Payment Processing 101

Did you know there’s more that goes on behind the scenes, from when customers pay businesses with their cards to when the business receives their payment? Well, there is! A whole lot goes on! So, how do businesses accept debit and credit card payments? How exactly do payment solutions like card terminals work? And what happens behind the scenes of payment processing?

In these articles, you’ll learn all about card networks like Visa and Mastercard. You’ll learn about how swiping a card through a magnetic strip reader is different from making a contactless or EMV payment. And you’ll learn about cutting-edge industry solutions like mobile payments, QR codes, and even biometric payments.

Did you know that contactless cards use radio wave technology—and that there’s a small antenna inside the credit card? Did you know that Visa and Mastercard have pioneered programs that allow customers to pay with a smile or a hand scan? Have you ever wondered how Amazon’s cashierless stores work? Do you know how many parties are involved in a single credit card transaction?

Aside from these very interesting “big picture” topics, we’ll explore pinpointed questions that relate directly to your business, like—why are flat-rate credit card fees so bad? What other pricing structures are there? What is an MCC or merchant category code—and does it impact my business? Or should I still accept cash?

In our Payment Processing Basics articles, you’ll get an overview of how payment processing works. The process of taking card payments will be demystified—and you’ll have more information to make better decisions moving forward—such as who to choose as your payment processor. As you’ll see, many of these considerations can only be answered when you consider the type of business you own.

Mobile and Contactless Payments

Everything you need to know about why your business should offer convenient and secure contactless payment options to your customers.

Why ECS Payments Is Superior to Other Processors: The Power of Dedicated Customer Service

When payment processing fails at your busiest time, ECS Payments delivers fast, expert support to protect your revenue and keep your business running smoothly.

Unlocking Growth Together: Partner and Reseller Opportunities with ECS Payments

ECS Payments helps businesses turn everyday transactions into ongoing revenue through partner and reseller opportunities.

How Long Does an ACH Transfer Take? ACH Payment Timeline Explained

Confused about ACH transfer timing? Learn how understanding the ACH payment timeline can help you avoid delays, protect your cash flow, and keep your business running smoothly with help from ECS Payments.

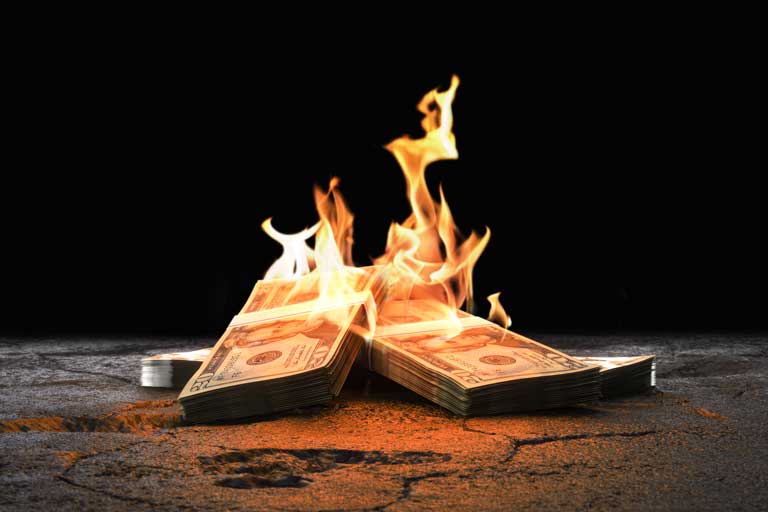

ACH for Recurring Payments: Why Credit Cards May Be Costing Your Business More Than You Think

Is your payment method quietly draining your profits? Discover how switching from credit cards to ACH for recurring payments can reduce fees, minimize failures, and boost your bottom line.

How to Accept ACH Payments Online: A Practical Guide for Growing Businesses

Imagine waking up to a fresh deposit in your business bank account,no chasing payments, no card fees. Just reliable, low cost revenue thanks to ACH, the smarter way to get paid online.

Voice Payments: How This Hands Free Payment Method Is Reshaping Checkout

What if your customers could pay just by speaking? Voice payments are changing checkout—and it’s time to see what that means for your business.

PCI DSS 4.0: What Merchants Need to Know in 2025

Is your business ready for PCI DSS 4.0? Discover what’s at stake—and what steps you must take to protect your customers and stay compliant in today’s evolving data security landscape.

Accepting Cash & Credit Card Surcharge Laws: Best Practices

What if adding a small credit card surcharge could actually protect your profits? Learn how to implement surcharge and cash discount programs legally, clearly, and smartly.

Navigating the New “Click to Cancel” Law: What Merchants Need to Know in 2025

Running a subscription-based business? The FTC’s new Click to Cancel Rule could impact how you retain trust, stay compliant, and avoid costly penalties

Understanding Payment Processor Fees and How to Optimize Them

Credit card fees eating into your profits? Learn how to cut costs, avoid hidden charges, and keep great service—all without the confusion.

A Guide to Integrating Payment Systems with Accounting Software

Manual payment entry wastes time and invites errors. Our quick guide shows you how integrating your payment system with your accounting software can simplify your workflow, improve accuracy, and help your business grow.

Understanding Temporary Holds on Credit Cards: A Guide for Merchants and Financial Managers

Explore how holds work behind the scenes, how customers perceive them, and strategies to make them more acceptable. While not all businesses use holds, they are particularly relevant for those managing reservations, travel, or shipping transactions.

How Credit Card Settlements: Impact on Business Finances and Payment Processing Best Practices

When a customer pays with a debit or credit card, the funds don’t instantly appear in the business’s bank account. Instead, a series of steps transfer the money from the customer’s account to the business. A key component of this process is credit card settlement.

Integrated Accounting Systems: Streamlining Financial Operations for Your Business

Accounting software has advanced from basic tools to integrated systems, unifying financial data across departments. Now, you can instantly reconcile books and access accurate company financials in one place.

Processing Recurring Payments: Challenges and Solutions

Overcome subscription payment challenges by implementing automation, PCI DSS compliance, dunning management, multiple payment solutions & customer service.

Omnichannel Payment Processing: Integrating In Store, Online, and Mobile Payments

The more opportunities you have to collect payments through different channels with omnichannel payment processing, the more sales you will have.

Navigating Regulatory Challenges in Payment Systems for Healthcare

Build trust and avoid penalties. Payment systems for healthcare must comply with industry regulations such as HIPAA and PCI DSS.

Charge Cards vs. Credit Cards: Which is Right for Your Business?

Is there a difference between charge cards and credit cards? The answer might surprise you. And yes, it can affect your business.

Charging Credit Card Fees: Understanding the Legality and Best Practices

Charging credit card fees to customers is a great way to avoid extra costs for your business. However, surcharges have regulations you must follow.

Advancements in Biometric Authentication for Payment Systems

Payment solutions that use biometric authentication can provide a more secure transaction process, reducing fraud and potential chargebacks.

Exploring Non Profit Payment Solutions: Challenges and Opportunities

Efficient payment solutions for non-profits include increased donor satisfaction, retention, and fundraising potential, and reduced administrative costs and risk of fraud.

The Future of Blockchain in Payment Processing

Blockchain technology in payment processing has benefits including enhanced security transparency, traceability, cost-efficiency & global reach.

Payment Processing for the Gig Economy And Freelancers

Payment processing options for freelance and the gig economy aren’t all equal. If you are a freelancer or gig worker you have choices with how you accept payments.

Digital Identity Verification and Payments

Digital identity verification enhances transaction security and streamlines KYC compliance by using advanced digital ID methods.

Emerging Markets and Digital Payment Adoption

Consumer demand for digital payment adoption continues to increase, leading to the emergence of new markets and driving global economic growth.

The Impact of Quantum Computing on Payment Security

With AI advancements and quantum computing on the horizon, payment security may be threatened. Here’s what you need to know as a business.

How to Qualify for a Merchant Cash Advance: A Step by Step Guide

Merchant cash advances are easy to apply for. Providers care more about your processing than your credit and you will simply need a few things to qualify.

Mobile Wallets Vs. Traditional Banking

Mobile wallets use contactless technology to allow customers to easily make payments from their phones online or in person without plastic cards.

ECS Merchant 101: Credit Card Authorization Explained

A credit card authorization protects both the merchant and the cardholder. The merchant can ensure funds are available before delivering goods or services and

How to Implement Sustainable Payments to Benefit Your Business

Sustainable payments benefit businesses and the planet—from biodegradable cards, digital wallet solutions and paperless receipts.

The Rise of Biometric Payment Systems

biometric payment systems are the way of the future. Business owners must prepare themselves with what accepting payments will look like in just a few years.

Adapting to Consumer Demand for Payment Flexibility

Consumers want payment flexibility at the point of sale. Is your business equipped to handle this demand? If not, you could be missing out on business.

Integrating Payment Systems with IoT Devices

Integrating payment systems with IoT devices has helped to automate transactions and enhance user convenience.

Navigating Global Payment Regulations To Ensure Compliance

Accepting global payments can be challenging due to varying regulations. But, the potential rewards can be advantageous.

The Role Payment Gateways Play in Enhancing Customer Experience

Up to date payment gateways and check-out processes keep customer experience intact. Make sure you’re not making these mistakes with your business.

The Impact of Digital Transformation on Lending Institutions

Digital innovation is transforming how lending institutions operate. However, financiers can harness technology to enhance efficiency.

Manufacturing Businesses Can Effectively Bill Customers with ECS Payments

Manufacturing businesses can effectively bill customers with ECS Payments, offering flexible invoicing options while ensuring security, analytics, and mobile payment gateway options.

How Mobile Apps are Changing the Borrower Experience in Personal Loans

Mobile applications are streamlining personal loan applications and helping lenders in efficient credit assessment and faster borrower approvals.

eCommerce Checkout Best Practices

Efficient eCommerce checkout optimizes your customer experience and generates higher conversion and revenue growth.

How To Accept iPhone Payments

Accepting as many forms of payment as possible, including iPhone payments, will always benefit businesses by catering to a broader market share.

Payment APIs: A Guide for Merchants

Payment APIs enable communication between different digital systems, which facilitates secure and seamless payment processing for businesses.

How To Scale Your Saas Business

Claim your market share of the growing SaaS industry? Scale your SaaS business through social media, content marketing, trade shows & sales teams.

Merchant Accounts 101

Merchant accounts are essential for businesses to accept digital payments such as debit and credit cards both in-person and online.

Google Pay: An In-depth Guide

Merchants boost customer base and revenue by seamlessly integrating Google Pay at their point of sale, enhancing payment options.

Integrated Payments with ECS Payments

Integrated payments create a cohesive business by seamlessly combining payment processing hardware and software with various business operations.

ACH Reversals vs. ACH Returns

ACH reversals correct transactions that may have errors, while ACH returns occur when a transaction fails or is rejected before funds are transferred.

Online Payment Systems: How Does It Work?

Online payment systems secure businesses and broaden their reach, yet active data security measures are essential beyond relying solely on payment.

Accept Payments For Your Cleaning Service Business

Why your cleaning service business must accept credit and debit card payments, how to easily do it, and why cash and p2p payments aren’t worth it.

Understanding High-Risk Payment Processing Gateways: A Comprehensive Guide

High-risk payment processing gateways cater to high-risk businesses. They specialize in handling larger transaction volumes & international transactions.

Mastering High-Risk Payment Processing: Strategies, Challenges, and Solutions for Businesses

To navigate the challenges that come along with high-risk payment processing such as chargebacks, fraud, and fees, you need to understand how payment processing works.

How to Keep Costs For Processing Wholesale Payments Down

Processing wholesale payments requires strategic considerations. With lower profit margins, minimizing credit card fees is essential.

Merchant Services for Wholesalers Beyond Just Payment Processing

Wholesale merchant services offer unique solutions due to the industry’s place in the supply chain. See what wholesalers should consider beyond payment processing.

The Future of Payment Processing: Innovations and Challenges in 2024

Merchants must stay informed on the fast-evolving future of payments for a seamless blend of convenience, security, and limitless possibilities.

EdTech Payment Processing: Overcoming Risks and Enhancing Accessibility

How can EdTech companies seamlessly integrate and efficiently manage edTech payments? ECS Payment shows you the best payment solutions.

Telemedicine: Bridging Gaps in Healthcare and Simplifying Payments

Telemedicine makes health care visits convenient. Your patient payment options should be just as easy.

Why NACHA API Standardization Matters For Your Business

NACHA API Standardization in the ACH network facilitates the translation process between systems of the payment ecosystem.

Custom Patient Payment Options Can Improve Your Healthcare Practice’s Revenue

Leveraging the help of a practice management bridge can help you provide flexible, customized patient payment options to increase your revenue.

How to Sell Merchant Services

Learning how to sell merchant services successfully means understanding your market, and addressing customer needs through active listening & authenticity.

Streamlining Healthcare: The Power of Practice Management Software

The impact of practice management software on healthcare practices and payment processing efficiency. Do you have the best program?

Cut Costs and Boost Sales: Why It’s Time to Consider a New Payment Processor for the Holidays

Switching to a new payment processors for the holidays can be a cost-effective strategy for your business.

Unleash Your Website Potential: How a New Payment Processor Can Transform Your Holiday Season

A new payment processor for your eCommerce business may be the key to unlock your holiday sales potential. Find out the signs you need to switch.

How to Upgrade Your Payment Processing Equipment

Upgrade Your Payment Processing Equipment to Stay Ahead of the Tech Curve With Modern POS Solutions. Boost Security, Efficiency, and Customer Experience.

Pre-Authorization Charges: What are they?

Preauthorization charges can be a great tool for merchants to protect their high-dollar transactions.

9 Signs You Have a High-risk Business

9 signs that say your business is high-risk and will need high-risk payment processing solutions including the products you sell.

The Benefits Of ACH Payments For Business Owners

Business owners can take advantage of the benefits of ACH transactions, such as cost-efficiency & convenience.

Enterprise Payment Processing

Enterprise payment processing for large businesses making millions of dollars per year needs a variety of payment methods & a positive payment experience.

Magnetic Stripe Card vs. EMV Chip Card

EMV Chip Card technology makes the transfer of credit card data safer than magnetic stripe cards. Mag stripes will be eliminated completely by 2024.

Payment Processing Gateways 101

You need the right payment processing gateway to run your business. Learn everything you need to know about what to look for when selecting the right gateway.

POS Debit, Descriptors, Disputes, and Point of Sale Charges 101

Learn how to properly navigate POS debit, optimize bank descriptors, and minimize chargebacks with our point-of-sale guide.

An Integrated Payment Gateway Can Cut Your Costs and Increase Profits

Integrated payment gateways benefit businesses by reducing costs, increasing efficiency, providing security features, and offering control.

Wireless Credit Card Processing Benefits

Wireless credit card processing has advantages for both brick and mortar retail, restaurants, pop-up shops, foods trucks, and vendors in any industry.

Improve Your Patients Experience And Lower Your Cost With ECS Payment Processing Solutions For Healthcare

The right payment processing solutions for healthcare can eliminate time-consuming and revenue-draining manual practices.

Unlock Business Bliss with Spa Credit Card Processing Solutions

Enhance client and business experience through seamless spa credit card processing with contactless payments, online reservations & subscriptions.

Secure and Compliant Payment Processing for Healthcare Practices

HIPAA-compliant payment processing for healthcare facilities is crucial, ensuring secure, private, and legal transactions, safeguarding patient data and trust.

Understanding B2B Payments

Explore efficient B2B payment processing solutions, including tailored integration for streamlined operations and enhanced customer experiences.

How To Choose the Right Provider for Your Medical Credit Card Processing

Learn how to choose the ideal partner for your medical credit card processing needs, ensuring seamless HIPAA-compliant payments.

Introducing ECS and Practice Management Bridge Payment Processing Solutions For Your Healthcare Facility

ECS and Practice Management Bridge payment processing solutions and management systems reduce healthcare facility costs by 33%.

The Best Dental Payment Processing for Offices

The best dental payment processing solutions to date. Enhance efficiency and financial management in your dental practices with Practice Management Bridge and ECS Payments.

Collecting Online Rent Payments Made Easy

Collecting online rent payments can be easy…if you use a payment processor for online rent payments.

Online Payment Processing For Dropshipping

A dedicated payment processor and merchant account can help protect your dropship business and its online payments.

Accurate Customer Data For Recurring Payments is Crucial

Subscription services are a popular money-making business today. But, if you are not getting accurate data in subscription services, you could be missing out.

3 Mistakes To Avoid in Recurring Billing

Subscription services business models are a great way for merchants to profit more with loyal customers. But be careful to avoid these fatal mistakes.

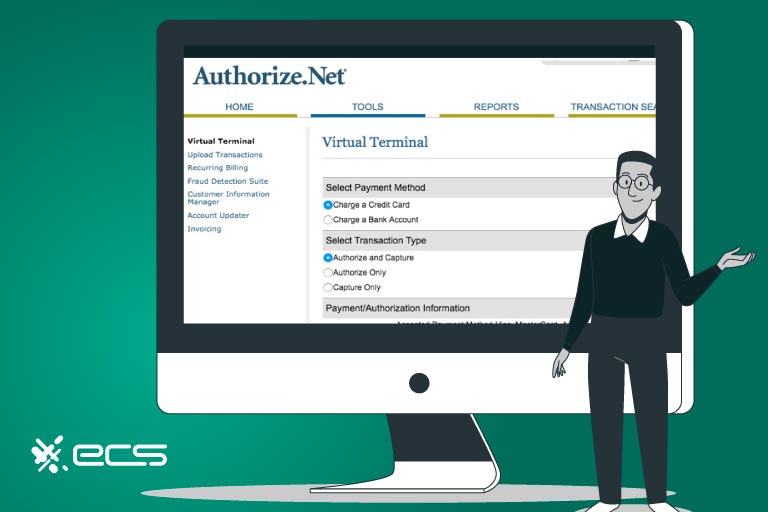

Authorize.net and ECS Payments Processing For Your Business

Explore Authorize.net and ECS Payments Gateway Features for your business. You’ll learn about integration options, eCommerce solutions, secure transactions.

How To Implement Recurring Billing Integration

Efficiently process your customers’ credit cards, debit cards, and ACH payments, with recurring billing integrations for your merchant account.

Payment Processing for Freelancers

Take control of your business with cost-effective payment processing for freelancers. Say goodbye to hefty platform fees and save thousands of dollars each year for your financial freedom.

Payment Terminal vs. POS Systems

Payment Terminal vs. POS System: Both provide merchants with card acceptance capabilities. We explore the benefits of each depending on your needs.

ECS Payments: Credit Card Processing Solutions

The best merchant service provider is ECS Payments credit card processing solutions. Offering 1. credit and debit card processing 2. In-house support 3.Integrated gateways.

Online Payment Processing 101

ECS specializes in online payment processing and high-risk payment solutions for every type of eCommerce business.

How the NMI and ECS Payments Partnership Can Benefit Your Business

Access diverse features like multi-currency acceptance, virtual terminals, subscription management, and more with the NMI and ECS Payments partnership.

What Is A Hosted Payment Page?

A hosted payment page is hosted by another server, generally run by your payment gateway. It is the fastest way to start accepting payments for an eCommerce website.

The Most Comprehensive Firearms Payment Processing Point of Sale Solutions You Need For Your Business

The ECS Trident1 partnership facilitates high-risk firearm payment processing, compliance, inventory, and other business processes for gun stores, gunsmiths, and shooting ranges.

How to Leverage eCheck Payments

Save time and money by learning to leverage echeck payments for your business. The ACH network makes it easy to process digital payments.

What Does PCI Stand For and What Is PCI Compliance?

PCI compliance is when a merchant follows standardized regulations for credit card security put forth by the PCI Security Standards Council.

Retail Payment Processing 101

Without the right retail payment processing systems, services, and pricing structures, your business is missing out on savings that could multiply your revenue.

The Best Restaurant Credit Card Processing Solutions

The best restaurant credit card processing solutions will grow your business, provide exceptional customer service, and run a streamlined operation.

What Is Straight Through Processing And How Can It Benefit Your Business?

Merchants using straight through processing can enjoy the benefits of seamless automated electronic data transfers.

What is Authorize.net? A Payment Gateway Explained

Authorize.net is a gateway solution for traditional and high-risk merchant transaction processing. It offers many different tools for merchants to use.

Sales Invoices For Payment Processing: a Godsend to My Growing Business

A sales invoice includes key information from an order such as how much, the cost per unit, and the total cost. It includes information about the buyer.

Why You Should Avoid Signing Up For Merchant Bank Credit Card Processing

Merchant Bank Credit Card Processing may not be the best solution for your business…and here’s why!

5 Signs It’s Time to Switch Payment Processors Before the Holidays

5 signs it’s time to switch payment processors before the busy holiday season. 1. high fees or wrong payment structure 2. poor customer service.

How to Switch Merchant Accounts

Don’t make the mistake of sticking with or choosing the wrong payment provider. Learn how to best switch merchant accounts for your business.

6 Red Flags Indicating That It’s Time To Switch Payment Processors

Red flags that you need to switch payment processors for your business include 1) expensive pricing structures 2) Hard-to-reach customer support.

Temporary Merchant Accounts For Seasonal Businesses

Temporary Merchant Accounts could be an option for seasonal businesses, however, companies like ECS offer permanent merchant accounts for a better cost.

What is a Merchant Services Provider?

A merchant service provider provides services to businesses that eneable digital payment collection for their products and services from their customers.

What Are Integrated Payments And How Do They Work?

Integrated payments leverage analytics to help merchants boost their sales with insights into their business

Merchant Account Limits: A Guide

Merchant account limits are set in place to protect businesses, cardholders, and the financial institutions involved in the process.

Get Paid Faster With Payment Links!

payment links help your business accept payments online without the need of an eCommerce website. They offer easy solutions for quick payments.

Merchant Payment Solutions to Benefit Your Business

Merchant service providers provide merchant payment solutions that businesses can leverage for seamless POS including 1) debit and credit card processing.

What’s The Difference Between Debit Cards and Credit Cards? Which is Better?

The difference between debit cards and credit cards may play a factor into processing fees, rewards points, where a customer will shop.

ACH Processing Fees and The Hidden Costs Of Checks

ACH processing fees are typically less than one dollar. Flat rates can run between 2-4% of the entire transaction which could be hundreds.

Implement Cashless Payments For Business Growth

A cashless payment system includes those that accept debit cards, credit cards, ACH deposits, cryptocurrency, and checks.

Debit Card Solutions: An Overview

With the right debit card processing solutions, you have a convenient way to collect payments from multiple sources, attract more clients to your business

Automate Invoice Processes to Up Level Your Business

With a simple integration, automated invoice processes will benefit your business with more time for better task management resulting in increased profits.

Push and Pull Payments Explained

To push money means to give it or send it and to pull money means to take it. We explain more on how this type of payment is used

What Systems You Need to Consider For Your Small Business Payments

With the landscape of the market and technology constantly changing, small business payments need to keep up. Consider implementing these payment systems

Credit Card Processing 101: Understanding the Key Players, the Process, the Fees, and More

In this article: Credit Card Processing 101 we go over everything you need to know about credit card payments, solutions, and more

Everything You Need to Know About Merchant Fees

With confusion surrounding merchant credit card fees, we easily explain everything you need to know about processing costs.

Payment Gateway Comparison: Authorize.net vs NMI

The most popular payment gateways are Authorize.net and NMI, in this article we dive into a detailed Payment Gateway Comparison

ACH Vs Wire Transfer: Understanding The Key Differences

The key difference between ACH vs wire transfer is that wire transfers are quicker but more expensive and potentially more exposed to fraud, while ACH payments are slower, much more cost-effective, and very secure.

Know the Difference: EMV Chip Cards Vs. Magnetic Stripe Cards

EMV Chip Cards Vs. Magnetic Stripe Cards: EMV chip cards offer reduced credit card fraud which means less liability and chargeback risk for merchants

Payment Processing for Small Businesses

The best payment processing for small businesses offers flexible pricing structures, card acceptance and transaction variety to accept all credit cards from anywhere.

Understanding Credit Card Processing Interchange Fees For Merchants

Discover what hidden interchange fees you’re paying as a merchant to process credit card transactions. Learn what to do and how to better assess your contract.

What are NFC Payments and How Do They Work?

There are advancements in payment technology all the time. One of which is NFC payments. Learn all there is to know about how NFC payments work

Must-know Surcharging Rules To Protect Your Business

Surcharges at the point-of-sale can significantly reduce a merchant’s credit card fees. But it’s imperative to know surcharge rules to keep your business out of trouble

5 Simple Tips To Help Your Business Handle A Credit Card Processing Outage Like a Pro

Credit card processing outages can significantly disrupt a business. Learn the top 5 tips that will help you handle these occurrences like a pro

Integrating Gateway Services Directly With Your Processor – Collect Payment Like a Pro

ECS integrated gateway allows you to collect payments with no third parties involved during a secure checkout.

Everything You Need to Know About Payment Reversal

Payment reversals can significantly impact a business. earn everything you need to know about how to minimize your risk and keep your customers happy

How To Boost Revenue with Self-Serve Card Payment Solutions

Discover how self-serve card payment solutions can easily generate business growth and the ultimate customer experience at your merchant location.

Stop Wasting Money! Why Merchants Are Choosing Interchange Fee vs a Flat Fee

Interchange fee vs a flat fee, what’s best? All your questions answered when it comes to choosing the best processor pricing for your business.

10 Key Features Your Payment Processing Company Should Offer

Choosing the best payment processing for your needs is important. Follow along for the top 10 key features you need from your payment provider.

Discover How Consumer Financing Can Drastically Boost Your Small Business Sales

The solution for inflated prices is as easy as offering consumer financing. Discover how consumer financing can profit your small business.

eCommerce Payment Processing Solutions: A Step-by-Step Guide

An easy guide that can help you set up eCommerce payments to rake in the big bucks and thrive without a the need of a physical storefront.

Unattended Payment Kiosk: Self-service Payment Solutions

Unattended payment kiosks offer a self-service point-of-sale experience that’s quick, clean, and cost-effective.

8 Benefits of Artificial Intelligence in Payment Processing

AI advancements offer a surplus of benefits that have made daily life easier and more convenient especially in the payment processing world.

Payment Processing for New Business Owners

New business owner? Ready to accept card payments but don’t know where to start? Follow along for the 101 on all things payment processing.

A Point of Sale Systems Buying Guide

The right point of sale system can seamlessly synchronize your business in all of its functions for front-of-house and back-office duties.

QR Codes: Payments Made Easy

Stand out as an innovative merchant with little effort. Optimize your point-of-sale with QR codes for payments. Your customers will love.

Low-Risk Merchant Processor

The most successful way for low-risk merchants to attract the most customers is to partner with a low risk processor to accept all payment.

ACH – A Modern Day Payment Solution

ACH transactions electronically transfer funds between bank accounts without the need for a physical card, cash, or check this modern payment.