What if a single second delay at your checkout was enough to cost you a lifelong customer? It sounds like an exaggeration until you look at the modern consumer who expects every transaction to be instantaneous. Many business owners do not realize that their payment setup is often the final hurdle that determines whether a shopper returns or seeks out a competitor. Choosing between ECS payment terminals and software-based solutions is not just a technical decision for your IT department.

It is a strategic choice that dictates the flow of your revenue and the quality of your customer service. The equipment or the software you use for checkout and orders can either be a partner in your growth or an unnecessary point of friction that slows your daily operations.

We understand that the world of merchant services feels like a maze of hardware specs and processing rates. As a business owner, you want to spend your time perfecting your product or service rather than troubleshooting a card reader. That is why we focus on simplifying the bridge between your hard work and your bank account.

Whether you are running a high-traffic boutique or a specialized B2B consultancy, the way you capture funds matters. The right setup ensures that every sale actually ends up in your pocket with the least amount of risk and the highest level of efficiency. Let’s dive into how the latest technology from ECS can transform your checkout experience into a competitive advantage.

Overview of ECS-supported Terminals and Virtual Terminal

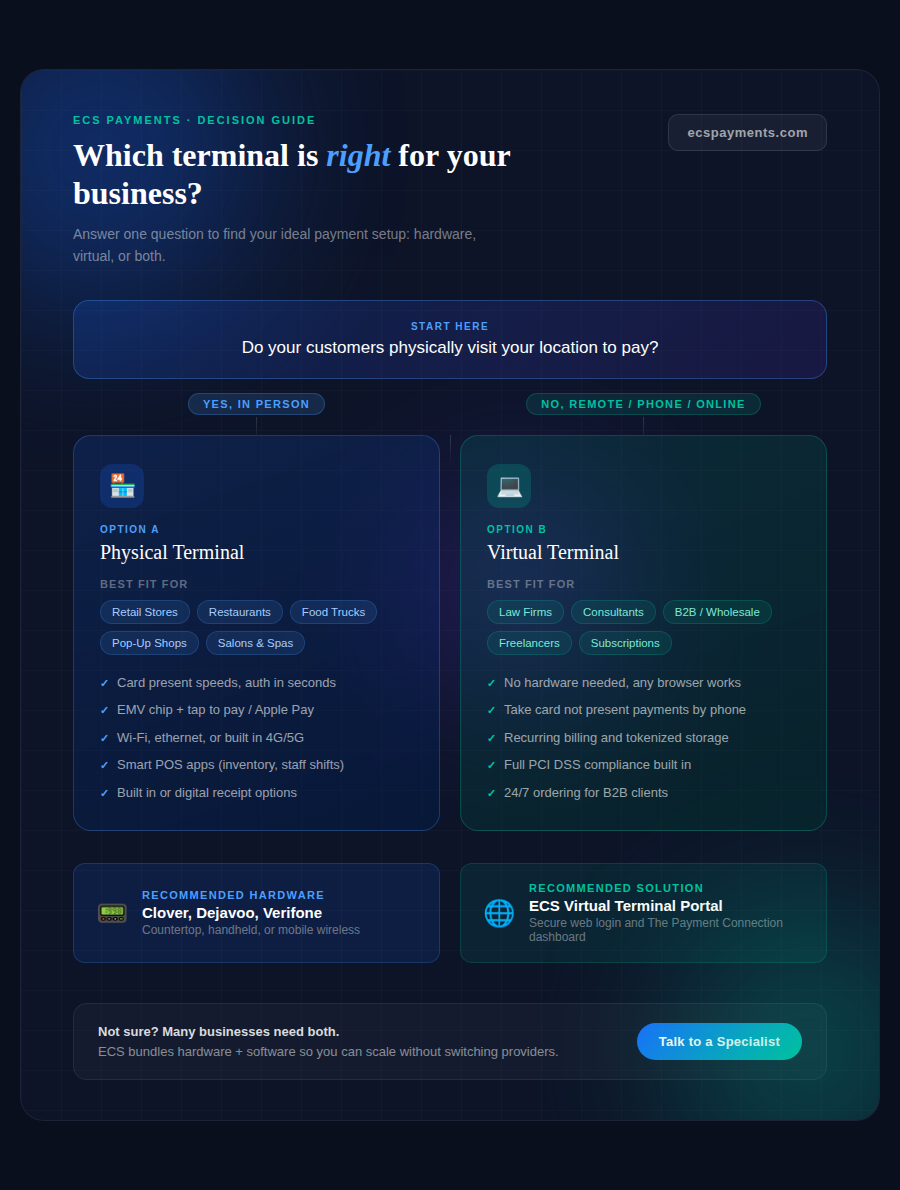

Payment technology has branched into two main paths, which are physical hardware and web-based software. At ECS Payments, we provide a diverse range of ECS payment terminals designed to fit into any physical environment. These include industry-leading names like Dejavoo, Clover, and Verifone. These machines offer different builds that can sit on your counter or travel in your pocket to provide a dedicated way to take payments on the go.

On the other side of the coin, an ECS virtual terminal offers a completely hardware-free experience. This is a secure web portal that you can access online from any computer, tablet, or smartphone. You do not need to purchase expensive peripherals to get started. You simply log in and key in the customer information. This flexibility is invaluable for businesses that do not interact with clients face-to-face. Having both options available allows a business to scale without being tethered to a single way of doing things.

When to Choose a Physical Terminal

If your business involves a storefront where customers walk in and hand you a card, a physical device is usually the gold standard. Retailers and restaurants thrive on the speed of card-present processing ECS solutions. There is a psychological comfort for a customer when they see a dedicated machine. They know exactly where to tap their phone or dip their card. This physical interaction is fast, and it reduces the chance of errors that naturally come with manually typing in credit card numbers.

Physical terminals are also built for volume. If you have a line of ten people waiting for coffee, you cannot afford to spend ninety seconds on each person. A modern terminal handles the authorization in a matter of seconds.

Many of these devices also include built-in printers for receipts or the ability to send receipts digitally. This keeps the line moving and keeps your staff focused on the next order. High-traffic environments require hardware that can take a beating and stay connected through Wi-Fi or even cellular data if the internet goes down.

When a Virtual Terminal is the Better Choice

There are many business models where a physical counter simply does not exist. Professional services like law firms, accounting practices, and freelance consultants often do their work remotely. In these cases, an ECS virtual terminal is the superior choice. You can take a payment over the phone and manage all “Card-Not-Present” transactions. Virtual terminals are also an excellent tool for B2B companies that deal with wholesale orders or large contracts.

The virtual terminal is also a powerhouse for administrative efficiency. It allows you to set up recurring billing for subscriptions or monthly retainers. You do not have to call the client every month to ask for their card details again. The system securely stores the tokenized information and runs the charge on a schedule you define. This creates a reliable stream of cash flow and saves you hours of manual invoicing work. According to the Federal Reserve 2025 Diary of Consumer Payment Choice, remote payments now account for roughly 23% of all consumer purchases, showing a steady rise in the preference for non-physical transactions.

Features to Compare Across ECS Terminal Options

Finding the best terminal for small business success requires looking at the specific features that will impact your day-to-day life. One of the most important considerations is connectivity. Some terminals require a hardwired ethernet connection, which is very stable but keeps the device in one spot.

Other options offer Wi-Fi or built-in 4G/5G capabilities. This is perfect for businesses on the move, like food trucks, street fair vendors, or pop-up shops. For these types of merchants, you want to ensure your terminal can follow you wherever the sales are happening.

You should also look at the user interface. A smart terminal with a touchscreen, like the Clover Flex, feels as intuitive as using a smartphone. It can even run apps that help you track inventory or manage employee shifts. Basic terminals are simpler and more affordable, but they might lack these advanced management features. Every ECS terminal supports EMV chip technology and contactless payments like Apple Pay. This is non-negotiable in 2025; 65% of US adults use a digital wallet for their purchases.

Security and Compliance for Card-Present and Card-Not-Present Transactions

Data security is the foundation of any payment relationship. When you use ECS payment terminals, you are benefiting from hardware-level encryption. The moment a card is dipped or tapped, the data is scrambled. It stays encrypted as it travels through the networks to the bank. This protects you from the nightmare of a data breach. The cost of failing to secure data is rising every year. IBM’s 2024 Cost of a Data Breach Report indicates that the average cost of a breach for financial-related organizations has reached over $6 million.

Virtual terminals require a different kind of vigilance because you are often “keying in” the data. ECS ensures that our virtual portals are fully PCI-DSS compliant. This means we take the burden of meeting strict security standards off your shoulders. We use tokenization to replace sensitive card numbers with random IDs. If a hacker ever accessed your internal systems, they would find nothing but useless strings of text. This security allows you to focus on your clients with the peace of mind that their financial data is ironclad.

How ECS Bundles Terminals and Software

We believe that pricing should be transparent for all our merchants. Many processors hide fees in complex contracts or statement line items that are deceptive. At ECS, we focus on a partnership model. We often bundle the hardware with our proprietary software to give you a complete ecosystem. This includes access to our in-house dashboard called The Payment Connection. This tool allows you to see every physical and virtual transaction in one place.

Rather than the standard flat-rate pricing structure from many of the more popular payment platforms, our pricing models usually focus on interchange-plus structures. This means you pay the actual cost from the card brands, plus a small and clearly defined markup. Although “convenient,” flat rates can punish you as you grow. But if a merchant would prefer the convenience, we can still offer this pricing structure.

The goal is to be flexible and custom to each one of our unique merchants, depending on their needs. Our contracts are designed to be fair and flexible because we want to earn your business every single month. With ECS payments, not only do you have access to the latest technology and the safest payment gateways, but you also have a support team that offers full transparency, pricing, and answers the phone right away whenever you need any assistance.

Decision Guide: Matching ECS Terminal Options to Business Types

Choosing the right path does not have to be difficult. If you run a retail store or a restaurant, you should prioritize a countertop smart terminal. Look for something that integrates with your POS and supports high-speed printing. If you are a service provider or a contractor, a mobile wireless terminal or a virtual terminal is likely your best bet. This allows you to accept payment on the job site or via a phone call later that evening.

For B2B companies or wholesalers, the virtual terminal is almost always the winner. These types of businesses trend toward virtual checkout for routine, high-volume, and recurring orders. Virtual checkout allows buyers to place orders 24/7, check real-time inventory, and track shipments.

Virtual systems are preferred for speed and to avoid the logistical delays of in-person ordering. And let’s not forget about automation. Many wholesalers now use B2B marketplaces (like Faire) or custom eCommerce sites to handle transactions without direct sales rep intervention. It handles the large transaction volumes and recurring billing needs common in corporate environments.

Why ECS Payments is Your Best Thought Partner

In a market crowded with giant, faceless corporations, ECS Payments stands out as an authoritative and human-centric alternative. We do not treat our merchants like account numbers on a spreadsheet. We understand that behind every terminal is a business owner who is trying to build a legacy. Our team has decades of experience in the nuances of the payment industry. We use that knowledge to help you navigate everything from chargebacks to hardware upgrades.

We take pride in being a proactive partner. While other companies might leave you with a generic 1-800 number, we offer personalized, in-house support, with extended hours, and real people on the other end of the line. We provide a level of stability and trust that is hard to find in the fintech world today. We value your time and your security as much as you do, and we are here to ensure that your payment processing is the strongest part of your business operations.

Conclusion

The difference between a “good enough” payment system and the right one can be measured in thousands of dollars of saved time and captured sales. Whether you decide that the best path forward involves the tactile reliability of ECS payment terminals or the digital agility of an ECS virtual terminal, we are ready to help you implement the change. Your setup should match the ambition of your business. Do not let outdated technology be the reason a customer decides to shop elsewhere.

Would you like to speak with an ECS specialist to determine which specific hardware or software bundle fits your current volume and future goals? We can walk you through a personalized demo and help you find the most cost-effective way to modernize your checkout experience today.