Payment technology for businesses is continually evolving. These advancements are making businesses more efficient and creating greater customer convenience. If you haven’t updated your payment systems recently, now might be the time. Let’s look at some exciting innovations in payment hardware, including smart terminals, wristbands, wrings, and biometric scans.

What is the Difference Between a POS and a Smart POS?

Some of the most noticeable differences between a POS and a Smart POS are in the hardware size. Traditional payment processing equipment is big and bulky. By contrast, smart payment terminals are sleek, thin, and compact. The slimming trajectory of these small business payment tools\ is not due to fad diets but rather developments in hardware and software.

Contemporary smartphones and tablets, which can serve as point of sale (POS) technology, are powerful pieces of equipment. They can perform several tasks and have just as much operating capability and storage as a personal computer. The creation of cloud storage and web-based applications means that much of the data storage and task management can be outsourced to data centers, allowing the hardware to slim down even more.

Touchscreens, Cameras, and Increased Flexibility

Touchscreens and cameras also facilitate multifunctionality. With a traditional POS, a scanner is necessary for reading barcodes. A printer is needed to print receipts, even if it’s a Bluetooth POS system printer. By contrast, a smartphone or tablet camera can scan barcodes with a camera the size of a lentil. Receipts can be emailed or sent to a separate printer (which is also probably smaller).

Touchscreen POS terminals also facilitate greater flexibility. A traditional POS has a keyboard layout set in stone (not literally, since the POS is probably plastic). Smart devices and their touchscreens can morph from an itemized display of purchases into a PIN pad, all in the blink of an eye.

Tablet POS Systems: Improving Versatility and the Aesthetics of Your Register

All these differences listed above have facilitated a generation of smaller, more compact payment processing devices. What’s the upshot of these hardware-focused improvements facilitated by cloud computing, touchscreens, and increased computing power?

A smart POS can move around a sales or restaurant floor and look much more up-to-date than a big, bulky POS from the 1990s. Regarding the look of where customers make their purchases, think about upgrading to a smart POS in the same way you’d think about remodeling a kitchen or bathroom.

Don’t downplay this last point. Think about doing a walk-through of a home you might purchase. Dated fixtures look (to be blunt) ugly and immediately lower the home’s sale value. A dated, bulky POS makes your business look out of touch, especially in a generation when most consumers have smart devices of their own.

Innovative Integrations

Integration is the ability of one software program to interface with another, automating the process of transferring data. The exact mechanism of how integration works revolves around APIs or application programming interfaces. These are rules and protocols that allow software developers to facilitate the communication of one program with another.

Integrations have revolutionized various industries, from retail businesses to gas and oil. For most consumer-facing businesses, the point of sale system is the heart of their various integrations: accounting software, inventory management, gift card and loyalty programs, and even human resources. For online stores, payment gateways use POS integrations to facilitate transactions.

Consumer-facing payment gateways also work for in-person transactions, such as at a restaurant, where customers can use QR code payments to complete their purchases and leave. No more waiting around for wait staff as they hold you hostage waiting to run your card.

An Example of Integrations at Work

Let’s look at an example right at the old “cash register.” When a customer presents their credit or debit card to pay for something, and the sale is completed, the payment processing software will “notify” other related software systems.

The items that were sold will be checked off the inventory management software. The dollar amounts will be entered into the accounting suite. Perhaps if some sort of upselling was involved (payment protection plan, additional items, or memberships), that would be forwarded to HR software to issue sales bonuses.

Consider how much manpower (e.g., paid employee time) is saved by automating this data transfer. Nobody has to sit down and reconcile the sale numbers with the accounting books, inventory, and HR bonuses (if applicable). Everything happens instantly and perfectly, reducing human error (and the mistakes it causes).

Can a POS Predict the Future?

But wait…there’s more! Integrations facilitate the transfer of information between software systems. They can also predict the future…by looking at the past. The POS provides a large amount of data to analyze. The study of this data is referred to as the science of analytics.

Processing payments becomes the key to understanding customer sentiments and planning how to capitalize on them. What do customers purchase, and when? Do they pair certain items together? Are certain items hot sellers? Are certain items not selling?

Information like this, provided by the POS, can help a business make decisions moving forward. Is it time to move this product forward in the store and create a prominent display? Should we move these two products closer together since customers frequently buy them together, encouraging the development of an already existing trend?

Big Data and Big Picture Decision-Making

The list of questions to ponder is almost endless. However, without the analytics provided by POS systems at the time and point of sale, it would all be guesswork. POS software integration with analytic software is one of the most exciting aspects of retail payment solutions today.

Studies have shown that businesses using analytics can increase their revenue by 20% while reducing costs by 30%. And there is no shortage of data out there to analyze! In 60 seconds, global users conduct 6 million Google searches, share 66,000 thousand photos on Instagram, send 4.3 million Snaps, and spend $443,000 on Amazon.

You can bet your bottom dollar that Amazon uses AI to comb through those $443,000 to understand and capitalize on key trends. And while you may not be selling that much in 60 seconds, you should certainly leverage the same “big data” principle to examine trends and respond accordingly. The key to doing so lies in the innovations in POS technology, particularly with integrations and analytics.

Say Cheese! Bizarre or Brilliant POS Hardware Trends

What do you think about paying for something with your face? In 2022, Mastercard tried this idea in select convenience stores in Sao Paul, Brazil. Customers pre-registered with Mastercard so they could walk into any of the five St. Marche store locations around Ibirapuera Park and pay for something with their faces.

The program was a success. The 1,000 people who registered were three times that of the expected registered consumers. They made six transactions throughout the three-month trial period, on average. A survey of customers after the trial revealed that 90% were comfortable with the process, and nearly 80% would recommend it to a friend.

The upshot of that survey is that 10% of consumers were not entirely comfortable with the idea, even after participating in the program. Moreover, 30% were ambivalent enough or outright disliked the idea to the point where they would not recommend it to a friend.

These findings “between the lines” indicate the possibility of pushback against biometric payment methods. Consumers are used to tendering cards to credit card readers, but having a POS scan their face or retina may seem invasive.

Concerns With Biometric Payments

Similarly, biometric payment methods will probably continue to flower as a payment option. Not to be outdone, competitor Visa tested out a pilot program in Moscow, Russia. In partnership with Sberbank and X5 Retail Group, Visa rolled out a pay-with-a-glance program in 150 grocery stores.

Interestingly, many of these particular payment hardware innovations are being tested outside the US. American consumers may be more concerned about the privacy of collected biometric data. A survey was taken of consumers’ comfort regarding Amazon’s plan to roll out hand scan payments in Whole Foods Stores.

7% of polled consumers were very comfortable with the idea in 2019, and only 10% in 2023. 15% were somewhat comfortable in 2019, and only 17% in 2023. These are not significant increases! And 78% were not at all comfortable with the idea in 2019, followed by 73% in 2023…roughly the same (that is, a very small 5% difference).

Delving into why Americans are less comfortable with biometric payments than their international counterparts would be a fascinating anthropological study worthy of Malcolm Gladweel (author of The Outliers).

However, Amazon has still decided to roll out the biometric payment program, Amazon One. After all, it is optional. All 500+ Whole Foods stores in the U.S. have hardware in place to allow customers to pay for their groceries with a wave of their hands. Third-party retailers like Panera Bread have also expressed interest in Amazon One, which already has 3 million enrolled users.

Mobile POS Solutions

Another exciting innovation in payment technology is mobile POS solutions or portable POS devices. Companies like Square, Stripe, and dozens of other enterprising payment processors now offer small hardware that can be connected to a smartphone.

This means an employee’s smartphone can suddenly turn into a mobile POS. This cashless payment hardware has several applications, but one is helping merchants collect payments in locations where they would otherwise be forced to collect cash and lose out on sales from customers who want to use cards.

Event Vendor and Contractor Payment Solutions

Vendors selling goods or services at a fair or festival are one obvious example, particularly when these venues have a poor or limited internet connection. The mobile POS system of a small apparatus plugged into their phones can allow said businesses to collect plastic payments alongside cash with a cloud-based POS solution.

Mobile POS solutions are also incredibly helpful for the bottom line of fleet-based businesses. Think of contractors, plumbers, electricians, and pest control services where employees make house calls. These employees do not need to lug a clunky POS into their house call. Rather, they can bring a wireless payment device that plugs into their phone.

This mobile payment technology can help defend cash flow by capturing customer payments immediately instead of asking them to call the office or send an invoice. It can also eliminate contractor corruption (where contractors present clients with a different price and pocket the difference).

Could the Phone Itself Become a POS?

These mobile payment solutions still require some hardware, though. What if there was a way to turn the phone itself into a POS? There’s no place to insert a credit card, so it would have to be a contactless payment system. And indeed, with the latest developments in NFC technology (near-field communication), that is a possibility.

Applications now exist that can turn a mobile phone into secure payment hardware for receiving contactless payments. A customer can wave their contactless card or their own mobile phone over the employee’s phone, and a contactless payment will occur—just like it would with a POS system in a store.

The Elimination of Plug-In Hardware

This particular development is so exciting because it eliminates the last necessary piece of hardware from the picture: the small card reader that would plug into the phone. Now, not even this device is needed. Contactless payment applications to turn phones into readers are the ultimate evolutionary step of very portable payment technology.

Or are they? One can imagine combining this technology with the abovementioned technology: biometric payments. In the near future, it seems unlikely that a phone application could scan a customer’s face to collect payment, eliminating the need for all hardware and even a plastic card or digital wallet payment from the customer themselves.

Wrist Band Payments

Another exciting development in payment technology is wearables. Many consumers have become aware that the Apple Watch can facilitate contactless payments through ApplePay, just like a mobile phone. However, they may not be aware of the idea of preloaded wristbands that can be used to make contactless payments at large venues like sporting events and concerts.

A number of startups, like Tappit, Purewrist, and Oveit, are now selling contactless wristbands enabled with NFC or RFID (radio frequency ID communication). In general terms, this event-focused fintech starts with a customer registering and preloading the “wristband” with a set dollar amount. Once at the sporting event, they can use the wristband to make seamless purchases at concessions stands.

Speeding Up Lines, Improving Experiences

You might wonder why venues would not just jump right into the biometric transaction idea. Indeed, JP Morgan partnered with Formula One to try out biometric payments at the Miami Grand Prix. Some sports fans or concertgoers may not be so crazy about biometrics in general (if the above survey about Amazon One is any indicator).

Wristbands are less invasive because they can be tossed after the event and don’t require the wearers to register anything personal, such as a picture or a scan of their hand. Either way, biometrics, and wristband payments offer the potential to significantly speed up concession lines and improve the overall experience for attendees.

One Ring to Rule Them All

In a similar vein, companies like McLear have created payment rings that consumers can wear. The ring McLear created is quite stylish and made from high-quality zirconia ceramic. It’s scratch-resistant, durable, waterproof, and hypoallergenic—its black obsidian shine makes it look like it might have been forged in the volcano of some dark wizard’s castle (that part is our opinion).

Inside the ring, a small antenna follows its curvature. It’s the same type of antenna involved in contactless card payments. Consumers make a payment by delivering a contactless fist bump to any payment terminal with contactless card or digital wallet compatibility.

How Does the McLear Payment Ring Work?

Customers load their card info into a cloud-based wallet, unlike the digital wallets stored “on” smartphones (those, too, are largely cloud-based). The ring does not have a battery and does not need to be charged because hovering the ring near the terminal activates the exchange of information that gets the payment going.

McLear is a UK company on its second generation of ring technology. It remains to be seen if this particular wearable tech will make its way to the US, but it’s hard to see why not. The ring is a less “clunky” wearable than a bracelet or smartwatch. It doesn’t ever need to be charged, which gives it an advantage over smartphone-based mobile wallets.

Mobile Device Stranger Danger

The use of wearable rings and even contactless cards raises some security concerns. Criminals are always ahead of the game, trying to figure out the best way to steal money. Once upon a time, they installed card skimmers in POS terminals to pull information off the magnetic strips on the back of cards. Well, actually, they still do—with chipped cards. In fact, some skimmers have recently been spotted in San Diego convenience stores.

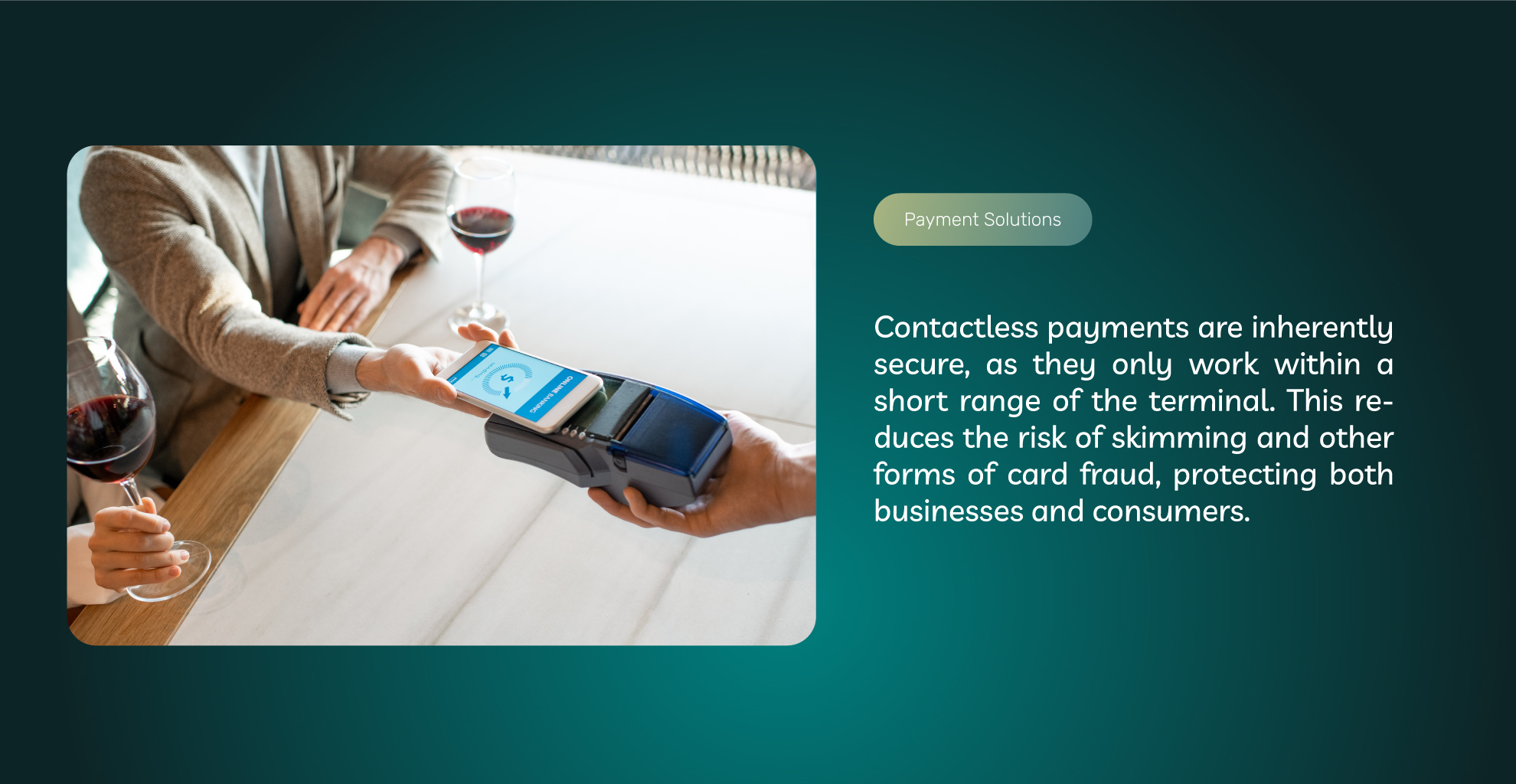

Though EMV compliance (e.g., chip insertion payments) has helped slowly eliminate a lot of card theft, cardholders aren’t out of the woods yet. However, contactless payments are fairly secure because they only work if the card or mobile wallet is within 1-2 inches of the terminal.

An Easy Crime in a Busy Crowd

However, a new theft scheme has emerged, with criminals “accidentally” bumping into contactless cardholders and stealing payments. Rings, bracelets, and even cards in a pocket could be susceptible to this method of theft. According to The Daily Mail, the equipment needed for this crime can be found online for about 30 quid (that’s British slang for UK pounds).

The problem (at this time) seems to be more prevalent in the UK. One can almost picture a Dickinson-like tramp bumping into tourists, pretending to tumble, and saying something endearing like “oi—blimey, guvnah” as they put their bowler hat back on (many cultural assumptions made here, but you get the royal picture).

Biometric or Wearable Payments? Or Both?

The trajectory of payment technology seems to be heading in two particular directions: wearables and biometrics. It will be interesting to see which technology becomes more prevalent. The obvious selling point of biometric technology is that consumers do not need to bring anything with them—their wallet, or even their phone.

This is one reason Mastercard chose to roll out their biometric trial run in Sao Paulo: the area they chose was around a popular jogger’s park. People exercising and leaving their cards at home could pop into a store to pick up a snack or a bottle of water.

The downside to biometric payments is that some consumers may find them eerie or invasive. They may be concerned about data leaks involving their own features, which could be used to perpetrate remote fraud.

Wearables as a Comfortable Alternative

In-person transactions could not be facilitated because the scanning technology also assesses the depth of the face or hand it scans, and everyone’s features are unique (and face grafting sounds like something out of Batman, so we’ll leave it alone for now). In fact, biometrics at the point of sale are probably the best form of POS transaction security.

However, the threat of remote fraud is real, especially when paired with AI and cryptocurrency (which cannot be tracked down and makes for a quick getaway). Also, consumers might have ethical concerns about large databases of very personal consumer information, just as they might about a camera in their home.

Wearables are an alternative to biometric payments. They present the same wallet-free convenience as biometric payments, with less threat of fraud or invasive corporate surveillance overreach. The most common payment wearable is probably the Apple Watch, but the drawback is that it needs charging.

The Future is Here: The Choice is Yours

Could battery-less rings and wristbands be an alternative to biometrics and wearables needing power? What about a wearable inside the skin, such as a microchip? This technology has already been tested out in Europe. However, consumers may also find it invasive.

It seems likely that the future of payment services will cater to consumer choice. Financial institutions already recognize the value of letting consumers pay how they want. Even as some choices disappear, such as magstripes, others, like biometrics and wearables, will emerge. Consumers can choose from new methods that populate the landscape of processing payments.

Frequently Asked Questions About Innovations in Payment Hardware

A smart POS outdoes traditional POS payment hardware with its sleek and compact design. It is powered by contemporary tablets, smartphones, or other cloud-based hardware. A smart POS can perform several tasks, has a large operating capability and storage, and can easily integrate with a variety of software. ECS Payments offers innovative POS system solutions. Contact us today to learn more.

POS systems can be integrated with various software applications to streamline business operations. Some common integrations include:

•accounting software

•inventory management systems

•gift card and loyalty programs

•human resources software

These integrations allow businesses to automate tasks, improve accuracy, and gain valuable insights into their operations. If your business is looking for a smart POS system, contact ECS Payments for more information.

We’ve come a long way from traditional magnetic stripe cards. We’re even surpassing EMV chip cards with NFC contactless payments. However, the future of payments involves using biometrics and wearables like watches and rings to process transactions.

Smart POS systems have many benefits, including:

•increased flexibility

•improved aesthetics

•enhanced security

•more portability