A surcharge or checkout fee is an additional charge that a merchant asks a customer or client to pay if they are paying with a credit card. This fee can only apply to credit cards and not debit cards. In fact (spoiler alert) to add a surcharge to a debit card is a violation of operating regulations in terms of accepting payment. Additionally, there are other rules around applying a surcharge amount to purchases. Let’s take a look at what those are.

What Does a Surcharge Mean?

The term surcharge comes from late Middle English, entering the lexicon in the 15th century from the Old French term surcharger—which was a verb that meant to overload something. Back in those days, a surcharge had more to do with putting too many burlap sacks on a donkey than charging customers extra for paying with plastic.

In fact, plastic didn’t even exist back then—not to mention that money was made of real gold and silver, instead of paper debt notes. In any case, the use of the term surcharge as an extra charge began around 1885.

Today, a surcharge is almost universally known as an extra fee that merchants will levy on customers paying with credit cards. It sounds rather fancy, as do most terms originating in France. One thinks of a suited butler handing you a bill on a silver platter, gracing you with the privilege of paying extra for the luxury of using plastic.

One almost feels like saying: thank you so much for asking me to pay extra for the privilege of already paying you for the good or service rendered. Sarcasm aside, we need to examine the nature of the surcharge vis-a-vis the rules and regulations that relate to merchants.

Why Do Businesses Add a Surcharge?

It’s easy to see why businesses accepting credit cards would want to impose credit card surcharges. While there is no fee for taking cash, and possibly some fees for taking checks, there are certain fees imposed for credit card transactions.

Credit card processing fees around the United States often range from 1.3% to 3.5%, depending on the card brand. Visa and Mastercard typically charge the lowest fees, while American Express is often the most expensive. And in addition to credit card fees, there may also be payment processing fees.

As a side note, it’s helpful to consider that these convenience fees are a tradeoff for the benefits of taking credit card payments and that cash actually has its own hidden costs. Cash needs to be deposited in the bank periodically. While the amount of cash you should keep in your till depends on the ticket price of items you sell or services you provide, keeping too much cash can attract crime.

In fact, around 5% of violent crimes occur in convenience stores at gas stations, and a big part of the reason why is that they are cash-heavy businesses. Of course, taking cash to the bank costs time, and time is money.

An alternative is to use a cash pickup service like Brinks, but that will also cost money. So at the end of the day, paying a small additional fee for the ease and safety of plastic may be more than worth it.

Can Businesses Charge a Convenience Fee?

But even so, many businesses, especially small business owners, feel compelled to add a credit card convenience fee. As it turns out, this is their right…but only for credit cards. There has been an unfolding legal drama in the form of a class action lawsuit entitled Payment Card Interchange Fee Settlement. Although the story is still working its way through the Second Circuit Court of Appeals, one outcome has been that merchants may add a surcharge to transactions.

However, they may only do so either at the Product Level or Brand Level. Never both. Brand level surcharges apply to all transactions made with a certain brand of credit card: Visa, Mastercard, Discover, or American Express, for instance. And Product level surcharges only apply to certain types of purchases, regardless of what type of plastic is used for payment. However, there are some additional surcharge rules for each type.

Rules For Brand Level Surcharges

A brand-level surcharge must be applied to all credit cards using that particular network, regardless of what bank, credit union, or financial institution issued the card. For example, a Visa surcharge would be applied to all credit cards bearing the Visa logo, regardless of whether it’s Chase Freedom or the Bank of America Cash Rewards. The surcharge cannot be larger than the average discount rate for the particular brand.

To explain in a little more depth, the merchant discount rate is actually the rate that merchants pay for payment processing. So a merchant being charged 3% for the privilege of collecting American Express cannot charge a 5% surcharge and pocket the 2% difference—and in any event, the surcharge can never exceed 4%. For merchants that accept numerous credit card brands, there may be some additional rules.

Rules For Product Level Surcharges

Merchants must use product-level surcharges uniformly for all transactions made for that specific product, regardless of the card brand used. The surcharge cannot be greater than the average merchant discount rate for that specific product.

For example, if the average cost of your restaurant collecting plastic payments for a Wagyu Beef Burger topped with white truffles is 3% or $180, you cannot impose a $360 surcharge for said burger (incidentally, if you did the math, you might know we’re talking about the $6,000 Golden Boy). You might be wondering if you could just up the price of the burger—a question that will be answered later.

In any case, your surcharge can never exceed 4% and there will be additional rules and regulations for merchants who accept multiple brands of credit cards. As you can see, the limitations around product-level surcharges are very similar to those around brand-level surcharges.

Does Visa Have Surcharge Rules?

In addition to Visa Core Rules that merchants must adhere to, there are Visa rules and regulations for merchants around implementing surcharges. Visa requires merchants in the United States to fill out Visa’s unique credit card surcharge notice form 30 days before implementing surcharges. This form will ask for information about the merchant, what other credit cards they accept, and their acquiring bank.

Visa surcharge rules 2022 and 2023 for merchants limit surcharging to credit cards only, excluding debit cards and prepaid cards. In addition to the Visa surcharge registration, merchants must alert consumers of the surcharge with clear signage at the point of entry (to brick-and-mortar locations), at the point of sale, and on every receipt. Additionally, merchants should make sure they are adhering to state and local regulations about surcharging.

Visa merchant rules also say that merchants cannot apply surcharges to debit cards, even if the customer selects credit. If a merchant operates stores in multiple states—some that allow surcharges and others that prohibit it entirely—Visa network rules do allow that merchant to apply surcharges in states where it is permissible, even if this creates a lack of uniformity across state lines vis-a-vis their surcharge policy.

Does Mastercard Have Surcharge Rules?

Mastercard surcharge rules require the merchant to also notify their acquirer and/or their payment processor, in addition to notifying Mastercard of their intention to add a surcharge. Merchants must fill out the Mastercard Merchant Surcharge Disclosure Form, providing information like merchant name, contact information, number of locations that will be surcharging, type of channel (e.g. brick and mortar, online, mail order), and type of surcharge—brand or product.

Mastercard reminds merchants that they can only apply one type of surcharge: either the brand or product surcharge. Additionally, there is a cap on the surcharge. For brand surcharges, the cap is either 4% or the merchant’s average effective merchant discount rate that it pays its acquirer to accept Mastercard.

For product level surcharges, it cannot be more than the merchant’s cost to accept Mastercard, minus the Durbin Amendment’s cap on debit interchange fees (these numbers vary by payment network). Merchants must also give a clear disclosure at the point of sale and on the receipt, including the percentage and the total amount (on the receipt).

Does American Express Have Surcharge Rules?

American Express only allows government agencies, educational institutions, utility companies, and rental establishments (e.g. real estate rentals) to issue a surcharge. Merchants searching the American Express Merchant Reference Guide will not find anything about surcharging in there. This is because it’s only permitted for certain types of Amex-accepting businesses.

This is particularly difficult because Amex charges some of the highest interchange fees in the industry, and the restrictions around surcharges make it difficult for merchants to recoup their costs. This might be one of the many reasons why Amex is one of the more disliked credit cards, at least for merchants accepting plastic.

Does Discover Have Surcharge Rules?

Discover does not allow surcharging unless it is surcharging other cards as well. Moreover, if a merchant is surcharging other cards, the surcharge must be uniform across all brands. Remember that the legal landscape of surcharging may change at any time, both because of company policies and because of sweeping legal changes such as those implemented by the class action lawsuit that solidified the legality of surcharging in the first place.

Nevertheless, as you can see from this overview, your best bet for recouping convenience fees is Visa and Mastercard. In some cases, Discover and Mastercard acceptance will not facilitate surcharging your customers and clients.

Are Surcharges Allowed Everywhere?

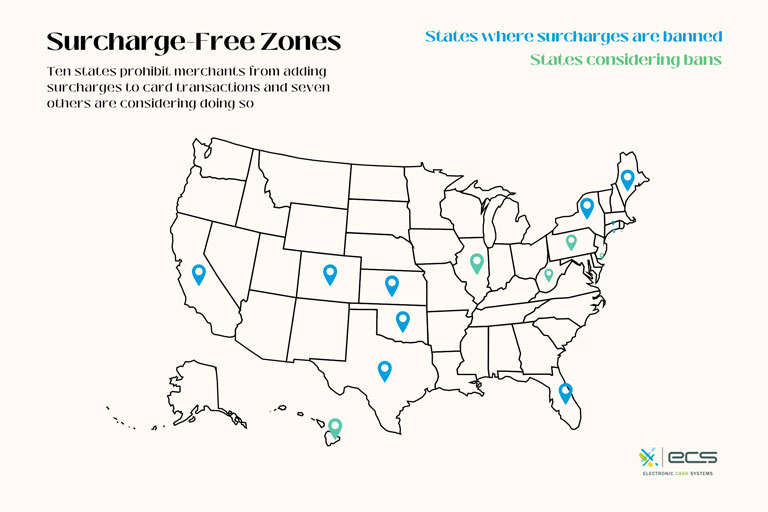

This brings us to our next point. Surcharging was illegal entirely or subject to limitations in California, New York, Texas, Florida, Colorado, Massachusetts, Connecticut, Kansas, Maine, and Oklahoma. But, free speech-related lawsuits helped lift these bans in Texas, Florida, New York, and California. As you can see, in the remaining percentage of the geographic country (by state at least) surcharging has been and is totally acceptable.

However, there may be limitations on surcharging in more local jurisdictions like counties and cities. So it’s a good idea to check with your local chamber of commerce, if, for instance, you must use a particular signage. If you operate a franchise, you should also consult with the franchise rules to make sure you can add surcharges. And if you can, what rules you must adhere to.

What is a Surcharge Violation?

A surcharge violation is when a merchant adds a surcharge to a consumer’s card, without abiding by the card brand or state’s legislation. This could either mean they did not have the appropriate signage up or they added a surcharge onto a debit card, etc.

Either way, if a merchant is adding an illegal surcharge to purchases, customers may report them to the state’s attorney general’s office. If the merchant is a repeat offender, the state can prosecute the business.

Additionally, if a merchant is breaking the card network’s rules, they may face a terminated merchant account. Which would be detrimental to the business.

Should I Add a Surcharge?

Merchants must consider this question carefully in terms of customer experience. Consider for instance, that one of the most common reasons online shoppers abandon their carts is surprise additional costs. In terms of brick-and-mortar businesses, even if you post clear signage at the door (per Visa requirements) a surcharge may still throw customers off at the point of sale.

Even if they complete the purchase (abandoned carts are less common in face-to-face sales) they may be hesitant about coming back. Just think about how you feel if you are dining at a restaurant, and after you receive your check, you see that there’s an 18% automatic gratuity. A surcharge is never going to exceed 4%, but the premise is still the same: consumers do not like surprise charges.

But that leaves you in a bit of a pickle in terms of recouping your interchange fees. One approach is to just consider this a matter of convenience that you’re willing to pay for (as mentioned earlier). Keeping too much cash in your registers can be dangerous, and depositing cash takes time. There’s just a certain unparalleled convenience to taking debit and credit cards, and there’s a pretty even split between the two in terms of consumer usage. Another solution, of course, is to fill out the paperwork, post the signage, and start collecting fees.

Are There Alternative Solutions to Surcharge Fees to Recoup Credit Card Processor Fees?

A solution that a merchant should consider is just building the surcharge into their pricing. There is nothing that says you can’t charge 3% more for a good or service. But keep in mind, some merchant fee structures are based on a percentage. So if you have this type of pricing structure as opposed to a flat rate, and then you charge more for your products, your credit card fees will also increase. Additionally, you will once again have to factor in customer experience.

A compromise might include adding 1% or 2% to the price in order to recoup half the costs and letting the rest go. Whatever you decide, remember that picking out the payment processor with the best fees can go a long way towards minimizing the need to surcharge at all.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.