It’s easy to see that it’s the holiday season. The lights are up. Trees are up. And indoor spaces in regions that never see snow look like a winter wonderland. But what exactly does that all mean for small businesses, Q4 cash flow, and how consumers will celebrate the holidays in 2023?

Travel Plans Changes From 2022 to 2024

Travel is an essential part of the holidays if movies ingrained in our cultural consciousness tell us anything (we’re thinking of Home Alone). Last year, the unfortunate inflation had left 79% of polled consumers tweaking their travel arrangements in 2022 and early 2023.

Last Year’s Travel

Inflation had impacted airfare prices with a 33% increase in 2022. Gas, of course, has and is still increasing to record highs. And it’s always a topic of discussion, around the family dinner table, the water jug at the break room, or the radio, “Oh my gosh! Gas is so expensive!”

But regardless of the cost to travel, some are not phased. Around 75 million consumers who are traveling for the holidays will put their expenses on a credit card. Which will result in a potential $3.3 billion in interest payments if they take the average of three months to pay it off (just in time for Spring Break).

However, 23% of typical holiday travelers saved money by keeping their travels more local. While this was bad news for exotic destinations, it helped local venues in the hospitality and entertainment.

2023 to 2024 Holiday Travel Predictions

But, things are looking up this year. According to Forbes, even though the inflation is still impacting Americans, 87% are still planning to travel the same, if not more than they did last year. 49% plan to increase their holiday travels for 2023 and into 2024.

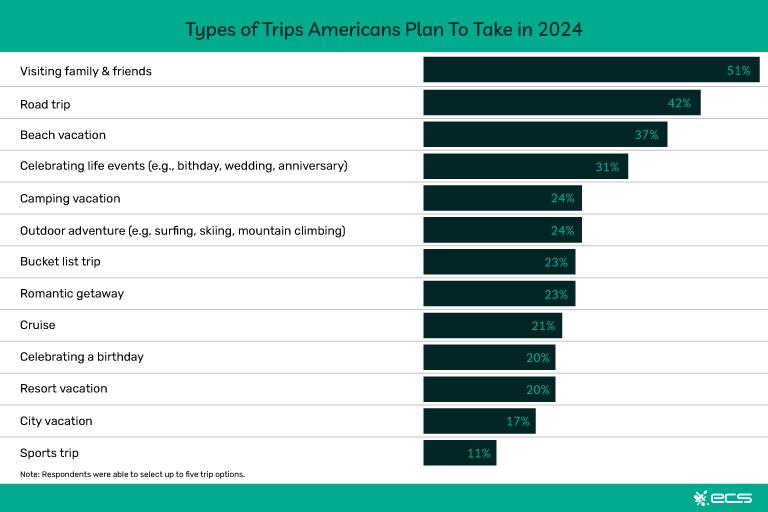

American’s aren’t just traveling for vacation for the holidays, and not for family either. The below graph indicates all types of reasons Americans plan to leave the mundane and get out in the world again as it normalizes.

Inflation Vs. Holiday Travel Budgets

Americans are well aware that travel will cost them. It’s a big investment. And one that’s more important for some, than for others. Adjacent to travel budgets is inflation. And although prices are still high, especially for gas, especially in CA at well over $6, 45% of surveyed consumers will allow for a higher holiday travel budget in 2023 into 2024. 49% of surveyed respondents expect to spend over four grand on travel during the 2024 calendar year.

However, preparing healthy budgets does not make any American immune to inflation. While nearly half of the American population plan to spend a reasonable amount on travel in 2024, the other half will likely alter their travel plans to adjust to tightened budgets from the effects of inflation.

So what do these adjustments look like? Respondents plan to save by traveling next year on the off season or selecting less popular destinations that offer more for their money.

Holiday Spending Thanks to Credit Cards

Just over half of travelers use credit cards to pay for travel. 41% select to use debit cards as

their form of payment. Though some may be using debit as a way to keep tabs on their legitimate budget, credit cardholders who can pay off their balance in full at the end of the month have a huge advantage.

Most travelers who select to pay with credit card strategically use those that have travel perks such as airline miles, airport lounge access, and points to use for hotels, rental cars, and more. Interestingly, it was determined that younger travelers (Gen Z and millennials) were more likely to use travel perk credit cards.

BNPL Options For Holiday Spending

With the cost of travel, gas, groceries, and other necessities, many consumers will turn to buy now, pay later options for their holiday gifts and other purchases. While for decades, this has simply meant using credit cards or store financing, online shoppers now have a plethora of BNPL options proffered by fintech startups like Klarna, Affirm, and Afterpay. These integrations offer consumers some excellent advantages over credit cards, such as 0% interest and no credit check.

By contrast, consumer credit cards can be very difficult to get, and of course, they come with interest payments. Consumers are responding positively to the BNPL, especially as the holidays approach.

As many as 40% of polled consumers said they would use BNPL options to fund as much as 50% to 99% of their holiday shopping. The same poll uncovered that the BNPL may also facilitate more spending…after all, if you don’t have to pay for everything upfront, why not pay more?

While around 20% of BNPL shoppers said they’d spend more than $1,000 this holiday season, only 16% of non-BNPL shoppers (e.g. those using cash, credit, or debit) said they’d be willing to spend the same amount.

Merchants have also responded positively to fintech options like Klarna, which is partnered with over 450,000 retailers already and is facilitating more than 2 million daily transactions.

Supply Chain Woes

Supply chain woes are another factor that will impact the holiday season. Over the last few decades, the global supply chain has become increasingly more complex, more delicate, and more easily breakable with the slightest disturbance.

With Covid related closures resulting in a cascade of side effects, with container ships backed up at ports and empty shelves in a store near you. As many as 95% of polled merchants in 2022 reported they need to adjust their holiday planning in response to supply chain issues.

Unfortunately, 2023 has seen no lift on the supply chain crisis. These supply chain woes are passing through to consumers which means that consumers need to plan their holiday shopping ahead of time and be prepared to spend a higher dollar amount than they would have before the supply chain issue arose.

While it’s true that labor shortages created some of these supply chain woes, others—like agricultural products—are caused by poorly timed natural events like adverse weather, or geopolitical conflicts like the turbulence in Eastern Europe.

Travel Plans

Travel is an essential part of the holidays if movies ingrained in our cultural consciousness tell us anything (we’re thinking of Home Alone). Unfortunately for many Americans, inflation has 79% of polled consumers suggesting they will be tweaking their travel arrangements in 2022 and early 2023.

For instance, 23% of holiday travelers, according to the same research, will save money by keeping their travels more local. While this is bad news for exotic destinations, it might be good news for local venues in the hospitality and entertainment space.

One contributing factor is the cost of airfare, which has soared 33% in the past year. And although rental car prices have come down a little bit, gas has increased by 25% or more. Around 75 million consumers who are traveling for the holidays will put these expenses on a credit card. Which will result in a potential $3.3 billion in interest payments if they take an average of three months to pay it off (just in time for Spring Break).

And now the question that everybody wants to know the answer to…for those travelers heading to exotic destinations outside the United States, where will those travelers go? One traveler’s insurance poll listed some destinations that might surprise you, including Israel, Spain, Canada, and Columbia. For travelers who don’t want to break out a passport, top domestic destinations include New York, Seattle, Orlando, Phoenix, and Los Angeles.

Giving

Remember the reason for the season, they always say. One aspect of consumer spending during the holiday season is not about me, myself, and I, and that’s giving. Giving Tuesday is the prime day for giving back, at least according to popular consumer sentiment.

The holiday was created in 2012 to offset Black Friday and Cyber Monday. But as it turns out, Giving Tuesday is actually the second biggest day for donations to nonprofits. The first is December 31st, and it’s easy to see why…this is the last day of the tax year, and the last opportunity to lower your taxable income with a nice donation.

Giving levels have dipped from pre-pandemic years, which is understandable given the havoc that has unfolded in the realm of many consumers’ personal finances. Food banks (34% of donations), religious institutions (32%), and animal-related causes (32%) were actually the biggest recipients of charity in 2021.

According to Giving USA, American charity declined by 3.4%, or 10.5% after adjusting for inflation in 2022 compared to the previous year. $499.33 billion in charitable donations was actually a decline following two years of record generosity. In fact, 2021 broke the record, soaring over $500 billion.

However, other resources claim the opposite, Charity Vest claims they say the highest number of donations to date in 2022. So, as far as 2023 is concerned for the holidays, American’s will continue to donate in the billions, but it is uncertain whether this number will increase or decrease.

The top recipients of charity in 2022 were as follows:

- religion

- human services

- education

- foundations

- health

- public-society benefit organizations

- international affairs

- arts, culture, and humanities

- environmental and animal organizations

While giving has dipped a little bit since pre-pandemic levels, come 2023’s holidays, we know that Americans are still interested in being generous…especially when it’s tax deductible. Thus, we should continue to see similar contributions.

Shopping Habits

The day after Thanksgiving has long been regarded as an exciting time to line up outside a store in the early hours of the morning for doorbusters, prizes, and amazing deals. If you’re wondering what exactly consumers are spending money on, research shows that the biggest categories are toys, jewelry, electronics, and clothing. In any case, there is an undeniable trend toward online shopping. Especially omnichannel shopping experiences across social media platforms.

This means that brick-and-mortar businesses are going to need to put more focus on creating an experiential shopping experience. The holidays are an excellent time for this, since decorations, samples, music, and events (like a visit from Santa Claus) can generate some engaged foot traffic…and sales.

A recent poll suggests that 39% of shoppers plan to do the majority of their shopping online for the holidays, while 23% will do most of their shopping in store. Which would suggest a continued decline for in-person shopping. Online shopping is quick, convenient, and most consumers can find exactly what their looking for all in one place, a their fingertips. Convenience like this frees up shoppers time, giving more space for time spent with family and friends during the season that calls for it most.

The biggest online shoppers are millennials, Generation Z, and women. A significant number of online shoppers, more than half, are using mobile devices to do their holiday shopping. This of course means that merchants need to have a mobile presence and integration with a payment processor that can create a seamless checkout experience. Online shopping is big business in the United States, with projected eCommerce growth rate of 10.4% in 2023.

What Does 2023’s Consumer Spending Habits Mean for Business Owners?

Though we can look back at previous years, predicting exact consumer spending habits for 2023, can be a challenge due to various factors such as economic conditions, market trends, and unforeseen events. However, there are general trends that business owners should consider when planning for the 2023 holidays.

First and foremost, it’s a digital world. The ongoing shift towards online platforms will continue. Business owners should prioritize their online presence, or invest in e-commerce capabilities if they haven’t already.

Next, and newer on the scope of consumer desires is sustainability and locally sourced goods. Businesses that emphasize environmental and social responsibility, such as eco-friendly products, and a positive social impact will attract a larger customer base.

Of course, though it’s not as extreme as last year, inflation is always going to scare some consumers away from spending too much on their holiday shopping. Design some strategic pricing strategies to entice and offer value to cost-conscious consumers.

Last, customer experience and personalization are sure ways to leave an impression on customers. In fact, it’s what many are looking for. And if you provide excellent customer service, the impression is sure to be positive.

The more impactful a business can be on a customer. The more likely they have won their loyalty. Even if prices aren’t as affordable. Be sure to also leverage data analytics and AI tools to market accordingly and customize customer offers and interactions with staff.

To contact sales, click HERE. And to learn more about ECS Payment Processing visit Retail.