How To

Many business owners get into a business to pursue a passion or a dream. Others want to be their own boss. Either way, nobody really shows them the back-end processes that HR, IT, and accounting departments take care of at a larger company. Wouldn’t it be nice if you could focus on doing the things you love and leave all that paperwork behind?

Unfortunately, most business owners don’t get to live that particular aspect of the dream. The average SMB owner may spend 16 hours per week on administrative tasks. Marketing, payroll, accounting, and inventory are just a few regular concerns—not to mention surprises.

Good news: many of these how-tos can be automated by the latest software developments. Your payment processing company can integrate with accounting, inventory, and even HR functionalities to smooth out back-end processes.

Every debit and credit card payment facilitates the organization of your inventory and an exact accounting of your sales numbers. In our blog posts, you’ll see how the most up-to-date payment solutions (hardware and software) can make your business day run much more smoothly.

There are some business how-to’s that can’t be automated. We’ll cover those as well in some of our blog posts: how to open a bar, how to scale your SaaS company, how to upsell, how to lower food costs…there are lots of exciting ideas in a variety of industries that we’ll explore in our business how-to articles.

How The Rich Scale Their Businesses

The rich scale their businesses by identifying their most profitable customers and focusing their marketing efforts on reaching new ones

How Smart SaaS Billing Becomes Your Secret Growth Weapon

In the world of SaaS, your billing system isn’t just how you get paid—it’s how you build trust, reduce churn, and fuel long-term growth.

Why Direct Debit Might Be the Smartest Billing Move Your Business Hasn’t Made Yet

Still printing invoices or chasing payments? Discover how direct debit can simplify billing, boost cash flow, and save your business time, money, and stress.

Why Most Online Stores Fail and What the Smart Ones Are Doing Differently in 2025

Launching an online store is easy—but growing one takes smart systems, seamless payments, and a strategy built to scale from day one.

How Long Can You Stay Afloat? The Truth About Cash Burn Rate Most Owners Ignore

Know your burn rate—because guessing your cash runway isn’t a strategy. ECS Payments helps you stay in control.

Reducing Billing Errors: Tips for Maintaining Invoice Accuracy

Small billing errors can lead to big issues—lost payments, disputes, and delays. Discover how invoice accuracy protects your bottom line.

Recession vs Depression: How To Protect Your Business

knowing the key differences and outcomes of a depression and a recession can better help prepare your business to succeed no matter the economic climate.

The Ultimate Guide to Electronic Invoicing: How It Works, Benefits, and Best Practices

The Ultimate Guide to Electronic Invoicing explains how digital transformation in accounts payable enhances efficiency, reduces bad debt risk, and simplifies payment collection for small businesses.

Implementing Dual Pricing to Reduce Credit Card Processing Fees: A Guide for Business Owners and Accountants

Merchant pricing models always involve costs for accepting credit cards. When reducing processing fees isn’t feasible, implementing dual pricing can help. Here’s an overview of dual pricing and its legal considerations.

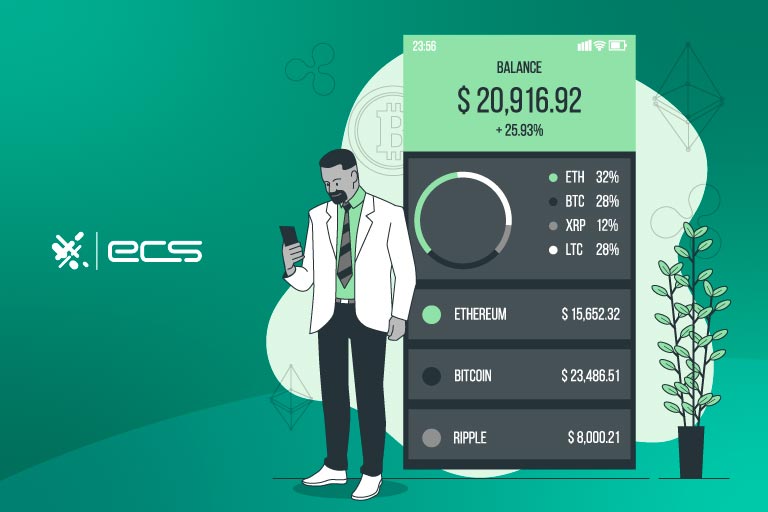

How is XRP and Ripple Designed for Payments?

Ripple XRP could be the future of payments as it bridges two different currencies in a way that is easier to manage and send than current methods.

How to Qualify for a Merchant Cash Advance: A Step by Step Guide

Merchant cash advances are easy to apply for. Providers care more about your processing than your credit and you will simply need a few things to qualify.

How to Improve Business Cash Flow

Understanding your business’s cash flow is essential for conducting a healthy financial analysis and making informed decisions

Friendly Fraud: What Is It And How To Avoid It?

Friendly fraud does not involve third-party criminal activity. Rather, it occurs when a cardholder purposely or accidentally issues a chargeback.

How To Accept Payments Over The Phone

Learn why businesses need to accept payments over the phone, their benefits, risks, costs, and seamless integration tips.

How To Accept iPhone Payments

Accepting as many forms of payment as possible, including iPhone payments, will always benefit businesses by catering to a broader market share.

How To Scale Your Saas Business

Claim your market share of the growing SaaS industry? Scale your SaaS business through social media, content marketing, trade shows & sales teams.

How To Accept Digital Wallet Payments

Digital wallets provide secure mobile payments, boost sales, expedite checkout, enhance security, and attract customers. Businesses can accept them with an NFC card reader.

How To Accept Apple Pay From Customers

Elevate customer experience and optimize revenue by embracing Apple Pay – the top choice for secure, hassle-free payments in-person and online.

How To Open A Bar Successfully

Navigate the essential steps on how to open a bar successfully. From licenses to design, master the art of bar ownership and turn your passion into profit.

12 Fears of Starting a Business and How To Overcome Them

Identifying which fears of starting a business are holding you back is essential. Here, we help you understand and overcome these common fears.

How to Keep Costs For Processing Wholesale Payments Down

Processing wholesale payments requires strategic considerations. With lower profit margins, minimizing credit card fees is essential.

Upselling Techniques and Other Creative Ideas to Boost Your Average Ticket Price

Discover effective upselling techniques to enhance your business revenue. Explore insightful strategies for sustainable growth and reduced marketing costs.

How To Save Receipts For My Business Taxes

Saving business tax receipts is essential for the most streamline accounting practices and best tax break.

How to Invoice: 9 Essentials You Should Include

This guide teaches businesses like you how to write an invoice like a pro to ensure timely payments and streamline your financials.

How to Upgrade Your Payment Processing Equipment

Upgrade Your Payment Processing Equipment to Stay Ahead of the Tech Curve With Modern POS Solutions. Boost Security, Efficiency, and Customer Experience.

How to Pick the Best Healthcare Payment Processor for Your Practice

The right healthcare payment processor is essential. Practice Management Bridge and ECS explain exactly what to look for, for a secure and streamlined practice.

2024 Sales Strategy: Markups and Margins

We explain the key differences and strategies for boosting your sales in 2024 with markups and profit margins.

How to Lower Food Costs For Your Restaurant

Discover how to lower food costs through proven restaurant strategies. These simple solutions will make you kick yourself for not thinking of them sooner.

How to Hold Employees Accountable

Learn these top tips for how to hold employees accountable while encouraging a positive workplace.

How to Launch and Operate A Successful Restaurant

Launching a successful restaurant takes time, research, a great concept, and funding. We are here to break this down for you to give you a head start.

Why and How To Collect Customer Data

Collecting customer data is important for facilitating recurring payments and guiding marketing strategies—both on a personal and market-wide level.

Trendy Restaurant Social Media Ideas To Boost Your Business

Use these viral restaurant social media ideas to engage customers and boost the popularity of your brand online and in person for higher sales.

How To Protect Yourself From Restaurant Liabilities

There are plenty of ways to address risks and restaurant liabilities in the industry.

SMS Payment: How Your Business Can Leverage Text to Pay

Businesses can use text to pay by texting customers a payment link. With a click, the customer is brought to a payment gateway to complete their payment.

How to Get a Federal Firearms License (FFL)

See which Federal Firearms License or FFL you need to work in the firearms industry. There are different types of FFLs based on your business.

How to Price Your Services: A Formula

How to price your services (1) know your marketplace (2) factor in your indirect and direct expenses (3) factor in how much you need to make (4) charge.

How to Leverage eCheck Payments

Save time and money by learning to leverage echeck payments for your business. The ACH network makes it easy to process digital payments.

How to Switch Merchant Accounts

Don’t make the mistake of sticking with or choosing the wrong payment provider. Learn how to best switch merchant accounts for your business.

Stop Packages From Being Stolen by Porch Pirates

Use these steps to protect packages and your business from porch pirates and stolen deliveries

Get Paid Faster With Payment Links!

payment links help your business accept payments online without the need of an eCommerce website. They offer easy solutions for quick payments.

7 Easy Contactless Ways to Collect Payments

Merchants can collect contactless payment in 7 easy ways 1) NFC-payment 2) QR codes 3) mobile wallets 4) online payments 4) Subscriptions 5) ACH

How To Price Your Products: A Guide

Knowing how to price your products can be tough. That’s why we’ve created his guide to give you the scoop on where your prices should come from and how to set them.

How to Easily Build Business Credit with an EIN

Build your business credit with your EIN. Separating your personal and business finances is the best way to make sure you are set up for success.

How To Build Business Credit: From Personal Experience

Business credit tells lenders how trustworthy your business is to lend to. Without it, you will have an impossible time securing funds to build your business

A Guide On How To Start Your Own Subscription Business Model

A Subscription business model’s key advantage is that its revenue is based off of recurring billing. This helps small businesses with customer retention

How To Easily Drive More Sales to Your Website

If you’re wondering how to drive sales to your website, you can implements the following tactics for your small business

How to Start a Small Business in 2024: The Ultimate Guide

It’s necessary to learn the 12 key steps on how to start a successful small business in 2024 and bring your dreams to life.

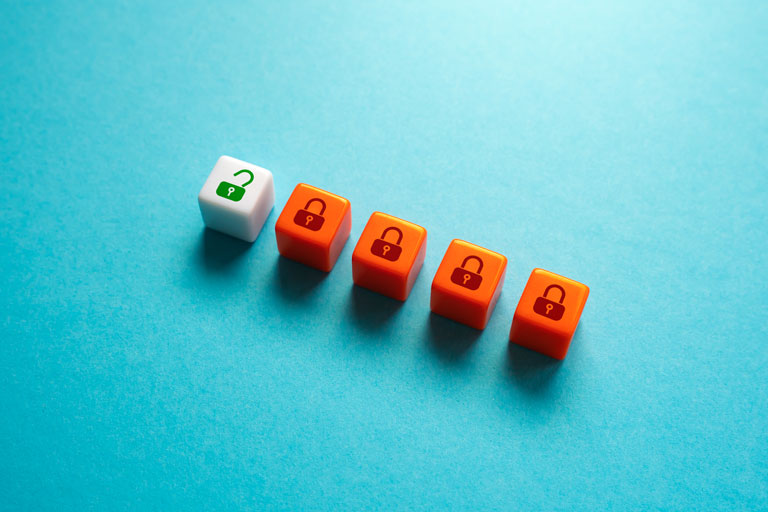

How to: Secure Your Business With Two-Factor Authentication

Two-factor authentication is an extra layer of security that involves multiple authentication methods: knowledge, possession, and inherence

How to Use Retail Analytics to Grow Your Sales

We provide you with the key concepts you need to learn how to use retail analytics to grow your sales in 2023.

How to Detect And Prevent Fraudulent Transactions

Discover key tools to prevent transaction fraud at your business, minimizing the risk that fraudulent transactions pose and their impact your business.

How To Boost Revenue with Self-Serve Card Payment Solutions

Discover how self-serve card payment solutions can easily generate business growth and the ultimate customer experience at your merchant location.