A merchant cash advance is a temporary type of financing tool that can benefit businesses that accept credit and debit payments. However, the term cash advance gets a bad rap among consumers. Partially because it’s a term used interchangeably with hard money loans.

Hard money loans are actually fairly common in certain industries like real estate investing. Whereas traditional mortgage financing comes with too much red tape. But hard money loans and their high-interest rates are usually associated with a sense of desperation or at least that’s how they’re often perceived.

As we will see, however, a merchant cash advance is something totally different. All the same, small to midsize business owners who are not flipping homes may be reluctant to take out a cash advance. So first, let’s take a look at what “cash advance” typically connotes and explain why that’s not the case for business owners.

Consumer-facing Cash Advances

A substantial number of consumers have actually relied on consumer-facing cash advances or payday loans, as they are also called. Because they help consumers float through the week until payday. In states with the loosest lending requirements, 6.6% of consumers took out a payday loan at least once in the past five years. While in states with moderate requirements that number is 6.3%. And in states with the tightest requirements, 2.9% of consumers took a cash advance.

To put things in a little perspective, the average American is more likely to have a tattoo (30%), and have traveled to at least one foreign country (19%), but less likely to believe that The King has not yet left the building (less than 6%). We’re talking about the immortality of Elvis, of course. In any case, while payday advances are not necessarily viewed as normative consumer behavior, there is a decent percentage of Americans who have had to rely on them.

High-Interest Rates

It’s no secret that payday loans have punitive interest rates. For instance, a payday loan in Idaho may run on average a 652% APR (you read that right). Some of the most common customers of payday loans are unbanked individuals, recent immigrants, young adults strapped with student debt, and divorced parents.

With no implication of judgment, it’s easy to see that many payday borrowers are in financially difficult situations. This is perhaps the reason why payday lending is illegal in 12 states and cash advance regulation is tight in 18 states. And with a summary like this, it’s no wonder the term cash advance creates some aversion.

Thankfully merchant financing is not really a cash advance. Even though it may be referred to as such. But first, let’s continue looking at cash advances in general, into the broader landscape of debt and spending habits in the American economy.

Americans Need Debt to Thrive

Americans will go to a four-year university to obtain the requisite accreditation for entering the workforce. In the process, incurring an average of $37,500 in federal student debt or $55,000 in private student debt. They’ll need a vehicle to get to work, borrowing an average of $42,000 for a new vehicle, and $28,500 for a used one.

If they decide to move into a home, they’ll end up in the company of homeowners who still owe an average of $220,000 to their bank. To keep up with the proverbial Jones Household, they’ll rack up an average credit card balance of $5,500.

No wonder only 25% of American households are debt free. These outstanding balances and their associated interest rates translate to a “standard” debt-to-income ratio of 43%. Meaning that $0.40 of every dollar made is going to pay off outstanding financial obligations. With numbers like that, consumers will more often than not need to use some sort of financing to make large purchases. Only around 44% of Americans have $1,000 saved up to cover a surprise expense, let alone a voluntary purchase like new furniture.

While the picture we have painted of American debt seems somewhat bleak, it’s a double-edged sword. So now on to the good side of the blade: debt financing is what makes the American lifestyle possible for most consumers. Getting a four-year degree, a new vehicle, and certainly moving into a home would not be possible for most Americans. Especially since inflation has outpaced wages over the last few years.

And Now on to Business Debt

You might be wondering: what does any of this have to do with my business? The answer: if consumers need debt to live life, you need debt to operate your business. Around 17% of small and medium-sized companies had outstanding debts that ranged from $100,000 to $250,000. Of course, this number only increases as businesses grow larger. Especially businesses in a startup or growth stage.

And if you need any more indication that companies need to find money to make more money, look no further than the stock market and its list of publicly traded companies. These businesses have engaged in equity funding whereby they’ve sold off portions of the company on an open market to raise more capital.

Unfortunately, if your business is not structured as a C-Corporation, that’s not a fundraising strategy you can engage in. In most cases, you’ll need to borrow money to start a business, grow a business, or carry it through a time of poor cash flow. Unfortunately, as many as 29% of businesses fail because they run out of money. While 56% of them borrow money to grow, acquire new assets, or pursue a new opportunity.

How Do Businesses Typically Get the Money They Need?

Bank Loans

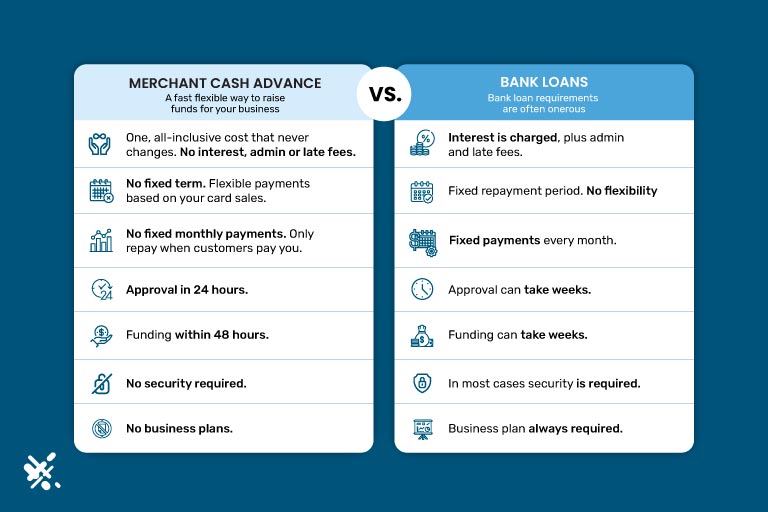

Some traditional options include bank financing—that is, a business loan. Unfortunately, ever since the subprime lending crisis of 2008, banks have tightened their lending requirements. This can make it difficult for small businesses especially to secure the funding they need. Even more so if their owners have less-than-desirable credit scores or if the business does not have a lengthy history of operation.

Angel Investing and Private Equity Funding

Other options involve angel investing or private equity funding. This essentially means fundraising. Usually with the promise of returning investors their money back (plus growth) or even some equity in the company. The downside to this approach is that rounding up investors can be a lot of work. Sometimes with no result—if, for instance, an investor is just not interested, even after their free lunch.

Another downside is that trading money for company equity means you will lose some control over the business. Sort of like an in-law who moves into the basement and won’t leave, resulting in sitcom material (which is far less funny if you’re trying to make money). While this can shake up even the largest corporations, it can be especially disruptive for a small to midsize business. Making this type of funding not worth the long-term fallout.

Merchant Cash Advances Vs a Business Credit Card

A merchant cash advance is different from a traditional loan in that they are unsecured. Meaning there is no collateral. For instance, a consumer-facing mortgage has the security of a property that can be foreclosed if the borrower defaults. A vehicle loan has a vehicle that can be repossessed. In this regard, a merchant cash advance is similar to credit card transactions, which are also unsecured forms of debt.

A merchant advance is different from a credit card though in that a credit card can be considered revolving debt. Once the card balance is paid down, there is more room on the card to make new purchases. A merchant cash advance is different in that once the loan is paid off, there is no line of credit that you can take with you.

There’s Nothing Desperate About a Merchant Cash Advance

As discussed in our intro, the term cash advance typically has a connotation of desperation, tied into a broader landscape of debt. But merchant capital advance is something else entirely, more akin to a business loan.

Credit Card Sales Are Determining Factors

This is due in part to the fact that a merchant cash advance ISO (independent sales organization) will look at your credit card sales. If you do not have a productive business (in terms of cash flow), you won’t be able to get a cash advance.

This is something that sets this far apart from the type of predatory lending that preys on consumers. A potential merchant cash advance ISO program will look at your daily credit card volume and based on these credit card payments (volume, size) offer you a lump sum of cash.

Merchant Cash Advance Repayment

The repayment term will involve forwarding a merchant a portion of those sales every month until the cash advance is paid off. Sometimes the term may end first, although the lender will generally try to prevent that in their initial assessment of your sales volume.

Daily, weekly, and monthly repayment options are often available. Which offer a greater degree of flexibility than that which is typically afforded by the more rigid terms of a business line of credit. A common percentage during the repayment period is 10% of sales, although they may range from 5% to 20%.

If your sales are booming for one week, that will accelerate the paydown of the cash advance. If they are more stagnant the next week, your repayment will slow down. But you won’t have to frantically scramble to piece together minimum payments (to be clear, there will likely still be some minimum amount to pay). The fact that your repayment plan is based on sales volume offers some repayment flexibility through periods of varying cash flow.

So How Can I Get a Merchant Cash Advance?

Obtaining a business merchant cash advance may require a few things that you probably already have. Such as a business bank account, a store located within certain parameters, a compatible payment processor, a certain regular level of sales, and a low-risk account. In most cases, your business will need to accept credit and debit payments.

Merchant cash advances are easier to get than traditional financing. The application usually takes 48-72 hours, which sure beats the days, weeks, or months of traditional underwriting. Merchant cash advance companies care less about your business model and corporate governance than they do about your actual hard sales.

Other selling points include the aforementioned flexibility because repayment is based on sales volume. There are no manual payments to make (or forget) because a percentage is taken right from each swipe, dip, and chip insertion. The loans do not require collateral and in some cases, even someone with bad credit can get them—because once again, the loan is not so much about the borrower and their credit history as it is about the cash flow.

What Are the Downsides of a Merchant Cash Advance?

There are some cons to a merchant cash advance. Interest rates may be high…as much as 20% to 50% of the principal loan amount. To put that into an honest perspective, the average business loan was 5.4% for fixed-rate loans and 6.25% for variable loans. A merchant cash advance may be up to ten times more than that…but those are the breaks for faster, easier funding, with far more flexible repayment terms.

Other cons can include the frequent repayment schedule, which can eat away at your transactions until it’s paid off. Then there’s the fact that these types of cash advances are only available to businesses that take card transactions. If your business takes plastic and cash, and the split between them is roughly even, that may result in less funding for you.

Just as they are for consumers, cash advances are not a long-term funding solution for business owners. They might be used for purchasing inventory, equipment, marketing, cash flow relief (during bad times), and surprise business expenses. For things that don’t need an immediate solution, the lengthier time of the business loan underwriting process is worth the wait, at least in terms of the lower interest rate.

Cross Your i’s and Dot your t’s

It’s very important to also examine the terms of a cash advance. There could be penalties for early repayment or confessions of judgment embedded in the contract. A clause that essentially makes you forfeit your legal case even before it gets to court. If you don’t have an in-house or on-retainer lawyer to help review the borrowing terms, you should ask as many questions as you possibly can of the potential lender. Leaving no stone unturned.

Many cash advance companies are online and may be hard to get on the phone. You may want to see if the payment processor you already work with offers merchant cash advances. They will be reluctant to spoil a working relationship with existing clients and consequently are more likely to be transparent and offer borrower-friendly terms for cash advances. Additionally, since the merchant is servicing the advance, you won’t have to worry about integration issues: the processor can just collect repayment as the card payments come in.

Factor Rate Versus APR

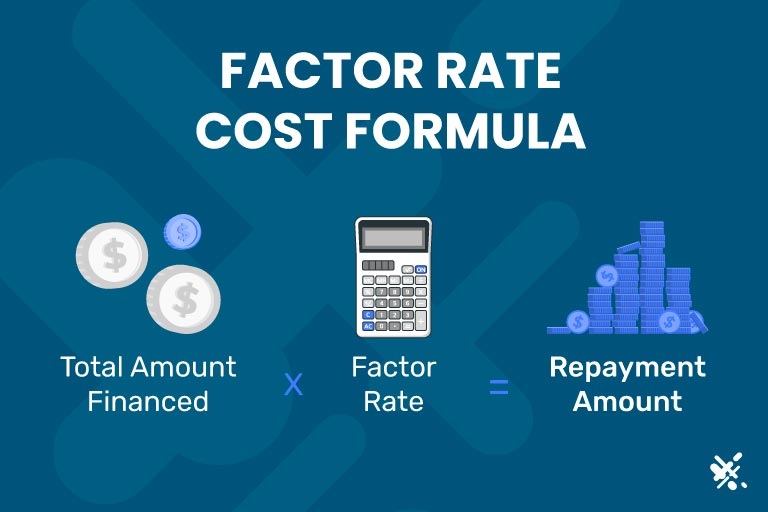

There are some different parts to the merchant cash advance, with different terminologies than the typical loan. The principal (as it is with traditional loans) is the amount you borrow and must repay. The factor rate is how much you’ll repay the cash advancer, expressed in what is often a two (sometimes three) digit number. For example, if your principal is $20,000 and your factor rate is 1.5, you’ll ultimately owe the lender $30,000.

In some ways, since the loan is repaid as sales come, the factor rate is not the same thing as an annual percentage rate. If your sales volume takes off shortly after the cash advance is made, you’ll pay it off before the end of the year. This means you won’t have a 50% APR eating away at a lingering balance. Even if your factor rate is 1.5.

Even so, most cash advances will have a repayment period, which usually is 12-24 months. Beware that if the loan is not satisfied by this time, there may be a balloon payment whereby you’ll need to pay the balance right away.

Is a Merchant Cash Advance Right For My Business?

Remember there is a world of difference between a consumer-facing cash advance and a merchant cash advance. A consumer-facing cash advance is often based on…well, nothing—and that’s why they are so frequently predatory.

By contrast, a merchant cash advance is based on the cash flow generated from credit card sales. If your transaction volume and size is healthy, you should not be concerned about paying the cash advance back.

However, you will still need to take note that the interest rate (as expressed by the factor rate) of a cash advance is significantly higher than that of traditional business financing. Cash advances for a business are similar to those for consumers in regard to the fact that they are short-term solutions with some fairly punitive interest rates. If your business has a surprise expense that’s not covered by insurance or the amount of cash you have on hand, a merchant cash advance might do the trick.

Alternatively, if a unique opportunity is in front of you that you’d like to take advantage of (a competitor unloading inventory as they close up shop or a piece of equipment on sale), a cash advance can make it happen within 48-72 hours. Minimal questions asked. Aside from how much plastic you are swiping.

Remember that in terms of securing a merchant cash advance, your best bet is to start with the payment processor with which you already have a working relationship.

To contact sales, click HERE. And to learn more about ECS Merchant Cash Advance visit Lending.