Payment rails, the underlying systems that move money, are shifting. From slower batch processes to near-instant value settlement, the dynamics of how funds flow are evolving. Understanding these new payment rails is no longer optional if you’re managing a small or mid-sized business and care about cash flow, customer experience, or staying competitive.

Overview Of The Shift From Batch To Instant Transactions

Historically, most merchant transactions have been processed on batch systems, where payments arrive in daily or multi-day cycles, resulting in a lag in clearing and settlement. For example, standard ACH transfers can take 3-5 business days, and credit card clearances often take 1-3 business days. However, with newer payment rails, funds can now move much faster, liquidity improves, and you, as the merchant, can respond in real time rather than waiting.

The shift from traditional, slower methods to near-real-time processing is occurring for several reasons:

- Pressure from mobile commerce

- Consumer expectations for immediacy

- Competitive forces in the financial services industry

According to a recent report, real-time payments in the U.S. accounted for approximately 1.5% of total payment volume in 2023, yet they experienced significant year-over-year growth.

For small or mid-sized merchants that stay on older rails, you may fall behind in operational efficiency, customer satisfaction, and cost control. Even if your adoption is early, being prepared now gives you a strategic edge.

Real-Time Payments (RTP) And FedNow Overview

When we discuss real-time payment rails, we refer to systems where money is transferred from payer to payee almost instantly, at any time of day, and settles quickly (typically within seconds or minutes), rather than hours or days. In the U.S., key rails include the RTP® Network via The Clearing House and the FedNow® Service from the Federal Reserve Board.

How RTP Differs From ACH And Card Networks

- ACH (Automated Clearing House) typically works in batches because the system processes transactions in scheduled groups rather than individually in real-time. The transaction involves multiple parties: the Originator, the Originating Depository Financial Institution (ODFI), the ACH Network (operated by Nacha and the Federal Reserve), and the Receiving Depository Financial Institution (RDFI), each adding a step in the process. This batch processing model, in addition to the multiple parties, contributes to delays. Transactions must wait for the next scheduled processing window and subsequent settlement period, often resulting in funds taking one to three business days to clear.

- While a card transaction is near-instant for the consumer (the authorization), the actual money transfer (settlement) is a complex, multi-step back-end process involving the acquirer, the card network, and the issuer. This back-end lag means merchants often wait one to three business days to receive funds.

- Real-time rails, on the other hand, offer 24/7/365 availability, immediate settlement (or very near-immediate), and often simpler routing. For example, The Clearing House reports that the RTP network reaches approximately 70% of demand deposit accounts in the U.S. through more than 850 connected financial institutions.

- For merchant owners, one of the biggest operational differences is liquidity. If funds arrive sooner, you can reinvest faster, reduce reliance on working capital loans, and respond faster to market changes.

Compliance Implications And Settlement Timing

For compliance, real-time payments bring new considerations. Because funds move quickly, the risk of fraud, error, or reversal decreases, but the window to intervene also narrows. Merchants and payment processors must ensure robust Know Your Customer (KYC) and Anti-Money Laundering (AML) controls, as well as effective fraud detection.

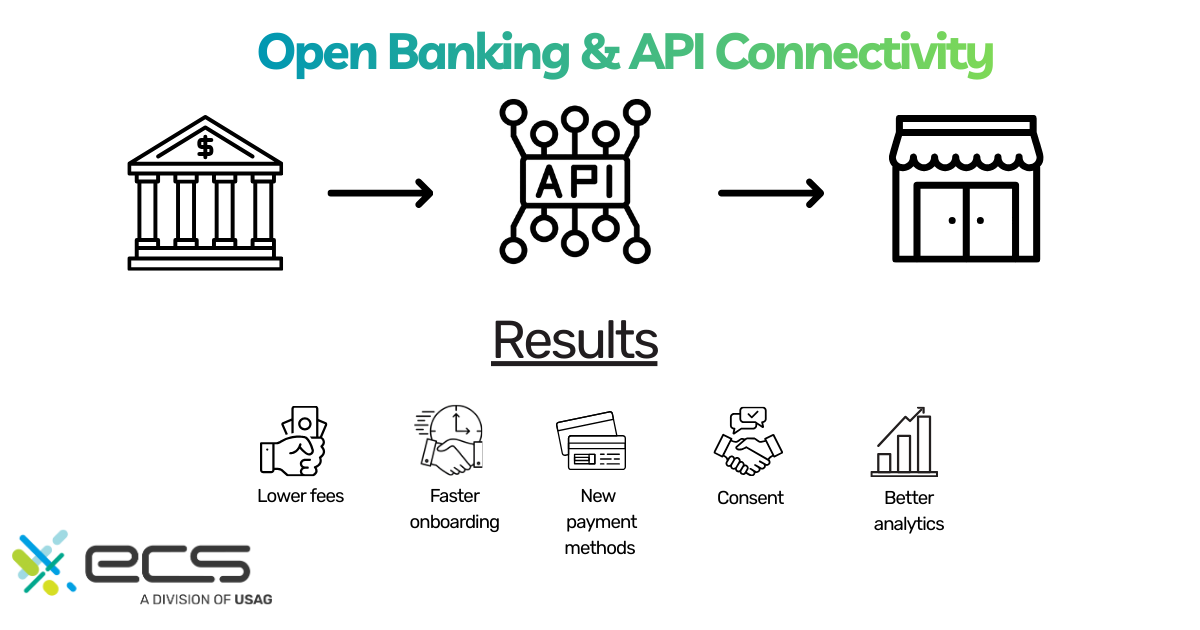

Open Banking And API Connectivity

Another layer to the evolving payment rails is open banking and API connectivity. This is less about the rails that move money and more about the data and connectivity around those rails, such as how bank data, account data, and transaction data can interoperate across systems.

What Data Sharing Means For Merchants

Open banking means that, with customer consent, bank account and transaction data can be accessed via APIs and used by third-party applications. For you as a merchant, this can mean: faster onboarding, better analytics, richer payment options for customers, alternative payment methods (such as account-to-account transfers rather than cards), and improved customer experience.

For example, instead of asking a customer to enter a card, you might enable a direct account payment via an API call. That can reduce card interchange fees, reduce declines, and increase conversion. But it also means you must manage data securely, get the right agreements in place (customer consents, data-sharing agreements), and integrate with systems that handle API flows.

Security And Consent Requirements

With this connectivity comes responsibility. You must ensure the tools you use are compliant with applicable regulations and consumer data protection laws, that you obtain appropriate consents, and that you work with partners (payment processors, gateways) that handle the data securely.

If you work with a payment processor that offers open-banking connectivity, they should provide API documentation, security certifications, and transparent support for you.

Tokenization And Network-Level Security

When payments move faster and data flows wider, security becomes even more critical. That is where tokenization and network-level security protect the rails and protect your business.

How Tokenization Protects Stored Credentials

Tokenization replaces sensitive data (like a card number or bank account number) with a unique token. If someone intercepts the token, they cannot reuse the underlying credentials. According to recent statistics, about 60% of merchants use tokenization in 2025 to secure customer payment data, and over 70% of financial institutions report reductions in payment fraud after implementing tokenization technology.

For a merchant accepting stored payment credentials from subscriptions and recurring payments or managing loyalty programs, tokenization is a must. It reduces your exposure, compliance burden (such as PCI scope), and risk of breaches.

ECS Payments’ Role In Secure, Domestic Processing

At ECS Payments, we understand merchants are under pressure: faster payments, more data, more expectations. When you work with ECS Payments, you’re tapping into a payment processor that supports secure handling of credentials, compliance with U.S. payment infrastructure updates, and a path forward as new rails become mainstream. We’re a partner that helps you engage with these emerging payment rails without having to rebuild everything from scratch.

Adoption Roadmap For Merchants

Here’s a practical roadmap for your business to engage with the evolving payment rails.

1. Assess Readiness

Look at your current payment stack. Are you still relying primarily on batch systems or older integration with card networks only? Do you store credentials? Does your business process recurring billing? Do you have high fraud/decline rates? These are indicators that you might benefit from upgrading. Also assess internal operations: can your accounting, reconciliation, and customer service systems respond faster when payments settle sooner?

2. Choose A Compatible Payment Gateway Or Processor

You want a partner that supports newer rails (e.g., RTP, FedNow) or is planning to support them, offers tokenization, supports API connectivity, and can integrate with your systems (ERP, CRM, e-commerce).

3. Pilot

Start small. Choose a subset of payments (for example, high-value clients, premium subscriptions, or a test of account-to-account payments) and launch the new method alongside your existing rails. Monitor performance: settlement speed, conversion rates, fraud/decline incidents, and customer feedback. Use your data to build a case for broader rollout.

4. Scale

Once you’ve validated the pilot, expand to more payment types, more customer segments, and more offerings. Communicate to your customers that you are offering faster, more flexible payment options. Train your staff and update operations to handle near-instant settlement. Because when you scale, the operational expectations change: if customers pay faster, you might deliver faster; if funds arrive sooner, you might discount working capital costs.

5. Transparent communication with customers about new methods

Don’t forget the customer side. If you roll out a new payment rail or method, let your customers know: “Now you can pay directly from your bank account, and funds will be transferred in seconds,” or “Your funds will be available for delivery faster.” That communication builds trust, improves adoption, and can differentiate you from competitors still using slower payment paths.

Conclusion

The payment rails are changing, which can improve cash flow, speed up settlements, create a better customer experience, and strengthen security. If your business is still dependent solely on legacy batch systems, you risk falling behind.

Your business can take advantage of these changes. Make sure you assess your readiness, use a future-focused payment partner, pilot new methods, and scale carefully. By partnering with ECS Payments, you gain the expertise and infrastructure you need to navigate this transformation. Real-time, data-rich payments are coming. You want to be ready.