If you’re looking to start a new business or expand an existing small business, how you accept payments from customers can be one of the most important decisions you make. You want to take as many payment options as possible. This helps businesses of all sizes attract new customers and grow their sales.

You need a merchant account to accept digital payments, such as credit and debit cards. A merchant account gives businesses access to the worldwide payment networks that handle digital payments.

You’ve likely heard of merchant accounts before, but you may still have questions about how they work and how to obtain one.

Thankfully, we’ve put together this article to explain everything you need to know about merchant accounts and how you can use one to start accepting digital payments.

What Is A Merchant Account?

A retail merchant account is a specialized type of financial account used by virtually all types of businesses that accept electronic and digital payments.

The “merchant” in the merchant account refers to the business. Whether you sell a product or provide a service, a merchant account allows you to process electronic payments from customers and receive the funds.

Merchant accounts are used by both physical retail stores and online e-commerce stores or websites. They are also necessary for “pop-up” stores or any other type of business that wants to accept electronic payments.

Is A Merchant Account Like A Bank Account?

New business owners sometimes confuse a business bank account with a merchant account, meaning they think each serves the same purpose. However, merchant accounts are separate from a business’s bank account.

A business bank account is an account through your local bank branch that allows you to deposit or withdraw funds related to your business.

A merchant account does hold funds for a short time, but these are only the funds generated via electronic payments. The owner then transfers the funds to their business bank account at regular intervals.

A business bank account by itself is not enough to process credit or debit cards for your business. You’ll need a merchant account in order to process payments and receive funds from credit or debit card transactions.

You then connect your business bank account to your merchant account to accept the funds and then spend that revenue on business expenses.

Merchant credit card accounts are also separate from the merchant account the business uses to process customer payments.

How Do I Get A Merchant Account?

You get a merchant account through a merchant account provider or payment processor. A payment processor is part of the financial institution network that makes up the entire electronic payment system.

Payment processors work as a type of intermediary between credit card networks and various merchants.

Your choice of payment processors is essential because they will be your main point of contact for all of your payment technology needs or questions. If you choose a payment processor with poor service or high fees, you won’t be happy with your merchant account.

The good news is that there are reputable and respected payment processors that merchants can work with. The right payment processor can help you build and grow your business through the proper payment solutions to fit your industry and specific business plan.

Choosing A Payment Processor

When choosing a payment processor, you want to keep a few things in mind to ensure they can support your business and provide you with the tools you need to succeed.

Below are a few key areas to be aware of when shopping for a payment processor.

Customer Service

Customer service is essential when searching for a payment processor. Digital payments today require specific integrations with other technology your business is already using.

If you have any questions about setting up your processing, you want to be able to get answers as quickly as possible to avoid downtime or other issues.

Look for payment processors that have their own in-house technical support and can be reached via phone or email.

Payment Processing Options

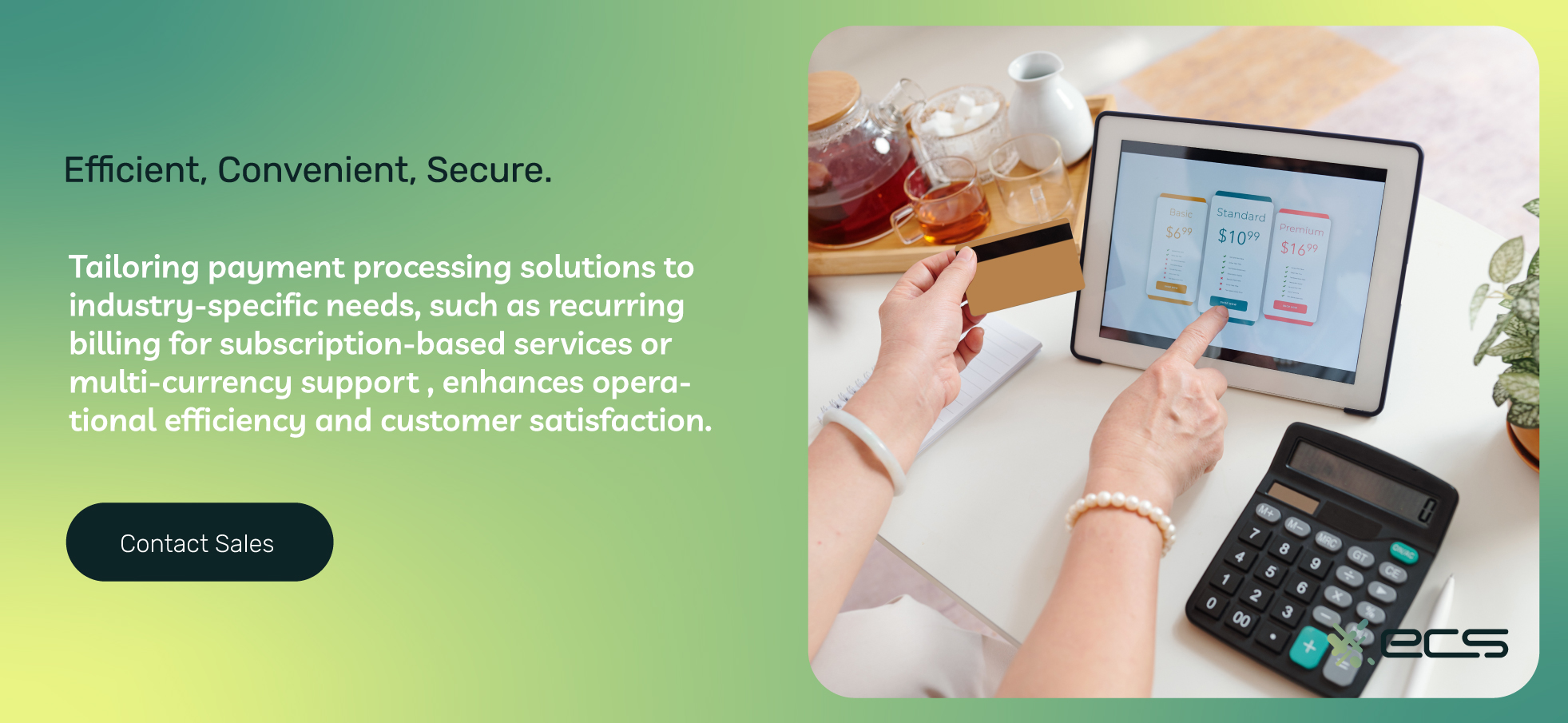

Depending on your business, you may have unique processing requirements. For example, certain industries have their own requirements for payment processing, and only certain companies specialize in that type of processing.

Ensure your payment processor has both the experience and knowledge of your industry to ensure the services they provide align with your business and industry.

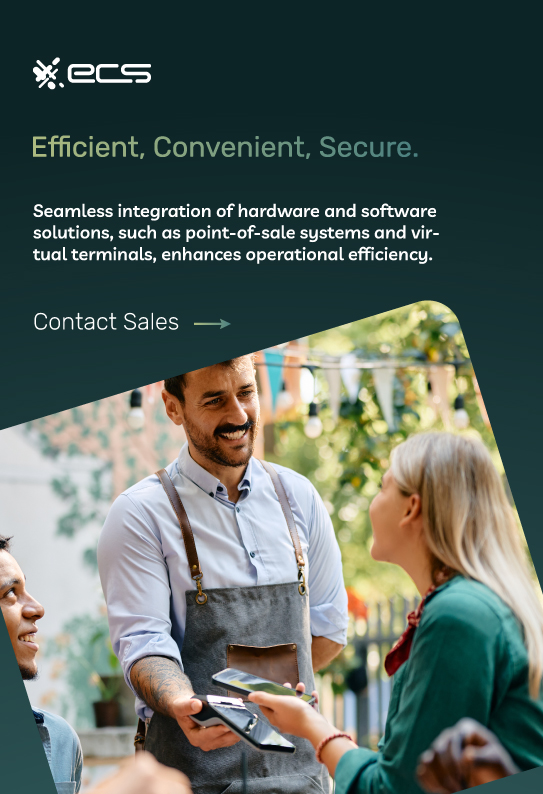

You may also need to integrate specific hardware or software with your merchant account. Features such as a point-of-sale POS system or virtual terminal. Check to make sure your payment processor offers support for these additional processing features.

Competitive Fees

All credit card and debit card processing will come with fees the merchant must pay. However, you want to avoid paying more fees than necessary, as each transaction represents lost revenue when paying higher fees.

Different payment processors may offer different fees and fee structures. Some processors may also offer a one-size-fits-all fee structure, which is generally not the best way to go.

You want to ensure you are paying the lowest possible fees based on your expected transaction volumes and the type of product you’re selling.

Also, in-person transactions will have different fees than online sales because there is often less risk when the card is present during the transaction. Less risk generally means lower transaction fees.

So, it’s important not to pay a flat rate, which could cost you more if your transaction profile consists of mostly in-person transactions.

Applying For A Merchant Account

When you’ve chosen your payment processor, you will apply for a merchant account through them. This is an easy process, and you should already have most of the materials you need readily available.

Today, merchant account approval typically occurs within a few business days from when you submit your completed application.

Most merchant account applications will require you to provide the following information.

Business Name And Registration

You’ll need to provide your business registration or business entity registration. For example, your articles of incorporation or similar documents.

Employer Identification Number

When applying, you will need an employer identification number (EIN). This is a free identification given out by the IRS and is unique to your business. You can apply for a free EIN on the IRS website.

Business Bank Account

Most payment processors will require that you have a business bank account. The account will need to be under the name of your registered business.

Previous Transaction Volumes

If you’re an existing business and are switching merchant accounts, your new payment processor will want to know your past transaction volumes. This will help them find you the lowest fees.

Financial & Credit History

In some cases, you will need to provide financial records or statements. Most payment processors will do a brief credit check to ensure you haven’t had a merchant account closed in the past.

Types of Merchant Account Providers

When it comes to merchant accounts, it’s important to realize the difference between your own merchant account and a shared or aggregate merchant account.

Many large service providers, such as Stripe or Square, operate as aggregate merchant account providers. With those services, you don’t actually have your own merchant account. Instead, you share a merchant account with all of the other merchants.

These types of services offer far less flexibility for merchants. They also will almost always have higher fees than if you went and got your own merchant account.

Those services also have restrictions regarding the types of products and services you can sell. They can ban your account and hold your funds if there is any violation.

A true merchant account is one you obtain through a payment processor. With this type of merchant account, you have full control over your processing and your funds. You will also pay far lower fees with every transaction.

High-risk Merchant Accounts

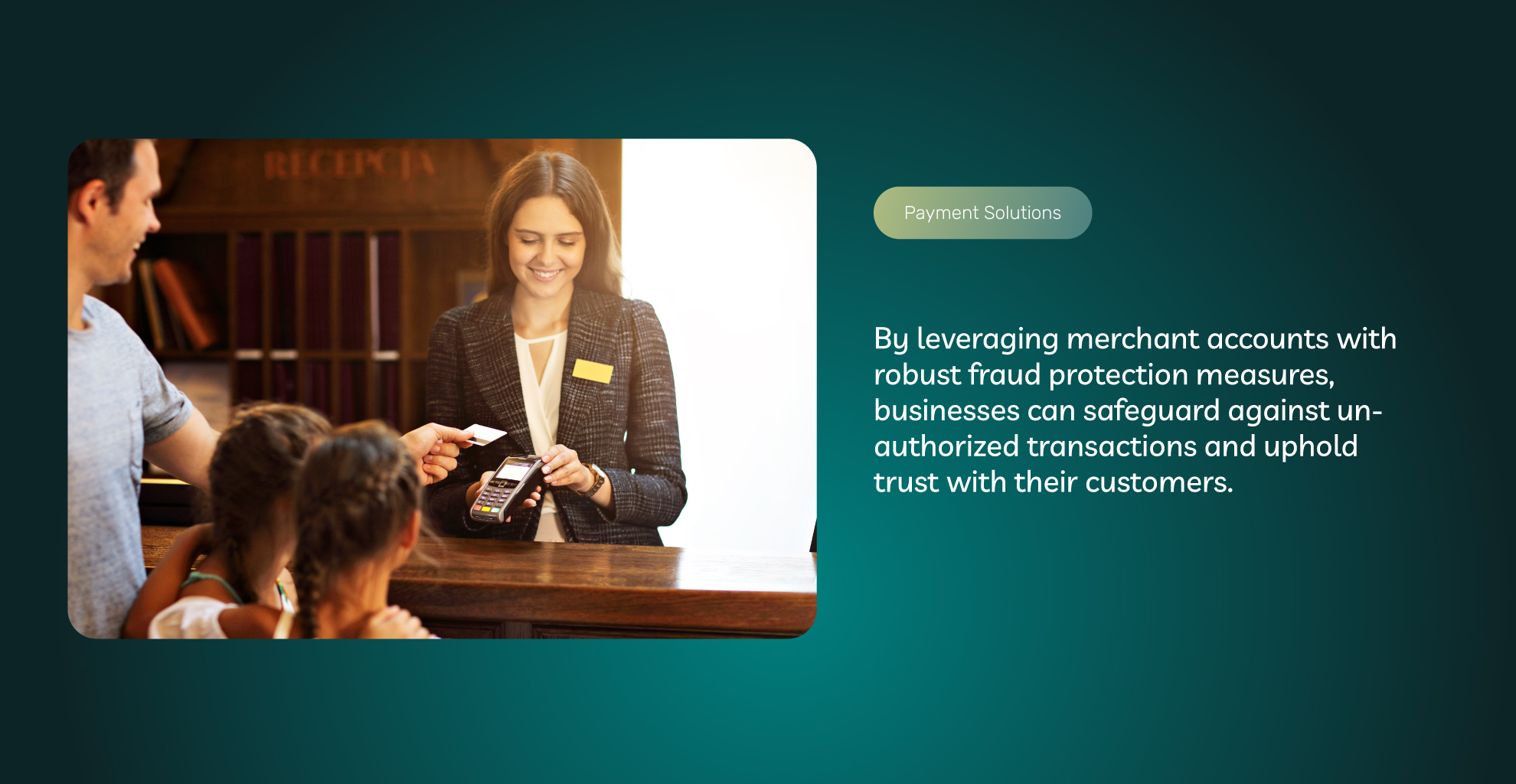

Some industries and merchants require high-risk credit card processing. All credit and debit card processing involves a risk of fraud. However, payment processors, credit card issuers, and merchants aim to keep that fraud as low as possible.

However, some industries are simply at a higher risk for fraud. Payment processors offer high-risk merchant accounts to allow businesses in these industries to accept payments.

These specialized merchant accounts have higher fees to offset the higher risk profile of their industry. They may also use higher fraud protection protocols than other standard-risk merchant accounts.

The purpose is to find a balance between mitigating risk while still allowing businesses in high-risk industries to accept payments.

Some high-risk industries include:

- Firearm and ammunition sales

- Tobacco products, vapes, and e-cigarettes

- High volume sales

- Gambling

- Digital currencies or cryptocurrency

- Coaching or mentoring services

- Debt services

- Adult products

- Supplements

- CBD products

That’s just a sample of high-risk industries and products, and there are more that fall under the high-risk category.

You will need a specialized merchant account if you sell products considered high-risk or operate in a high-risk industry. For example, a gun dealer would need a high-risk firearms merchant account.

Some payment processors specialize in high-risk transactions. Selecting a payment processor with experience in this area is important to ensure you can get the lowest fees possible.

An experienced processor can also help you maintain your merchant account so you don’t have excessive fraud or returns that can limit your processing ability.

It’s important that you don’t try to process high-risk transactions with a standard merchant account. The credit card companies can deem this as a type of fraud. If this happens, it can prevent you from obtaining a merchant account in the future or force you to pay higher fees.

Merchant Account Fees & Transaction Costs

All merchants must pay fees when accepting credit and debit cards through their merchant accounts. Your goal should be to pay the lowest merchant account charges as possible.

Different fee structures can apply to merchant processing, each with its own pros and cons. Below are the most common fee structures available for new merchants.

Flat Rate

Flat rate pricing charges the same fee for every transaction you accept. This is usually a percentage along with a per-transaction price.

This is the simplest pricing model, but it will also cost more in transaction fees. It’s usually best for merchants who make small ticket sales and want consistency in managing their expenses.

Interchange-Plus Pricing

Interchange-plus pricing often yields lower overall transaction costs for merchants, but the pricing is more difficult to understand.

With interchange plus pricing, the credit card companies first impose the interchange fee on each transaction. Your payment processor then adds a fee on top of this mandatory interchange rate.

This means different transactions will have different fees, but you will likely get the lowest possible fee per transaction.

Other Merchant Account Fees

Besides transaction fees, some merchant accounts will have other mandatory fees.

These include:

Setup fee

This is usually a one-time fee when setting up your merchant account. This fee is used for the application process and other related expenses.

Monthly or Annual Fee

Your merchant account will also include a monthly service fee. This can include your payment processor’s fees and the payment gateway access fee. There are also sometimes annual fees depending on your merchant agreement.

Chargeback Fee

If a customer initiates and wins a chargeback, you must pay a chargeback fee. These can be costly, so you want to avoid chargebacks as much as possible.

Monthly Minimum Fee

For some merchants, a small fee is applied if they don’t meet a monthly minimum threshold or processing rate. Accurately estimating your monthly transaction volumes can eliminate this fee.

Batch Fees

Most transactions are processed in batches for simplicity. A small fee applies to each batch being processed.

Overall, fees are a normal part of online transactions or retail transactions. But you want to avoid merchant service accounts with too many additional fees over the ones listed here when looking to accept credit card payments.

Things like early termination fees are also something to look out for when obtaining a merchant account.

Your payment processor’s custom support should be able to answer any questions you have about fees associated with your merchant account.

How To Get A Merchant Account Today

If you’re starting a business or want to expand your business by accepting more payment methods, you must have the right merchant account.

At ECS Payments, we offer dedicated merchant account solutions designed specifically for your business. We also help all of our clients enjoy the lowest fees possible based on their industry and transaction volumes.

Contact ECS Payments today to learn more about our merchant account services designed to help your business succeed.

Frequently Asked Questions About Merchant Accounts

A merchant account is essential for all types of businesses, both online and physical stores. It is a specialized financial account that enables businesses to accept digital payments, such as credit and debit cards.

Yes, a merchant account is different from a business bank account. While a business bank account is for general financials related to your business, a merchant account is necessary to process credit or debit card transactions. The funds from electronic payments are temporarily held in the merchant account by your payment processor and then transferred to your business bank account.

You can obtain a Merchant Account through a merchant service provider or a payment processor. These providers act as intermediaries between credit card networks and merchants. Choosing a reputable payment processor is crucial, as they will be your main point of contact for all your payment needs. The merchant account application process involves providing business information, an EIN, bank details, financial records, etc. Contact ECS Payments if you’d like to apply for a merchant account.

Customer service, payment processing solution options, affordable fees, and overall support for your business are important aspects to consider when selecting your business’s payment processor. Contact ECS Payments to apply for an affordable merchant account with easy-to-reach client support.