To the average person, ACH vs Wire transfer seem to be the same. But is ACH a wire transfer? As it turns out, ACH transfers and wire transfers are very separate things. Moreover, there are practical ramifications to these payment method differences. Let’s dive deeper

Wire Transfers and ACH Transfers Enter the Money Moving Landscape

In 1968, a cadre of bankers in California were concerned that the growing volume of paper check transactions would break the system used to process them (humorous to imagine, as divergent as this is from today’s consumer preferences).

This resulted in the creation of the first regional Automated Clearing House network. The creation of several others eventually resulted in NACHA, which sounds like something that goes well with cheese but actually stands for the National Automated Clearing House Association (go figure). NACHA is not a government organization. Rather, NACHA is a composition of private industry and public sector partners who use the ACH network to process payments.

What is an ACH Payment?

So what does ACH transfer mean, anyway? ACH stands for Automated Clearing House. ACH payment moves money between financial institutions using the specific ACH network. The ACH operators send money throughout the business day in batches over the Automated Clearing House Network.

How Does an ACH Payment Work?

ACH payments are the only type of payment network that handle push and pull transactions—something that wire transfers cannot do.

ACH Credits

An ACH Credit deposits money into a receiver’s account. For instance, an employee may receive their paycheck an a retiree may receive their social security in the form of a direct deposit credit.

ACH Debits

Conversely, an ACH debit takes funds from a paying account. For instance, a subscriber paying for a subscription service or a homeowner or renter making utility bill payments.

Involved Parties

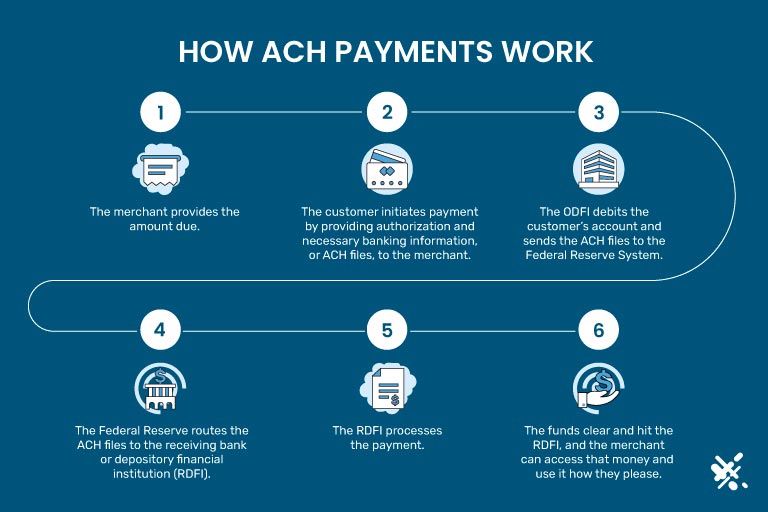

The bank that initiates an ACH transaction is the Originating Depository Financial Institution, or ODFI. The bank that receives the transaction is the (drumroll please) Receiving Depository Financial Institution or RDFI. The bridge between them is the network of ACH operators who operate through the Federal Reserve Bank or a different participating clearinghouse.

In simplest terms, a clearinghouse works like this: party A wants to send party B money. Between them is party C, who will make sure that both parties honor their obligations and execute the contractual arrangement. C will do this by collecting money from A and then paying it out to B, rather than A just giving B the money.

Obviously, a clearinghouse is not needed for certain types of transactions, such as where a customer hands a business owner cash. But for other types of transactions—for example, where an employee’s bank is miles away from the employer’s bank—a clearinghouse is a necessary party in facilitating rapid transactions between two parties.

ACH Transaction Timeline

ACH payments generally take 2-3 days for the entire transaction to settle. But in 2015, NACHA began rolling out Same Day ACH Payments. Same-day ACH payments have shown marked growth in transaction volume, growing 74% in recent years. However, this rapid growth belies the fact that same-day ACH is just 2% of the total ACH volume.

How Do Wire Transfers Work?

Now moving on to the difference between ACH and wire transfers. A wire transfer starts when a party wishing to send money approaches a bank. They will provide IBAN or BIC numbers to make sure the payment is sent to the right place. The sending bank will then communicate with the receiving bank via an international system like SWIFT or a domestic system like Fedwire.

The two banks will not typically use a clearinghouse but instead, will have a direct reciprocal relationship with each other. Alternatively, a bank or wiring agency may not need a reciprocal relationship if the transactions starting and ending points are managed by the same bank or company. For instance, in the case of Western Union, cash can be sent from one WU kiosk to another and available for pickup within hours.

ACH Vs Wire Transfer: What are the Differences?

ACH payments take 2-5 days to process. Although they can technically be processed on the same day. Wire transfers, by contrast, are much faster and sometimes instantaneous. ACH payments may have limits to them, depending on your financial institution. For instance, Chase limits wire transfers to $100,000 per transaction, with higher limits for businesses.

ACH payments typically only work within the same country, using the local currency. Banks do not typically offer international ACH payments. International exchanges need to use a wire transfer.

The tradeoff is that wire transfers typically have much higher fees, which range up to $50 per transaction. In some cases, both the recipient and the sender will have to pay the fees. ACH payments generally cost $0.29 on average, per transaction.

ACH payments are arguably more secure. They are sent in batches by payment processing companies who utilize built-in fraud detection. Wire transfers, processed as they are directly from bank to bank, take less time and are next to impossible to reverse—making them the modus operandi of many a long-lost uncle in Africa who just needs to collect a small fee in order to process the release of your princely inheritance.

What is Better for Your Business: Wire Transfer or ACH?

It’s all about (1) how fast the transaction must be completed (2) how often it will be performed, and (3) the trust or lack thereof you have in the receiving party. To boil it down in practical terms, wire transfers are a good option for urgent payments, especially large ones, where there is little security concern. ACH payments are good for smaller, non-urgent payments, especially consistent ones that could rack up charges over time—like biweekly direct deposits or monthly bill pay.

What type of transfer is better for your business will depend on several factors, including the immediate situation at hand, and the type of product or service your business supplies to its customers.

Wire Transfers For Businesses

For example, if you invest in real estate and just got off the phone with a very motivated seller in a different state, time is of the essence. This is especially true in the investment space where investors do not use financing options like a consumer-facing mortgage.

A wire transfer can get a down payment to a potential seller and help close a deal the same day. As long as something like a hard money loan or swing loan is set up to cover the rest. In this example, time is of the essence, there is likely a low risk of fraud, and the transaction is a one-off.

ACH Transfers For Businesses

Subscription Business Models

ACH is the way to go for subscription services or recurring payments, think utility bills or digital services. You don’t want your fee to collect to be close to or more than your actual transaction. The fees to process ACH payments are far lower than card payments. They are also arguably more secure because card numbers can change—for instance if the card is lost, stolen, or expired—the heartbeat of your payments won’t skip a beat. Bank account numbers, by contrast, do not change.

Payroll

While you can use a POS terminal or online payment gateway to collect payments from customers, you cannot issue paychecks over a credit card network. You’ll need to use ACH payments for your payroll direct deposit.

If you own a restaurant and have ten employees working for you, ACH direct deposit is a no-brainer. Using wire transfers to issue paychecks 26 times per year is would cost you up to $13,000. Using ACH would cost $75. The space between those numbers is a dozen pounds of black truffles—or probably a number of other things of greater importance unless you own a Michelin Five Star Restaurant.

It’s true that these days you could issue payment to employees through something like Zelle, PayPal, or Venmo, but that will lead to other problems unless your employees are actually not employees at all, but genuinely independent contractors.

Are Zelle, Paypal, and Venmo ACH or Wire Transfers?

Zelle is a service that allows bank account holders to instantly transfer money to someone else’s bank account. While it seems like a wire transfer in its instantaneous nature, it actually uses the ACH network. However, Zelle has some limitations like limits on how much you can send.

PayPal and Venmo have several functionalities including P2P money transfer and acting as a payment gateway for credit and debit card processing. As such, these platforms work with both the ACH network and the card networks to allow consumers to use plastic payments or a checking account. They are not wire transfer apps, although Western Union does have its own app as well.

ACH Payments Can Also Reduce Chargebacks

ACH payments may also have a lower risk of chargebacks and when chargebacks do occur, there is less of an avalanche to clean up. That’s because credit card payments involve several parties—issuing banks, acquiring banks, payment processors, and card networks. A chargeback causes a chain reaction that several parties must rectify, snowballing fees that are ultimately slapped on the merchant which could be up to hundreds of dollars.

Part of the reason chargebacks are less likely with ACH payments is that banks are often more unwilling to reverse ACH transactions. For instance, when it comes to credit cards, customers can claim they never received something or that it was damaged when they file a chargeback. For ACH payments, a problem with the product or service is not enough to initiate a reversal—only a problem with the payment itself.

Wrapping up the ACH Payment Vs Wire Payment Comparison

To wrap it all up, ACH transfer vs wire transfer is a comparison that seems to initially have some similarities. But there are a few key differences on the back end, such as the use of a clearinghouse (in the case of ACH) or a reciprocal relationship between banks (like a wire transfer).

Practical differences between wire transfers vs. ACH is that wire transfers are quicker but more expensive and potentially more exposed to fraud, while ACH payments are slower, much more cost-effective, and very secure.

To contact sales, click HERE. And to learn more about ECS ACH Payments visit ACH.