Bank chargebacks were designed for consumer protection. However, they can often be over-utilized. Chargeback reasons can sometimes seem unfair for merchants. But denying credit card transactions altogether would be detrimental to businesses.

Processing credit card payments is critical in today’s advanced market. With over 1.3 billion debit cards and credit cards in the US, businesses cannot afford to accept only cash in the modern economy.

To successfully accept digital payments it is important to understand the ins and outs of chargebacks and how they can affect you. This article will explore the basics of chargebacks.

The Fair Credit Billing Act (FCBA) of 1974

Unfortunately, there is no way to stop a cardholder from raising a dispute with their bank. Consumer protection laws within The Fair Credit Billing Act (FCBA) of 1974 cover cardholders. The FCBA protects consumers from unfair billing practices.

The FBCA protects consumers against paying for defective or missing goods, unauthorized transactions, unrecognized charges, billing errors, or fraudulent charges. It also enables individuals to dispute any charges related to these types of occurrences.

What is a Bank Chargeback on a Credit Card?

A chargeback occurs when a cardholder disputes a debit or credit card charge from your business. They can dispute a charge for any number of reasons, including fraud, inaccurate billing, defective items, etc.

The cardholder will inform their bank and if the bank agrees with their client, the transaction is forcibly reversed. If the cardholder wins the dispute, the merchant account receives a debit for the transaction cost plus a chargeback fee. There are additional consequences your business may suffer from a dispute. Which we will discuss later.

Credit Card Dispute Vs a Chargeback

Though many use these terms interchangeably, a dispute and a chargeback are technically different. A dispute is when a customer disagrees with a charge and informs their bank.

The chargeback is the action the bank takes to reconcile the customer’s dispute. The chargeback is the forced transaction reversal. It automatically removes the funds from the merchant account.

Payment Reversal Vs a Chargeback Vs a Refund

A payment or authorization reversal reverses an authorization hold. This means the transaction was not yet completed and the funds were not yet settled into the merchant’s account.

Conversely, a chargeback reverses a transaction after it is already settled. This means funds are forcibly removed from the merchant account and credited, sometimes temporarily to the cardholder.

Payment/authorization reversals do not damage merchant account standings. However, chargebacks not only have additional fees, but they can also damage merchant account standings with their payment processor.

Refund Vs a Bank Chargeback

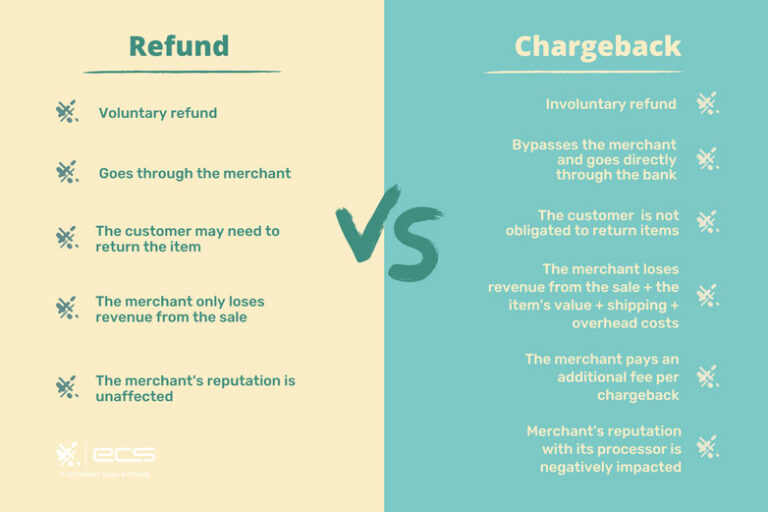

To a cardholder, a refund and a chargeback have the same goal. Get their money back. Though these options may seem interchangeable to the consumer, a chargeback and a refund are very different, especially as it affects the merchant.

Cardholders need to understand the difference between the two.

Refund

A refund is when your business voluntarily reimburses a cardholder for a transaction. Because the merchant is approving the transaction reversal, there is no negative impact on their reputation with their payment processor.

A refund issues credit back to the customer and the item is generally returned. Depending on a business’s refund policy the return may not be necessary.

For merchants to avoid unnecessary chargebacks, it is important to write a clear return policy. And make reasonable refunds easily accessible.

Chargeback

Conversely, chargebacks are involuntary on the merchant’s side. Cardholders bypass the merchant altogether and request intervention from their issuing bank.

When a customer issues a chargeback, they are not obligated to return the item. As a result, the merchant not only loses the revenue from the sale but the value of the merchandise.

Additionally, merchants could lose out on overhead costs from shipping, fulfillment, and interchange. Lastly, the merchant will receive a debit for a chargeback fee from their processor.

The chargeback process can be potentially damaging to the reputation of a merchant account. Merchants should avoid giving cardholders any reason to file a chargeback.

Cardholders should only use chargebacks in extreme situations. Never to simply avoid the merchant when seeking a refund. They should be a last resort. If seeking a proper refund from the merchant proves impossible or if a card was really used for an unauthorized transaction.

Chargebacks Offer Consumer Protection

The creation of chargebacks is to safeguard consumers. Therefore, the chargeback process is naturally skewed in favor of the cardholder. Their issuing bank decides who is responsible for the transaction. This process provides consumers protection from:

Merchant Error

The risk of a forced payment reversal helps to keep merchants vigilant. Promoting exceptional customer service with all their transactions.

Merchant Fraud

Chargeback costs deter fraudsters from posing as legitimate merchants. Minimizing the sale of defective or counterfeit products.

Criminal Fraud

Lastly, chargebacks are most often used to protect cardholders from unauthorized criminal activity on their credit cards.

The 6 Most Common Reasons for Bank Chargebacks

There are a few cases when chargebacks can be necessary to protect a cardholder. In most cases, this would be in response to fraudulent purchases or unruly merchants. However, it is always best for customers to speak to merchants before filing a dispute with their bank.

For stolen or lost cards, consumers should contact their issuing bank immediately to prevent fraudulent charges. But for almost every other case, cardholders should directly reach out to the merchant before calling the bank.

Merchants can correct most mistakes or accidents with a simple phone call or in-person customer conversation. This route is more beneficial for both parties. The cardholder will receive their funds quicker than they would with a chargeback. And the merchant avoids a chargeback and strikes against their account altogether.

If you understand the most common reasons customers issue chargebacks, you can attempt to fix issues before they arise. Minimizing the risk of customers filing a dispute.

1. Fraud

For stolen or lost cards, consumers should contact their issuing bank immediately to prevent fraudulent charges. But for almost every other case, cardholders should directly reach out to the merchant before calling the bank.

Merchants can correct most mistakes or accidents with a simple phone call or in-person customer conversation. This route is more beneficial for both parties. The cardholder will receive their funds quicker than they would with a chargeback. And the merchant avoids a chargeback and strikes against their account altogether.

If you understand the most common reasons customers issue chargebacks, you can attempt to fix issues before they arise. Minimizing the risk of customers filing a dispute.

2. Unrecognized Transaction

A common reason customers file chargebacks is that the descriptor of a purchase is one they do not recognize. If a customer does not remember making a purchase that relates to a certain descriptor they may dispute it.

Sometimes the descriptor that bank statements have for a transaction may not accurately reflect the business. Make sure you and your credit card processor are aligned with your transaction descriptor.

Keep in mind, you may have an agreement on the correct descriptor for purchases with your processor. However, it is ultimately up to the cardholder’s bank how they post the description of the transaction on bank statements.

3. Pricing Issues

In some cases, pricing issues occur when a customer is double charged or charged incorrectly for a product or service. Additionally, a customer may file a dispute if they believe the cost was not worth what they received. Be sure to bill your customers correctly and offer a product that matches the cost.

4. Recurring Subscriptions

If your business offers subscription services, chargebacks can be very popular. Recurring billing can pose difficulty to many cardholders. Oftentimes figuring out how to cancel a subscription can be too much of a hassle.

Therefore, customers will issue chargebacks when they cannot stop the billing cycle. Be sure to have a simple cancellation procedure for your customers should they decide they no longer want their subscription. Otherwise, you will face costly chargebacks.

5. Dissatisfied Customers

Unfortunately, a common reason for chargebacks is simply that a service or product is unsatisfactory to a customer.

Having a flexible return policy and easy return process will minimize customers’ chargebacks as a refund substitution.

Additionally, accurate product descriptions will ensure that customers know exactly what to expect with their purchase.

6. Delivery & Shipping Issues

If a business ships its products, one concern would be making sure packages arrive. Not only arrive, but the delivery of products should be on time and undamaged. If you are outsourcing shipping to a third party, be sure to use a reliable company. Especially one that communicates with customers on the whereabouts of their orders.

The Four Types of Bank Chargebacks

If a business ships its products, one concern would be making sure packages arrive. Not only arrive, but the delivery of products should be on time and undamaged. If you are outsourcing shipping to a third party, be sure to use a reliable company. Especially one that communicates with customers on the whereabouts of their orders.

Friendly Fraud

Friendly fraud—also called chargeback fraud— is responsible for most chargebacks. It occurs when a cardholder mistakenly or purposefully reverses a legitimate charge to recoup their money.

Because chargeback abuse is so high, merchants are more likely to experience fraud from their customers rather than from criminals.

There are numerous reasons for a cardholder to file a friendly fraud chargeback. For example, if the cardholder:

- does not recognize or forgot about the purchase.

- forgot about a subscription or recurring payment.

- misunderstood the delivery time.

thought they were part of a scam. - Inquired to their issuer about a transaction and unknowingly initiated a dispute.

Deliberate Fraud

Friendly fraud is a critical issue. Moreover, not all consumer chargeback fraud is “friendly.” Consumers can deliberately abuse the chargeback system for a variety of reasons:

- The cardholder pretends their card was stolen or they didn’t receive an item to get their money back.

- The cardholder wants to avoid a restocking fee with their return.

- The cardholder has “buyer’s remorse.”

- The cardholder finds the return process too complicated.

- The cardholder wanted to make a return but the return time frame expired.

- The cardholder’s family member made the purchase but the cardholder didn’t want to pay for it.

- The cardholder wants free items.

- The cardholder believes a chargeback is the same thing as a refund.

- The cardholder finds filing a chargeback more convenient.

True Fraud

True fraud is when credit card information is stolen and used to make unauthorized purchases. Unfortunately, businesses cannot expect to win a dispute for true fraud.

Unless the cardholder is lying about the fraud and the merchant has contrasting proof. Such as a matching signature or photo evidence. Fraud prevention tools are an effective way to avoid credit card fraud.

Merchant Error

When a merchant makes a mistake, customers lose trust. As a result, a cardholder may skip asking for a refund and go directly to their bank. Examples of merchant errors include:

- Double-charging a customer

- Mischarging a customer

- Sending the wrong product

- Not sending the product at all

- Providing a defective product

- etc

With good business practices, merchants can better protect themselves from financial liability.

Common Bank Chargeback Reason Codes

Depending on what reason the cardholder is filing a chargeback, there are different reason codes assigned to the case. Each credit card brand has different codes. The chargeback reason code provides distinctive information about the dispute category to both the acquirer and the merchant to help resolve the dispute.

If you receive a chargeback, it is imperative to review the provided reason code so you can take actionable steps to avoid future chargebacks, especially for the same reason.

| Visa Chargeback Reason Codes | Mastercard Chareback Reason Code |

|---|---|

| 30: Services Not Provided or Merchandise Not Received 57: Fraudulent Multiple Transactions 62: Counterfeit Transactions 81: Fraud- Card-present environment 83: Fraud- Card-absent environment 13.2: Canceled Recurring Transaction 13.3: Not as Described or Defective Merchandise/Services 10.3: Other fraud- Card Present Environment 10.4: Other Fraud – Card Absent Environment 12.6: Duplicate Processing or Paid by Other Means 13.1: Services Not Provided or Merchandise Not Received | 4837: No Cardholder Authorization 4840: Fraudulent Processing of Transactions 4849: Questionable Merchant Activity 4863: Cardholder Does Not Recognize – Potential Fraud 4831: Transaction amounts differ 4853: Cardholder dispute 4841: Canceled Recurring or Digital Goods Transactions 4855: Goods or Services Not Provided |

| American Express Chargeback reason Codes | Discover Chargeback Reason Codes |

|---|---|

| F14: Missing Signature F24: No Card Member Authorization F29: Card Not Present F30: EMV Counterfeit F31: EMV Lost/Stolen/Non-Received A01: Charge Amount Exceeds Authorization Amount A02: No Valid Authorization P05: Incorrect Charge Amount P08: Duplicate charge C04: Goods/services returned C05: Goods/services canceled C08: Goods/services not received or only partially received C14: Paid by other means C28: Canceled recurring billing C31: Goods/services not as described C32: Goods/services damaged or defective | UA01: Fraud – Card Present Transaction UA02: Fraud – Card Not Present Transaction UA11: Cardholder claims fraud (swiped transaction, no signature) NA: No Authorization AA: Does Not Recognize AP: Recurring Payments AW: Altered Amount CD: Credit/Debit Posted Incorrectly DP: Duplicate Processing PM: Paid by Other Means RM: Cardholder Disputes Quality of Goods or Services |

Bank Chargeback Consequences: Merchants

For cardholders, chargebacks shield against dishonest business practices and criminal activity. For businesses, however, chargebacks can be a serious threat to revenue and sustainability. According to recent studies, by 2023, merchants will lose out on approximately $117 billion annually from chargebacks.

The initiation of chargebacks was to protect consumers from fraudulent transactions and merchants. But the reality is, even reputable businesses struggle with unfair chargebacks.

For merchants, chargebacks are a serious matter which could severely affect their business. What’s more, even if a merchant submits adequate evidence in the rebuttal portion of the process, the decision is out of the merchant’s control.

Over time, chargebacks could have serious negative effects on a business including:

Chargeback Fees

There is a $20-$100 fee to merchants for every chargeback filed against them. Regardless if a customer cancels their dispute later, the merchant’s fee does not change. The process still requires administrative work from the processor and issuing banks. Thus, the debit on the merchant’s account for the initiation occurs either way.

Product Loss

When a customer files a chargeback, they are skirting their way around a legitimate return. Because of this, the merchant is unlikely to receive the product back. Resulting in product investment loss and loss in potential future revenue from reselling it.

Product Handling Costs

Merchants not only lose investment costs, profit, and future revenue potential, but they also lose out on the costs paid to process the initial transaction. Including card processing fees, shipping costs, handling costs, etc.

Threshold Fine

If a merchant’s monthly chargeback rates exceed a predetermined threshold, the card networks could fine the business an additional $10,000. The fines can continue as long as the merchant remains non-compliant. Continually accruing chargebacks.

Decreased Revenue

Because chargebacks impact a merchant’s cash flow, they can disable a merchant’s ability to pay bills, restock, hire staff, make profitable income, or grow.

Time Loss

Disputing chargebacks can be a lengthy process. The time a merchant spends accurately providing details to refute the customer’s claim can severely impact their ability to properly manage the business elsewhere.

Increased Processing Rates

Processors may label merchants who have a high chargeback ratio as high-risk. As a result, payment processing companies charge high-risk merchants higher credit card processing fees.

Account Termination

If a merchant fails to lower their chargebacks below their threshold, their acquiring bank can deem them too risky. When a payment processor views a merchant account as risky, they may terminate their account.

Difficulty Finding a New Processor

When merchant accounts are terminated due to excessive chargebacks, they are added to the Merchant Alert To Control High-Risk (MATCH) list. Merchants on this list are thus, blacklisted. Which means it could be impossible to secure a new payment processor. At least for the next five years.

With this occurrence, a merchant’s only option would be to secure a high-risk merchant account, which usually comes with very high processing fees. However, even this can prove difficult once a business is on the MATCH list.

Bank Chargeback Consequences: Consumers

Merchants are not the only ones who are negatively impacted by chargebacks. Though chargebacks are designed to aid cardholders, consumers who file illegitimate fraud claims can also rack up negative consequences.

- Chargeback decisions can take several months. Whereas a refund only takes 5-7 business days. So the cardholder will receive their funds slower than if they had asked for a refund.

- Banks may penalize or close cardholder accounts that file friendly fraud.

- Cardholders who lie or “cry wolf” too many times can risk not getting the assistance they need if they ever do experience real fraudulent activity on their account.

- If a cardholder’s bank account is closed due to chargeback abuse, it could negatively impact their credit score.

- To compensate for the costs associated with chargebacks, merchants increase their prices. This, in turn, negatively impacts all consumers.

How Do Credit Card Disputes Work?

Now that we know what a credit card chargeback is and how it affects both sides, let’s dive deeper into how the chargeback dispute process works.

The chargeback processes can be challenging, and quite taxing on merchants. There are multiple parties involved and merchants are basically “guilty until proven innocent”.

What’s worse, is a cardholder can dispute a transaction months after the actual sale date. Which makes finding documentation difficult. Keeping accurate and organized records is extremely important.

The number of steps involved in the chargeback process will vary based on different factors. Such as the card brand used, the processor platform the merchant is on, the type of chargeback, and if the chargeback is an initial dispute or second chargeback.

Because different card brands have different rules on their chargeback process, merchant service providers can assist their merchants by providing them with accurate information from each card brand, such as from the Mastercard and Visa chargeback guides.

With that being said, here are the basic steps involved in the credit card chargeback process :

Step 01 | Cardholder Files a Dispute

The cardholder files a dispute about a charge on their card with their issuing bank. From there, if the bank sees their claim as valid, they will initiate a chargeback to the merchant’s acquiring bank.

Step 02 | The Issuer Reviews the Claim

The cardholder’s bank reviews the claim and then assigns a reason code to the client’s case. This reason code gives the merchant an explanation as to why the consumer is disputing the transaction. If the issuer feels the cardholder’s case is illegitimate, the bank will void the dispute.

Step 03 | The Acquirer Receives and Reviews the Claim

The issuing bank then contacts the merchant’s acquiring bank. If the acquirer has evidence to counter the claim, they will submit it to the issuer on the merchant’s behalf. Conversely, if the acquirer has no evidence, it will forward the chargeback to the merchant.

Step 04 | The Merchant Receives the Chargeback Notification

The merchant’s acquiring bank forwards the chargeback to the merchant, giving them the option to plead their case. The processor will require merchants to send evidence either by email, fax, or mail.

The day a merchant receives the notification of a chargeback, their acquiring bank debits their account. Then, the cardholder receives a provisional credit until the final dispute decision.

Step 05 | The Merchant Reviews the Chargeback

After reviewing the chargeback information, the merchant can then choose to challenge or accept it. This decision is based on whether the merchant believes the claim is legitimate or not. And if they have sufficient evidence to fight the dispute.

Chargeback rebuttals can be time-consuming. However, if it is not done, a business can develop a reputation of being an easy target for fraud. Additionally, fighting illegitimate chargebacks result in revenue recovery.

Step 06 | Merchant Compiles and Sends Rebuttal to Acquirer

If the merchant decides to challenge the chargeback, they will compile all relevant and requested evidence. This may also include a rebuttal letter. They will then send the information to their acquiring bank. The bank then reviews the documentation to ensure the merchant’s material meets the dispute requirements.

Some merchants conduct the chargeback rebuttal process internally. While others hire chargeback management companies for this purpose.

Whichever approach a merchant takes, it is important to keep organized and detailed records to help collect all the necessary documentation to fight any future chargebacks.

Step 07 |The Issuer Reviews Evidence and Finalizes a Decision

Once the issuing bank receives the evidence, they will conduct a review to determine the winner of the dispute. This portion of the chargeback process can take as little as a few days, up to a few months.

Step 08 | The Appropriate Party is Credited

If the merchant wins the case with sufficient evidence, they will be re-credited the amount that was originally debited for the transaction. Minus any chargeback fees for administrative costs.

However, the merchant may lose the case due to insufficient evidence or other reasons deemed unfit by the cardholder’s bank. In this case, the merchant’s debit for the transaction is permanent and the cardholder receives the credit back.

Step 09 | Arbitration

If a cardholder loses their chargeback case, they can claim a second chargeback. Depending on their bank and the card network, this will result in pre-arbitration or arbitration.

Certain processors do not allow merchants to fight pre-arbitrations and it becomes an automatic loss for the merchant. Even if they won originally. Other processors allow the merchant to support the legitimacy of the transaction with further information.

Bank Chargeback Time Limits

When a customer disputes a transaction, they have 120 days to file a chargeback against a merchant. The merchant’s response time varies depending on the network. Some chargebacks only warrant 10 days. But the most common timeframe is 30 days.

How Long is the Chargeback Process?

Chargeback timelines vary depending on how long the merchant takes to respond, the card network, and the issuing bank. The process can take as little as a few days to a few weeks. While some chargebacks may take a few months to come to a finalized decision.

Merchant Chargeback Rates

The following sections will go over what a chargeback threshold is, how to calculate chargeback ratios to determine where you are at in the threshold, and what is average, acceptable, and dangerous in the chargeback to transaction ratio equation.

Chargeback Threshold

A chargeback threshold is the set maximum number of chargebacks that a merchant can have before they look too risky to the card networks. If the card networks see too many chargebacks on a merchant account, there will be penalties. This could include fines, higher credit card processing rates, and even account freeze or termination.

Acceptable Chargeback Ratio

With a maximum threshold, the pertinent question is, how many chargebacks are you allowed to receive as a merchant?

The industry standard is less than 1%. Preferably .65% or lower. If a merchant has a regular chargeback ratio of .9% or higher it could result in the above-mentioned network penalties.

Visa Fraud Monitoring Program

For Merchants that are experiencing high volumes of fraud, the credit card networks must step in. For example, The Visa Fraud Monitoring Program (VFMP) is a system designed by Visa. It keeps these merchants in check. Incentivizing them to manage their transactions more carefully to reduce their chargeback rates.

Visa enrolls merchants who exceed 0.9% chargeback rates in the standard-level fraud monitoring program. Furthermore, Visa enrolls merchants above 1.8% in the excessive program.

From here, Visa may charge merchants additional fees. Or give the merchant automatic liability on all chargebacks they receive. Visa uses these penalties to urge merchants to enlist better practices. Reducing their fraud and chargeback rates.

How to Calculate a Chargeback Rate

How do you know if you are at an acceptable chargeback ratio? You will need to do some basic math.

To find your chargeback rate, divide the total chargebacks received by the total number of transactions within the same singular month. That will determine your chargeback rate.

For example, if you have 300 transactions for the month of November and 5 chargebacks you would divide 5 by 300 and your average chargeback rate would be .0167%. This would be below the standard maximum chargeback threshold.

Chargeback Win Rates

The average win rate of a chargeback for a cardholder is 68%. This means that merchants only win about ⅓ of their chargeback cases.

Though the numbers seem to favor the cardholder, it is still important for merchants to always respond to their disputes.

How Many Disputes Can You Do?

In many cases, even honest merchants with legitimate transactions can suffer excessive chargebacks from customers. But how many disputes can a merchant respond to?

It is recommended that merchants dispute credit card chargebacks. Unless they believe the cardholder’s dispute is valid. Then they should not fight the dispute.

However, merchants must fight invalid chargebacks. Doing so will prove the legitimacy of their business to their processor, the card networks, and the issuing banks.

Additionally, it can dissuade consumers from filing illegitimate chargebacks when there is a high probability they will lose.

Chargeback Rates By Industry

Certain industries are at higher risk of chargebacks than others. The highest ratio at an average of 0.66% is in the software industry. This can be because the majority of software is usually sold as a subscription. In many cases, customer’s either do not recognize the recurring charge or cannot figure out how to cancel the subscription.

The financial services industry takes second place in high chargeback rates at 0.65%. Third place goes to media and eCommerce at 0.56%. Following closely behind are the retail and travel industries at .50%.

Other industries that are at high risk for chargebacks include:

- Dating services

- Online gambling

- Online pharmaceuticals

- Adult entertainment

- Jewelry

- Gaming

- Legal services

- Health and wellness

How to Minimize Chargebacks

Because the chargeback process is time-consuming and even damaging to merchants, it is best to try to prevent chargebacks as much as possible.

Though a merchant has no control over a customer’s decision on disputing credit card charges, there are a few steps businesses can take to minimize their risk. So how do we reduce chargebacks? Let’s take a look.

Adopt Credit Card Fraud Prevention Tools

Credit card fraud is especially high with eCommerce transactions. However, merchants can adopt anti-fraud tools to reduce unauthorized transactions. These advanced tools may include two-factor authentication, location and address verification systems, and personal information screening.

Provide an Easy and Reasonable Return Process

Merchants who offer a convenient return process are less likely to have frustrated customers. Customers who find it difficult to make a return on an item will instead ignore the return process with the merchant altogether and head straight to their bank to file a dispute. Their main goal: get their money back.

Clear Shipping and Warranty Policies an Easy and Reasonable Return Process

Other than an easy return process, you will want to be sure you have a clear shipping expectation and warranty policy. Customers should be well advised on how long it will take to receive an order. Moreover, customers should have clear guidance on what is and is not covered under your warranty policy.

Merchant Name Accuracy

Be sure your processor has your merchant account name correct. You want your store location name to match what customers see on their bank statements. If there is a charge with an unfamiliar merchant name, a customer is more likely to file a dispute with their bank.

Keep in mind, however, that it is the customer’s bank that makes the final decision. They decide how a transaction description reads on their customer’s bank statements.

Accurate Product Descriptions

Make sure your products and services are accurately described. This will minimize any customer misunderstandings or confusion. If a customer believes they are receiving one thing and gets something different than their expectations, there is more of a chance of an unsatisfied customer filing a bank chargeback.

Should Merchants Fight Chargebacks?

If a merchant agrees with the chargeback and believes the customer is correct in disputing the transaction, then no. The merchant should not send in a rebuttal and let the chargeback play out.

However, if a merchant is sure the charge was legitimate and the customer received the proper service or product, they should always fight these chargebacks.

Merchants who do not respond to their chargebacks lose status with the card networks and can face penalties. Fighting chargebacks with accurate evidence puts good standing on the merchant’s account with the banks and can discourage future fraudulent chargebacks.

Bank Chargebacks Next Steps

Chargeback threats can evolve and affect merchants daily. Because of this, merchants should have effective chargeback management and prevention strategies in place to save their account status and avoid paying additional fees.

It is valuable to partner with an effective merchant services company that has extensive experience in chargeback protection solutions. ECS can help you understand your credit card chargeback merchant rights and help manage your account effectively.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Banking.