Running a firearm business is a serious venture, not to be taken lightly. Every shipment and every sale is under a state and federal microscope. The paperwork is nonoptional, compliance rules are not flexible, and one mistake can bring the kind of attention no business wants, which is why it is so important to understand and comply with FFL regulations.

One key part of those regulations involves FFL transfers. Handling transfers correctly not only keeps you compliant but also protects your business reputation and strengthens customer trust. Let’s take a closer look at what they involve and why they matter.

What Exactly Is an FFL Transfer

An FFL transfer is the legal process of transferring a firearm through a dealer with a Federal Firearms License. Anytime a firearm crosses state lines or is sold online, federal law requires it to go through a licensed dealer who handles the paperwork and runs the background check.

The goal is simple: keep firearms out of the wrong hands while making sure every transaction is documented and compliant. An FFL transfer keeps everything above board. It protects buyers, sellers, and dealers by making sure every firearm changes hands legally and safely. The ATF’s FFL Quick Reference Guide lays out the official standards if you want to see the full requirements.

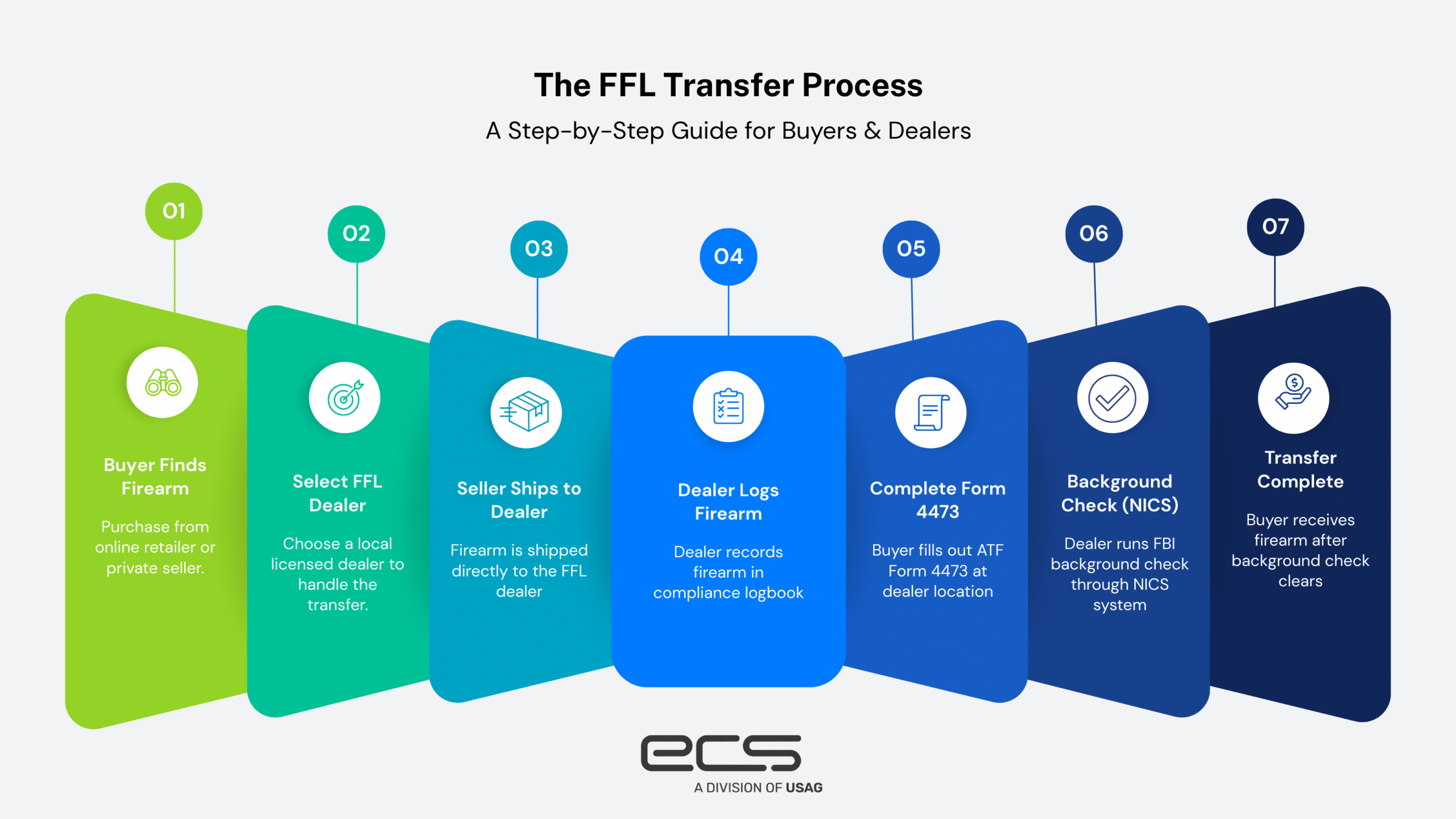

How the FFL Transfer Process Works

Here is how it usually goes. A buyer finds a firearm online or from a private seller and then picks a licensed dealer to handle the transfer. That dealer makes sure the shipment follows all the rules before it ever arrives. When it does, the dealer logs it into their records for compliance purposes.

The buyer then completes ATF Form 4473, providing all the information needed to run a background check through the FBI’s NICS system. Once the check clears, the dealer finalizes the transaction and hands the firearm over to the buyer.

The entire process usually takes a few days, depending on shipping times and how quickly the background check processes. It is rarely as complicated as it sounds, especially once you have done it a few times.

What Dealers Charge for FFL Transfers

Fees for FFL transfers vary quite a bit. Some dealers charge around $20, others $50, and in busy urban areas, you might see fees closer to $75 or more. Why the difference?

Location plays a big role. High-demand areas tend to have higher fees. Some dealers offer extra services such as storage or help with additional paperwork, which adds to the cost. Smaller shops in rural areas often keep prices low to bring in repeat customers.

For many dealers, the transfer itself is not the main source of profit. The real value is in the relationships and the extra sales that come with having customers walk through the door. A smooth, professional transfer experience often leads to ammo sales, accessories, or even future firearm purchases.

The Legal Side Every Dealer Must Know

Federal law is very clear about what has to happen for every transfer: ATF Form 4473 must be completed, a background check must be run through NICS, and detailed records must be kept for every sale.

On top of that, some states add their own layers of regulation. California, for example, requires waiting periods and additional forms. Skipping a step can lead to fines, loss of your license, or worse.

Dealers who stay organized and treat compliance seriously avoid legal problems and give customers confidence that every transaction is handled correctly.

Advice for Buyers and Sellers

If you are a buyer, it helps to find a local FFL dealer before making a purchase so you know where the firearm will be shipped. Ask about the transfer fees in advance and bring proper identification when it is time to fill out the paperwork.

For sellers, make sure the dealer you ship to has a valid FFL license and communicate timelines clearly with your buyer. Everyone appreciates knowing what to expect.

If you want a broader overview of firearm sales rules, the Forbes Advisor guide on online firearm regulations is a solid resource.

Why Dealers Should Care About FFL Transfers Beyond Compliance

On the surface, transfers look like paperwork. But smart dealers see them differently. Each transfer brings someone into your shop, giving you a chance to build trust and strengthen relationships.

When customers have a smooth, professional transfer experience, they come back. They buy ammo, accessories, and sometimes another firearm altogether. Over time, those small moments add up to long-term business growth.

The challenge many dealers face, though, is payment processing. Traditional banks often label firearm businesses as high-risk, leading to frozen accounts or unexpected restrictions that can interrupt your cash flow.

That is where ECS Payments comes in. We specialize in payment processing for high-risk industries, including firearms, so dealers can accept payments without worrying about sudden account freezes or compliance problems. Our goal is to keep transactions secure, fast, and fully aligned with federal rules so you can focus on your customers.

Why ECS Payments Is the Right Partner for FFL Dealers

ECS Payments understands the unique challenges firearm businesses face. We have payment solutions specifically designed for this industry, from ATF compliance requirements to banking restrictions. We offer:

- Firearm-friendly merchant accounts

- Fast approvals for regulated businesses

- Secure transactions that protect both dealers and customers

- Compliance-focused software partnerships designed to meet federal and state regulations

For dealers who want to grow, ECS Payments provides the tools to keep payment processing smooth and reliable. Check out our guide on payment gateways vs. merchant accounts to learn more about the options available.

Final Thoughts

An FFL transfer is more than a legal requirement. It is part of running a professional, trustworthy firearm business. It protects buyers, keeps dealers compliant, and creates opportunities to build long-term customer relationships.

With the right payment partner, transfers become easier for everyone involved. ECS Payments helps firearm dealers simplify payment processing so they can focus on growing their business without the stress of compliance or banking restrictions slowing them down.

If you want to make FFL transfers and payments work seamlessly together, ECS Payments is ready to help you get there.