If you own a business, you already know payment processing isn’t as simple as swiping a card and calling it a day. There’s actually a “middle man” that businesses need to have the capability to accept card payments. You hear terms like “payment gateway” and “payment facilitator” tossed around, and while they might sound interchangeable, choosing the wrong one can lead to higher costs, frozen funds, or missed opportunities to scale.

This article is about understanding how money actually moves through your business so you can pick a solution that works for you today and doesn’t hold you back tomorrow. Let’s break it down.

What Is a Payment Facilitator (PayFac)?

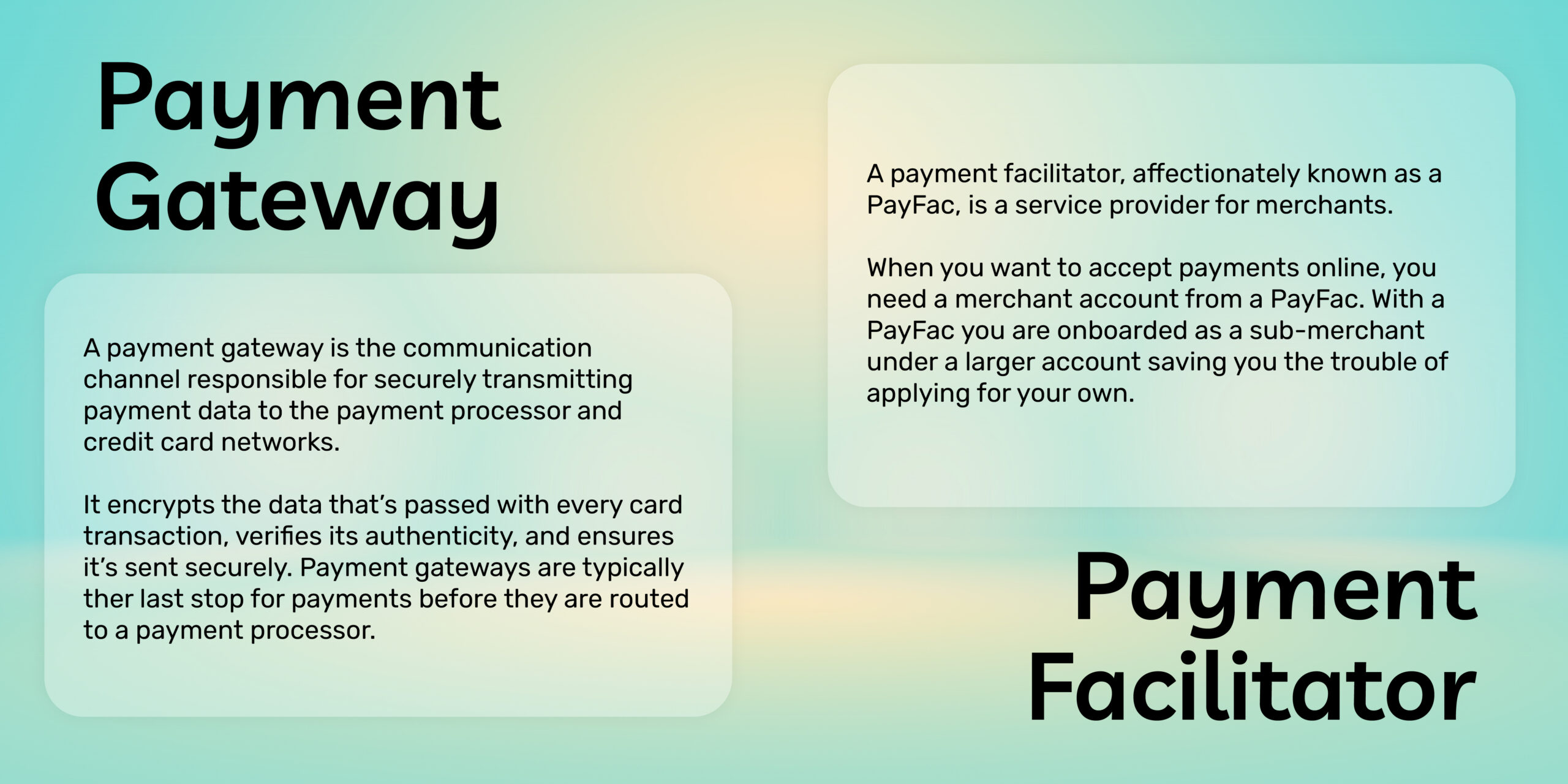

A payment facilitator, often called a PayFac, exists to make life easier for small businesses that need to start taking card payments quickly. Instead of requiring each business to go through the lengthy process of setting up its own merchant account, the PayFac provides a master account and onboards small businesses as sub-merchants under its umbrella.

Platforms like Square or Stripe made this model famous. They allow businesses to start processing transactions almost instantly. No long applications or waiting days for underwriting and approval. For a small coffee shop or a local boutique just starting out, that kind of speed can be a game-changer.

But it’s not all upside. PayFacs typically come with flat-rate pricing, a set percent as a fee to process card transactions, that seems simple at first, but can add up quickly as sales grow. They also set strict risk rules, which means if your business has a suspicious transaction, sometimes for reasons outside your control, your funds might get frozen or worse, your account might get shut down.

So while a PayFac works beautifully for quick launches and smaller operations, it may feel limiting as your business scales or if you’re in an industry with unique needs.

What Is a Payment Gateway?

Now, let’s talk about payment gateways. A gateway acts as the secure digital bridge between your customer, your business, and the banks involved in a transaction. When someone makes a purchase online and enters their payment details, the gateway encrypts and transmits that data so the transaction can be authorized.

Names like Authorize.net and NMI are big players here, and for good reason. Gateways offer more control, better reporting, and advanced features like recurring billing or fraud prevention tools. They integrate with shopping carts, accounting software, and CRM systems, making them a powerful hub for growing businesses.

Of course, there’s a tradeoff. To use a gateway, you need your own merchant account, which requires a more thorough underwriting process. That can mean extra paperwork and a little more time upfront. But, in exchange, you gain lower processing fees as your volume grows, along with the ability to customize your payment setup to fit your exact business model.

It’s worth noting that Data Bridge Market Research suggests that the global payment gateway market size was valued at over $35 billion in 2024 and is expected to reach $152.26 billion by 2032, with a CAGR of 20.10%. That’s proof of just how essential these systems have become for modern commerce.

Key Differences Between a PayFac and a Payment Gateway

The simplest way to look at it is this: a PayFac owns the merchant account, while with a gateway, you own it. That difference affects nearly everything else.

PayFacs are fast and easy. You can often sign up and start accepting payments the same day. But convenience comes at the price of higher fees and fewer customization options.

Gateways, on the other hand, take longer to set up because you need your own merchant account. Yet they reward that patience with lower costs over time, richer reporting tools, and far more flexibility. You also control the risk process instead of having a third party make decisions that could impact your cash flow.

Because companies, like ECS Payments, who offer gateway services do a thorough underwriting process before accepting your application, you are less likely to have your accounts frozen or merchant accounts shut down, because they’ve already vetted your business. What could threaten this security is if you suddenly change your business model or industry without notifying your gateway provider.

Ultimately, speed versus control is the real dividing line here.

PayFac vs. Payment Gateway: Which One Is Right for Your Business?

If you’re just launching your first store or dipping your toes into eCommerce, a PayFac might be all you need to get moving quickly. It’s a plug-and-play solution, perfect for testing your business idea without getting bogged down in logistics.

But if your business is growing, processing more transactions every month, or dealing with recurring billing, fraud prevention, or complex integrations, a payment gateway starts to make more sense. Over time, the ability to customize your setup, negotiate better rates, and maintain full control can save you thousands.

For high-risk industries like subscription-based services, CBD, and travel, gateways paired with specialized processors are often the only realistic choice. PayFacs tend to avoid these sectors because the risk doesn’t fit their one-size-fits-all model. The Federal Reserve reports that electronic payment volumes continue climbing year after year. Digital payment dependence requires robust, scalable infrastructure for long-term success.

Where ECS Payments Fits In

Here’s where ECS Payments becomes a valuable partner. We don’t force businesses into a single model. Instead, we offer dedicated merchant accounts combined with flexible gateway solutions so you can have the best of both worlds.

Many businesses come to us after outgrowing PayFac platforms because they need lower costs, more features, and real people to call when questions come up. We also specialize in industries PayFacs typically avoid, helping businesses manage chargebacks, reduce fraud, and integrate payment systems seamlessly into their operations.

Here’s the bottom line. With ECS Payments, you get more than a generalized payment processor. You get a partner who understands the challenges of running a business and can tailor solutions as you grow.

Conclusion: Making the Right Call

Payment facilitators and payment gateways both have their place. If simplicity matters most for your business, a PayFac offers a quick way to start accepting payments. But for businesses ready to grow, seeking lower costs, greater control, and long-term stability, a payment gateway is the smarter investment.

The right choice depends on your goals. And if you want help weighing your options, ECS Payments is here to guide you.

Talk to ECS Payments today and find the payment solution that scales with your business.