Gas prices not only directly affect the American consumer, but gas prices and small business success are directly correlated. So how do rising gas prices affect the economy exactly?

The pump’s impact weighs heavily on consumers, strapping them with higher monthly expenses. Moreover, the rising cost of fuel also affects the American economic machine as a whole. Higher gas prices, especially diesel, affect the supply chain.

Diesel is the lifeblood of the American economy. So many of our products require diesel transportation. Anything transported by way of a tractor-trailer, ship, or plane is marked with higher shipping costs when fuel costs increase.

2022 and 2023 Gas Price Increase

Throughout Summer 2022, Americans have seen and dealt with the effects of inflation. This includes the influx in fuel prices.

For the first time on record, billboards across America have spiked their average to over $4 a gallon this summer. Some states averaged over $6. Furthermore, some cities in higher-priced areas even suffered prices as high as $9 per gallon.

A year ago, average American households were spending about $2,800 a year on gasoline. Now, the same households are projected to shell out over $5,000 this year.

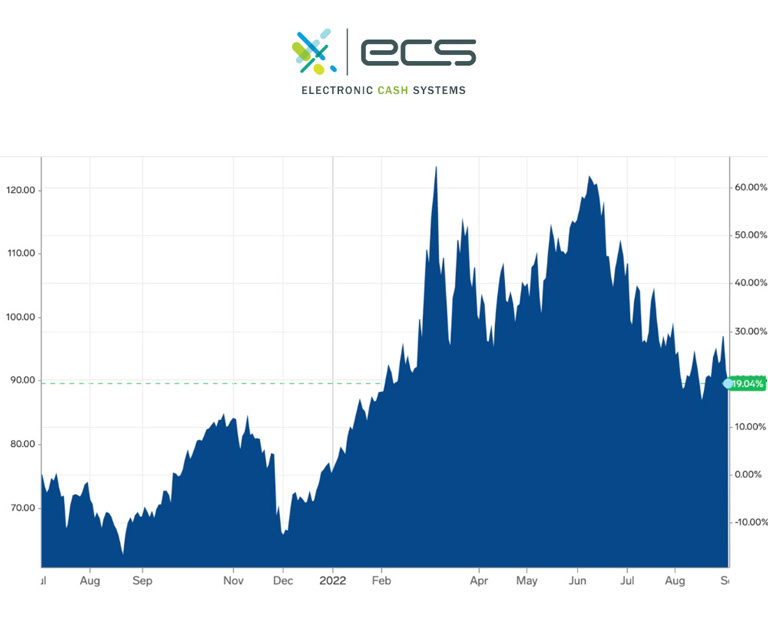

In the Spring and Summer of 2022, the United States experienced the highest level of oil prices since 2008. The national average was topping off at $147 per barrel. In the previous 5 years, average oil barrels ranged from $41.96 to $70.68.

What Causes the Change in Gas Prices?

Gas prices and shipping expenses are dependent upon a variety of factors. Many have argued the real reason for oil and gasoline influxes. To this day, there will never be a clear answer to this question. Many factors have been blamed for the cycle of rising and falling gasoline prices this summer and in decades past. These can include:

- Crude oil prices

- Refining costs

- Pipeline availability

- Drilling production

- Labor supply

- International shipping costs

- Supply and demand

- Politics

- War

- Stockholder investments

- Covid-19

- The ever-changing economy (inflation and deflation)

Covid-19’s Effect on Gas Prices

When Covid-19 hit, travel restrictions, lockdowns, and business closures reduced the gas demand. Because of this, there was a surplus of oil, and a lack of faculties to store it. Oil exporters included in the Organization of the Petroleum Exporting Countries (OPEC) cut off production to avoid oversupply and under-demand.

When travel bans were lifted this year and businesses began operating at full force, the oil demand increased back to pre-pandemic levels. People were driving, flying, and traveling again. However, production was not able to keep up. OPEC countries gradually begin to increase their supply.

Crude oil production can be complex to reboot. Nonoperating oil wells can be difficult to start back up and drilling new wells naturally takes time. Because of the uneven supply for the increased demand throughout 2021, “post-pandemic” oil prices continued to rise.

Political Effects on Gas Prices

Throughout history, different presidential administrations were either praised or ridiculed based on the cost to fill up a gas tank. Every administration is unique. However, they all enact different policies and agendas that allow or halt drilling, build or cut off pipelines, favor or reject green energy, and cause prices to go up and down every year or so.

Regardless of the political effect on gas and oil prices, administrations, state-wide or overseeing the country, can alter gas taxes. Which in turn, makes a consumer’s gas bill seem even higher than it would.

Additionally, political views on supporting different OPEC countries during times of war have made a clear impact on the price of crude oil. The war between Russia and Ukraine has also influenced the cost at the pump in 2022.

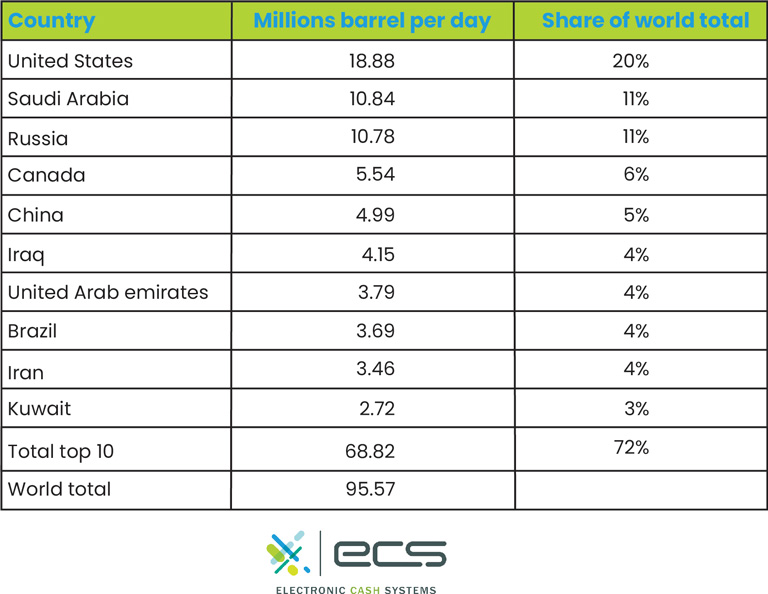

Russia ranked as the third largest oil supplier worldwide. Because of the Russian invasion, the United States Executive Order has banned the importation of Russian petroleum, crude oil, natural gas, and coal products.

Economic Fluctuations Effect on Gas Prices

Like any good or service, gas prices and shipping are non-exempt from the effects of market forces. The market and economy drastically shifted in 2020 in response to the pandemic. Two years later, America is attempting to get back on its feet again.

Now, with the after-shock of inflation, supply, and demand chains have altered accordingly. Labor and supply shortages, wage requirements, the cost of drilling and fracking, and refinement production have all contributed to the inflated price of fuel.

Furthermore, due to shareholder demands, oil companies have been requested to refrain from drilling new wells. Investors believe oil prices won’t remain high for long enough to receive a profitable return on investment. Due to their pledge of capital discipline, increasing oil supply remains at a halt.

How Are Fuel Prices Affecting Businesses?

Rising gas prices have become a daily difficulty for consumer households. However, businesses are also struggling with this surge. The rate increases for fuel will directly affect inflationary fees on goods and services. Added fuel surcharges will be implemented to compensate for the additional business expenses and shipping costs.

Big Business Affected

Many companies have experienced the burden of rising gas and diesel prices. Diesel fuels the American economy. Most goods come from somewhere that must be shipped to the supplier. Unfortunately, with ocean freights, tractor-trailers, and airplanes needing fuel to operate, shipping rates are going up.

During their quarterly earnings calls, big-name companies like Target, Walmart, and Amazon have voiced their concerns about rising shipping prices. Fuel costs are roughly one and a half times higher than a year ago. In return, this has doubled overseas shipping rates.

Target claims the increased fuel prices will generate an additional $1 billion in costs to the company for the fiscal year. Walmart claims accelerated fuel prices were $160 million more than they forecasted for the quarter. Unanticipated import freight rates and transportation costs have required inflationary product pricing.

Therefore, some price increases have been made. However, it has not been quick enough to match the rate of acceleration of shipping costs. This has created timing issues with the company’s expenses and profit margins.

Higher costs for jet fuel have also impacted the airline industry. The United States Postal Service included. Jet fuel prices are threatening to cost the industry over $10 billion more than just 2 years prior. Therefore, not only are shipping costs affected, but fees for airline tickets, postage, and priority mail packages are also seeing heightened costs.

Small Businesses Affected

Fuel prices, including diesel, not only affect big business shipping rates. The small business market also takes a hit. As it is, small businesses can struggle to yield a profit, especially in their beginning stages. Most small business owners don’t have much wiggle room when it comes to profit margin versus rising costs.

Many small businesses operate as eCommerce stores that must ship all their products nationally or even internationally. Some small businesses are service-based, like plumbers, contractors, electricians, exterminators, cleaning services, etc, and must drive to their customers. Others are delivery-based like your local restaurant, bakery, flower shop, or farmer.

Locally made DIY goods, flowers, and foods are sold at craft fairs and farmers’ markets all over the country. However, to get local organic goods to a farmers’ market in a downtown urban city, farmers may need to drive long commutes. Coincidentally, just like the big businesses, when gas prices increase, these small businesses also have to charge more for the same service or products to compensate for the rising cost of shipping and fuel.

Unfortunately, some consumers see these increased prices and compare them to larger corporations with lower fees. Because consumers’ wallets are also hurting, they may choose to support the larger brand. In return, this hurts a small business’s ability to profit, grow, or even make ends meet.

Is There Any Relief in Sight for Gas Prices and Small Business Owners?

Fuel prices at the pump are hurting consumers and businesses directly. Businesses have to inflate their product and service prices to cushion their added costs. In return, consumers are paying the price for this compensation.

However, oil prices have since deflated from their record-breaking highs. But today, it remains above $90 a barrel. To compare, the highest oil prices over the last 5 years averaged just over $70 a barrel.

As we attempt to look ahead, there is no way to know what the future holds. However, some experts say that the only thing that will quell expensive gas prices is a decrease in demand.

Demand destruction could be as simple as the unaffordability of record-breaking highs. Consumers are choosing to stay home rather than spend the money to drive somewhere.

Additionally, with Summer coming to an end, school starting back up, and vacation travels cooling down, demand rates are beginning to drop. Predictions indicate oil prices may drop to $65 a barrel by the end of the year.

Furthermore, some investors have begun to sell their stocks in the oil business. This may lead to lower future gasoline costs. If this prediction continues, small businesses may see more profits in their pocket in 2023. At the least, it could yield a temporary reprieve at the pump.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Credit & Debit.