Your Healthcare Business

Healthcare businesses that adopt medical financing instantly become a one-stop shop for all patient needs.

Smartphones the Digital Payments Solutions of the Future

It is crucial for businesses to offer their consumers smartphone payment options. Digital payments are essential for consumer satisfaction.

Merchant Financing 101

Financing can play a key role in the ability to grow. Merchant financing can help your small-business acquire the capital it needs to succeed.

eCommerce Payment Processing Solutions: A Step-by-Step Guide

An easy guide that can help you set up eCommerce payments to rake in the big bucks and thrive without a the need of a physical storefront.

Unattended Payment Kiosk: Self-service Payment Solutions

Unattended payment kiosks offer a self-service point-of-sale experience that’s quick, clean, and cost-effective.

Restaurant Payment Software: 8 Functions Your Business Needs To Thrive

Determine the right restaurant software that will increase revenue and customer service experience with optimized efficiency and streamlined.

8 Benefits of Artificial Intelligence in Payment Processing

AI advancements offer a surplus of benefits that have made daily life easier and more convenient especially in the payment processing world.

A Point of Sale Systems Buying Guide

The right point of sale system can seamlessly synchronize your business in all of its functions for front-of-house and back-office duties.

Low-Risk Merchant Processor

The most successful way for low-risk merchants to attract the most customers is to partner with a low risk processor to accept all payment.

ACH – A Modern Day Payment Solution

ACH transactions electronically transfer funds between bank accounts without the need for a physical card, cash, or check this modern payment.