Mobile and contactless payments—what exactly are they, what’s the difference between them, and why would you as a merchant need to know more about them?

When it comes to the evolution of the consumer world, the growth and prosperity of your business will be dependent on molding with the ever-changing technology in payment processing, including embracing the different types of payments that are now essential for consumer satisfaction.

This article will delve into the differences and similarities of mobile and contactless payments and the benefits they offer. These insights will provide your business with the foundations to consider implementing contactless and mobile payment options into your payment solutions for an enhanced customer experience.

What are Mobile and Contactless Payments?

Contactless and Mobile payments may be used interchangeably as they do have certain similarities. However, there is are also distinctions between the two.

Contactless Payments

Contactless transactions are the new era of consumer payment trends. It encompasses making a payment without having to touch your payment device to the card reader at all. Customers can complete a contactless transaction with a credit or debit card or via a mobile wallet. However, the only way this is possible is via the facilitation of an NFC chip-which not all cards or older phone generations have.

Mobile Payments

Mobile payments, on the other hand, refer to payments only made with a mobile device. A cardholder would need to upload their card information to their mobile wallet, which is linked to their smartphone with e-wallet applications like Apple Pay, Google Pay, or Samsung Pay. Depending on the mobile device, different “e-wallets” are better suited for different cardholders.

Mobile payments can also take place via online virtual payment gateways accessible via websites, payment links, or QR codes. A customer can manually enter their payment information into the online gateway, or use their mobile wallet to auto populate the payment fields. And either way you slice it, mobile payments are still contactless.

Is There a Difference Between a Mobile Wallet and a Digital Wallet?

Mobile wallet, digital wallet, Apple Pay, Google Pay, etc., seem to be used almost interchangeably; however, there is a huge difference between these terms.

A mobile wallet is an application on a smartphone like Apple Pay, Google Pay, or Samsung Pay. These apps securely store credit card information to then be used to scan in person at a merchant location. A cardholder can enter their debit or credit card information on their app and then use their phone to process a payment at the point of sale.

A digital wallet or e-wallet is a virtual program like PayPal or Venmo that offers the capability to send funds to and from a person’s bank account directly between two individuals with a click of a button. A customer typically cannot use a digital wallet to make store payments for goods or services at a merchant store location, but rather, they must use a mobile payment system on a POS device or terminal to scan their mobile wallet or NFC-enabled card.

What is NFC Technology?

Near-field communication (NFC) is a technology that allows two devices to communicate with each other by exchanging data through radio waves. NFC is a short-range technology with a range of up to 4 inches.

NFC is used in a variety of applications, including:

- Contactless payments: NFC-enabled credit cards and mobile devices can be used to make payments by simply tapping them against a card reader.

- Mobile payments: NFC-enabled mobile devices can be used to make payments at contactless terminals.

- Access control: NFC tags can be used to control access to doors, buildings, and other secure areas.

- Data exchange: NFC can be used to exchange data, such as contact information or files, between two devices.

A small chip inside a card or mobile device facilitates near-field communication. Cards with NFC chips are not the standard “dip chip” but rather one that you cannot physically see. NFC capability would be recognizable with an icon that looks a lot like a Wi-Fi symbol.

For contactless NFC payments, the customer must hover the physical credit card or the opened smartphone app near the card reader. However, keep in mind that contactless payments also require a card reader or terminal equipped with contactless technology.

What is RFID Technology?

Radio frequency identification (RFID) is a related technology that, on the other hand, can operate over longer distances, up to several meters. It uses radio waves to identify and track objects. While NFC is two-way communication, RFID can sometimes be used in one-way communication.

RFID has a variety of uses, including:

- Inventory management

- Asset tracking, such as locating cars or other valuables

- Access control into secure areas or buildings

- Highway toll collections from moving vehicles

As you can see, most RFID technology is not necessary for payments.

Why Your Business Needs Contactless Payment Options

Over the last few years, since the COVID-19 pandemic erupted, contactless payments have skyrocketed to an all-time high. Consumers are looking for the safest and most convenient way to go about their shopping.

Contactless payments will continue to escalate and dominate the payment industry in the years to come. In fact, recent studies indicate that:

- there was a 150% increase in contactless payments between 2019 to 2020.

- the US now ranks the highest in contactless cards compared to any market in the world.

It is projected that the global contactless payment market will quadruple by 2026. - 46% of global consumers have replaced out their most frequently used card for one that offers contactless

Furthermore, card networks Discover and American Express both now only issue replacement cards with contactless capabilities. All card issuers will most likely only be sending these types of cards in the future.

Rather than swiping, dipping, or keying in their card information, offering contactless payment options to your consumers provides them with transactional ease, added convenience, and a shorter time in line to pay for their products and services.

Ease and Convenience of Mobile Payments

With mobile payments, your customers can frequent your store and leave their wallets at home! Most consumers will not frequent a store that does not offer the option to pay with the cardholder’s “go-to” method. How many times have you lost or forgotten your wallet somewhere?

It happens to the best of us! But rarely do we leave home without our cell phones. We typically know right away if we’ve left our phones on the counter. We turn around, grab our phones, and continue with our day.

Phones are the modern world’s communication device, with texting, calling, e-mail, search engines, clocks, cameras, and now most importantly, wallets! If your customer leaves their wallet at home, it is crucial to be able to offer more payment services, including the option to pay using their smartphone.

This type of business practice of offering mobile payment solutions will set you apart from your competition. If your competitor does not offer contactless payments or a variety of payment options, and you do, you will be, by default, creating repeat business and loyal customers. Ease and convenience are number one for modern-day consumers and their active lifestyles.

Speed and Efficiency of Contactless Payments

Even though standard card transactions are much quicker than paying with cash or check, contactless payments are even more instantaneous! A typical transaction with a chip or magnetic stripe card takes around 3 seconds to transmit all the data and display the approved or declined response.

A contactless payment or “tap-to-pay” will take as little as one to two seconds! By the time the mobile device or NFC-enabled card is out of your consumer’s pocket and near the terminal, the screen is already displaying a response message.

Rapid transaction times will not only satisfy your customers at the register, but will also appease the line behind them. Long, slow-moving lines provide a customer the opportunity to re-think their purchase. It gives them ample time to debate if the price is right, if they genuinely need the item, or if their time is more valuable than waiting to make the purchase.

Customers forced to wait in these types of lines may end up putting things back or walking out of the store altogether. Ultimately, they may even find another merchant who has faster-moving lines for checkout.

With contactless payments, you are ensuring your customers that their time is valuable, and you are also removing any downtime for your consumers to debate their purchases. Less time at the register generates brief wait times in line and encourages customers to visit more frequently, offering an experience that will take less time out of their busy day to complete their purchases.

Contactless Payments are Hygienic

Contactless payments say it all. Since the awareness of the spread of diseases has become the height of topic in today’s world, keeping a distance is the trending experience consumers are looking for regarding managing their health.

Because contactless payments are just that, contactless, there is no exchange between parties of handing the cashier your card, cash, or check.

Added Security of Contactless payments

Another huge benefit to contactless payments is the additional security measures in place versus those used in older cards with magnetic stripes. Mobile wallets never store full card numbers and personal information.

Furthermore, contactless payments generate a one-time code for each transaction. As a result, the transaction no longer transmits the card verification code (CVV) and cardholder’s address and name.

Because of the lack of personal information transmitted and stored and the additional security measures in place with contactless payments, fraudulent activity does not pose as high of a threat as it once did with older card generations, and therefore, as a merchant, you will also carry less liability.

Tech-Savvy Generations Influencing the Global Payment System

The continued new advances in contactless payments and payment options for merchants are ultimately driven by the increasingly tech-savvy younger generations raised on electronics.

These generations may never have to touch cash again.

Soon enough, these younger groups may not even know what a dollar bill is. We are quickly approaching a cashless society, whose only means of payment are by way of digital currency.

In fact, 41% of consumers say they would not shop at a store if it did not offer contactless payments. And 57% of the surveyed said they are simply more likely to choose a merchant that offers contactless payments at point-of-sale.

More Merchants Are Opting For Contactless Acceptance

For many reasons, including hygiene and speed, 73% of merchants actually prefer their customers to use a contactless payment method. The same percentage of small businesses share the belief that offering new forms of digital payment acceptance are fundamental to their growth.

70% of these merchants in the United States have experienced customers requesting to complete their purchases using a contactless payment option. And in offering more ways to pay, customer satisfaction skyrockets.

The reason so many cardholders can increase the frequency in which they choose to use their contactless payment methods is the recent increase in the availability of merchants who are now able to accept these types of payments.

Today, over half (67%) of the merchants in our economy who accept credit card transactions also offer contactless options. Moreover, by 2024, 59% of small businesses in the US plan to shift to using only digital payments.

Setting Up Your Business with Contactless Payment Options

Mobile wallets or NFC-capable cards are becoming increasingly more popular. However, these types of payments cannot take place unless the card reader or terminal at your business location is also NFC capable.

Contactless Point-of-Sale Devices

Your business can accept contactless payments through point-of-sale devices such as a physical terminal, mobile phone, or smart tablet. Most up-to-date terminals today are equipped with contactless technology.

The same goes for modern mobile phones and tablets. Merchants can accept contactless transactions straight from their smart devices with the latest tap-on-phone technology.

Most card terminals today like Dejavoos, Clovers, and Verifones, can communicate captured card information via a typical telephone line connection, cellular network connections through AT&T, Sprint, or Verizon, or with internet connections via ethernet and Wi-Fi.

Electronic Cash Systems (ECS) offers support for CDMA, GPRS, IP, or dial-up environments at all merchant locations. ECS is also pleased to provide these “made for purpose” terminals to assist in setting up your business for success.

ECS Makes Contactless Adoption Simple

At Electronic Cash Systems (ECS), we understand that older equipment may not be compatible with this new technology. As a “one-stop-shop” payment processor, we want to make it as convenient as possible for our merchants to be able to offer updated payment solutions to their consumers.

We offer free replacement terminals to any of our merchants looking to make the switch! It is now easier than ever to make the switch and soar above your competitors in your industry.

Contactless and Mobile Payment Challenges

While contactless and mobile payments offer a world of flexibility for your customers and increased benefits for you, you still need to consider the potential challenges you’ll face when using this technology.

Regulatory Compliance

Any merchant that accepts contactless payments must comply with the Payment Card Industry Data Security Standards (PCI DSS). PCI DSS is a series of security regulations that merchants must adhere to in order to process any type of credit card transaction. The goal is for merchants to ensure that their payment terminals are secure to protect sensitive cardholder data.

Consumer Education

Consumer education is essential for successful use of contactless and mobile payment features. Not only do customers need to know that you accept contactless payments, they also may need education on the benefits and security of contactless payments to feel confident using this technology. Merchants should:

- Display signage or verbally explain to customers that you accept contactless payment methods at the point of sale.

- Provide training to their employees to accept and influence customers to use contactless payments.

- Display of point-of-sale signage explaining the benefits of contactless payments.

Compatibility and Infrastructure

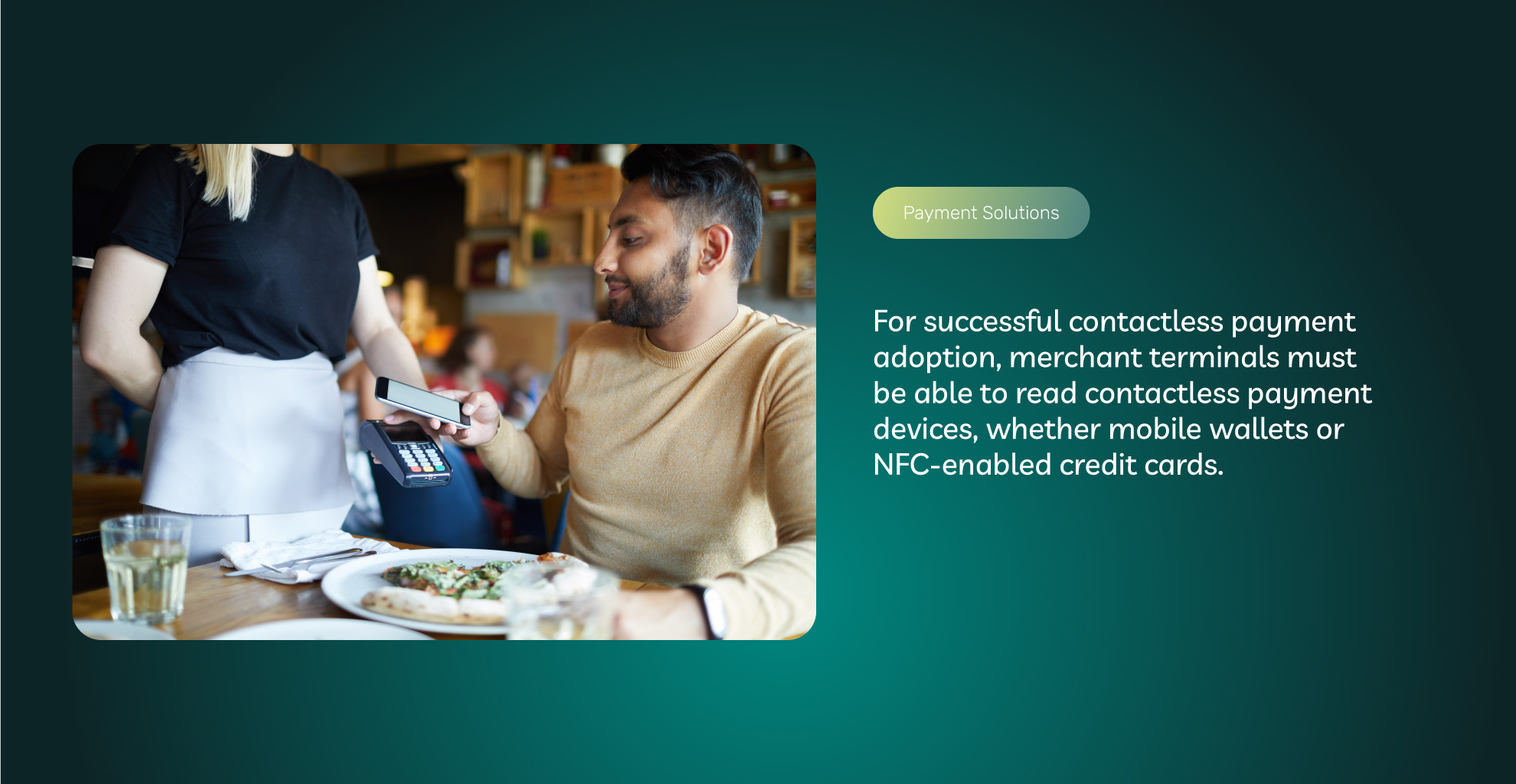

For successful contactless payment adoption, merchant terminals must be able to read contactless payment devices, whether mobile wallets or NFC-enabled credit cards.

To ensure compatibility, merchants should have a terminal with up-to-date NFC technology. Merchants can upgrade their devices with contactless readers or purchase new upgraded hardware from their payment processor.

The cost of this upgrade varies depending on the specific agreements and terms the merchant has with their payment processor and their specific needs.

However, remember that you can offset the potential costs of upgrading payment equipment by the increased sales that contactless payments can generate from more tech-savvy consumers who prefer to shop at stores that offer this payment technology.

Mobile and Contactless Payments Conclusion

All in all, we now understand how important it is to stay up to date with the latest in technology. Not only will this help keep your business in the loop with what’s trending in today’s world, but it will also gain satisfaction from your consumers.

Gaining this type of confidence from cardholders will put you at the top of the chain in your industry and can rank you higher than your competition. To gain access to all the benefits contactless payments have to offer, you will need to find yourself a credit card processor that you can entrust to your business. One that offers a wide variety of payment solutions for your business. At Electronic Cash Systems, we aim to be the “Best in Class”, and with that, our merchants will inherently rise to the same standard.

To contact sales, click HERE. And to learn more about ECS Mobile and Contact Payments visit Contactless & Mobile Payments.

Updated on July 2024