High-risk merchant accounts offer digital payment processing solutions to businesses that payment processors consider high-risk. These merchants can have a difficult time finding efficient and economical digital payment processing. But with a little persistence, you are sure to find the right high-risk merchant service provider for you to be able to accept credit card transactions.

In this article, we will discuss everything you need to know about high-risk merchants, high-risk merchant accounts, how they work, and what it means for your business.

High-Risk Industries and Businesses

High-risk merchants vary across many industries. So, first things first. It is beneficial to know if your business falls into this category. From there, we can discuss what steps you need to know next.

The following industries and businesses fall into the high-risk category:

- Auctions

- Bail Bonds

- Card-not present firearms

- CBD (all products, including Delta)

- Coaching, seminars, and online educational services

- Collection agencies

- Continuity/subscription offers

- Credit Repair

- Dating services and online dating

- Debt consolidation

- Debt collection

- Debt repayment (short-term lenders)

- Digital goods

- Doc prep

- E-cigarettes

- E-commerce

- Firearms

- Furniture and electronics

- Health supplements and nutraceuticals

- Marijuana cards, doctors, and products

- Money transmitters, MSBs, licensed lenders

- Multi-level marketing (MLM)

- Non-Fl account loading

- Outbound & subscription direct marketing

- Pawn shops

- Subscription services and companies with recurring payment plans

- Quasi cash

- Timeshare relief and exit services

- Tobacco & nicotine products

- Vape & paraphernalia

If your business industry was included in the above list, keep reading to learn more about high-risk merchant solutions.

High-Risk Merchant Meaning

So, we know what might identify a business as high-risk. But the big question is why? What makes a business or industry risky? Who is at risk and what are they at risk of?

The ultimate risk is: what is the potential for the business to receive a high volume of credit card chargebacks. Chargebacks result in forced payment reversals on a merchant account. Sometimes merchants can reconcile disputes, while other times the merchant loses out on these funds.

Chargebacks can occur for reasons such as fraud (unauthorized transactions), incorrect transaction amounts, inaccurate item descriptions, and difficult consumers or merchants all the same. The more at risk, a particular business is for chargebacks, the higher potential is that a bank or payment processor will label them high-risk.

The reason is, banks and payment processors can take a hit when the transactions they facilitate for merchants receive a chargeback. Disputes cost time, money, and a hit to reputation. To compensate for this, merchants typically incur fees per every chargeback they receive.

Who Categorizes Businesses as High-Risk?

The classification decision of a business is in the hands of sponsoring banks and their payment processors. Banks are the ultimate decision-makers when it comes to payment processing rules and regulations. Therefore, each business is categorized as low-risk or high-risk depending on a multifaceted list of indicators. This list of factors can go beyond chargeback ratios. But can also include the type of products or services offered, the business’s credit history, and the potential for fraud.

Labeling a business as high-risk is a way that financial institutions can protect themselves from any legal concerns or loss of revenue by increasing the cost of payment processing for these types of businesses.

What is a High-Risk Merchant Account?

As we mentioned above, a high-risk merchant is more likely to have high chargeback ratios, default on payments, or potentially commit or aid in the commitment of fraud or illegal activity.

To compensate for risky merchants, certain payment processors are bank approved to process credit card payments and ACH transactions for these businesses. The account that coincides with processing payments through a high-risk merchant service provider, is called a high-risk merchant account.

Do I Need A High-Risk Merchant Account?

It is important to know if your business is categorized as high-risk. Understanding the difference between high-risk and low-risk processing will give you a better idea of how your business will be affected. It will also provide insight into how to go about finding the right payment processor for you. The following list will provide more details on whether or not you will need to look for a high-risk payment processor.

What Could Classify a Business as High-Risk?

The following criteria are some indications that your business may be classified as high-risk and you will need to identify a high-risk merchant service provider.

High Fraud and Chargeback Volume

Immediately, a merchant who experiences a high volume of chargebacks may suffer when it comes to finding a payment processor who will approve them for a less costly, low-risk merchant account. Because the number one thing banks are looking at is the chargeback ratio, businesses that experience fraud, identity theft, and unauthorized transactions often will need a high-risk gateway merchant account the majority of the time.

The MATCH List

If a merchant has extensive chargeback volume, they may end up on the MATCH list. The MATCH (Member Alert To Control High-risk Merchants) list is a database compilation of blacklisted businesses that have been terminated by their acquiring bank or payment processor due to excessive chargeback amounts. This clearly causes concern for credit card processors. Even high-risk credit card processors may draw a line in the sand for any merchant who is on the MATCH List.

Highly Regulated Industries

A business in a highly regulated industry is required to have extensive licensing. Additionally, highly regulated businesses have to withstand ongoing government involvement, stipulations, and requirements. This may mean the products or services the merchant is selling are restricted by such standards as age requirements and federal law.

Such businesses would sell items and services such as marijuana, CBD, e-cigarettes, adult entertainment and products, firearms, and pharmaceuticals to name a few. In most, if not all cases, these businesses would need an appropriate high-risk credit card processing account.

Recurring Billing/Subscription Payments

Businesses that offer subscription-based products or services can fall under high-risk. This is because oftentimes, customers may sign up for a free trial and either forget or cannot figure out how to cancel the next month’s payment. Because recurring billing can be difficult to cancel, cardholders may find the easier route of going to their bank and issuing a chargeback if they see a subscription payment on their bank account statement.

Poor Credit

Credit scores are just one factor that payment processors and financial institutions consider when evaluating a merchant’s application for a merchant account. And there isn’t a specific credit score that is considered “poor” for a merchant. But, generally speaking, a credit score below 600 is considered a poor credit score for any individual.

Credit history criteria may vary from payment processor-to-payment processor. Payment processors and financial institutions may also look at other factors such as the business’s payment history, financial statements, business licenses, and other relevant documents when assessing creditworthiness.

But when applying for a merchant processing account, you can count on the fact that your credit will be pulled. Whether this is a soft or hard pull will depend once again, on the payment processor you’ve applied to. A business owner with poor credit may be at more risk of bankruptcy, legal issues, financial concerns, and of course chargebacks if the merchant is untrustworthy.

If a merchant has poor credit or a history of financial difficulties, they may have more difficulty obtaining a merchant account and may be categorized as high-risk. This could result in higher processing fees or additional requirements such as a reserve account to cover potential chargeback

High Transaction Volume

Merchants that process high transaction volumes or transaction amounts may be subject to a high-risk merchant account. For example, if you process $20,000 or more a month, or if you have an average transaction amount of $500 or more, you risk more opportunities for higher chargeback ratios.

When a business processes a high volume of transactions, there is a greater chance that a customer will dispute a charge or that a fraudulent transaction will go unnoticed. Fraudsters often target high-volume merchants because they can blend in more easily with legitimate transactions and avoid detection.

Accepts International Payments

International sales always carry a risk potential. They can involve additional regulatory and legal complexities, as well as a higher potential for fraud and chargebacks.

Payment processors or financial institutions must comply with different laws and regulations for international payments that can vary by country. This can increase compliance issues and the coinciding legal and financial penalties for merchant non-compliance.

In addition, the risk of fraud and chargebacks is higher with international payments because of the possibility of difficulty in verifying the identity of the customer which can compromise the legitimacy of the transaction.

Lastly, International transactions are also subject to currency exchange rates. When there is a conversion between rates of currency, it can create cardholder confusion. So, if an international cardholder thought they were charged the wrong amount, they could issue a dispute with their bank.

Certain countries are marked as high-risk for fraud. So if you are a merchant that does business outside of the U.S., Canada, Australia, Japan, Australia, or European countries, you may have to apply for a high-risk merchant account.

New Merchant Accounts

If a merchant is brand new, they may require high-risk payment solutions due to their lack of experience processing payments. With a limited processing history, merchants may be deemed high-risk simply because they do not have a track record or any data for payment processors and banks to analyze and evaluate the merchant’s profile. As a result, payment processors have no way to assess the merchant’s risk level.

Additionally, a new merchant may be considered risky with an uncertain or unproven business model. With little to no history of successful operations, it makes it difficult for payment processors to evaluate the potential risks associated with the business.

eCommerce Merchants

Why are e-commerce merchant accounts considered high-risk? Because eCommerce merchants accept online payment through a virtual terminal gateway. This means that card information is eyed in. Keyed payments are what’s called card-not-present transactions because the customer is not presenting a physical card to a merchant.

A card-not-present transaction can pose more threat for chargeback due to fraud. If there is no physical card, PIN entered, or signature required for a card transaction, there is more potential that an unauthorized user may have access to the card, initiating the transaction. With that in mind, it is not impossible for an eCommerce merchant to obtain payment processing. They would simply need to apply for a high-risk eCommerce merchant account with a payment gateway for high-risk businesses.

The Business Is in a High-Risk Industry

Even if a merchant has a clean reputation, they still may be subject to needing a high-risk merchant processing account if the industry they belong to is already labeled high-risk. Certain risky industries could be the ones mentioned above.

High-Risk ACH Processing

High-risk processing not only applies to credit cards but also applies to the ACH network. Merchants who wish to issue ACH transactions from bank account to bank account can do so. However, if the above-mentioned factors apply to the merchant’s business, they may need to apply for a high-risk merchant account.

ACH transactions can also be risky and subject to chargebacks. ACH transactions return as fraud. A merchant may see some of the following reasons for a return on a debit request:

- R05 Unauthorized Debit Entry

- R07 Authorization Revoked by Customer

- R08 Payment Stopped or Stop Payment on Item

- R10 Customer Advises Unauthorized, Improper, Ineligible, or Part of an Incomplete Transaction

If a merchant receives too many return notifications, they will be subject to account closure per their payment provider.

What is a High-Risk Merchant Processor?

A high-risk merchant processor has privileged relationships with acquiring banks that allow them to offer payment processing services to high-risk merchants. Some processors can work with high-risk and low-risk merchants, while others are only able to work with low-risk businesses. And then, there are certain payment processors that specialize in only high-risk, therefore, they do not work with any low-risk merchants.

High-Risk Card-Not-Present Transactions

However, it is important to note, that even if you receive approval to process with a high-risk merchant processor, you still might run into difficulties in accepting certain payment methods. For example, some banks prohibit card-not-present payments.

Card-not-present transactions refer to payments made by entering the card information manually (keyed entry). All online payments would be considered card-not-present and some in-person transactions, even though the card may be physically present, can still be categorized as card-not-present, if the cashier keys the card data into the POS system.

Therefore, if a high-risk merchant is restricted against card-not-present transactions, they would need to swipe, dip, or in contactless transactions, tap a card on a physical payment terminal.

What Should I Look For in Merchant Services for a High-Risk Account?

First things first when it comes to selecting the right high-risk merchant account service provider. You must make sure that the provider you are looking into accepts your type of business. Reason being, that even though the payment processor accepts high-risk transactions, they may not allow your specific industry.

Next, pay careful attention to the fees the merchant service provider is charging. This is because you may find that one provider offers better rates for low-risk accounts, but for high-risk, they may not be affordable. Different payment processing companies will offer competitive rates to win the account, so push for that.

You will need to do your research when comparing different high-risk payment processors. Some providers offer payment processing solutions with high-risk merchant account instant approval.

For others, it is not so simple. The process may be more tedious, lengthy, and in-depth. But that specific provider may come at a more affordable rate. You will want to look for a payment provider that offers customizable plans that will meet your unique business needs, whether you receive high-risk merchant account instant approval or have to wait a while to be approved. The approval time frame is less important in the end compared to the services that you receive.

Where Can I Find a High-Risk Payment Processor?

Businesses in the above-mentioned high-risk categories should know where to look for a high-risk merchant service provider. Providers like Square and Stripe do not support high-risk payment processing.

Whereas full-service payment processors like ECS and payment gateways like NMI, or Authorize.net provide high-risk payment gateway solutions for high-risk merchants. If your business ends up not being a high-risk one, these providers also offer low-risk payment processing.

How to Open a High-Risk Merchant Account

Opening a high-risk merchant account can be a bit more challenging than opening a traditional merchant account, but it’s still possible. So, let’s get one thing straight. Getting a high-risk merchant account is not difficult, regardless of what you might hear.

With that said, there are a few items you can complete that will make the processes more streamlined. So here are some steps you can take to establish a merchant account with a high-risk payment processor:

Work on Your Credit Score

One thing that can help make your application process go smoothly, would be to make sure you work on maintaining a decent or better yet, good credit score. Business owners of any risk level, who have poor credit scores, may face additional obstacles when it comes to securing an affordable credit card payment processing account.

High-risk payment processors are equipped to handle the riskiness of your business. However, they may decide that even though they accept high-risk merchants, they do not accept high-risk merchants with additionally poor credit.

Find a High-Risk Processor

You’ll need to find a payment processor that specializes in working with high-risk merchants or merchant services for high-risk businesses. Some of the best high-risk credit card processors that cater to these business models include PaymentCloud, ECS Payments, etc.

Provide Necessary Documentation

Once you’ve found a high-risk credit card processing company, you’ll need to apply for a merchant processing account. you will need to submit an application and provide some business and tax documentation to help them evaluate your business’s risk level and determine your merchant account approval.

This documentation may include your bank’s financial statements, credit reports, business licenses, processing history, and other relevant documents. Each company will have a step-by-step process that will guide you on the exact steps for submission.

Expect Higher Processing Fees

High-risk merchants typically pay higher processing fees compared to traditional merchants. You should be prepared to pay these higher rates in exchange for the ability to process credit card payments as a high-risk business.

Consider Your Chargeback Ratios and Their Consequences

High-risk merchants are more susceptible to chargebacks. Which are disputes initiated by customers for payments that they do not agree with or perhaps may not want to take ownership of. Some payment processors may require you to maintain a reserve account to cover your risk of potential chargeback and possible failure to complete payments due.

Reserve accounts take a small percentage of a merchant’s daily batch and hold it for an extended period of time. Slowly over time, when a merchant proves they are reliable and able to make payments or lessen their chargeback ratio, is when a payment processor may slowly begin to release a merchant’s reserve account. Most traditional merchant accounts do not require a reserve.

Read Your Merchant Account Contract Carefully

Lastly, before signing on with a payment processor, you should carefully read the contract. Make sure you ask questions to be sure you fully understand the fees, terms, and conditions of the contract. Many merchants end up in unhappy relationships with their payment processors, typically regarding merchant fees.

So, be sure you understand all the clauses and costs that you will be subject to. You will also want to gain a full understanding of your contract terms- How long is the contract? And are there any early termination fees? This is one line item that many merchants may not be aware of or skip over when reviewing their contracts.

An early termination fee can potentially be a hefty one. Meaning, if you sign a contract for a certain length of time–let’s say 5 years– you may decide you’re unhappy with the service or you find a cheaper option. So you decide to switch processors in 3 years. But you may end up paying thousands of dollars for breaching your contract.

Remember that every high-risk merchant account application is evaluated on a case-by-case basis, and there’s no guarantee that you’ll be approved for a high-risk merchant account.

Check out our high-risk payment processing account checklist for more information.

How To Get an Instant Approval Payment Gateway

The merchant account approval process can be a lengthy one. However, there are a few things you can do to speed up the process for a high-risk merchant account instant approval in the USA or an offshore merchant account instant approval.

One thing we would advise against is actually targeting a merchant service provider that advertises high-risk merchant account instant approval. These companies may seem like an easy option, however, it may result in a more frustrating and unsatisfactory payment processing experience in the long run.

A high-risk merchant can greatly increase their chances of a fast-approval merchant account simply by writing a cover letter to their payment processor. This cover letter should highlight all the best features of one’s business.

These features should stand out amongst other businesses. Such features could include the financial success and long-term customer relationships the business carries. Or it could highlight the top-of-the-line fraud prevention measures the business has implemented. Moreover, a high-risk merchant could address their fulfillment duration. Meaning, how long it takes from when a customer pays and when their product or service is received.

The reason is, timely durations between payment and received could result in a higher likelihood the merchant will receive a cardholder chargeback. The one thing payment processors want to avoid is excessive chargebacks. So the more steps put in place to reduce chargebacks, the lower risk you pose to payment processors.

Finally, the quicker you can send in the requested information and supplemental documentation, the sooner you should receive your merchant account approval.

The Risks of Instant Approval in High-Risk Credit Card Processing

In the fast-paced world of digital transactions, business owners often find themselves drawn to the idea of instant approval for high-risk credit card processing. Rapid account activation and immediate access to payment processing capabilities, means quicker revenue generation and a wider client base.

Instant approval for high-risk credit card processing may seem like a lifesaver, it promises quick access to essential merchant services, especially for businesses in industries known for elevated chargeback rates or susceptibility to fraud, making it more difficult to even find processing to begin with.

However, beneath the surface of the convenience lies a minefield of risks that could prove detrimental to the survival of your business. High risk merchants must be aware of potential and significant trade-offs, particularly with underwriting protection.

Why Underwriting Protection Matters

Underwriting the process in which payment processors assess the risk profile of your business. Accurate assessment helps to design merchant account tools to safeguard against potential issues such as excessive chargebacks, fraud, and regulatory compliance challenges. Proper underwriting is critical to your defense against these hazards.

Unfortunately, instant approval merchant accounts often bypass or minimize the critical underwriting process. While it may expedite your ability to process digital transactions, it can leave you exposed to vulnerabilities that could lead to severe consequences. Without detailed underwriting, your business may be ill-prepared to handle the unique challenges posed by high-risk transactions.

Adequate underwriting helps payment processors to identify potential issues in advance. They can customize payment processing solutions to suit your specific needs and implement safeguards such as risk mitigation strategies. With the protection of underwriting, you gain peace of mind, knowing that you have a payment provider who understands the unique challenges you face as a high-risk merchant and is committed to your success.

This is not to say all high risk merchant account providers bypass this crucial system. Some are very thorough in their process, yet with a quick approval turn-around time, like ECS Payments.

Does High-Risk Mean Higher Fees?

The short answer is Yes. High-risk merchants typically have to pay higher fees to process credit card payments than low-risk merchants would. When dealing with a risky business, financial institutions need to compensate for the liability. This means increased prices to cover their costs should they have to facilitate excessive chargeback procedures or deal with any legal issues regarding the merchant account.

High-risk merchant accounts may be subject to longer contract terms, annual fees, or an expensive early termination fee should the contract be breached or terminated early. Additionally, high-risk merchant accounts may also acquire a rolling reserve. A rolling reserve is when your payment processor will hold a set percentage of transaction profits until it can verify your account is processing legitimate transactions and makes enough to cover its incurred costs.

Moreover, chargeback fees can be more expensive for high-risk merchants than for low-risk merchants. Yes, they both will pay a fee for incurring chargebacks, however, high-risk chargebacks may just be more costly.

Keep in mind, before signing your contract, you can discuss all of these fees with your payment processor sales representative. Many may try to make accommodations for merchants depending on the situation to secure a successful contract.

High-Risk Merchant Account vs. Low-Risk Merchant Account

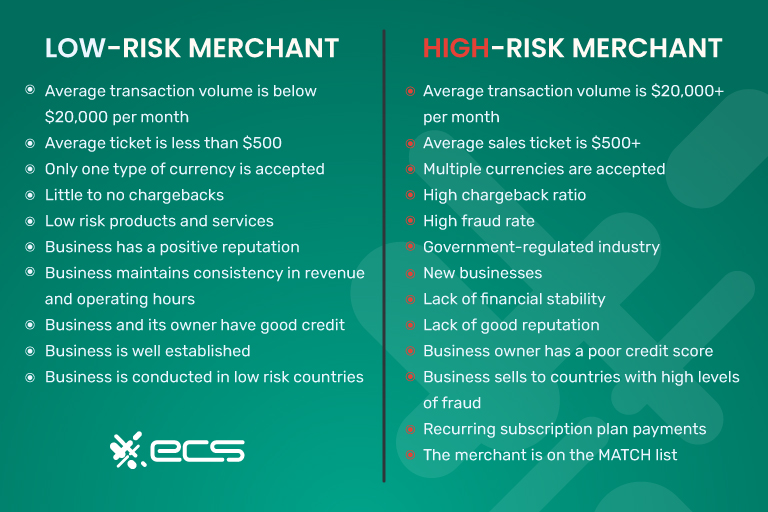

There are a few differences between a low-risk merchant and a high-risk merchant in the eyes of a payment processor. Low-risk merchants are generally established merchants that process less in volume, have lower ticket averages, have little to no chargebacks, only transact in 1 currency, and have a good reputation- including the business owner’s credit score.

The below comparison will better help to differentiate the definitive characteristics between a low and high-risk merchant.

One thing to note is that your risk level can change as your business develops over time. For example, if your business grows, or you start accepting new currencies or start selling new products, you may go from low-risk to high-risk.

If this does occur, beware, your payment processing company may change your risk status, which would require a new contract and higher fees. Or they might terminate your contract completely.

Termination would either be due to a breach of contract or the processor’s inability to process for high-risk merchants. If this happens, you will need to locate a payment processor who can process high-risk merchant transactions.

ECS High-Risk Merchant Accounts and Payment Gateway Solutions

At ECS, we understand that every business is unique in its payment option needs. That’s why we offer merchant accounts with high-risk payment processing services. Tailored to meet your specific requirements.

With our high-risk payment processing, you can accept payments from customers around the world, including those in high-risk industries such as all CBD products (including Delta), licensed gambling, dating services, firearms, and more. Our advanced fraud detection and fraud prevention measures protect your business and ensure secure transactions.

In addition, we offer competitive rates and flexible terms, so you can choose the plan that works best for you. Plus, our dedicated support team is ready to assist you with any questions or concerns.

Conclusion

In conclusion, finding the best processor to accommodate your high-risk merchant account doesn’t have to be a challenge. You deserve reliable high-risk credit card processing to keep growing your business and gaining traction with better customer experiences.

Yes, obtaining a merchant account can be a daunting task for businesses that are classified as high-risk. However, it is not impossible, and there are steps that merchants can take to increase their chances of being approved for a merchant account.

It is important to find a reputable merchant service provider payment processor that specializes in high-risk payment processing. They offer the experience needed to work with high-risk businesses and can provide proper guidance on how to mitigate risk and prevent chargebacks.

Merchants should be proactive in preventing fraud and chargebacks by implementing effective fraud prevention measures and clearly communicating their return and refund policies to customers.

By taking these steps, merchants can demonstrate their commitment to managing risk and increase their chances of being approved for a high-risk merchant account or even better yet, a traditional merchant account, later down the road.

Accepting digital payments is essential for businesses to thrive in today’s market. While being classified as high-risk can make this process more challenging, it is not insurmountable. By partnering with the right payment processor, like ECS, and taking steps to mitigate risk, high-risk businesses can successfully accept credit card payments and grow their business.

To contact sales, click HERE. And to learn more about ECS High-Risk Payment Processing, visit High-Risk.

Frequently Asked Questions

A high-risk merchant for credit card processing refers to businesses that operates in industries that have a higher likelihood of receiving excessive chargebacks above the 1% ratio or fraudulent transactions.

High-risk merchant account services are designed for businesses with a high likelihood of chargebacks, fraud. High-risk businesses need specialty payment processing solutions to manage their associated risks effectively. Certain high-risk businesses may pose threats to payment processing companies with their reputation, or the inability to sustain their merchant account payments.

High-risk credit card processors provide unique services tailored to the needs of high-risk businesses. Beyond, offering payment processing in general at an affordable cost to high-risk businesses, these services could also include fraud protection and chargeback mitigation.

When searching for the best high-risk credit card processors, consider factors such as their industry experience, merchant fees, fraud prevention tools and measures, and how quick;y they can get you approved or the ability to provide instant approvals, if needed.

A high risk merchant payment gateway securely transmits payment information between customers, merchants, and payment processors. The gateway is needed for both physical and virtual terminals.

Some high-risk merchant account providers do offer instant approval. However, the eligibility criteria and approval timeframes may vary. If you need a merchant account now, we recommend applying as soon as possible so you can start transacting and earning revenue. Contact ECS today to see if you qualify for one of our high risk merchant accounts.

A high risk bank account is designed for businesses considered that may be risky to process credit card payments. Only certain banks will agree to settle funds to high-risk merchants. To obtain a high risk bank account, you can contact financial institutions or specialized high-risk account providers.

Yes, there are high-risk merchant account providers in the USA. Not all merchant accounts can support high risk businesses. This all depends on the sponsoring bank partnerships and their allowances for payment processing. Luckily, ECS payments is a leading high risk merchant account providers in the USA.

Yes. High-risk ecommerce merchant accounts are available to merchants who accepts payment online. Weather you sell physical products online, subscription services such as online entertainment, or software as a service (Saas) ECS payments high-risk eCommerce payment processing has you covered.