If you’re a merchant that accepts credit card payments, you already know you’re paying your payment provider a fee, stemming from interchange rates, to utilize their digital payment solutions. So, what exactly are these fees, and who dictates them?

The overall credit card transaction fees you pay on every purchase are dictated by the payment structure that your processor has you on. This may have been an option that was decided on at signing your contract, or it may be the only fee structure your provider offers. Either way, the structure you are paying on is all designed around one major component: interchange rates.

In this article, we will discuss what interchange rates are, who determines them, what they cost, why, and how they play a role in the economics of your business.

Merchant Processing Fees

Whether a credit card is swiped, dipped, tapped, or keyed in if a business accepts that digital payment method, there is a processing fee involved per credit or debit card transaction.

It can be a challenge to understand which payment processing company to work with because each company has differing fee structures. This means merchants may pay certain fees with one processor and a totally different fee with another, for the same exact transaction. The differing fee structures can create a ton of confusion for merchants when knowing who the best processor for them is.

Regardless of the payment process, the overall transaction fees are typically a bundle of fees that consist of the interchange fee, a per transaction fee, and any additional fees on the merchant account. Let’s take a look further into these fees for merchants.

Definition of Interchange Rates and Fees

Any time a business runs a transaction, merchants, financial institutions, the credit card network, and the payment processor exchange information. With the amount of facilitation that occurs between parties, there is a cost involved. This cost is called an interchange rate. The rate is a percentage of the cost of the total card transaction.

What Factors Dictate the Interchange Rate?

Credit card processing fees can be a bit complicated. They may be difficult to predict depending on a merchant’s fee structure. If a merchant is on any fee structure other than a flat rate, the per transaction rate will vary depending on a multitude of factors.

But the interchange rates are the base of all credit card fees. Additionally, a merchant’s credit card processing fees will vary depending on their pricing structure, the type of card, and the way the information was received.

How Much Are Interchange Fees?

It is a common struggle to know what you will pay in interchange reimbursement fees. To put it simply, there is no standard interchange fee across all cards or transaction types. Each credit card network has a standardized interchange rate for any type of card or transaction. In fact, there are hundreds of unique interchange rates based on the following factors:

The payment card type (debit or credit)

The credit or debit card network (Visa, Mastercard, American Express, or Discover)

The type of credit card (standard, rewards, privilege, gold, platinum, business, etc)

The industry of the merchant (retail, grocery, restaurant, travel, healthcare, etc)

The transaction method (card-not-present or card-present)

Each credit card processor and card brand will have unique fees for individual transactions. The good news is that these interchange fees are pre-determined and transparently listed on either Fiserv’s website (a major payment processor) or the individual network’s website. You can take a look below at the card brand’s current rates:

- Visa interchange rates

- Mastercard interchange rates

- Discover interchange rates

- Amex interchange rates and Optblue program

Key things to keep in mind:

- Card-not-present transactions have higher fees

- Rewards cards will have a higher interchange rate

- There will be a higher fee if a card is keyed or swiped when it has EMV or NFC capabilities.

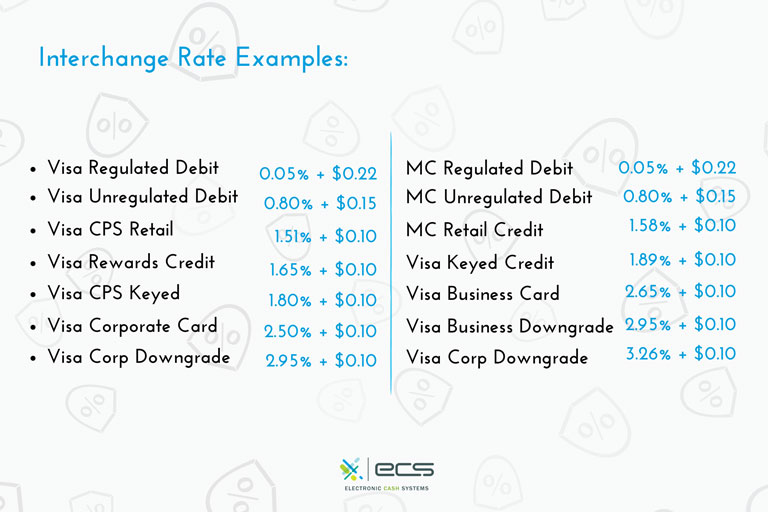

Examples of Common Interchange Rates

Interchange rates for the US can range anywhere from 0.05% to 3.26%. However, these averages in reality vary based on the various factors listed above. And they also vary per card brand.

Who Establishes Interchange Fees?

As a merchant, you may be paying your interchange costs to your merchant service provider. However, these rates are determined by the card brand networks, such as Visa, Mastercard, Amex, and discover. The network then charges the card issuer, and the issuing bank then charges the payment processor.

Finally, the merchant service provider charges the merchant. Ultimately it is the merchant’s responsibility to cover the fees for every digital transaction payment at their business. Either through a merchant’s flat-rate processing pricing structure or an interchange pass-through structure.

Basically, the merchant is compensating the cardholder’s issuing bank for the benefits of real-time transaction authorization and transaction security features with every electronic purchase.

Can Interchange Fees Change?

Yes, the card networks do change their rate every so often. In fact, Visa and Mastercard may change their fees about twice a year. Don’t worry, the rates are public knowledge and your payment service provider may announce these changes once they are posted in April and October, or they will be listed on the network’s website.

Are Credit and Debit Interchange Rates the Same?

No, they are not. Debit interchange rates are typically lower than the average credit card processing interchange rate. This is because the debit network is completely separate from the credit network. They each have individual rules, regulations, and processes.

Why Don’t My Rates Decrease When I Run Transactions With Lower Interchange Rates?

If your merchant processing fees are unwavering, regardless of the transaction or card type, you are probably on a flat-rate fee structure with your payment provider. Most small businesses are coaxed into signing up for flat-rate fees because they are the easiest to comprehend.

Easy comprehension makes for predictability and easy accounting come the end of the month. This is because flat-rate fee structures mean your cost per transaction never changes. But this means you do not get to take advantage of cards that may offer lower interchange rates. One benefit, however, is for the cards that have higher interchange rates, your fees will not increase.

To comprehend your monthly merchant fees you must understand a few things. First, interchange rates are non-negotiable. Your payment provider will pass them on to you.

Next, on top of interchange fees, your provider will also charge you additional fees for their services. Some of these fees may be assessed and billed separately, and others may be bundled with interchange rates in your month-end statement.

Let’s dive deeper into what additional fees you may run into as a merchant processing digital transactions.

Additional Payment Processing Fees

Keep in mind, the following fees may be part of your merchant statement. However, in some cases, these fees may not apply to you.

Authorization Fee

Anytime a merchant’s terminal receives credit card information via swipe, dip, tap, or keyed-in transactions, an authorization message is sent to the card’s issuing bank. Regardless if the card is approved or declined, an authorization fee will apply. This fee can be anywhere from 10¢ – 30¢ depending on your merchant account provider.

Chargeback & Retrieval Fees

The Fair Credit Billing Act gives cardholders the legal right to dispute any transaction they disagree with on their statement with their issuing bank. If the bank agrees to proceed with their client’s concern, they will issue what’s called a chargeback.

A merchant is notified of a chargeback once they see a debit to their merchant bank account, and receives either a fax, email, or letter to detail the debit and outline the details of the chargeback. From here, a merchant has the opportunity to continue the process with rebuttal submission. Proving the authenticity of the transaction. This can be done with signed purchase receipts and a written rebuttal response.

Whether a merchant fights against the dispute or leaves it alone, the banks and processors involved will still charge the merchant fees to compensate for their facilitation of the cardholder’s dispute. This chargeback fee can be between $15 – $25 per dispute.

Pre-arbitration Fees

Furthermore, if a merchant were to win a chargeback case and the cardholder is unwilling to accept it, they might file a second chargeback. In this case, the processor would elevate the case to what’s known as pre-arbitration.

Some processors and card networks may allow the merchant to send a second rebuttal. Conversely, others will dictate an automatic loss for the merchant. Regardless, pre-arbitration fees can be between $50 to $150. Unfortunately, a chargeback or pre-arbitration fee may cost more than the original transaction amount.

Voice Authorization Fee

A voice authorization fee would apply in circumstances where a payment terminal is down for whatever reason and therefore, cannot process transactions. In this case, a merchant can call their processor and provide the card information over the phone to receive authorization for the transaction. This fee is rare and will be between 65¢ – 95¢.

Debit Fees

Though interchange rates for debit cards may be lower than credit cards, the debit network will add an additional 20¢ authorization fee to each PIN-based transaction. Moreover, a merchant may need to pay between $5 – $10 monthly to have access to the debit network.

Wireless Fees

Wireless terminal options give merchants the flexibility to process in-person transactions from anywhere. Either throughout their store location or on the go. Wireless terminals need a cellular or wireless (Wi-Fi) network connection.

This connection can only be facilitated through a company such as Sprint, AT&T, Verizon, etc. A merchant may incur monthly wireless terminal connection fees between $10 – $25.

Furthermore, there may be a per transaction fee for every purchase done on a wireless connection. These fees can range between 5¢ – 15¢. Finally, a merchant service provider may require a setup fee which could range between $40 – $60.

Equipment Lease Fees

Many processors offer merchants the option to lease their payment terminal rather than purchasing a terminal in full upfront. Leasing equipment means paying smaller increments over a longer period of time. But that means that your monthly merchant statements would have additional fees, especially if you have a lease option with interest built in.

App Subscription Fees

Merchants who use POS systems like Clover may decide they’d like to take advantage of some of the business tools that are offered as built-in applications. Many of these tools are not free of charge, and so come with a subscription fee to utilize. Keep in mind proper subscription management will limit unnecessary charges every month.

Monthly Fee

Regardless if a merchant is processing digital payments or not, they may still need to pay a monthly statement fee. This fee can range between $10-$15 monthly. This fee is basically a service fee to your merchant service provider to maintain your account, keep your gateway open, supply you with detailed statements, and offer easy access to customer service.

Monthly Minimum

If a merchant did not process their set minimum per their contract, they may be required to meet their processor’s minimum monthly fee anyway. Monthly minimums are set up by account representatives to meet a set standard fee so the services provided are compensated regardless of the processing amount.

For example, if a merchant account has a minimum fee of $50 and the merchant only processed enough to charge $25, an additional monthly minimum fee of $25 will apply.

ACH Batch Fee

Some payment processors may charge an ACH fee every time they send batch funds to the merchant’s bank account. This fee can range from 5¢ – 25¢ and is quite rare.

Network Association and Card Brand Fees

Credit and debit networks require participating merchants who process payments via cards to pay annual network association fees to remain eligible. The fee cost will vary by the specific network but it will show up on a merchant’s month-end statement.

Discount Rate

The discount rate is the final per transaction sum of a merchant’s interchange rate fees, per transaction fees, and any of the above-mentioned per transaction fees. A merchant’s total discount rate will vary depending on the risk level associated with the merchant per the processor. The riskier they are, the more costly a merchant’s discount rate will be. And vice versa.

Effective Rate

Every merchant has an effective rate. An effective rate is the overarching percentage of the cost to process digital payments. A merchant can figure out their effective rate by dividing the total fees paid to their processor by the total in credit card sales.

This can be per month or per year. However, keep in mind that month-to-month can vary dramatically depending on the sales volume’s consistency.

Take this as an example: if your gross credit card sales are $500,000 for the year and you paid $10,000 in payment processing fees, your effective rate is $4,000/$500,000 = 2%. If a merchant can determine their effective rate based on different processing quotes from each prospective merchant service provider, they will have a better understanding of which provider best suits their business needs.

How Do Interchange Rates Accompany Merchant Pricing Structures?

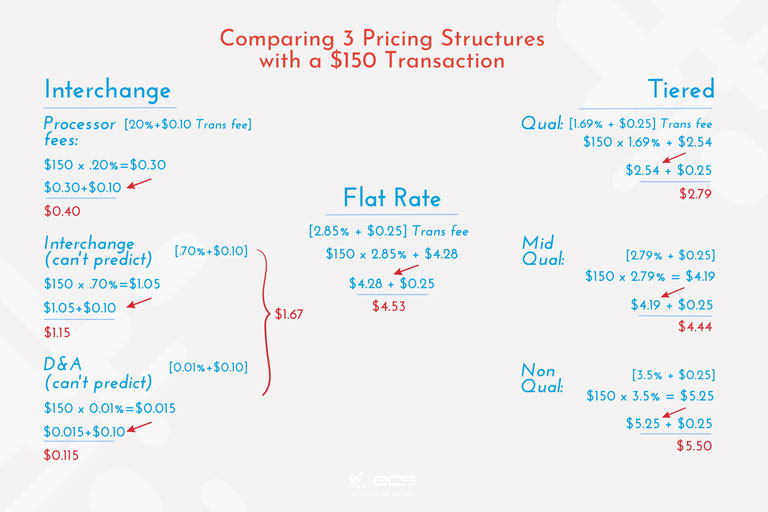

Payment processors can offer merchant fee structures in one of 2 ways combining interchange rates. Either with interchange pass-through, which is known as interchange plus pricing. Or with a bundled approach. Found either in flat-rate or tiered pricing.

Interchange-Plus Pricing

Interchange pass-through transparently creates a separation of the interchange from the processor’s markup fees. This pricing structure is an exact pass-through of the interchange rate from the card brand to the merchant, plus a per transaction fee from the processor.

With this type of plan, a merchant will always know the exact amount the processor takes as opposed to the interchange costs from the card networks. The rate a merchant pays will always fluctuate. But the processor’s margin will always remain constant. Merchants who process over $5,000 a month find this pricing structure the most affordable.

Flat-Rate Pricing

Conversely, with the bundled approach, we have flat-rate pricing. This fee structure bundles the interchange rate with the payment processor’s markup into one singular charge. This makes predicting monthly processing costs a piece of cake.

However, there is no way to really know how much of the fee is going to the bank and how much the processor is making off the transaction. Flat-rate does not account for lower interchange on a debit card or certain types of credit card transactions. Because of this, merchants typically overpay for this type of processing fee structure. So the merchant would pay the same rate every time, while the processor may profit more from different transactions.

Tiered Pricing Model

Tiered pricing allows for the fluctuation of fees and thus profits for both the merchant and their payment processor. Tiered pricing uses the interchange fee as the base, plus different factors of a transaction, based on risk, to determine which one of four tiers the transaction will fall into for the credit card processing fees. The pricing tiers are:

- Qualified (lowest risk, lowest cost)

- Rewards (cards that offer benefits like travel, retail discounts, etc)

- Mid-Qualified (would have been low risk, but the info was keyed in, or batched out late)

- Non-Qualified (high risk, keyed in, batched late, highest cost)

The qualification category would be dependent on factors like:

- The sale location

- Card-present vs card-not-present

- The card level (rewards, business, etc)

- Credit vs. debit

- The captured cardholder information (name, address, etc)

- The time between the authorization and settlement

Credit Card Processing Interchange Rates: Conclusion

To wrap this all up, interchange rates are the non-negotiable fees that any merchant who offers credit card payment solutions to their customers will have to pay to use this service. Interchange is created by credit card brands and paid out to the issuing banks.

Merchants will have to pay these fees in one of 3 ways to their payment processing company through their designated fee structure, in addition to any processor markups. Hopefully, this insight can provide you with valuable tools to understand what you’re paying and how to get the best price for your business.

Interested in learning about how to pass on your credit card fees to your customers?

To contact sales, click HERE. And to learn more about ECS Credit Card Processing visit Credit & Debit.