Swiping a credit card to make a payment was for a long time an image embedded in our cultural consciousness. However, in many countries outside the U.S. paying with a credit card involves inserting a chip into a point-of-sale terminal. And has since the 1980s.

This practice has become the preferred industry standard in the U.S. as well. Recent developments in payment technology –like mobile payments and QR codes–may supplant the need for plastic entirely. However, until that happens, it’s good for business owners to know the difference between EMV chips and magnetic strips.

How Did Cards Work Before Magnetic Strips?

The first credit cards did not even have magnetic strips on the back. Instead, business owners took an imprint of embossed account numbers on carbon copy paper. Then, later in the day, used this information later to run the transaction.

This practice may still be seen in rare instances when a POS terminal is totally offline. Meaning out of commission, as they don’t need an internet connection to operate. Or, you might see it in places where you can purchase glass bottles of Coca-Cola from an ice chest on the porch, next to a banjo player with wicked-fast fingers.

Such a scene is unlikely, as most banks no longer accept imprints. There are obvious safety reasons for this. All it takes is one unscrupulous employee or a customer with sticky fingers to steal a credit card number imprint left on the counter.

But as mentioned, the vestigial remnant of this practice—the imprint—may be leveraged by a merchant left stranded offline. They may ask for a card number and later input the card data into the POS when it’s online again. But consumers should be wary about leaving their numbers on paper and merchants should be scrupulous about shredding them.

The Unlikely Birth of the Magnetic Strip

An IBM engineer for the CIA developed this magnetic strip or magstrip as it is sometimes referred to. Somehow all good stories come back to secret societies or espionage agencies, don’t they?

He couldn’t quite figure out how to get the magnetic strip onto the badge in question. That is, until his wife suggested he use a clothing iron to melt it on—and a star was born. We’re not sure how the laundry turned out, but that seems to be a side detail.

Issuing banks began to provide customers with magnetic cards in the 1980s. Around three decades after the first plastic credit card (issued by American Express, incidentally). This same technology was (and is still used) for ID badges, driver’s licenses, and public transit tickets. A basic summary of the technology is that the magnetic strip contains information stored on three separate tracks (more on exactly how this works later).

Meanwhile, Over in Europe…

Meanwhile, across the pond, Europeans had a little bit of a different idea about credit cards. The silicon-integrated microchip had already been invented in (drumroll please) Silicon Valley, California in 1959.

But it wasn’t until the 1960s that two German engineers attached a microchip to a smart card for ID purposes. By the 1980s, France’s Carte Bancaire was issuing chip cards, followed by Germany and the rest of Europe.

Part of the reason the standardization of chip technology took off much faster in Europe was because of security. There was a much greater lag time in the transfer of information from the merchant to the card network. Which meant more time to commit credit card fraud. As chip cards offer greater security (more on that later), the lack of real-time payment processing

One Network to Rule Them All

However, the presence of magnetic strips and chips, combined with the plethora of banks and borders in Europe, led to a confusing payment landscape. Driving up fees for merchants and card issuers. Thus, standardization was needed.

Europay, Mastercard, and Visa banded together to form the EMV Standard. This guaranteed the global acceptance of chip cards. These three payment processors in Europe created a behind-the-scenes toolbox to facilitate worldwide interoperability.

While chip cards are a sort of gold standard outside the United States, the domestic rollout was a little bit anticlimactic. By 2016—after card networks had requested merchants meet an October 2015 deadline to begin using EMV payment—around 42% of merchants had still not bothered to update their POS terminals. Including the 43% of retailers who had experienced a past data breach.

And 56% of consumers didn’t really care if a merchant asked them to swipe or chip their card. In fact, 41% of consumers didn’t even know if their cards were chip-enabled.

EMV Cards in the U.S. Today

Fast-forward to today. Around 81% of face-to-face card transactions involve a chipped card. More than half of American consumers prefer using a chip card at the card reader. Conversely, only 11% said they prefer to swipe their cards for whatever reason—perhaps the satisfaction of the sound. That number dipped to 9% among consumers who were familiar with contactless payments. And around 81% of consumers would be fine if the magnetic strip went the way of the dinosaur (extinct).

By 2040, Mastercard will have phased the magnetic strip out of select regions. And by 2030, Mastercard will no longer allow issuers in any part of the world to provide cards with magnetic strips. This part of the card will have gone the way of the embossed digits.

Chip-enabled credit cards are not the end of the payment story. The latest frontier– as briefly mentioned at the outset of this historical survey– is contactless payments. Chips using NFC radio technology can “talk” to the POS. Phones with mobile wallets can do the same thing, making the plastic credit card obsolete—chip or stripe.

And in developments that strike some as exciting and others as weirdly dystopian or rather straight from the Book of Revelations, NFC chips may one day be embedded in the human body for contactless payments.

EMV Chip Cards Vs. Magnetic Stripe Cards: How Do They Work?

And now on to an apples-to-oranges comparison of the EMV chip card versus the magnetic stripe. But first, let’s do a broad overview of how both technologies work.

Magnetic Strip Transactions

In magnetic strip transactions, the card is swiped at the POS terminal. The POS terminal reads information off the tracks on the strip. It contains the card number, the customer name, the expiration date, service code, and card verification code (CVC). Most of this information is on the first two tracks, with the third sometimes used for country and currency codes.

The POS reader has a solenoid device that can activate and control magnetized particles in the stripe. This device is just a coil wound into a tight helix around a metallic core. It produces strong magnetic fields if a current passes through it. The magnetized strip on your card initiates this reaction. Resulting in the solenoid reading information off the strip.

The POS terminal then sends an authorization request to the issuing bank. This sets up an exchange of information between that bank, the merchant’s acquiring bank, and the card network (Visa, Mastercard, Discover, or American Express as the four main ones).

One security issue with this type of payment is that there is no way to individualize a transaction. This means that a fraudster can install something like a card skimmer on a POS to collect payment details. Then use this information for a different transaction.

EMV Chip Transactions

EMV chip technology works a little differently. Although some steps are the same. A card is inserted into the terminal, chip-end first. The terminal and chip make contact, and the terminal verifies the card issuer. The chip verifies the PIN details input by the customer on the terminal. The chip provides the terminal with a one-time code to use instead of the card number. Which means that every single transaction is individualized.

This type of tokenization is much different than the old swiping method, where the POS collects card details such as the number and expiration date. With a chip card, the merchant never receives a customer’s card number and neither can anyone else. Because it’s never part of the transaction.

The rest of the transaction involves some of the same steps as the magnetic strip. Such as with the issuing bank, acquiring bank, and card network getting involved in the transfer of money from point A to point B. However, information about the issuer can be stored in the chip. So that the issuing bank actually does not need to be contacted in these transactions.

Magnetic Strip Vs EMV Transactions

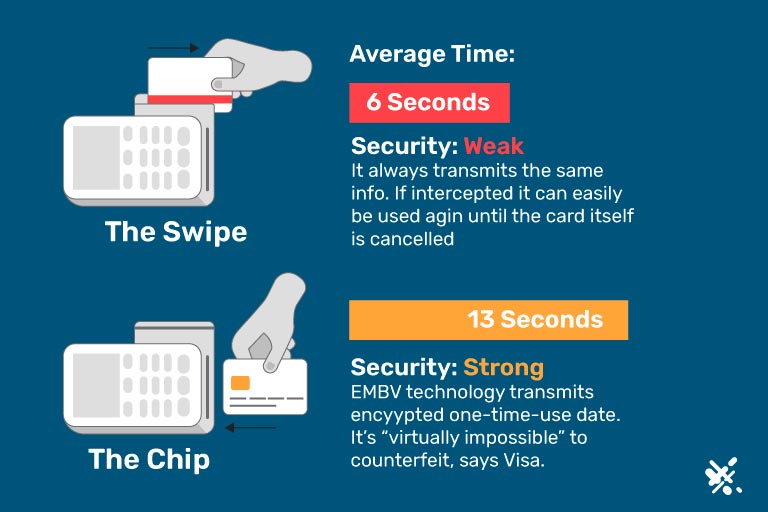

To summarize, magnetic strips are a type of transaction that involves the collection of static data. While chip card transactions involve dynamic, encrypted data. This makes it much harder for chip cards to become subject to fraudulent transactions. Which is why card networks have asked merchants to switch over.

While it’s not illegal for merchants to use a magnetic strip for transactions, they do become fully liable for any fraud that occurs because of it. Visa found that counterfeit fraud dropped 76% from 2015 to 2018 when EMV chip cards were introduced at a larger scale in the U.S.

Can EMV Chips Foil Online Card Fraud?

EMV cards have an obvious, added benefit for card-present transactions when the customer and their card are in front of the merchant. But online transactions may still pose a problem. These card-not-present transactions typically involve inputting the card number, expiration date, and CVV, along with some other information like a billing address.

Here, it behooves the merchant to work with a payment processor who can provide a secure online payment gateway. Minimizing online card fraud. Because all a criminal needs is the card information itself. And from the consumer end, it’s a good best practice to avoid letting your card out of sight to protect the verification code from appropriation.

Merchants should take note that QR codes are also considered card-not-present transactions. And the chip versus strip issue will once again be irrelevant. A QR code is a sort of black-and-white pattern that is viewed through a customer’s smartphone camera.

Their phone will then direct them to a website where they can complete payment. This can be done by either using a card or a P2P application like PayPal or Venmo. There is no swiping, dipping, or chipping here. So if a customer has someone else’s credit card or credit card info (like a picture on their phone) there is no stopping the fraud from happening as it happens.

This is one of the reasons why the merchant discount rate is going to be higher for card-not-present transactions. There is just more inherent liability. But at least for card-present transactions, the EMV chip is a much more secure option than the stripe. So much so that (as mentioned) in the near future cards will not even have magnetic strips anymore.

The Future of Chips Might Include CVV Codes

They may not have CVVs either. As discussed, a criminal who has stolen a tangible card and is aware of the cardholder’s address (easily located on a driver’s license, for instance) can use that card info to do some online shopping. Or shop anywhere where in-person QR codes are used to collect payment.

Card networks and issuers are contemplating a new phase of CVV code in which the code is also stored on a card chip. Not only that, but it is dynamic as well. The chip would create a new PIN for every transaction.

In some possible versions being tested out by PNC Bank, a small screen on the card would allow the customer to see a unique PIN to input into the POS. While this innovation certainly has the potential to eliminate card-not-present fraud as well, it still can’t stop a thief who has stolen the actual plastic.

The next wave in fraud prevention might be a shift to mobile payments that are biometrically locked. Meaning the mobile wallet cannot be accessed without a face scan or thumbprint. Beyond that, a microchip in the body is the ultimate layer of security. In any case, it’s all coming down to microchips—a technology that has changed the payment landscape…and much about life in general.

Do EMV Chips Have Any Downsides?

There are some downsides to EMV chips. One is that the transaction takes longer… In fact, it could take as long as 13 to 15 seconds. While that may not bother the generation that grew up on magnetic strips, it does bother the generation that’s become addicted to 10-second TikTok narratives. This is perhaps yet another reason why younger generations of consumers are shifting toward mobile payments. Ditching their wallets entirely.

Another downside to EMV chip technology is that it is obviously dependent on the microchip supply chain. One that is actually going through some difficulties. Automobile manufacturers are in the spotlight of the ongoing chip crisis. Mostly due to the fact that 90% of the world’s advanced chips are made in Taiwan, a country clearly in the sights of China.

But recent political development with Ukraine and Russia may also impact the supply chain. With effects on chips for consumer debit and credit cards—so much so that periodicals like the Washington Times warn consumers not to lose their credit cards. Because a replacement could take months.

Once again, trends in the payment landscape are suggesting the migration of payment technologies to realms outside the land of plastic. Perhaps ultimately with some biological integration. But for now, card-present transactions are predominantly microchip powered.

EMV Chip Cards Vs. Magnetic Stripe Cards: What Does This All Mean for Merchants?

Payment technology is always changing. One could even argue that the first credit cards were cuneiform tablets used by Sumerian merchants to keep track of their accounts and shipments. But good luck trying to pay with one of those today. They break easily and are next to impossible to read. Although you can get a lot of cash for them at your local history museum.

Then there were paper loyalty cards, issued by 19th-century businesses. Customers would show their cards and run up a tab that was settled at the end of the month. This is also a practice that has fallen out of vogue. So much so that even bartenders will collect a card before letting you run up a tab.

And lastly, (before actual plastic credit cards) there were dog tag-like items called Charga-Plates, issued by the Charga-Plate Group, Inc. New York from 1935 to 1950. A merchant would take an embossed imprint from the metal tag, which would be issued to loyal customers only. Microchips are just the latest iteration of card payment technology. And in terms of actual pieces of plastic, the most secure.

What does this l mean for merchants? Obviously, it means upgrading your POS equipment if you haven’t already. Switching to EMV readers is not as expensive as some merchants might think. When you couple that with significantly reduced liability and chargeback risk, you’re looking at a long-term investment with immediately tangible ROI. Then, of course, there is the looming disappearance of magnetic strips entirely.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.