Credit card merchant fees can pose a challenge to some small businesses when it comes to profits. Fortunately, small businesses do have the option to pass on their fees to customers.

This option, though helpful to a merchant, is a big decision. In choosing to do so, a merchant can risk possible backlash from customers. Luckily, we have a few different ideas to help reduce credit card fees for merchants.

Let’s dive deeper into these options. Plus their pros, cons, and what you should know before passing on fees to your customers.

What Are Merchant Credit Card Fees?

In today’s digital world, merchants who do not accept credit cards are doing themselves a disservice. This is the most common and convenient form of payment for consumers. Cash is rarely carried and wallets mostly contain digital forms of payment, such as debit cards, credit cards, and mobile wallets.

Unfortunately, accepting modernized digital transitions comes at a cost. Unlike a cash transaction, when a customer uses a credit card for payment, there are many players and moving parts.

The card brands (Visa, Discover, Mastercard, and American Express), the payment processor, and the banks all play a role to complete the transaction successfully. Because of this, a merchant must pay a fee for this service and the facilitation of digital transactions.

These fees include an interchange fee, per swipe fee, and additional merchant service fees.

How to Legally Pass on Credit Card Fees to Customers

Merchants can choose 1 of 4 ways to pass on credit card processing fees. Or at least reduce them. There are two ways to accomplish this: directly or indirectly.

The direct option would mean that the customer pays the processing cost with their credit card at the point of sale. This can mean adding a surcharge, increasing costs, etc. Either way, the customer is paying for the fee directly with their credit card swipe.

The indirect option would mean that the merchant incentivizes the customer to use a payment method that does not involve a digital transaction. Such as cash or check.

Let’s look further into these options to see which one will work best for your place of business.

1. Credit Card Surcharge Program

Adding a credit card surcharge program is the most direct way for merchants to pass on their credit card fees to customers. A surcharge program charges customers who chose to use a credit card to pay the full percent of the sale plus the per swipe fee that the merchant would have otherwise had to pay to the processor. Therefore, the merchant takes home 100% of their profit and pays nothing to use convenient digital payment solutions.

A surcharge program is pre-programmed into a merchant’s POS device by their merchant service provider. It can be tricky to implement. Merchants need to remember they will have to abide by state and federal laws. This includes letting customers and the credit card networks know about the use of the program.

The credit card networks such as Visa and Mastercard have their surcharge regulations as well. We recommend working with an experienced merchant service provider like ECS. We help you from start to finish.

2. Convenience Fees

Merchants can charge a convenience fee as a semi-alternative to surcharge fees. Its benefit is that they are legal in all 50 states. So long as the merchant abides by the credit card network policies. But its downfall is, unlike a surcharge, only certain situations allow for them.

A merchant can only issue a convenience fee when a transaction is occurring in an alternative fashion.

For example, A merchant could have a physical brick-and-mortar location. But they also offer online store purchases. The online purchase could have a convenience fee, but not the in-person one. This is because online purchases pose more of a convenience factor to the customer.

When it comes to convenience fees, customers can use cash in-store, cards online, and cards in person. But the convenience fee only applies to online or over-the-phone card payments. Not the one in person.

Convenience fees also differ from surcharges in that they do not cover the exact cost of the merchant’s credit card processing fees. But they do help offset some merchant fees. Surcharge fees would be a percent of the sale, whereas convenience fees are a flat fee.

3. Minimum Purchase Requirement

An indirect way of offsetting retail credit card fees is requiring a minimum purchase amount for any card transaction. If the transaction is less than the set amount, the customer must pay in cash. This is a legal solution in all 50 states.

This practice is mostly adopted by small business merchants with low ticket amounts, such as convenience stores. When merchants are set up with a flat fee pricing model plus a per-transaction cost, a small transaction may not even cover the cost that the merchant has to pay to run their card.

4. Offer a Cash Discount

Lastly, the obvious option to avoid credit card fees is to accept other forms of payment. Not only accept these forms but incentivize them to your clients. So, rather than charging more to customers using a credit card for payment, you offer to charge less to customers who chose to pay with cash.

Cash discounts are easy to implement and legal in every state. This option is especially useful for merchants avoiding processing fees, in states where surcharge programs are not legal.

The best way to implement a discount is to take off what the credit card fee would have been for that transaction. Unfortunately, this number can be difficult to calculate depending on which fee model you have with your payment provider. Considering interchange rates, per-swipe fees, and processor fees.

Furthermore, merchants can also incentivize debit card transactions over credit cards. This will help lower fees as well since debit cards have lower processing fees.

The Pros and Cons of Passing on Credit Card Fees to Customers

As of today, 60% of Americans prefer to use cards for payment. Thus, cash purchases make up less than 20% of all transactions.

Cards are America’s favorite method of payment because cards offer flexibility, convenience, and even rewards points. Additionally, using credit cards help consumers to build their credit score. Which can help when they need a loan or need to apply for housing.

But for merchants, offering card acceptance can pose a financial burden on small businesses. It is reasonable for merchants to try to minimize purchases made with credit cards if they do not benefit the business financially. So passing the financial concern onto their customers is a way merchants compensate.

Let’s look into the specific pros and cons of passing credit card fees onto customers.

Pros

- Merchants keep their profits: The biggest advantage to passing on fees to cardholders is the obvious one. Merchants can accept digital payments without having to pay for this solution.The customer takes on the full cost (with a surcharge program) at their discretion. Customers can avoid having to pay additional fees if they simply choose to pay with cash.

- Automatic surcharge: When merchants set up their point-of-sale with a surcharge program, they do not have to think about charging their cardholders/s. This program automatically takes out the credit card charge when that type of payment method is used at check out.

- Flexibility: When merchants implement surcharge programs, convenience fees, or minimum purchase requirements, they are not requiring anything additional from their customers. They are simply charging for customers to pay more conveniently. If a customer chooses to pay with their card, they will have to pay for the ease of the process. If a cardholder does not want to pay additional fees, they can select to use cash and avoid unnecessary charges.

Cons

Upset customers: If a merchant opts to charge customers for credit card transactions, they risk the potential of an upset customer. Which can impact customer experience and damage any type of relationship the merchant may try to establish with their clientele.

Loss of customer support: Additionally, if a customer is unhappy about paying for the convenience of credit card purchases, they could opt to choose to buy from a merchant’s competitor. One that does not charge additional fees to customers when they use credit cards. If this happens an attempt to save money could end up costing a merchant business.

Additional setup steps: To incorporate a surcharge program or convenience fee option, merchants must incorporate these options into their payment software.

Navigating rules and regulations: Surcharge programs have many different regulations that merchants must abide by. One common regulation is that a surcharge cannot be more than 4%. These regulations vary by individual states, countries, and credit card networks.

How to Explain Service Charges to Customers

First of all, stores with credit card surcharging are legally required to notify customers. Credit card companies send businesses signage that must be installed in the store near the credit card terminal.

Additionally, merchants should display all additional credit card fees at the bottom of a customer’s receipt as an additional line item. This can help reduce confusion and even minimize chargebacks (I want to use the chargeback article here once it’s published).

With keeping transparency in mind, merchants should also display the same signage or notification for convenience fees, minimum spending requirements, and cash discounts. This helps eliminate any unwanted surprises from the customers at checkout.

Additionally, it helps if merchants can explain why they chose to use a service charge in their credit card transactions. With the cost of inflation, additional fees merchants must pay to run their businesses can really hurt.

Explaining to customers that this is the cost to keep their business afloat may help build customer trust and support, especially for small local businesses.

Moreover, established merchants that may be changing their payment policies should have a credit card convenience fee notice to customers delivered before the program launch. It can help reduce customer tension and prepare them for their next visit.

Best Practices For Passing on Card Fees to Customers

If you’re a merchant looking to implement credit card fee policies for your customers, it’s essential to implement our best practices to avoid business disruption and customer complaints.

Remain Transparent

As mentioned previously, the best thing you can do to retain customer support is to remain honest about your policies and why. Not only is it legal to hang the appropriate signage, but it also establishes trust between you and your customers.

Explaining why you have to change your fees might help customers better understand why choosing your small business over others or even over large corporations is so important, especially during trying economic times.

Provide Customers with Options

Letting your customers know they have payment options can reduce immediate pushback. Knowing they have options and do not have to accept paying additional fees will help customers not feel forced or obligated. It is the best way to start the conversation.

If you inform your customers that they can use a debit card, they likely have one on them. Moreover, suggesting cash payment and a discount for this method could even make a customer excited.

This way, they see the transaction at your store as a benefit rather than a burden. And they’ll see one less transaction on their end-of-month credit card bill. Which always helps.

Follow All Rules and Regulations

Surcharging programs and convenience fee implementation is regulated by state laws and credit card issuers. If a merchant is caught doing sketchy or deceptive business practices with these credit card fees, they could be reported to the State’s Attorney General. Following all rules and guidelines is the easiest way to ensure you will stay out of trouble.

- Never charge above the 4% surcharge limit.

- Always properly display informative surcharge signs.

- Never apply a convenience fee or surcharge when it’s not allowed.

And remember, if you have a merchant service provider like ECS, we will help you set up the best surcharge program and make sure all your state’s compliance policies are met.

How to Reduce the Burden of Merchant Fees

Interchange fees for credit card processing are unavoidable. However, the card networks may not care who pays them. So long as someone does. This could be the merchant or their customer.

Eliminating interchange fees is impossible, but passing them on to customers directly or indirectly will help reduce their burden on merchants.

On top of interchange rates, merchants must also remember they are responsible for merchant account fees to their payment service provider (PSP).

Researching the best merchant services provider for your business will save you in fees and get you the payment processing solutions you need to thrive. Look for a provider who will not charge for unnecessary services. Or overcharge for transactions for your business model.

ECS designs custom packages for our merchants. We are a one-stop shop that offers the best fees and payment solutions to fit your individual needs.

Where Are Surcharges Not Allowed?

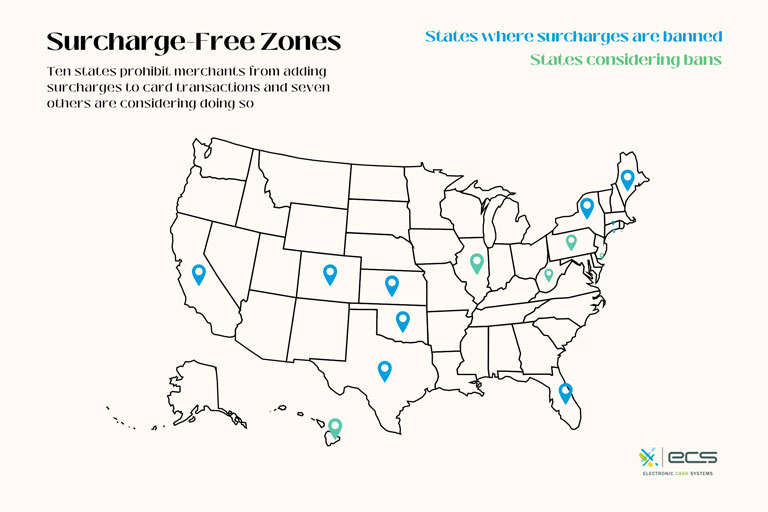

Based on Visa’s Online Merchant Surcharge Q&A document, there are currently surcharge restrictions in 10 U.S. states including:

- California

- Colorado

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- New York

- Oklahoma

- Texas

It is recommended to consult with your merchant service provider and/or legal counsel before implementing these practices in the above-mentioned states.

Can a Business Charge a Credit Card Fee on Debit Cards?

Per the card brands, merchants are not allowed to apply surcharges to debit cards. Regardless if a cashier selects “credit” or not, surcharge programming automatically identifies debit vs credit cards.

The good news, however, is that debit networks charge lower fees to merchants than credit networks. If a merchant would like to avoid a fee altogether, they can offer their customer a discount for using cash instead to pay for their transaction.

Can Credit Card Fees Be Eliminated?

At the moment, there is a debate going around on this very subject. Merchants continually fight it and the card brands obviously oppose the rejections.

Unfortunately, credit card interchange fees are a huge profit maker for card brands. It helps pay for advantage cards that offer beneficial rewards rates, reward certificates, and cash-back programs. Popular reward cards include:

- Amazon Prime Rewards Visa Signature Card

- Capital One Quicksilver Cash Rewards Card

- Discover it® Cash Back Card

- Citi Custom Cash℠ Card

- Wells Fargo Active Cash® Card

- Bank of America® Travel Rewards Card

- Chase Freedom Unlimited® Card

- etc

Other than credit card processing fees, credit card companies also earn a profit off of other fees. This could include foreign transaction fees, balance transfer fees, and interest rates. Though different companies have different 12-month variable APRs, the idea is the same. If their cardholder carries a balance on their card, the company will profit from them.

Use ECS as Your All-in-One Payment Solution

ECS is a one-stop-shop merchant service provider. We provide you with innovative payment solutions and handle all of your debit, credit, and even ACH payment processing. We will help you to better understand your options when it comes to merchant fees and passing on credit card fees to customers.

Interested in learning more about credit card processing fees? Check out our detailed article on credit card fees explained.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.