Processing fees can quietly eat away at profits each month. Card fees can feel like an unavoidable cost of doing business. But what if there was a way to offset them without raising prices across the board or alienating customers? We’re here to remind you, there is! That’s where dual pricing comes in.

This strategy has gained major traction across the retail, restaurant, and service sectors because it brings fairness back into the equation. Dual pricing gives customers a choice and gives merchants control over their margins again. Let’s unpack what it is, how it works, and why so many business owners are making the switch.

The Rising Cost of Card Acceptance

Credit card processing fees range between 1.5% and 3.5% per transaction. That may not sound like much until you realize how those fees compound across hundreds or thousands of transactions each month.

For a local restaurant or smaller retailer running on tight margins, that’s the difference between staying comfortably profitable and barely breaking even. Some merchants try to raise prices to compensate, but that approach risks alienating price-sensitive customers. Others look for “free” or low-cost processing solutions, which often come with hidden tradeoffs.

With over two-thirds of consumer payments made by card, of consumer payments made by card, small businesses need practical ways to offset these costs. Dual pricing is that solution. It’s a legal, transparent way to protect profits while giving customers clear payment options.

What Is Dual Pricing?

Dual pricing is a system where a business displays two prices for every item or service: one for customers who pay with cash and one for those who pay by card. For example, a small coffee shop might list a latte at $4.75 for cash and $4.90 for card. The price difference accounts for the cost of processing that card transaction, a cost many small businesses need to make up for.

In practice, it’s incredibly simple. The terminal or POS system automatically applies the correct price based on how the customer chooses to pay. There’s no confusion, no hidden surcharge, and no extra math for staff to figure out.

The best part is transparency. Instead of burying processing fees in your prices or disguising them as “discounts,” you’re presenting both options upfront. That openness helps build customer trust while letting your business retain more of its revenue.

How Dual Pricing Differs from Cash Discounting

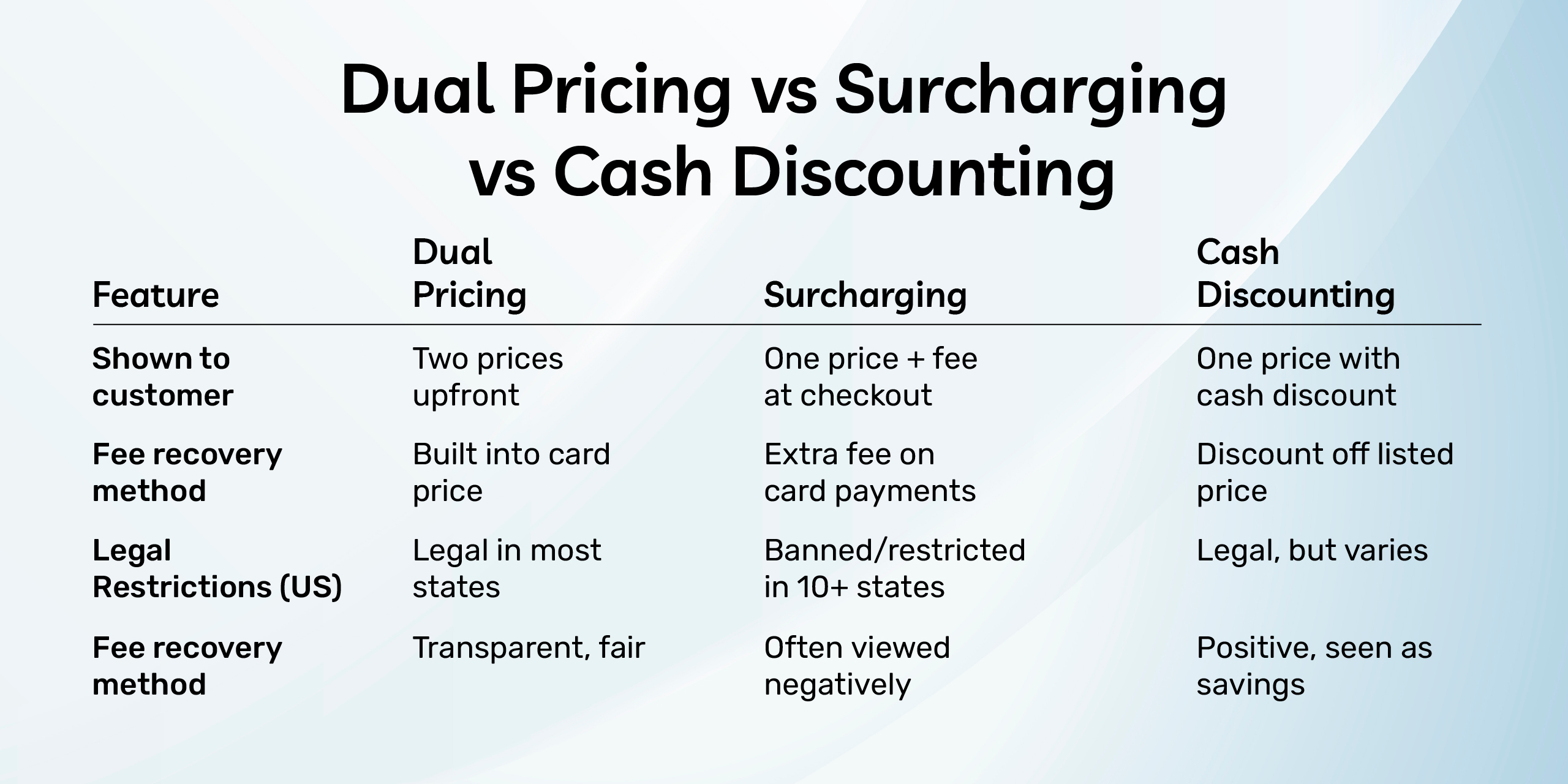

Many business owners initially confuse dual pricing with cash discounting, but the two are not quite the same thing.

Cash discounting gives a discount to customers who pay with cash. For example, a $10 item might have a $0.25 discount applied if paid in cash. The card price is the default, and the cash price is seen as a reward for avoiding card costs.

Dual pricing, on the other hand, clearly lists two prices before checkout. Customers see the card price and the cash price side by side. Card brands like Visa and Mastercard have specific guidelines for how pricing and fees must be displayed. With dual pricing, everything is out in the open, and that transparency keeps merchants within the rules.

The Federal Trade Commission also underscores the importance of price disclosure and transparency when listing different payment options. Dual pricing aligns perfectly with those standards.

When properly implemented, dual pricing is a cleaner, simpler system for both merchants and customers.

Why Businesses Are Switching to Dual Pricing

1. Dual Pricing Restores Profit Control

Inflation, higher interchange fees, and supply costs have left many small business owners with shrinking profit margins. Dual pricing, however, offers a fair way to reclaim control of your business’s profits. Instead of quietly absorbing processing costs, you can structure your pricing to reflect the real expense of accepting cards while giving your customers a more cost-effective option.

2. Dual Pricing Keeps Customers Informed

Customers appreciate transparency. When they understand why a card transaction costs slightly more, they’re less likely to feel blindsided and frustrated. In fact, most consumers are now accustomed to seeing surcharges or price differences based on payment method. The key to reducing any friction at checkout is communication. When customers know they have a choice, they respect it.

3. Dual Pricing Simplifies Compliance

Cash discount programs and surcharging have long been compliance minefields, particularly when card brand rules vary by state. Dual pricing eliminates much of that uncertainty. It’s structured in a way that aligns with Visa and Mastercard’s transparency guidelines, reducing your risk of noncompliance and costly disputes.

4. Dual Pricing Reduces Financial Pressure

By passing along processing costs to card-paying customers in a transparent manner, businesses can keep prices fair for everyone. Instead of raising prices across the board, dual pricing has zero effect on cash-paying customers and stabilizes profit margins, even during economic swings.

How Do Customers React to Dual Pricing?

There’s often an initial concern that customers will push back. After all, nobody likes paying more, right? The data tells a different story.

Most consumers today are used to differential pricing. They see it at gas stations, where card prices are higher than cash prices. They experience it when booking travel or paying online fees. The model is already familiar. It’s just newer in traditional retail and food service settings.

The key is communication. When you label prices clearly and explain that the card price is a reflection of the cost to process the card transaction, customers tend to appreciate the honesty and the option to opt for a more cost-effective price with cash. Clarity prevents confusion and turns what could be a point of frustration into a positive choice.

How to Implement Dual Pricing the Right Way

If you’re considering adding dual pricing to your business, success starts with the right tools and configuration. You’ll need a payment processor and POS system that supports automated price adjustments based on payment type. Manual workarounds create risk and slow down operations.

Here’s the simple workflow:

- Set your base cash and card prices in your POS or terminal.

- Clearly display both prices on menus, receipts, and digital displays.

- Let your payment system automatically apply the correct total based on customer selection.

- Review your daily reporting to ensure accurate reconciliation between cash and card sales.

It’s straightforward, compliant, and designed to minimize errors.

ECS Payments’ Dual Pricing Solutions

At ECS Payments, we help merchants take advantage of dual pricing through integrated, compliant systems that make the process effortless. Our solutions are designed for small and midsize businesses that want simplicity without giving up control.

We help configure our POS systems and terminals for dual pricing to automatically distinguish between card and cash transactions, adjust totals in real time, and generate clear reports for accounting and tax purposes. Merchants can see exactly how much they’re saving and track processing fees with complete transparency.

What sets ECS apart is our advanced technology, but even more so, our world-class support. Our team works directly with business owners of all sizes to ensure the setup aligns with card brand regulations and state laws. We don’t offer cookie-cutter programs; we tailor dual pricing to fit your specific business model.

Why ECS Payments Is a Trusted Payments Partner

ECS Payments has earned a positive reputation by putting transparency and merchant success at the center of every one of our solutions. We understand navigating complex compliance requirements can be a lot for small business owners. That’s why we make dual pricing as seamless and reliable as possible.

With ECS Payments, it’s true, you’re getting a comprehensive and responsive payment processor. But, you’re also getting a long-term partner who understands the realities of running a business. From restaurant owners managing daily cash flow to retail operators optimizing margins, our technology and service are built to make payments work in your favor.

Our approach is simple: no hidden fees, no misleading programs, and no confusing contracts. Just clear, compliant dual pricing options that help your business thrive.

Dual Pricing Conclusion

Dual pricing is a sustainable strategy that your business can use to balance fair customer pricing with the realistic costs of doing business. When you clearly present both cash and card prices, you can maintain profitability, build trust, and stay compliant with evolving payment rules.

In an environment where every fraction of a percent matters, dual pricing gives small businesses a competitive edge. The ability to keep costs transparent, retain margins, and give customers genuine choice is what makes it so powerful.

If you’re ready to explore how dual pricing could fit your business, ECS Payments can guide you through every step, from setup to compliance to customer education. Learn more or get started by visiting ecspayments.com.