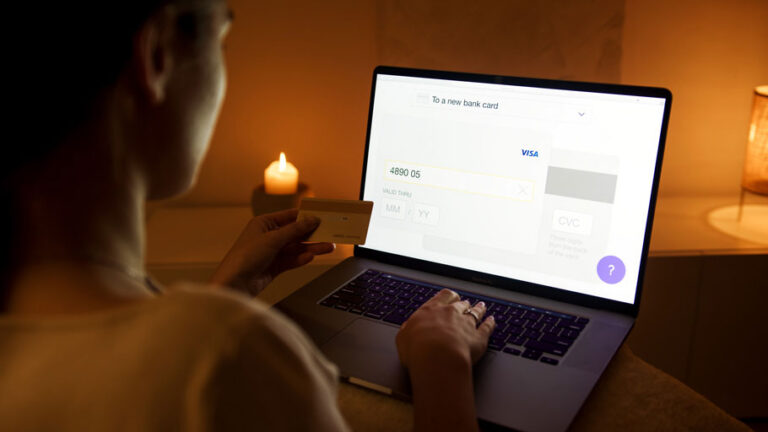

Integrating directly with a payment processor creates a smoother checkout experience for your online store customers. But what exactly does online payment integration mean? …and how does it work?

Your questions about how to add payment processing to websites and what are the key benefits of integrating your website with a payment processor will be answered in the following article.

The Payment Gateway

The payment gateway is essentially the digital bridge that allows payment to move from the customer or client to the retailer or service provider. Payment processors provide gateways that move the received payment from the cardholder’s issuing bank to the merchant’s acquiring bank account. Completing the digital transaction process.

The most used payment gateways are those serviced by PayPal (426 million) AmazonPay (50 million), Square (30 million), and Stripe (3 million). However, there are dozens of other fintech companies that offer payment gateways, and many of the smaller companies can provide more attentive, tailored service to their individual clients, like ECS. In any case, payment gateway solutions typically come in two forms: hosted and non-hosted.

Creating a Payment Gateway from Scratch

So, you may be wondering how to integrate a payment gateway into a website. We don’t need to go into too much detail here because this is going to be a no-no for most business owners. Writing code to create a payment gateway and integrating the backend to a pleasing front end with a positive user experience is a tall order to fill…one you don’t have time to fill if you’re running a business.

Hiring an engineer to code the payment gateway is going to be expensive. Then you will also have to provide maintenance, service, and security for the payment gateway. Trust is an important factor in the online shopping experience. Around 45% of consumers don’t even trust social media platforms to collect their payment information, and they use social media platforms all day.

That said, they are even less likely to trust your website if they have never encountered you before. Even for those consumers who are trusting enough to complete a transaction, coding your own payment gateway can become rife with security concerns. It’s better to outsource all that to a third-party payment gateway integration service that has the financial resources to vet each and every transaction and keep it all encrypted.

Hosted Payment Gateways

Hosted payment gateways redirect traffic away from your website temporarily to the payment gateway so that the customer can complete their transaction. This type of payment gateway is the easiest to integrate since it actually requires no true integration—just an installed plugin or perhaps a line of code that redirects browsers to the payment processor…who will then direct them back to your website once the payment is completed.

Disadvantages of Hosted Payment Gateways

The problem with this type of payment gateway is that it creates a poor customer experience. Imagine it from the perspective of a brick-and-mortar shopping experience: you’re walking around your favorite store at the mall, loading up your handbasket with (insert whatever you’re shopping for…scented candles, sporting equipment, toys). You approach the register to pay…but they tell you that you’ll need to actually take your basket to the other side of the mall so you can complete your payment. By the way…have you signed up to be on our email list?

As you can see, this creates a very negative customer experience. Although our example seems a bit extreme since when you’re online, you don’t need to navigate the treacherous waters of harping mall kiosk vendors (come check this hand cream out) and horrible muzak (like saxophone renditions of…well, anything). But although it’s far more subtle, payment redirects are still frustrating, especially when they are slow.

Some studies have shown that as many as 50% of browsers (in this case, your customers) will abandon a page if it doesn’t load within 3 seconds and that every single second translates to a 7% decrease in conversions. These are not statistics that bode well for retailers. To visualize the full impact of this problem, think again of a brick-and-mortar setting. Imagine watching 50% of your customers walk out the door because the checkout line is taking too long!

Who Benefits Most from Hosted Payment Gateways

Obviously, hosted payment gateways are not the way to go for any business that wants to make money. There are some businesses that hosted payment gateways will work for. These could include nonprofits such as religious institutions collecting donations…as most people making donations will not take back their generosity if it’s taking a few seconds to complete the translation. Service-based businesses can also get away with externally hosted payment gateways since they have a captive client base.

Even so, you’ll drastically improve the client experience by having a more integrated experience. This relates to our last point, that hosted payment gateways do work for businesses with a low-tech presence, perhaps using an older legacy website that does not offer payment processing integrations. However, if your business is using such a website or domain host, you should probably consider remodeling your online presence, and not only for the payment integration issue.

Non-Hosted Payment Gateways

This type of payment gateway is another name for direct integration with a payment gateway or payment processor. Integrated payment systems allow customers and clients to stay right on your website and complete their transactions.

While it’s true that certain payment processors will require you to shoulder a portion of the security issues, most companies today make their software more appealing by packaging everything into one bundle—including security.

Going back to the larger payment gateway service providers (Paypal, Amazon, etc.), business owners will find that some of them also make the website owner shoulder a portion of the programming burden.

However, a smaller fintech company offering direct payment processing integration can provide the attention and service you need to assist in setting up the payment solution integration. From the customer’s standpoint, this white-glove service is worth its weight in gold.

Direct Integration Benefits to User Experience

Another benefit to directly integrated payment solutions is that you can outsource many or all of the fraud, compliance, and security concerns to the payment processor. Card encryption and prevention of identity theft are handled by the payment processor. For small (and even midsize) business owners, this can eliminate a significant amount of headaches.

Another area of security where direct integration is beneficial is by tokenizing customer transactions to help the merchant avoid PCI DSS compliance costs. While larger companies processing millions of credit card payments every year might pay anywhere up to $200,000 to stay compliant, even a smaller business might pay a few hundred to a few thousand dollars to complete an Attestation of Compliance.

A payment processor can tokenize transactions to help you avoid these costs by tokenizing customer card payment details on their own servers for each transaction, which can be especially beneficial for returning customers or subscribers. All the same, you should make sure to discuss with your payment processor if there are any security concerns you are still responsible for overseeing.

Direct Integration Benefits to Maintenance

Yet another benefit to direct integration is that the maintenance of the payment gateway will be outsourced to the payment processor. Website maintenance for complex features like a payment gateway can cost hundreds or even thousands of dollars per month.

A payment processor offering their payment service to thousands of similar small businesses has the resources to take this maintenance off your to-do list. If there are technical glitches or disruptions that can create hurdles to the checkout experience, a third-party payment processor will also be better equipped to deal with it right away.

If your business was servicing its own payment gateway, the issue might take 24-48 hours to resolve, or longer. And working with large payment processors like PayPal can often leave a small business in the same boat, as they wait on hold with customer service.

By contrast, a smaller fintech company can provide more detailed, on-demand attention. Some of them may even allocate an account manager as a point person who is familiar with your business and can serve as a resource during a technical glitch.

Direct Payment Gateway Integration is the Way to Go

As you can see, when you choose to directly add payment gateways to websites, it has more benefits. It is the way to go, beating out coding your own payment gateway from scratch, or using a hosted payment gateway.

In terms of user experience, security, and maintenance, payment processor integration is the one-stop shop that will keep customers on your website, hitting buy now or subscribe. Direct integration is seamless on the front end from the customer perspective and thanks to all the developments in fintech within the last decade, it is also fairly seamless for the site and business owner.

To contact sales, click HERE. And to learn more about ECS gateway integration visit Integrations.