Merchant Tips

An Integrated Payment Gateway Can Cut Your Costs and Increase Profits

An integrated payment gateway streamlines payment processing by connecting your systems, reducing fees, improving security, and creating a smoother checkout experience that can increase conversions and profits.

Loan Management Software: Benefits and Features

Learn the benefits of loan management software, including automation, scalability, AI-driven credit decisions, and improved borrower experiences for lenders and retailers. Modern loan servicing platforms streamline the entire lending lifecycle, reduce manual tasks, and help businesses originate, manage, and grow loan portfolios more efficiently.

What is a Loan Management Software?

Loan management software is a centralized platform that automates the entire loan process from application and onboarding to servicing, payments, and compliance while delivering a fully digital customer experience. By streamlining workflows and integrating essential tools, it helps lenders reduce costs, improve risk management, and increase profitability across multiple loan types.

Soft Declines vs. Hard Declines: What Every Merchant Needs to Know

Many lost sales come from failed payment transactions. Understanding the difference between soft and hard declines helps merchants recover revenue and reduce cart abandonment.

Omnichannel Payments With ECS: Connecting Your Online Store, Terminals, and Invoices in One System

72% of businesses say payment processing impacts their ability to grow. ECS omnichannel payments unify every channel, including online, in-store, mobile, and invoicing, into one system so you can scale without the complexity.

Why Choose ECS for ACH and eCheck Processing: Lower Costs, Faster Cash Flow

Most business owners don’t realize how much profit they’re quietly losing to payment processing fees, until they run the numbers. This guide breaks down how ECS ACH processing can reduce transaction costs, stabilize cash flow, and give your business a smarter way to get paid.

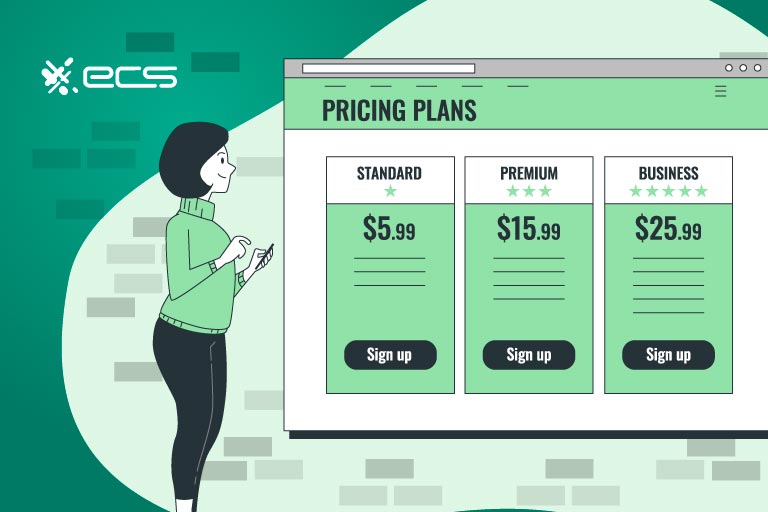

Choosing the Right Payment Terminal or Virtual Terminal Setup for Your Business

What if a single second delay at your checkout was enough to cost you a lifelong customer? It sounds like an exaggeration until you look at the modern consumer who expects every transaction to be instantaneous. Many business owners do not realize that their payment setup is often the final hurdle that determines whether a […]

What Is an FFL Transfer? A Complete Guide for Firearm Dealers and Buyers

FFL transfers are a critical part of legal firearm sales, ensuring every transaction meets ATF requirements, includes a proper NICS background check, and stays fully compliant with federal and state regulations. Whether you’re a buyer, seller, or licensed dealer, understanding the FFL transfer process helps protect your business, build customer trust, and avoid costly compliance mistakes.

A/B Testing Your Checkout: A Practical Guide to Increasing Conversion Without Lowering Prices

Every day, potential profit drains away because of small, unnoticed hurdles in your payment flow. Checkout A/B testing lets you stop guessing what your customers want and start using real data to build a frictionless buying experience.

What to Expect When You Switch to ECS Payments: Onboarding, Cost Review, and Ongoing Support

Switching payment processors doesn’t have to be complicated or disruptive. With ECS Payments, you gain clarity before committing, full support during onboarding, and real human support that helps you better understand and manage your costs.

Payments Analytics 101: The Metrics That Actually Move Revenue for Merchants

Most merchants only look at their payments when something breaks, and by then the damage is already done. Payments analytics helps catch problems early and turn payment data into better business decisions.

Payment Facilitator vs. Payment Gateway: What’s the Difference and Which Do You Need?

Payment facilitators and payment gateways may sound similar, but they offer very different levels of control, cost, and scalability. Understanding how each works can help you avoid frozen funds, reduce fees, and choose a solution that grows with your business.

Daily Discount Funding: A Smarter Way to Manage Merchant Cash Flow

End-of-month processing fees can drain a business’s bank account at the worst possible time. Daily discount funding eliminates that stress by spreading fees across daily deposits for more predictable cash flow.

The Hidden Revenue Inside Your Checkout: How Embedded Payment Platforms Drive Growth

Today’s payment platforms do more than process transactions; they shape revenue, efficiency, and customer trust. When designed strategically, payments become a competitive advantage rather than a back-office expense.

Emerging Payment Rails & What They Mean for Small and Mid-Sized Merchants

Learn how new real-time and open-banking payment rails accelerate settlements, enhance security, and unlock better customer experiences. Merchants that upgrade now gain faster cash flow and a decisive competitive advantage.

The Rise of Embedded Payments: What It Means for Software Platforms and ISVs

Embedded Payments let SaaS companies and ISVs create seamless, all-in-one platforms where transactions happen inside the software. With ECS Payments, ISVs get true Embedded Payments backed by direct bank relationships, full compliance, and flexible white-label options.

WooCommerce Fraud Prevention: How to Protect Your Online Store and Customers

WooCommerce Fraud Prevention is essential for protecting your business from costly chargebacks and lost trust. One incident of fraud can damage your reputation and customer confidence. Staying proactive is the only way to keep your store secure and your sales genuine.

How Tariffs Are Impacting Businesses

Many U.S. businesses are turning tariffs into opportunities, strengthening supply chains and unlocking new growth.

Which Dejavoo Credit Card Terminal Is Best For Your Business?

Choosing the right credit card terminal can transform your checkout process, and with secure and easy to use options for every setup, this guide to Dejavoo terminals helps you find the perfect fit for your business.

How Long Does an ACH Transfer Take? ACH Payment Timeline Explained

Confused about ACH transfer timing? Learn how understanding the ACH payment timeline can help you avoid delays, protect your cash flow, and keep your business running smoothly with help from ECS Payments.

PCI DSS 4.0: What Merchants Need to Know in 2025

Is your business ready for PCI DSS 4.0? Discover what’s at stake—and what steps you must take to protect your customers and stay compliant in today’s evolving data security landscape.

Cyber Threats in a Cashless Society: Prevention Strategies for Stronger Digital Payment Security

Ever had a transaction that just didn’t feel right? Learn how understanding digital payment risks and using the right security tools can protect your business, your customers, and your peace of mind.

The True Cost of Credit Card Fees for Small Merchants

Credit card fees are eating into your profits—understanding how they work could be the key to smarter pricing and thousands in savings for your business.

Accepting Cash & Credit Card Surcharge Laws: Best Practices

What if adding a small credit card surcharge could actually protect your profits? Learn how to implement surcharge and cash discount programs legally, clearly, and smartly.

SaaS Payment Tokenization: A Complete Guide

You’ve scaled your SaaS—now it’s time to secure it with tokenization, the key to safe, seamless, and compliant payments.

How Tariffs Are Driving Up Your Credit Card Processing Costs

Tariffs may seem like they only affect product prices, but they can also influence credit card processing fees—learn how trade policy could impact your business costs.

How Smart SaaS Billing Becomes Your Secret Growth Weapon

In the world of SaaS, your billing system isn’t just how you get paid—it’s how you build trust, reduce churn, and fuel long-term growth.

The Shift from Manual to Automated Bookkeeping: Why AI in Accounting Is No Longer Optional

Finance teams are replacing manual bookkeeping with AI to save time, reduce errors, and gain strategic insights faster than ever.

Why Most Online Stores Fail and What the Smart Ones Are Doing Differently in 2025

Launching an online store is easy—but growing one takes smart systems, seamless payments, and a strategy built to scale from day one.

How Long Can You Stay Afloat? The Truth About Cash Burn Rate Most Owners Ignore

Know your burn rate—because guessing your cash runway isn’t a strategy. ECS Payments helps you stay in control.

What Are Virtual Terminals? A Simple Guide for Small Businesses

Easily accept payments from anywhere—learn how a virtual terminal turns your device into a secure, no-hardware-needed solution for your business.

How to Handle Refunds and Cancellations in Payment Systems

Refunds and cancellations can make or break customer trust. Learn how to streamline your processes, prevent chargebacks, and protect your brand—whether you’re in retail, eCommerce, or services

Reducing Billing Errors: Tips for Maintaining Invoice Accuracy

Small billing errors can lead to big issues—lost payments, disputes, and delays. Discover how invoice accuracy protects your bottom line.

Exploring the Differences Between ACH Payments Vs. Credit Card Payments

ACH or credit cards—which is better for your business? While both offer digital payment perks like eCommerce and recurring billing, the differences could impact your cash flow and costs. Dive into our quick comparison to find out which fits your needs best.

A Guide to Integrating Payment Systems with Accounting Software

Manual payment entry wastes time and invites errors. Our quick guide shows you how integrating your payment system with your accounting software can simplify your workflow, improve accuracy, and help your business grow.

How to Create Custom Invoices with Branding and Personalization

Custom invoices boost professionalism, brand recognition, and workflow efficiency. Discover how to easily create personalized invoices that reflect your brand with the right tools and design elements.

Understanding Payment Gateway Integration: How to Choose the Right One for Your Business

Selecting the right payment gateway is essential for running a successful online or eCommerce business. Without a reliable payment solution, transactions can fail, revenue can suffer, and customer trust can be lost.

How to Optimize Your Invoicing Process for Faster Payments

Timely payments are crucial for maintaining healthy cash flow, yet many businesses face delays that impact growth and add financial strain. By optimizing your invoicing process, you can improve payment speed, reduce client late fees, and enhance cash flow management.

The Impact of Payment Fraud on Small Businesses and How to Protect Yourself

Small businesses face growing risks of payment fraud due to advancing technology and increased online transactions. This threat can cause significant financial and reputational damage, but implementing best practices can help protect against it.

Understanding Pass Through Fees: What They Are, How They Work, and How to Minimize Them

Many business owners focus on cutting labor or retail costs, but a smarter way to save is by reducing credit card processing fees. Pass-through fees are often overlooked, yet they can quietly eat into profits. Understanding and managing these fees can help businesses keep more of what they earn.

Understanding Temporary Holds on Credit Cards: A Guide for Merchants and Financial Managers

Explore how holds work behind the scenes, how customers perceive them, and strategies to make them more acceptable. While not all businesses use holds, they are particularly relevant for those managing reservations, travel, or shipping transactions.

The Ultimate Guide to Electronic Invoicing: How It Works, Benefits, and Best Practices

The Ultimate Guide to Electronic Invoicing explains how digital transformation in accounts payable enhances efficiency, reduces bad debt risk, and simplifies payment collection for small businesses.

Mastering Business Financial Decisions: Strategies, Tools, and Techniques for Success

Whether it’s choosing between a pricey lunch or a full gas tank or deciding how to invest $5,000 in a business, all financial decisions have consequences. Even small choices can impact overall financial stability. For SMB owners, the challenge is making smart financial decisions that balance short-term desires with long-term success.

Everything You Need to Know About Merchant Accounts for Your Small Business

A merchant account temporarily holds funds from purchases. Once the customer’s bank verifies sufficient funds and the transaction is complete, the funds are transferred to the merchant’s business checking account.

Implementing Dual Pricing to Reduce Credit Card Processing Fees: A Guide for Business Owners and Accountants

Merchant pricing models always involve costs for accepting credit cards. When reducing processing fees isn’t feasible, implementing dual pricing can help. Here’s an overview of dual pricing and its legal considerations.

12 Essential Questions to Choose the Right Merchant Service Provider for Your Business

Searching for a new merchant service provider? Think of it like dating—you want to ask the right questions and get to know the payment processor before committing. To help, we’ve compiled a list of key features and questions to guide your decision.

Comprehensive Guide to Optimizing Payment Links

Learn how payment links and mobile wallets simplify transactions—offering your customers a seamless, one-tap payment experience that boosts convenience and satisfaction!

Can I Legally Charge a Credit Card Fee to My Customers?

Is charging credit card fees to your customers legal and could it actually help your business stay afloat? Discover the answers and key insights that every business owner needs to know!

Avoiding Common Pitfalls When Using Merchant Cash Advances

Choosing a Merchant Cash Advance? Ensure you assess cash flow, research thoroughly, and understand the terms to avoid costly mistakes.

How to Improve Business Cash Flow

Understanding your business’s cash flow is essential for conducting a healthy financial analysis and making informed decisions

Friendly Fraud: What Is It And How To Avoid It?

Friendly fraud does not involve third-party criminal activity. Rather, it occurs when a cardholder purposely or accidentally issues a chargeback.

Inflation Indicators: 4 Metrics to Guide Business Planning

Inflation indicators have become a crucial tool for businesses and consumers, providing valuable insights into what to expect in the economic landscape.

How To Accept Apple Pay From Customers

Elevate customer experience and optimize revenue by embracing Apple Pay – the top choice for secure, hassle-free payments in-person and online.

Incorporate in Delaware vs. California: Pros and Cons

Deciding whether to incorporate in Delaware or California is a pivotal choice for businesses, with each state offering distinct advantages and drawbacks.

How To Sell My eCommerce Business: A Step-by-step Guide

Learn if there is a simple trick you’re missing to save your eCommerce business from selling. If not, these steps can get you the most out of your sale.

How To Open A Bar Successfully

Navigate the essential steps on how to open a bar successfully. From licenses to design, master the art of bar ownership and turn your passion into profit.

Corporate Transparency Act Of 2024: What Businesses Need to Know

The Corporate Transparency Act went into full effect on January 1, 2024 & It will impact millions of businesses.

3 Ways to Strengthen Your Supply Chain in 2024

Strengthen your supply chain to secure a competitive advantage, boost operational efficiency, and achieve cost savings with these 3 steps.

12 Fears of Starting a Business and How To Overcome Them

Identifying which fears of starting a business are holding you back is essential. Here, we help you understand and overcome these common fears.

7 Strategies For Business Growth in 2025

Businesses that adapt quickly and leverage these 7 strategies for business growth will thrive, while those that lag behind will struggle.

Discounting Smarter, Not Deeper! Discount Strategies That Work

Offering discounts is a great way to drum up more business, but it could eat away at your profits. Here are discounting strategies that work.

Is a Brick and Mortar Worth it Anymore?

Questioning the significance of traditional brick and mortar businesses in the era of digital dominance? We examine strategies for sustained relevance.

Remote Work Security: Challenges and Solutions

Remote work security is essential for businesses that have employees working outside of the workplace.

Upselling Techniques and Other Creative Ideas to Boost Your Average Ticket Price

Discover effective upselling techniques to enhance your business revenue. Explore insightful strategies for sustainable growth and reduced marketing costs.

How To Save Receipts For My Business Taxes

Saving business tax receipts is essential for the most streamline accounting practices and best tax break.

Business Tax Deadlines 2024: Corporations and LLCs

Business tax deadlines can be tricky to navigate. This in-depth review will help you to stay on top of all your tax to dos for 2024.

11 Ways to Prevent Data Breaches in Healthcare

Over the past 15 years, 360 million medical records were compromised. To prevent data breaches in healthcare, implement security measures & educate staff.

How to Invoice: 9 Essentials You Should Include

This guide teaches businesses like you how to write an invoice like a pro to ensure timely payments and streamline your financials.

Failproof Tip to Get Approved For a Merchant Account

To process credit or debit card payments with your business, you must be approved for a merchant account.

The Importance of Disclosing Your Return Policy to Customers

Crafting clear and effective return policies can elevate customer trust and satisfaction, leading to increased sales and business success.

2024 Sales Strategy: Markups and Margins

We explain the key differences and strategies for boosting your sales in 2024 with markups and profit margins.

Protect Your Business Against Email Scams

Learn how to protect your business against phishing scams. compromised business emails and phishing attacks threaten, exploit, and can be financially disastrous to any business.

How to Lower Food Costs For Your Restaurant

Discover how to lower food costs through proven restaurant strategies. These simple solutions will make you kick yourself for not thinking of them sooner.

How to Hold Employees Accountable

Learn these top tips for how to hold employees accountable while encouraging a positive workplace.

6 Strategies To Win Back Customers

Seeking out new customers is expensive. Learn how to win back customers with the following strategies.

How to Launch and Operate A Successful Restaurant

Launching a successful restaurant takes time, research, a great concept, and funding. We are here to break this down for you to give you a head start.

Why and How To Collect Customer Data

Collecting customer data is important for facilitating recurring payments and guiding marketing strategies—both on a personal and market-wide level.

Trendy Restaurant Social Media Ideas To Boost Your Business

Use these viral restaurant social media ideas to engage customers and boost the popularity of your brand online and in person for higher sales.

9 Tools to Protect Your Business from Credit Card Fraud

Strategies to prevent credit card fraud

How To Protect Yourself From Restaurant Liabilities

There are plenty of ways to address risks and restaurant liabilities in the industry.

How to Get a Federal Firearms License (FFL)

See which Federal Firearms License or FFL you need to work in the firearms industry. There are different types of FFLs based on your business.

What To Put On Your Business Card

Whether you are an owner of a business, a freelancer, networking, or searching for a job, here are the top things you must put on your business card.

How to Price Your Services: A Formula

How to price your services (1) know your marketplace (2) factor in your indirect and direct expenses (3) factor in how much you need to make (4) charge.

Your Sales Are Down? Do This to Fix it in 15 Days

Transform your business with expert insights, data-driven tactics, and actionable steps that guarantee rapid revenue growth in only 15 days!

9 Ultimate Business Growth Strategies

Business Growth Strategies For Your Small Business 1. Sales Strategies 2. Free Content Delivery 3. Influencer Marketing 4. Expand Your Product or Service Range.

5 Effective Ways Digital Goods Merchants Can Prevent Chargebacks

Because the products are not tangible, digital goods merchants experience a high volume of chargeback disputes. But there are ways to solve this issue.

Sales Invoices For Payment Processing: a Godsend to My Growing Business

A sales invoice includes key information from an order such as how much, the cost per unit, and the total cost. It includes information about the buyer.

How to Switch Merchant Accounts

Don’t make the mistake of sticking with or choosing the wrong payment provider. Learn how to best switch merchant accounts for your business.

Stop Packages From Being Stolen by Porch Pirates

Use these steps to protect packages and your business from porch pirates and stolen deliveries

Why Merchants Hate Square Customer Service

My personal story of how my square merchant account was frozen and how their customer service couldn’t so anything to help and what I did instead

The Dangers of Credit Card Processing Savings Analyses

ECS Payment Solutions’ wide variety of innovative payment solutions is specifically designed to help today’s merchants.

How To Build Business Credit: From Personal Experience

Business credit tells lenders how trustworthy your business is to lend to. Without it, you will have an impossible time securing funds to build your business

Nootropics Payment Processing: How My Small Business Overcame a Payment Processing Nightmare

Don’t make the same mistakes I made when it came to my nootropics payment processing for my business. Here are some helpful insights