High-Risk

Being labeled a high-risk merchant is a burden. Some payment processing companies won’t even work with high-risk merchants. Many of the ones that do often charge higher processing fees, or force the merchant to provide “rolling cash reserves.” While you may not be able to entirely escape these requirements (e.g., different fees and cash reserves), you can certainly mitigate their impact and lessen their severity—that is…if you work with the right payment solutions provider.

What does being “high risk” mean, anyway? Some industries are inherently viewed as high-risk. Supplements, adult entertainment, bail bonds, and credit repair are just a few industries that are slapped with this label. Sometimes it’s the product or service itself, while other times it’s the legal landscape around it.

Other times, a merchant is labeled as “high risk” because of their sales history. One too many chargebacks can lead to being blacklisted by Visa and Mastercard. And once that happens, it can be extremely challenging to change your image. Unfortunately, chargebacks are an increasingly abused phenomenon, particularly in specific industries like eCommerce and travel.

Sometimes, you might even be labeled as a “risky” merchant because you have no sales history. New businesses can have trouble securing a way to accept debit and credit card payments outside of platforms like Shopify, which offer unfavorable flat rate pricing models on fees. It’s a bit of a catch-22 for new businesses with little to no sales history to show.

Whatever reason applies to you (industry, sales history, etc.), learn more about high-risk payment processing and how to mitigate its impact in our articles below.

High Risk Payment Merchant Accounts Made Easy: Why Businesses Choose ECS Payments

ECS Payments supports high-risk businesses with tailored payment solutions that protect your cash flow and keep your operations running smoothly.

Processing Recurring Payments: Challenges and Solutions

Overcome subscription payment challenges by implementing automation, PCI DSS compliance, dunning management, multiple payment solutions & customer service.

Understanding High-Risk Payment Processing Gateways: A Comprehensive Guide

High-risk payment processing gateways cater to high-risk businesses. They specialize in handling larger transaction volumes & international transactions.

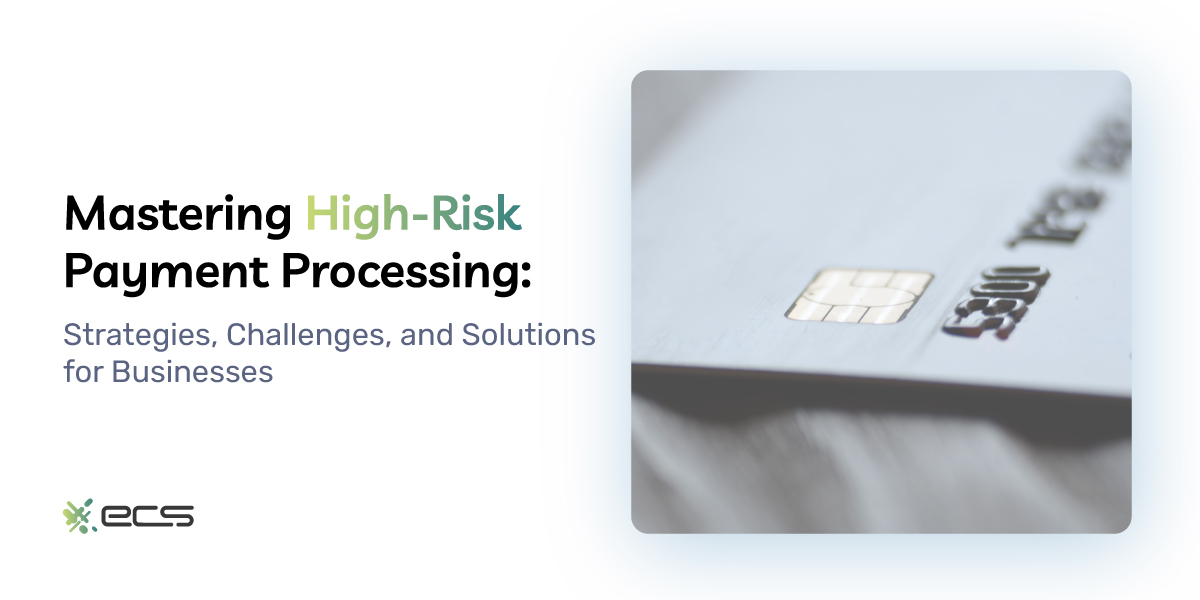

Mastering High-Risk Payment Processing: Strategies, Challenges, and Solutions for Businesses

To navigate the challenges that come along with high-risk payment processing such as chargebacks, fraud, and fees, you need to understand how payment processing works.

The Three Pillars of Gun Store POS: Hardware, Software, and Payment Processing

Gun store POS systems help firearms merchants with regulatory compliance, lowering costs and increasing efficiency, and exploring new revenue streams.

High Risk Payment Processors for Payment Gateways

A high-risk payment gateways makes it possible for your business to accept all digital payments. Discover the best high-risk gateways 2024 has to offer.

9 Signs You Have a High-risk Business

9 signs that say your business is high-risk and will need high-risk payment processing solutions including the products you sell.

Accurate Customer Data For Recurring Payments is Crucial

Subscription services are a popular money-making business today. But, if you are not getting accurate data in subscription services, you could be missing out.

3 Mistakes To Avoid in Recurring Billing

Subscription services business models are a great way for merchants to profit more with loyal customers. But be careful to avoid these fatal mistakes.

SaaS Payment Processing

SaaS payment processing involves recurring payments. The recurring billing cycle is handled by the payment gateway or the subscription management software.

How To Implement Recurring Billing Integration

Efficiently process your customers’ credit cards, debit cards, and ACH payments, with recurring billing integrations for your merchant account.

What To Do When WooCommerce Drops Your Merchant Account

WooCommerce merchant accounts can be tricky for high-risk merchants. Follow these steps when you need a payment gateway if yours is dropped.

How Instant Bank Verification Can Help High-Risk Merchant Accounts

Instant Bank Verification helps high-risk merchants not only receive merchant account approval faster but if implemented in their ACH transaction flow.

Payment Processors For Your Online Gambling Merchant Account

Payment Processors For Your Online Gambling Merchant Account

Credit Repair Merchant Accounts

To process credit card payments, you may need a high risk credit repair merchant account. ECS can better help you to understand

Friendly Firearm Payment Processing For Gun Shop Merchants

ECS Payment Solutions is specifically designed to help gun shop merchants with friendly firearm payment processing.

Get The Most Out of Your Debt Collection Agency Merchant Account

To get the most out of your debt collection agency, work with a high-risk payment processor that offers online debt collection payments, chargeback assistance & more

Nootropics Payment Processing: How My Small Business Overcame a Payment Processing Nightmare

Don’t make the same mistakes I made when it came to my nootropics payment processing for my business. Here are some helpful insights

A Guide On How To Start Your Own Subscription Business Model

A Subscription business model’s key advantage is that its revenue is based off of recurring billing. This helps small businesses with customer retention

What to do When Authorize.net Drops Your High-Risk Merchant Account

Authorize.net merchant accounts and payment gateways are necessary for merchants to process credit card payments.

Shopify Dropped Your High-Risk Merchant Account? Here’s What You Do

Shopify high risk merchants may face some dilemmas when it comes to processing payments online. Learn how to combat such complications with your Shopify merchant account

Everything You Need to Know About Opening a Bail Bonds Merchant Account

Opening a bail bonds merchant account — made easy with our tips and tricks to help you grow and get ahead of your competition.

Direct Marketing Continuity Subscriptions 101

Utilize our strategies to find the right payment processor for your direct marketing continuity subscriptions business

8 Benefits of a High Risk Merchant Account

Establishing a high-risk merchant account for your business offers 8 key benefits that are a must know if you want to grow your profits.

High-Risk Merchant Accounts and Payment Processing With Instant Approval

Finding a credit card processor for your high risk merchant account doesn’t have to be a challenge. Learn everything you need to know about high risk transactions

High-Risk Payment Processing: Multi-level Marketing 101

find out why multi-level marketing transactions are considered high-risk payment processing and how to successfully navigate payment within an MLM industry

High-Risk Merchants: Payment Processing Checklist

Conquer the battle of finding the best high-risk payment processor for your business with these easy steps to nail that application process.

High-risk Business Payment Processing: Are You At Risk?

High-risk business payment processing solutions are available to these businesses to easily collect credit card payments from customers.

Credit Card Processing for Tobacco Merchants

High-risk merchants selling tobacco products need a specialized payment processor to offer more ways to pay to increase sales and customers.

What is a Money Service Business?

A money service business is any person, entity, partnership, or financial institution that handles the conversion or transfer of money.