There is a lot that goes on behind the scenes with credit card transactions. Credit card processing is more in-depth than a simple swipe, dip, tap, or keying of a card and payment to a merchant’s business bank account.

So if you’re wondering why there are so many players in the game, fees to pay, and steps to take when it comes to accepting digital payment at your place of business, then this article will give you processing for credit cards 101.

Understanding payment processing means you will be able to differentiate between the key players, the fees, and the process that occurs every time card information is gathered. Keep reading below to find out everything you need to know when it comes to accepting cards for payment including what it is, why you need it, the key players, the process, and the fees you may encounter.

What is Payment Processing?

During the payment process of digital transactions, in a matter of seconds, the credit card information is authorized and authenticated by the transmission of information back and forth between a merchant’s terminal or payment gateway, the payment processor, the credit card networks like (Visa, Mastercard, Discover, American Express), and the card issuer (Wells Fargo, Chase, Capital One, Discover, American Express, Bank of America, etc).

Once a card is authorized, the funds are transferred between these financial institutions and eventually land in the merchant account.

Who Are The Key Players in Payment Processing?

As described above, there are many key players involved in processing credit card payments. Each entity will hand off account information from one to the next. With a result of a successful or declined transaction. So to further understand how the facilitation of credit card information works, we will first explain each key player and their role in the process.

The Merchant

The merchant is any business in-person or online that sells goods and/or services to customers. The merchant can accept transactions via credit card with a physical card reader (via swiping, dipping, or tapping) or a virtual terminal (keyed information). So, if you are reading this article and you own a business, then know we are talking about you here.

The Cardholder

You guessed it. A cardholder is a person who has been issued a credit card by their bank to use for buying goods or services from a merchant. This is also known as your customer.

The Issuing Bank

The issuing bank, also known as the card issuer, is any financial institution that is a member of the card brand associations so that it can issue credit valid credit cards. The issuing bank is responsible for the cardholder to be able to complete a transaction with their available funds or an available line of credit. Upon authorizing the card at the merchant’s terminal, the issuer will either decline or approve the transaction.

The Card Network

The card network or also known as the card brand would be either Visa, Mastercard, American Express, or Discover. The card networks are the main player that determines the rules and regulations when it comes to using their product.

The Payment Gateway

The payment gateway is a system that channels credit card information from the physical or online terminal to the payment processor. The payment gateway can either be software programmed into your POS device or physical card reader or a web-based system for a merchant’s virtual terminal.

The Acquiring Bank

The acquiring bank (acquirer) is the financial institution that is a registered member of the card network associations such as Visa and Mastercard. Merchants must obtain a merchant account with an acquiring bank to accept credit and debit card transaction deposits and settlements.

Because acquirers enable merchants’ ability to run credit and debit card transactions on their specific networks, they must also accept financial responsibility for such activities. Meaning, they and their merchants must abide by all laws, rules, and card brand regulations for card processing.

The Payment Processor

The payment processor, otherwise known as the credit card processing company, is the institution that facilitates the transportation of credit card information to and from your merchant terminal, the card issuer, the card networks, and your acquiring bank account.

Not only do payment processors facilitate your credit card processing, but they also can facilitate debit processing and ACH processing. Additionally, some payment processors can also supply physical terminals, POS systems, and gateway integration services.

Your payment processor will not only be the provider to aid your business in accepting credit cards, but they will also be your main point of contact for any questions regarding the funds in your merchant account from all your digital transactions.

In some cases, one entity can provide both functions of a processor and an acquirer (the processing of payments and the management of the settlement of funds from the cardholder’s bank to the merchant’s account).

How Does Credit Card Processing Work?

Though the act of a credit card transaction looks like it takes less than 3 seconds, numerous wheels are turning behind the scenes to make it all happen. So now that you are familiar with the key players of credit card processing, it’s now time to divulge more about how they are all involved in the process. There are three main phases of a credit card transaction: authorization, clearing, and settlement.

- Credit Card Authorization: To authorize a credit card is to verify with the issuing bank that the card has sufficient funds, is active, and that the data is all correct to proceed with the transaction. If everything checks out, the card transaction is approved.

- Clearing: After receiving approval, the credit card transaction is cleared. Meaning, the processor sends the data from the transaction to the card brands and issuing banks. The cardholder will see the transaction posted to their account.

- Settlement: After the transaction information is posted to the cardholder account, the funds are then officially moved over from the issuing bank and cardholder’s account to the acquiring bank to deposit into the merchant account.

Credit Card Authorization Process

Great, so now that we understand what the three steps are, let’s dissect them even further.

A transaction is initiated when a cardholder provides the merchant with their credit card information via swiping, dipping, tapping, or keying into a physical card reader, a POS system, or a virtual terminal online. Then…

- At the point of sale, the terminal will send the request for authorization with the corresponding credit card data to the payment processor.

- The payment processor then routes the request for authorization to the card networks such as Visa, Mastercard, American Express, or Discover.

- The card networks then forward the request for authorization to the corresponding issuer.

- From there, the issuing bank will validate the request by verifying the account for sufficient funds and the correct card data including, the account number, billing address, and CVV.

- Then, the issuer will send a declined or approved response to the card network attached to an authorization code.

- Next, the card networks will route the issuer’s response to the payment processor.

- The payment processor will send the response for approval or decline back to the merchant’s payment terminal at the point of sale.

- Finally, the transaction is completed between the merchant and the customer.

And guess what. This all occurs in less than 3 seconds!

Credit Clearing & Settlement

The next phase of the payment process is clearing and settlement. These steps will occur simultaneously.

The clearing is when the cardholder’s bank account will reflect the debit from the transaction and the merchant account will reflect the deposit from the same transaction. So the transaction has cleared the customer’s account and settled into the merchant’s bank. However, this step typically will occur hours after the initiation of the transaction at the point of sale.

Low to medium-risk merchants will typically have their funds settled within 24 to 48 hours of the point of sale. A high-risk merchant may experience a 5 business day settlement delay. This is for advanced protection measures put forth by the payment processor or merchant service provider.

Any credit card transaction that is successful will post to the cardholder’s monthly credit card statement from their issuing bank and the merchant’s transaction end-of-month statement from their payment processor.

Payment Processing Clearing Protocol

So, how does the transaction go from authorization to clearing? Again, let’s dissect this portion a little further:

- Once a business day has concluded, the merchant must “batch out” their card reader, POS system, or virtual terminal. This is typically a button or series of buttons that they will push to send all credit card transaction data to their payment processor. Unlike debit, credit networks do not automatically debit a cardholder’s account. They require this “batch out” step to clear the transaction.

- Once the merchant submits their batch, their payment processor will forward their transaction data to each of the card networks involved in the day’s transactions.

- Then, the card networks will transmit the transaction data to the individual involved issuing banks.

- And the issuing banks will post the transaction onto the cardholder’s account and “clear it” for settlement.

Settlement Process

- Once the credit card transaction has been authorized and cleared, the acquiring bank sends the request for settlement to the card network to debit the cardholder’s account for settlement.

- The card network will calculate the specific interchange rate on each transaction (a percentage of the transaction amount based on the card used and certain risk factors) and then deducts it from the acquiring account.

- The card network then sends the remaining funds to the issuer, who then temporarily credits the cardholder’s account.

- Then the issuer will deduct the transaction amount from the cardholder’s available credit and transmit the funds to the acquirer.

- The acquirer then settles the funds to the merchant account less their “discount rate” which is the transaction fee including the interchange rate for the processor’s transaction facilitation services.

- The merchant will then gain access to their funds to use for cash flow, savings, etc.

Will I Need a Payment Processor?

If you are a small or startup business and you don’t want to limit yourself and your customers to cash or checks only, then you will most definitely need a payment processor to facilitate digital transactions. Today, most merchants do accept debit and credit card transactions. And it is in your best interest to do the same if you want to be competitive within your industry.

Especially, because customers prefer paying with cards simply because of its pure convenience and even the benefits, rewards, and perks that credit cards offer for each transaction. So much so, that many consumers rarely carry cash or checks at all anymore.

However, because the card networks maintain strict relationships with their banks, merchants (like yourself) cannot process credit card transactions directly with them. You will need to establish a relationship with a payment processor to connect your transactions to the gateway to the network, to the issuer, and to your bank. Moreover, a payment processor’s direct relationship with card networks, and acquiring and issuing banks enables secure credit card processing.

It is important to know that payment processors can be tied to different merchant service providers. And they all come in different shapes, sizes, and types and offer different services, solutions, and of course payment structures. So it is important to be aware of your needs and the costs of credit card processing. Do your research to locate the best credit card processing company for your business.

What Are Credit Card Processing Fees?

Speaking of payment structures, what are credit card processing fees? Let’s take a look.

Merchants must pay credit card processing fees to accept credit card payments at the point of sale. These fees are charged by their merchant service providers, payment processors, and the card networks of those that they accept. (So if a merchant were to not accept American Express, they would not incur any fees from Amex).

How Are Credit Card Processing Fees Paid?

The credit card processing fees are paid as an automatic deduction from the merchant’s account after a credit card transaction is processed through a daily discount or at the end of the month in one large lump sum. The merchant will see an ACH debit to their account from their merchant service provider or credit card processor.

How Much Are Credit Card Transaction Fees For Businesses?

The exact amount of credit card processor rates will depend on a multitude of factors, such as the industry the merchant is in, the pricing structure determined by their payment processing contract, and even the type of credit card the consumer used (card interchange fees). Typically, the credit card processing fees are based on a percentage of the total amount, plus a flat fee (in cents) per transaction.

What is Included in Credit Card Processor Fees?

Credit card processing rates will vary as they will include several factors, such as the:

- Credit network interchange rates: charged as a percentage of a transaction to cover the cost to facilitate the payment per card type and other determining factors

- Credit network assessment fees: charged annually to merchants to remain eligible to utilize the credit network and to cover the maintenance of the infrastructure for payments and industry regulation management.

- Processing company markup fees: supplemental fees to cover and make a profit off of merchant services provided in addition to the transaction interchange.

So let’s break down what are credit card fees for businesses.

Interchange Rates

So, how much do credit cards charge businesses? Credit card processing interchange rates are fees for a certain percentage of the transaction. Each transaction, however, will have a different interchange rate based on variables such as:

- The card network type (credit or debit card)

- The card brand (Visa, Mastercard, American Express, or Discover)

- The card level (standard, rewards, privilege, gold, platinum, business, etc)

- The merchant’s industry (retail, restaurant, high-risk, healthcare, etc)

- The card data delivery method (card-present vs card-not-present)

These rates, however, are transparent and predetermined. You can locate the varying interchange rates on each network’s website. But be aware, these rates are subject to change twice a year. So if you’re wondering what Visa’s interchange rate for a certain rewards travel card is, or what the different Discover interchange rates are, you can visit their website for the most up-to-date information.

Who Pays Interchange Fees?

Interchange credit card processing rates are determined by the card networks (Visa, Mastercard, Discover, American Express), and charged by the issuing banks to the merchant’s acquiring bank for processing a transaction.

To compensate for the credit card fee rates for interchange, the merchant’s acquirer will turn it around to the merchant plus additional processor markups.

Authorization Fee

The authorization fee is charged every time a card is swiped, dipped, tapped, or keyed. Whether or not the transaction was accepted or declined, the merchant will still be charged a fee to cover the facilitation of the transaction and authorization.

Batch Fee

In some cases, a payment processor may charge a batch fee (5¢ – 25¢) every time they settle a daily batch to the merchant’s acquiring bank.

Return Transaction Fee

Even if a transaction is returned, the original transaction fee remains and a fee to facilitate the return will also apply.

Address Verification System Fee

A 1¢ address verification system (AVS) fee applies to keep cardholder data safe for an online payment gateway transaction.

PIN Debit Fee

The PIN debit fee ($5 – $10) applies to merchants monthly to access the debit network. And a 20¢ per transaction fee for each PIN debit verification entry.

Retrieval Request Fee

A retrieval request fee is a situation fee that would apply if a customer does not recognize a charge on their account. If they can inform their bank and ask them to look into the charge to explain what the transaction was for, this additional research comes with a fee.

But it is not charged to the cardholder who is inquiring. It is changed to the merchant who ran the transaction because this process requires the bank to request evidence from a merchant.

Chargeback Fee

Furthermore, if the cardholder is still unhappy with a charge to their account after more research, they can dispute the transaction with their bank. If this is the case (even for a legitimate transaction), the merchant is charged a chargeback fee to initiate the cardholder’s request and process the chargeback.

The good news is that a merchant will, however, have an opportunity to send in a rebuttal for the chargeback to prove that the transaction was authentic.

However, Regardless if the merchant wins or loses a chargeback, they will still owe a chargeback fee for the facilitation of the entire process which can be anywhere from $15 – $25 and more if there is a second chargeback or pre-arbitration.

Cancellation or Termination Fee

A cancellation or termination fee would apply if your merchant payment processing contract had a stipulation in it for canceling services before your contract is over. If you end your contract early, a fee could be in the hundreds, thousands, and even up in 6 figure digits for certain high-risk merchants (depending on their unique contracts).

Voice Authorization Fee

A voice authorization fee of 65¢ – 95¢ may apply if for some reason a payment terminal is un-operational and the merchant has to authorize a credit card via phone. This can happen if there is a malfunction, a power outage, or simply internet connectivity issues.

PCI Non-Compliance Fee

The card networks implement and enforce PCI compliance to any merchant who accepts credit card transactions. It is aimed at protecting and securing all cardholder data at the point of sale. If a merchant fails to become PCI compliant or maintain their compliance, they will be subject to a penalty fee for non-compliance.

Terminal Lease Fees

If in-person merchants decide they need physical payment terminals, they have the choice to either rent or buy one. Therefore, if a merchant chooses to rent or lease, rather than buy a terminal outright upfront, they will be charged a monthly fee on their statement.

Application Subscriptions

If you want to streamline your workflow with additional business tools provided on POS systems such as Clover, there may be additional application subscription fees that would apply to take advantage of these tools.

Monthly Fee

Regardless of how much a merchant processes for the month, there may be a set fee that a payment processor will charge for every month that the merchant has an active payment processing contract. This monthly statement fee could sit around $10-$15 and would cover the cost to maintain a merchant’s account and send each month’s statements.

Monthly Minimum

A monthly minimum may be applied to certain merchant processing contracts. If this is the case, a merchant must process a minimum amount to cover their processing costs. If they do not meet these criteria, a fee would be charged for the remaining fees that were not collected through the lack of credit card transactions for the month.

Wireless Fees

Wireless terminals are where many merchants are headed nowadays. Especially those in the restaurant industry. If this is an approach you’d like to take for your point-of-sale, there may be a set-up fee to facilitate wireless terminal connectivity ($40 – $60), an additional monthly wireless charge of $10 – $25 fee, and even a per transaction fee of 5¢ – 15¢.

Keep in mind that some of these fees may apply to your merchant account, while others may not. But we wanted to provide you with as many fees as possible that you may run into so you’re well equipped with the knowledge you need when signing a payment processing contract with your merchant service provider. So be sure to read all the fine print.

Pricing Structures

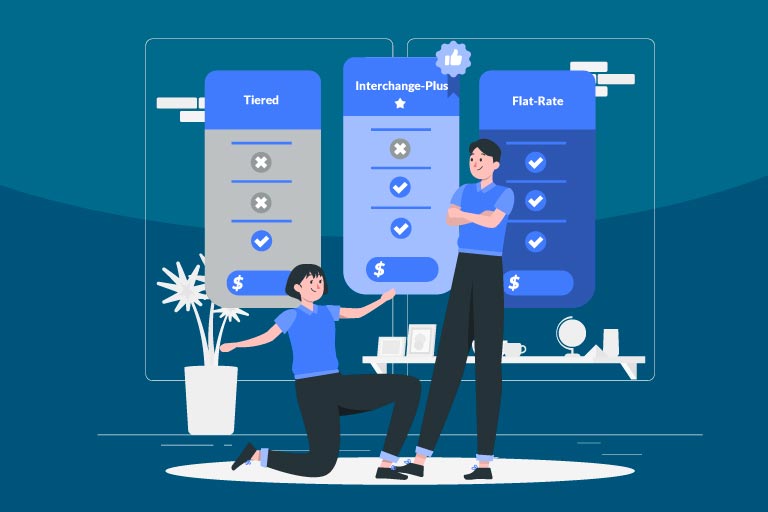

Credit card processing companies offer fee structures to their merchants in two ways that incorporate the network interchange rates. One approach is known as interchange pass-through or interchange plus pricing. The other approach, however, is bundled, which is found in either flat-rate or tiered pricing models.

Interchange-Plus Pricing

Interchange plus or interchange pass-through pricing structure is the most transparent way to create a separation of the interchange rate from the credit card processor’s markup fees. It is an exact pass-through to the merchant of the interchange rate from the card network. Plus a set per transaction fee from the processor.

Flat-Rate Pricing

Conversely, flat-rate pricing is a bundled approach. This fee structure uses one singular charge to bundle the network interchange rate with the credit card processor’s markup fees. It does make monthly processing costs easy to predict.

However, because the rate doesn’t change regardless of the rate of interchange, merchants will typically overpay for this type of fee structure.

Tiered Pricing

Lastly, we have tiered pricing, which is also a bundle of markups and interchange. This payment structure uses the interchange rate as the base price and calculates different transaction factors based on risk, to determine a tier that the transaction will fall into for its fee.

The tiers are:

- Qualified (lowest risk, therefore, lowest cost)

- Rewards (cards that offer perks like travel, retail discounts, etc- higher cost)

- Mid-Qualified (would have originally been low risk, but the information was keyed in or batched out past the cut-off)

- Non-Qualified (the highest risk (keyed in, batched late, etc) therefore, the highest cost)

The qualification would be dependent on factors like:

- The location of the sale

- Card-present versus card-not-present transaction

- The card level (standard, rewards, business, gold, etc)

- Debit or credit

- The cardholder information that was captured (name, address, etc)

- The amount of time between the authorization, batch out, and settlement

Credit Card Processing Conclusion

Credit card transactions are far more than just the point-of-sale device, the customer’s card, and both banks. In just 3 short seconds, think about just how many players were involved and the intricacies in that seemingly easy process.

Some payment processing companies, like Electronic Cash Systems, combine merchant services such as payment processing and also supply the hardware and software needed to accept digital payments such as card readers, POS systems, and online gateways. Which caters to an all-inclusive experience for your thriving business.

Despite credit card processing costs, most merchants agree that accepting credit card transactions is essential for the prosperity of their business. Accepting credit cards helps improve merchant sales and cash flow. And with the right payment processor, it can offer a convenient and secure payment alternative for customers.

I hope this article on payment processing 101 has given you a better understanding of credit card processing and all that is involved for you as a merchant.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.