Consulting firm Ipsos found that in 2022, 31% of small businesses—particularly consumer-facing businesses—charged a credit card fee to customers. This was a marked increase from previous years. Ipsos cited a behavioral shift among consumers from cash to card payments and increased inflation, which put the squeeze on business owners.

To reiterate, an influx of card payments subjected business owners to more frequent fees. On top of that, runaway inflation ate into profit margins. To combat this double-whammy punishment, business owners turned to the practice of passing credit card fees on to customers.

But is such a practice legal? How does it impact consumer perceptions of a business? And does it ultimately save a business money? Let’s find out!

What is a Credit Card Fee?

In this context, credit card fees are fees that a business charges its customers if they pay with a credit card. This is in contrast to the credit card fees a business pays to its payment processor so they can collect credit card payments.

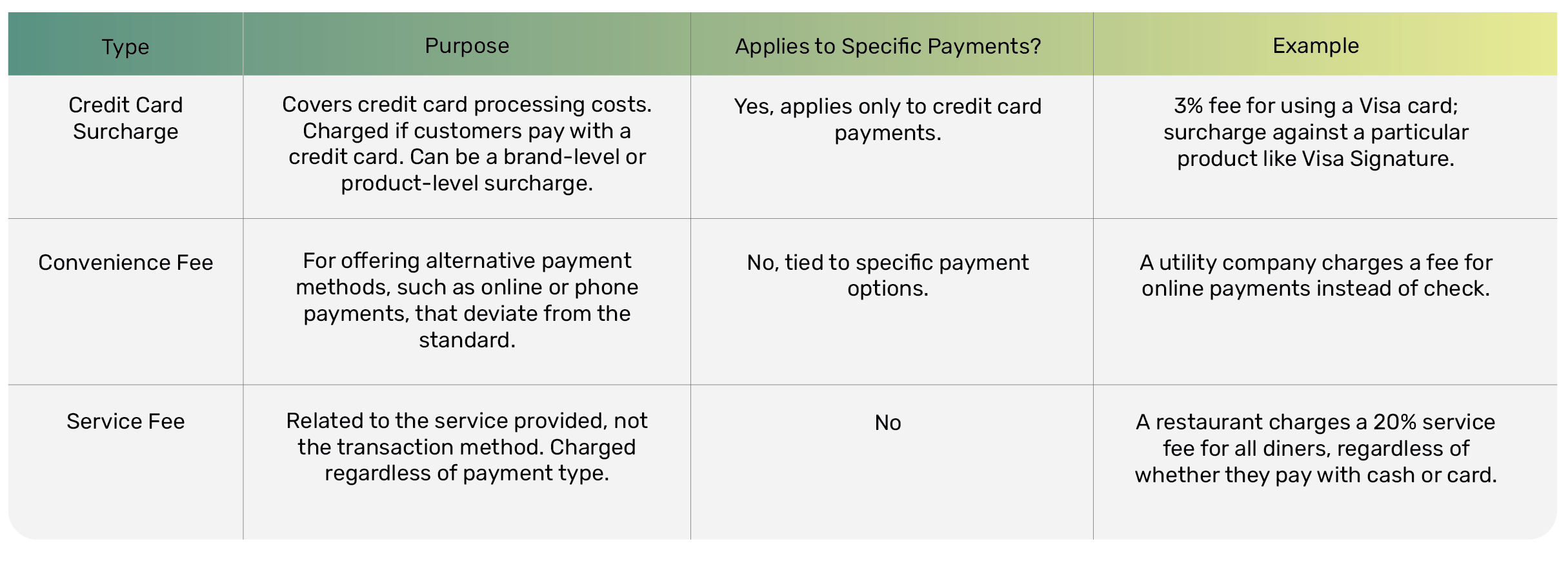

There are different ways to charge a customer a credit card fee. It could be issued as a surcharge or a convenience fee. It could be a brand-level surcharge against a particular card network (Visa or Mastercard) or a product-level surcharge against a particular product (Visa Signature, World Elite Mastercard).

To clarify, a product-level surcharge cannot be leveled against a particular card issuer like Bank of America or Wells Fargo. However, you could issue a surcharge against particular American Express products since these networks are also the issuers.

Service fees should not be confused with surcharges and credit card convenience fees. They do not relate to the transaction but to the service itself. For instance, a restaurant may charge all diners a 20% service fee, regardless of whether they pay with a card or cash.

Many organizations that collect monthly dues (utilities, insurance companies, educational institutions) charge convenience fees for online or phone payments made with a credit card. Purportedly, these help cover the operational cost of taking these payments.

Legal Considerations for Charging Credit Card Fees

Let’s get one thing out of the way: issuing surcharges is constitutionally protected under the First Amendment. That was the opinion of the Supreme Court, anyway, when they ruled against the state of New York in Expressions Hair Design v. Schneiderman, 2019.

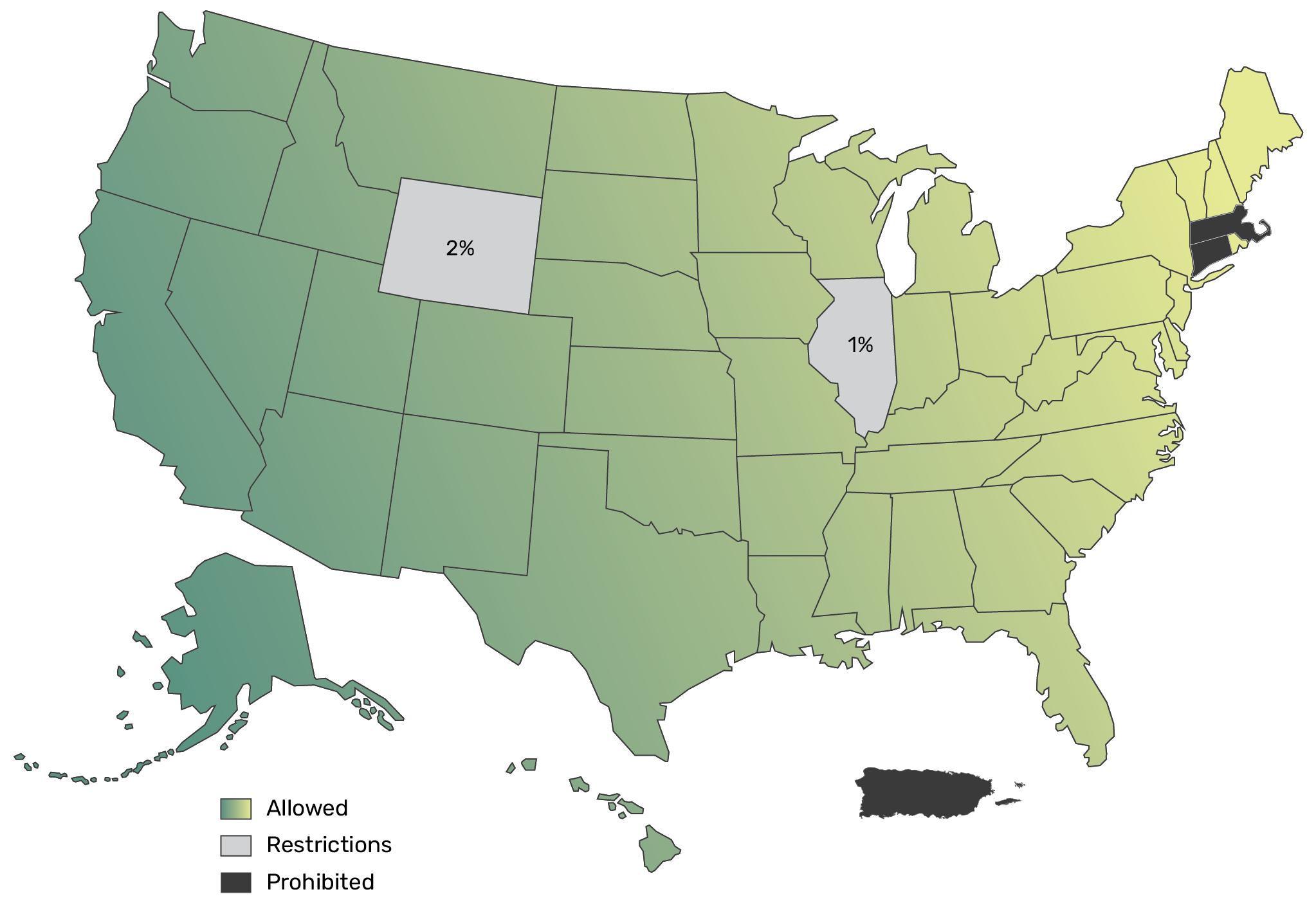

But that doesn’t mean you charge whatever you’d like, however you’d like. While there are no federal rules around surcharging, there are state rules. And card networks have also established their own parameters. Visa surcharge rules cap them at 3%, while Mastercard’s surcharge rules limit them to 4%.

States also have legal limits on credit card fees. Colorado’s surcharge cap is 2% of the transaction, while Illinois caps surcharges at 1% or the cost of the actual processing fee—whatever is less. Surcharges are forbidden in some states (Connecticut and Massachusetts) and Puerto Rico, but given the precedent set in the Expressions Hair Design case, that may eventually be overturned.

One piece of legislation that has also impacted credit card fees is the Durbin Amendment, if indirectly. The Durbin Amendment limited how much card issuers (e.g., banks) could charge merchants for accepting debit cards to 21 cents + 0.05% per transaction.

Banks started charging other fees to offset their losses and eliminating free services. In turn, merchants turned to the possibility of recouping losses by charging customers for credit card purchases to offset these costs. To clarify, the Durbin Amendment hasn’t changed anything about surcharging as much as it has driven businesses to do more of it.

Understanding Credit Card Surcharges and Convenience Fees

Now, let’s dive into convenience fees vs. surcharges.

A surcharge is a fee charged to cover the cost of processing a credit card transaction. It’s usually issued as a percentage of the transaction. As mentioned, caps on those percentages vary from state to state and within card networks. It’s never legal to charge more than the total processing fees a merchant pays. Otherwise, merchants would make money on their fees rather than cover their costs.

A convenience fee is (technically speaking) not really meant to recoup the cost of credit card processing fees. A convenience fee is often a flat fee meant to cover the cost of taking “alternative” payment methods such as online or over the phone. Although the two terms are often conflated, it’s important to realize that they are different.

In fact, legal convenience fees cannot discriminate against anyone for using a certain payment method, unlike surcharges (which, in a manner of speaking, can). The convenience fee is just (and only) for the “convenience” of making a payment that way…e.g., online or over the phone.

An interesting upshot to the distinction between surcharges and convenience fees is that convenience fees are less subjected to restrictions and regulations than surcharges. However, a business must still be transparent about issuing such fees, and they cannot be disproportionately larger than the true cost of offering the underlying “convenience.”

How to Legally Charge a Credit Card Fee

Interested in issuing surcharges to your customers? State surcharge laws vary, and each card network has its own surcharge regulations. These two sets of parameters can confuse the process. If you want to charge legal credit card fees, your two best immediate resources are your payment processor and your local chamber of commerce.

Whether you charge a brand-level or product-level surcharge, you need to notify the card network. Both Visa and Mastercard, for instance, have specific forms you can fill out to alert them that you will be issuing surcharges.

You’ll need to ensure that your fees do not exceed state limits or the limits of the card network in question. These limits can also not exceed the true cost of the transaction. As every transaction is different, you’ll need to ensure your payment processor can apply these percentages to your sales.

Legal credit card surcharges often require signage. Every state is different, but most states require clear signage at the point of sale, and some require it printed on receipts expressed as a dollar amount. On invoices that add a surcharge, you must itemize the fee and express it as a dollar amount.

The same is true with convenience fees. You must post signage stating that convenience fees will be applied to accept credit card payments in special circumstances, such as online or over the phone. In the case of “over the phone,” a verbal announcement would suffice.

Pros and Cons of Charging Credit Card Fees

You’re willing to adhere to US credit card fee laws (e.g., posting signage, notifying Visa and Mastercard). But is it worth it? What are the pros and cons of credit card surcharges? What about the pros and cons of convenience fees? And what do customers think?

Cons of Surcharging

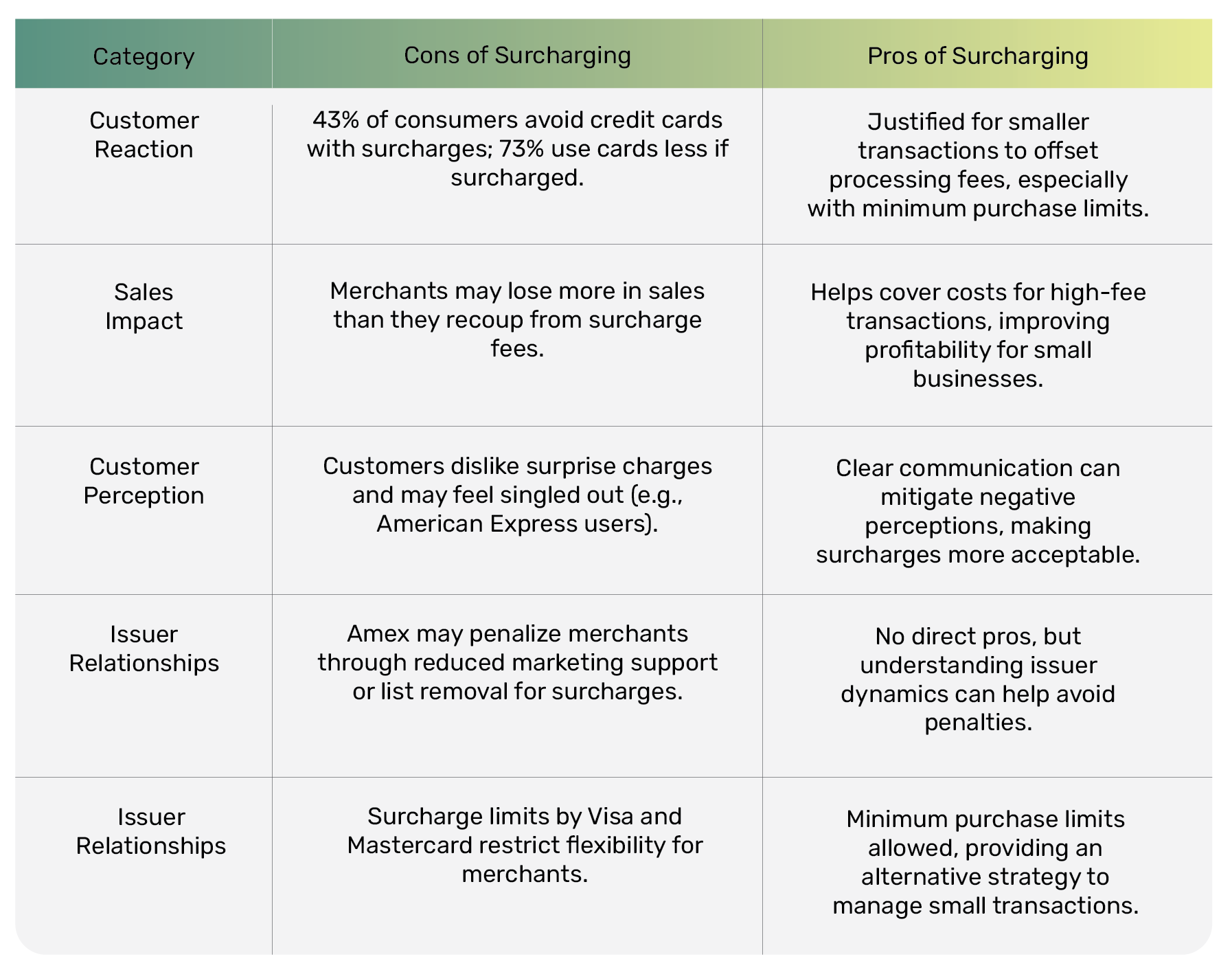

JD Power found that as many as 43% of consumers will not use a credit card if it’s subject to a surcharge, even if they had already set out to buy an item. 73% of polled consumers said they would use their cards less if they had to pay surcharges every time. Another Ipsos study found that merchants lost sales…losing more money than they recouped in surcharge fees.

Clearly, customers do not like being surcharged—and you don’t need statistics to figure that out…you just need common sense. Think about how you would feel, for instance, going into a restaurant and being surprised by additional charges.

Customers can also feel singled out. Suppose you had American Express surcharges (something understandable since American Express cards often have higher transaction fees). Customers with American Express may feel victimized, even if only subconsciously.

Earlier, we mentioned that Visa and Mastercard have surcharge limits. While Amex does not have a hard limit, it has other ways of discouraging merchants from issuing surcharges against its products. It may remove a merchant from its preferred merchant list or reduce its marketing support. This negative reception from the card issuer is another con.

Pros of Surcharging

On the other hand, you might feel that issuing surcharges is justified, particularly for smaller transactions where fees can eat up a greater proportion of the sale (in cases where there is also a flat fee component to the transaction fee). Unfortunately, you cannot issue surcharges based on the dollar amount. However, you can have minimum purchase limits for credit cards (e.g., purchases must be over $5).

Alternatives to Charging Credit Card Fees

With all these negatives, you might be wondering if there is some alternative to credit card fees. There certainly are, if you think outside the box a little bit…or rather, outside the point of sale.

1. Build Processing Fees into Your Pricing

One option is to build your payment processing fees into your pricing. However, this will drive up your prices by that percentage point. If consumers go crazy paying 3% more for eggs and milk, they probably won’t appreciate that.

2. Offer Cash Discounts

Another option is to offer cash discounts, which are legal in all 50 states. However, you must provide transparent information on the cash discount, just as you must provide transparent credit card fee disclosures (e.g., with in-store signage).

3. Incentivize Alternative Payment Options

You can also incentivize other forms of payment, such as check, cash, or ACH. If you have a subscription business or bill your customers monthly (for instance, you’re a landlord), this can actually be a great strategy for avoiding higher payment processing fees. For instance, ACH payments typically have much lower processing fees than card payments.

4. Negotiate Better Rates

Lastly, you can contact your payment processor and see if you can negotiate better rates. What kind of pricing model are they using? Flat rates? Tiered pricing? Interchange plus? If you aren’t using interchange plus pricing already, you should be.

This pricing model more accurately reflects the true cost of every transaction. If “inflated” processing fees are deflated, so to speak, you may not have to pass on those costs to your customers at all.

Many small businesses use a convenient payment processor like Square or Stripe (the name behind Shopify). These payment processors charge flat fees. Flat fees seem convenient and do indeed eliminate confusion. However, they are also substantially larger in the long run than more nuanced pricing schemes.

A business paying 2.9% plus thirty cents on every transaction (even ones that are a few dollars) will understandably ask its customers to fork over 3% to cover the “convenience” of using credit card payments. However, businesses do not have to accept these flat-rate pricing schemes. In fact, most payment processors (beyond large companies like PayPal) do not use them. If you can ditch bad pricing schemes, you can probably ditch surcharging as well.

Credit Card Networks’ Rules on Charging Fees

Remember that credit card surcharge compliance is also about following the card networks’ rules. Visa surcharges are capped at 3%. You must notify Visa and your acquiring bank 30 days before you begin issuing surcharges via a form on their website.

Mastercard caps its surcharges out at 4%. You must also notify them (and your acquiring bank) 30 days before issuing surcharges. Both Visa and Mastercard require prominent disclosure of the surcharges at the point of sale and printed on receipts.

Convenience Fees Vs. Surcharge

Recall that convenience fees are not really related to the use of a credit card over other payment forms. As such, card networks do not have specific rules for charging convenience fees. However, your state might have rules. The Durbin Amendment (mentioned above) also banned the use of convenience fees leveled against debit cards.

The fact that convenience fees can’t be leveled against debit cards makes it seem like they are synonymous with surcharges. However, the ban against debit card convenience fees is really a separate issue. In any case, card networks do not regulate convenience fees but check with your local chamber of commerce about state rules.

As mentioned, American Express does not have specific limits (although your state will), but it engages in behaviors that discourage merchants from surcharging. Discover has a unique rule whereby they request that if you are surcharging Discover brand cards, you will surcharge all other card brands equally.

Your best bet is to reach out to customer support for each card network to ensure you comply with their surcharging rules. Sometimes, this will be a bit of a juggling act. However, it’s a necessary act because otherwise, a card network could put you on a blacklist for failure to comply with their terms.

International Rules and Regulations on Charging Credit Card Fees

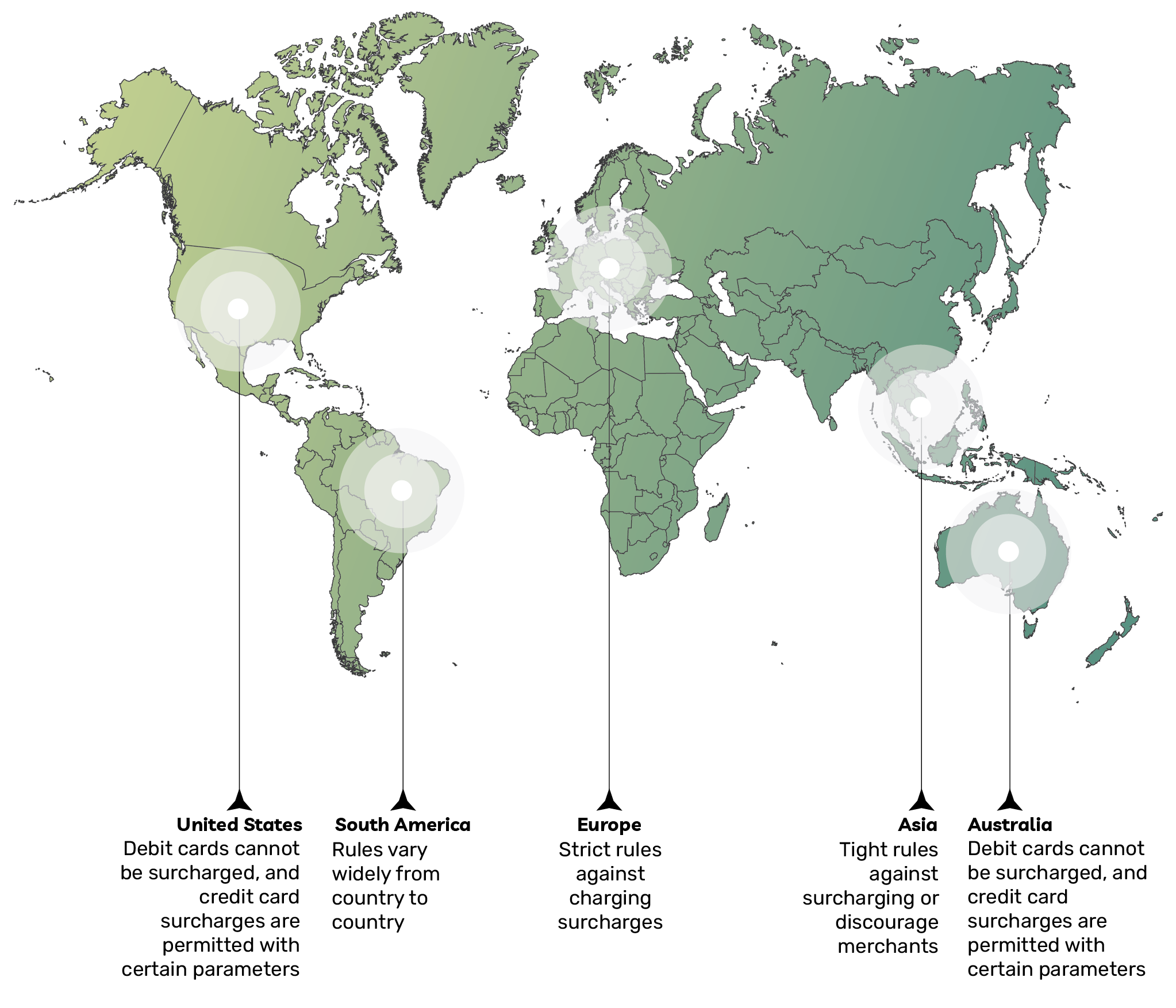

In the absence of uniform international credit card surcharge rules, the four card networks (Visa, Mastercard, Amex, Discover) still have theirs. These rules include (as mentioned) notifying the card network and your acquiring bank, certain limits on percentages, and requirements to post clear signage at the point of sale (and, for some networks, on receipts).

Travelers rejoice because the European Union has strict rules against charging surcharges. There are some exceptions, such as business credit cards and corporate credit cards. Because of its structure (e.g., issuing its own cards for its own network), American Express is not included in these limits and can be surcharged.

The Australian surcharge rules are similar to those of the United States: debit cards cannot be surcharged, and credit card surcharges are permitted with certain parameters (e.g., limits, and clear signage). Most Asian countries have tight rules against surcharging or discourage merchants from issuing them. In South America, rules vary widely from country to country.

For international businesses collecting a variety of payment options around the world, this varied landscape demands extra vigilance. A robust and proactive payment processor can help you stay on good terms simultaneously with every country in which you do business.

You may not be taking payments “around the world,” but if you are taking payments over the Internet and want to issue surcharges and/or convenience fees, this definitely bears consideration. Understanding the intersection of state law and card network policies is essential for charging credit card fees legally and maintaining compliance.

Conclusion

Surcharges are a percentage of the sale that allows businesses to recoup the cost of credit card transactions. A business may want to avoid the issue by encouraging paying with cash. Or it may embrace the idea and issue surcharges against a brand (Visa, Mastercard) or a specific product (Visa Signature) but never a credit card issuer (Bank of America).

Convenience fees seem similar but are different. They are often fixed fees that cover the cost of taking payments “a special way,” such as over the phone. While surcharges are subject to rules from card networks and states, convenience fees are less regulated.

Are you thinking about issuing surcharges to cover your processing fees? Have you considered examining your current pricing schemes to see if you can get better rates? Getting better rates with something like interchange plus pricing could eliminate the need to pass these costs on to your customers. Give us a call, and let’s see if we can help you avoid burdening your customers with extra fees.

Frequently Asked Questions About Charging a Credit Card Fee To Customers

It depends. It may be legal to charge customers a fee for using a credit card, but it must comply with state laws and card network rules, such as notifying customers at the point of sale, disclosing the fee amount, and keeping it under a certain percentage of the sale amount. However, some states have restrictions or outright bans on credit card surcharges.

Charging credit card fees to your customers has pros and cons. Whether the pros outweigh the cons depends on your business model and customer preferences.

Pros:

– Reduces the impact of credit card processing fees on your profit margins.

– Encourages customers to use less costly payment methods, such as cash or debit.

– Helps maintain competitive pricing by not including fees in product or service prices.

Cons:

– It can deter customers who dislike additional fees, potentially losing business.

– It may lead to negative customer experiences.

– Inconvenience of ensuring compliance with laws and card network rules.

To pass credit card fees to customers, first, you must understand the laws in your state and all credit network regulations and ensure you remain compliant. From there, you can implement a compliant surcharge program with your payment processor that automatically adds surcharges at checkout. But before you charge your customers, you must notify them at the point of sale and ensure your surcharge percentage is capped. Lastly, ensure you educate your employees on how to explain the surcharge policy to customers.