Retail

The term “retail” encompasses a broad sector of the consumer-facing economy. The lifeblood of a retail business is direct consumer interaction. And a big part of that interaction is the point of sale. Payment solutions may not initially seem as crucial as marketing campaigns or store layouts. However, a deeper dive into business processes reveals that payment processing is a core functionality of the retail world.

It’s far more than just collecting debit and credit card payments. The point of sale is a touchstone moment where the consumer interacts directly with your business. A sale that goes smoothly cements a positive customer experience. In-person, that means leveraging the latest contactless technologies like mobile payments. Online, that means safe, secure, and easy-to-use payment gateways.

Much has changed since the days when merchants took an imprint of credit card numbers on carbon copy paper. Mastercard and Visa have experimented with “face recognition” checkouts, while Amazon has experimented with staffless stores. While these inventions represent the outer reaches of retail payment processing tech, it behooves every retailer to be aware of the trends and at least stay on par with them.

As Mastercard and Visa phase magnetic strips out of existence, and more and more consumers ditch their wallets entirely—opting for mobile wallets—retailers must stay abreast of the hardware and software needed to collect these cutting-edge payments. Check out the posts in our blog focusing on the retail space, and the hardware and software that facilitates that core B2C interaction: the point of sale.

The Best Dejavoo POS Systems for Retail Stores

Choosing the right POS system can make or break your retail experience. Dejavoo POS helps you streamline checkout, boost efficiency, and keep customers coming back.

Payment Solutions for Firearm Training Academies: Streamline Billing, Reduce Risk, and Stay Compliant

Launching a firearms business without the right payment processor is risky. From chargebacks to compliance issues, the wrong fit can cost you big.

How to Optimize Payment Processing for Seasonal Businesses

Optimize payment processing for seasonal businesses by managing cash flow, reducing fees, and utilizing scalable solutions for peak and off-peak periods.

10 Efficient Ways to Collect Payments from Customers

No matter what type of business you own, there are many ways to efficiently collect payment from your customers. Here’s how ECS can help get you started.

Case Studies: Success and Challenges with Contactless Payments in Small Businesses

The trends and adoption rates of contactless payments help us to understand how contactless payments impact businesses and consumers.

Innovations in Payment Hardware

Examining the latest in POS technology, from smart terminals to portable devices for small businesses. Your payment hardware could make or break your business.

The Future of Retail: Unattended and Automated Payments

Improvements in automated payment technology has really improved customer checkout experiences, except at small businesses.

Mobile Wallets Vs. Traditional Banking

Mobile wallets use contactless technology to allow customers to easily make payments from their phones online or in person without plastic cards.

Is Merchant Cash Advance Right for Your Business?

A merchant cash advance is a type of financing that benefits businesses during start up or slow periods. Repayment is tied to credit and debit card transactions.

Fraud Management Solutions: Does Your Business Need One?

Layered fraud management solutions use various advanced methods to prevent fraud losses that can significantly affect businesses.

Five In-Person Payment Methods: Which One is Right for You?

In-person payments for mobile or brick-and-mortar businesses is essential. But, which type should you accept? Cash, debit or credit card, check, or ACH?

Google Pay: An In-depth Guide

Merchants boost customer base and revenue by seamlessly integrating Google Pay at their point of sale, enhancing payment options.

Integrated Payments with ECS Payments

Integrated payments create a cohesive business by seamlessly combining payment processing hardware and software with various business operations.

The Future of Retail Stores

The future of retail stores involves coexisting with e-commerce, embracing tech trends, enhancing customer experience, optimizing payments options and more.

Tap To Pay: Transforming Mobile Devices Into Payment Terminals

Turn your smartphone into a contactless tap to pay POS to revolutionize your business, enhance customer experience & streamline operations.

Benefits of a Pop-Up Shop to Perfect Your Brand

A pop-up shop offers a temporary retail space for businesses to increase brand awareness, gain new customers, boost sales & engage with clients.

Merchant Services for Wholesalers Beyond Just Payment Processing

Wholesale merchant services offer unique solutions due to the industry’s place in the supply chain. See what wholesalers should consider beyond payment processing.

7 Strategies For Business Growth in 2025

Businesses that adapt quickly and leverage these 7 strategies for business growth will thrive, while those that lag behind will struggle.

E-Commerce Isn’t Killing Retail, It’s Inspiring Experiential Shops

Is the ease of eCommerce killing retail? Or has it created an opportunity for in-person merchants to create a more immersive space for consumers?

7 Reasons Your Business Needs a Satellite Location

A satellite location can provide benefits such as new sales opportunities, reduced overhead costs, enhancing customer experience, and more.

Is a Brick and Mortar Worth it Anymore?

Questioning the significance of traditional brick and mortar businesses in the era of digital dominance? We examine strategies for sustained relevance.

Upgrade Your Retail Store Payment Processor for a Record-Breaking Holiday Season!

Upgrading your payment processor will better prepare you for a successful holiday season.

The Importance of Disclosing Your Return Policy to Customers

Crafting clear and effective return policies can elevate customer trust and satisfaction, leading to increased sales and business success.

Your Sales Are Down? Do This to Fix it in 15 Days

Transform your business with expert insights, data-driven tactics, and actionable steps that guarantee rapid revenue growth in only 15 days!

Retail Payment Processing 101

Without the right retail payment processing systems, services, and pricing structures, your business is missing out on savings that could multiply your revenue.

The Risks Of Buy Now Pay Later Services

Buy Now Pay Later (BNPL) offers payment plans to customers for immediate purchases, even though they may not have the full funds available.

5 Signs It’s Time to Switch Payment Processors Before the Holidays

5 signs it’s time to switch payment processors before the busy holiday season. 1. high fees or wrong payment structure 2. poor customer service.

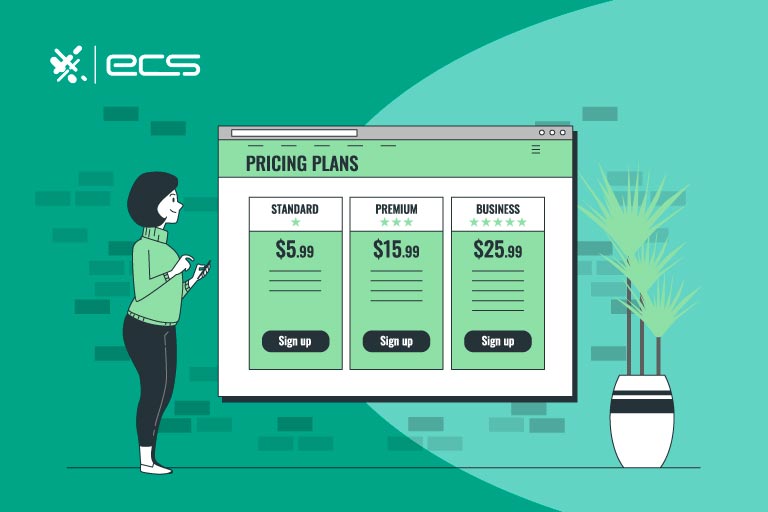

How To Price Your Products: A Guide

Knowing how to price your products can be tough. That’s why we’ve created his guide to give you the scoop on where your prices should come from and how to set them.

Best Retail Point of Sale Systems

A POS system, or point-of-sale system, facilitates cash or credit card transactions in retail sales and contactless payments

Become a Retail Inventory Expert: Learn The Difference Between UPC, SKU, and PLU

This guide is aimed at making you a product code expert. Learn the difference between UPC, SKU, and PLU, to streamline your business.

Unattended Payment Kiosk: Self-service Payment Solutions

Unattended payment kiosks offer a self-service point-of-sale experience that’s quick, clean, and cost-effective.