A merchant account is a type of account that temporarily holds funds from purchases. Once the customer’s bank has confirmed they have enough cash or credit to cover the transaction, and the merchant has held up their end of the transaction, the funds are released from the merchant account into your business checking account.

Merchant Account Versus Merchant Services Provider

A merchant account refers explicitly to the account for temporarily holding funds.

Sometimes, a payment processor may refer to their customers as “merchant accounts,” with an emphasis on accounts. That’s because, in sales, an account is a relationship. The merchant is the business owner (you).

So you may see the term “merchant account” referring to a business customer of a payment processor. However, a merchant account refers to the holding account for releasing funds as part of a “settlement.”

It’s easy to mix up merchant accounts with merchant services. Merchant services is a broader term that encompasses products and services beyond the account itself. A merchant services provider may facilitate payment processing to accept debit and credit cards. They may provide hardware and software like POS systems and online payment gateways.

They may provide integrations that connect the point of sale to accounting and inventory. And they may provide a merchant account as well. Sometimes merchant services providers can also provide their customers with a merchant cash advance—a loan repaid from the cash flow of debit and credit card transactions.

In all, merchant services are often synonymous with payment processing and some of its related products and services. By contrast, a merchant account refers specifically to that holding account. And a merchant account provider is the financial institution that manages this account.

Why Does a Business Need a Merchant Account?

Have you ever wondered why there are so many hotels around the airport? There are several reasons. One reason is to facilitate quick and easy meetings for business travelers. But another reason is that some people prefer to avoid going right from the plane to their home, and vice versa. Or, they must make an overnight rest stop before embarking or disembarking.

Think of a merchant account as sort of like the airport Hilton, only without the indoor pool and the complimentary omelet bar. Money from your customers goes into the merchant account and, as part of the settlement process, then goes into your business checking account.

Merchant Account Comparison: Escrow Account

In a sense, this makes the merchant account like your own escrow account. An escrow account is typically an account managed by a third party. A third party may own it, or it may be jointly owned by the two parties involved in the transaction. The money for the underlying deal goes into the escrow account until the deal is closed. This ensures both parties hold up their end of the bargain and nobody walks away.

Escrow accounts are most often used in real estate purchases. The seller and buyer agree to work with an escrow attorney, who will hold the funds until closing. This forces the buyer and seller to complete their contract. The buyer must purchase the home. And the seller must vacate the home by the agreed-upon date.

As a merchant, you may not sell homes (although some do). But you are performing transactions with customers. In return for products or services rendered, they give you payment. The payment will stop in a merchant account to satisfy all sides of the bargain.

Merchant Account Comparison: ACH Clearing House

You might have heard of ACH transactions. ACH transactions involve sending money directly from one checking account to another. Or do they? Actually, ACH stands for automated clearinghouse (or clearing house, if you like two words for the price of one). Even ACH transactions, which are done without card networks, have a middleman: the clearinghouse.

That clearinghouse is usually the Federal Reserve Bank. Now, truth be told, the first bank is not sending a neat pile of bills with a sticky note on it to the Federal Reserve, who will hold it before sending it on to the second bank. Nevertheless, a clearinghouse is needed. A middleman is necessary for facilitating the transaction.

The clearinghouse’s underlying principle is the same one behind a merchant account. A certain degree of complexity is involved in transferring money from a customer’s bank account to a business owner’s account. Several things could go wrong during the transaction.

One of those potential pitfalls is the reputation of the business itself. A business with a merchant acquirer can say: “this financial institution will vouch for us.” A business without a merchant account is an unproven entity in the payment landscape.

It could be insolvent, fraudulent, or poorly managed. Card networks and issuing banks want to avoid interacting with these merchants. But a merchant acquirer essentially vouches for them.

Who Provides Merchant Accounts?

In the process of a card transaction, the financial institution that services your merchant account is called the acquiring bank or acquirer.

The bank with which you have your checking account may offer merchant accounts. Alternatively, your payment processor can provide a merchant account. It is unlikely that your payment processor, merchant account provider, and business checking account provider will be three separate parties, but never say never.

However, generally speaking, acquiring banks also want you to have your business checking account with them. They may even require that to provide you with a debit and credit card merchant account.

The largest merchant acquirers in the U.S. by revenue share are Chase ($35.83 billion) and Fiserv ($35.38), the latter being a conglomerate formed by Citi, Santander, BBVA, and other banks (formerly known as First Data).

Then there is FIS/Worldpay ($31.42 billion), Global Payments ($11.15), Wells Fargo ($9.8), Bank of America ($8.89), Elavon ($3.34), and PaySafe $1.07). In total, there are 315 merchant acquirers in the United States, processing $11 trillion in total transactions.

Payment Aggregators

You might be wondering where PayPal, Stripe, and Square are in all of this. These companies are payment aggregators. That means they bundle all their customers under their own merchant ID. Businesses using these aggregators do not need a merchant account.

The payment ecosystem within the context of PayPal, Stripe, or Square looks different than it does with other credit card processing companies for small businesses (or businesses of any size, really). The parties to that transaction are fewer in number: you, the customer, their bank, the card network, and PayPal.

In this scenario, the bank with which you have a business account is not even in the picture. PayPal is. And they release the funds into that account. As such, there is no need for a business merchant account to facilitate the transfer.

The downside is that these payment aggregators have a flat-fee pricing model that becomes unfavorable at higher volumes. Some of them also have legendarily lousy customer service. Businesses that have grown beyond the selling phase on platforms do not offer suitable pricing structures to accept credit cards.

Members, ISOs, and MSPs

We mentioned that there are 315 different merchant acquirers in the U.S. A financial institution with a relationship with Visa or Mastercard is called a member bank. Member banks can sell merchant account services directly to business owners. Some larger acquirers partner with wholesalers to promote their services to the wholesaler’s customers.

Then there are ISOs and MSPs. An ISO is an independent sales organization. An MSP is a member services provider. They are essentially the same thing. Member banks sponsor ISOs and MSPs. They must meet the sponsoring member bank’s risk management standards and adhere to rules set forth by Mastercard and Visa.

All ISOs and MSPs must disclose that their “company is a registered ISO/MSP of bank, town, state. FDIC insured.” The card networks can fine them $25,0000 if they do not provide this disclosure. As ISOs and MSPs may be smaller than member banks, they may have less operational overhead. They can then pass these savings on to their customer merchants.

What You Need to Get a Merchant Account

Merchant acquirers are taking a risk when they agree to work with a business. In a sense, they are forwarding the merchant money as part of the settlement. What if a fraudulent merchant takes a large volume of orders, collects their funds, and then disappears without providing or shipping any of the promised products?

This is what would happen in the Wild West. A snake oil salesperson would roll into town, selling a wonder cure tonic. He’d collect his cash and ride off into the sunset before anyone realized the cure was bogus. Banks and card networks do not want this type of scenario to play out with a customer.

That’s why they will ask for some information about you and your business before providing a merchant bank account. They will want details about your business, such as its goods or services, your company name, EIN, and contact information. Additionally, they may also ask for your personal information, such as your SSN.

There is an underwriting process where the bank will assess your business in terms of risk and reward. They may want more information, like tax returns and revenue reports. A merchant services account is an investment on the part of the bank, and they want to make sure that investment is worth it.

What If I Can’t Get a Merchant Account?

Some businesses are high-risk merchants. There could be several reasons for this. One is the industry that a business is in. Tobacco, firearms, CBD, marijuana, adult entertainment, bail bonds, credit repair, and gun sales are just a few examples of industries that carry some risk in the eyes of a payment processing company.

This determination isn’t a judgment about the underlying products or services as much as it is about the legal and regulatory landscape around these businesses. And sometimes, it is not just the industry but the business itself.

A business with a bad credit history or a history of chargebacks is also a risk. This business may have a hard time securing a merchant account.

This type of business needs to find a credit card processor that works explicitly with high-risk merchants. These companies are set up to handle the risks associated with these businesses. They may compensate for these risks with higher fees or by requiring a rolling reserve.

A rolling reserve is an amount of cash the processor holds to cover the cost of any chargebacks. The reserve is released incrementally as the merchant builds up a good payment history.

The bottom line is that if you cannot get a merchant account at a large bank or recognizable ISO, continue looking. There is a merchant services provider out there for you…maybe closer than you think (wink, wink).

How Does a Merchant Account Work?

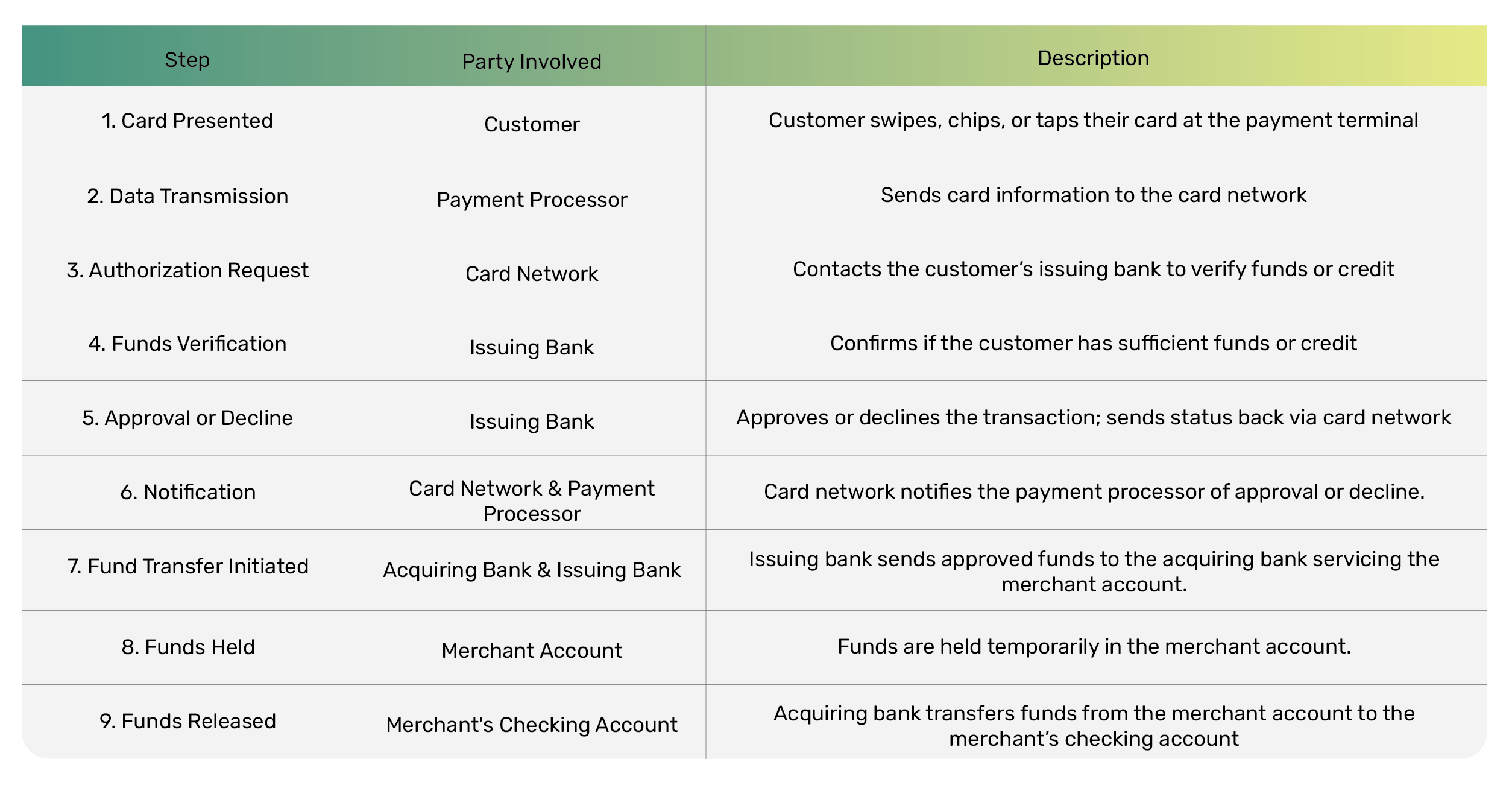

To answer that question, we must see how the merchant account fits into the broader processing landscape of a card transaction. Several parties are involved in this transaction: you, the customer, your bank (acquiring bank), their bank (issuing bank), the card network, and the payment processor or merchant services provider.

First, a customer presents their card for payment. The card is swiped, chipped, or tapped at the payment terminal (whether a virtual terminal, POS system, mobile card reader, etc.) The hardware and software from your payment processor send the card information to the card networks (Visa, Mastercard, Discover, Amex).

These card networks then contact the customer’s bank or credit card company. The issuing bank (their bank or card) will verify if the customer has enough cash or credit for the transaction.

If they don’t, the transaction will be declined. Bummer. If they do, the card network will ferry that information back to the payment processor, who will contact the acquiring bank. Whoever is servicing the merchant account (payment processor or acquiring bank) will see funds sent into that account from the customer’s issuing bank.

This all happens in a matter of minutes. The funds are then released into the merchant’s checking account. They can access the funds there, of course. But they cannot access them while held in the merchant account.

Remember, the merchant account is just a stopping point for the funds traveling from the customer to the merchant.

Your Business is Not My Business

There are many parties in a typical card transaction, outlined above. Again, they are you, the customer, their bank, your bank, the payment processor, and the card network. Why do there have to be so many parties? First off, there are many banking choices available to consumers.

Aside from the four horsemen of the banking apocalypse (Bank of America, Chase, Citi, and Wells Fargo), there are over 4,700 FDIC-insured banks in the U.S. These banks do not necessarily want to be in the business of facilitating card payments, so they leave that to Visa, Mastercard, Discover, and Amex.

Coincidentally, these card networks do not necessarily want to be in the business of receiving customer deposits, loans, mortgages, and all the other stuff that banks do, like ordering a massive amount of pizza before sending 18,000 employees home for good. Take a slice for the road!

Simultaneously, neither of these parties has typically wanted to get involved in peddling POS hardware to business owners, although times have changed. Too little, too late, as big banks will have to compete with a thriving marketplace of over 1,300 independent payment processors.

In any case, many parties are involved in every card transaction because there are many components involved. And each step of the way is serviced by a different financial institution. With so many players, there needs to be a stopping point for the money before it hits the merchant account. Once all the proverbial ducks are in a row, the money can be released to the merchant.

How Much Does a Merchant Account Cost?

It’s nearly impossible to answer this question in an all-encompassing way. Each bank will have different recurring fees (like a monthly fee) and transaction fees. If your payment processor and merchant account provider are separate entities, each party will charge you separately. You will also have different fees depending on if you need an online merchant account for transactions or if you accept only in-person transactions.

Interchange Rates

Every type of credit and debit card transaction is different. It’s hard to see this from the credit card terminal, but Visa, Mastercard, Amex, and Discover have different interchange rates. Debit and credit cards have different rates (and may use various networks). But wait… there’s more…every type of business has its own MCC (merchant category code), and the interchange rates for all these business types are different.

The only way to get an answer to this question is to sit down and review the fee schedule of the acquiring bank (or the payment processor, if they will be your acquirer as well).

Additional Fees

When looking into the interchange rates, don’t forget to also look for the authorization fee, transaction fee, statement fee, monthly minimum fee (for transaction volumes), batch fee, customer service fee, annual fee, early termination fee, chargeback fee, and fee for breathing (just checking to see if you’re still reading).

Fee Structure

In all seriousness, these are all potential fees you may encounter. What’s most important is transparency about the fee structure.

Many banks like to use something called tiered pricing. To make a long story short, this type of pricing model charges more for cards that present more risk of fraud or chargebacks (rewards credit cards, international cards, online transactions).

Interchange plus prices are often the best arrangement for the merchant. In this pricing scheme, the cost of every transaction reflects what Visa and Mastercard charge, plus a markup for the acquiring bank. However, most banks will not typically offer this pricing model, although credit card processors may be more likely to.

In recent times, many acquirers have switched to a six-tier pricing model. In this model, the three tiers are further split into two categories for debit cards: PIN and PINless transactions. The creation of this pricing model resulted from the Walmart Settlement—an (arguably) decades-long saga of space-opera-sized proportions between Visa and everybody’s favorite purveyor of low-priced goods (joined by 7,000 other businesses against the card network).

Merchant Account Wrap-Up

A merchant account is a type of account that a business owns but does not really have access to. It’s a holding account for them to receive transaction funds as the transaction clears. Card networks and banks will not work with a merchant unless they have a merchant account, which a merchant acquirer can provide or sometimes a payment processor.

Merchant Account FAQ

The following questions may have been covered in our article, but we will highlight some of the answers again.

No. Payment processors like PayPal, Stripe, and Square do not provide merchant accounts. A merchant links their bank account to these platforms to collect payments. But these large payment aggregators have terrible, flat-rate pricing that isn’t good for high (or even normal) sales volumes.

A merchant account is needed when a business uses a payment processor to collect debit and credit card transactions directly from customers (and not through a platform like Shopify or WooCommerce).

Merchant accounts vouch for a business. If a bank is willing to provide a holding account for your business, it says it is legitimate and creditworthy (enough). Card networks and the banks that service your customer’s cards do not want to work with unproven businesses. Your merchant acquirer is your gateway to the payment landscape.

Indeed they can. Not every payment processor can do this, but some provide these services. In fact, your payment processor is a great place to start looking for a merchant account if you don’t have one already.

Why not kill two birds with one stone? If you use your payment processor for multiple services (payment processing, merchant banking), they might even be able to give you better rates.

Frequently Asked Questions About Merchant Accounts For Small Businesses

No, PayPal is not a merchant account. Payment processors like PayPal, Square, and Stripe are considered payment aggregators. They combine many merchants into a singular account. They usually have flat-rate pricing that may not suit merchants with high sales volumes. A true merchant account is needed when a business collects debit and credit card transactions directly from customers. Contact ECS Payments for more information if you’re looking for a merchant account.

Yes, some payment processors can also provide merchant acquirer or merchant account services. If you’re looking for a one-stop solution for payment processing and merchant banking, contact ECS Payments, as we offer both services and can provide you with better rates than the leading competitors.

A merchant account serves as a holding account for customer transactions as they clear. After transactions clear, the batch funds for the day are settled into your merchant account. From there, you can transfer these funds into your business bank account. If you need assistance in applying for your merchant account, contact our team at ECS Payments.

The cost of a merchant account varies depending on the fee structure of your payment provider. To understand the costs and pricing models for merchant accounts, contact ECS Payments for a transparent discussion and personalized solutions tailored to your business needs.